The Big Idea: A CompleteTrend Following Portfolio With Options

Overview:

First, I’d like to thank everyone for the great feedback on my Weekly Market Recap, it was extremely helpful.

We’re moving into 2014 soon and it’s a good time to put together a big picture look at how I see 2014 playing out. Since launching Theta Trend, I’ve introduced several systems including:

- Top Performing ETF’s Monthly Rotation System

- The original Theta Trend options system

- A Classic Donchian Breakout system***

- Weekly pTheta – A Parabolic SAR weekly options trend following system***

- Theta Breakout – A Donchian channel options trend following system***

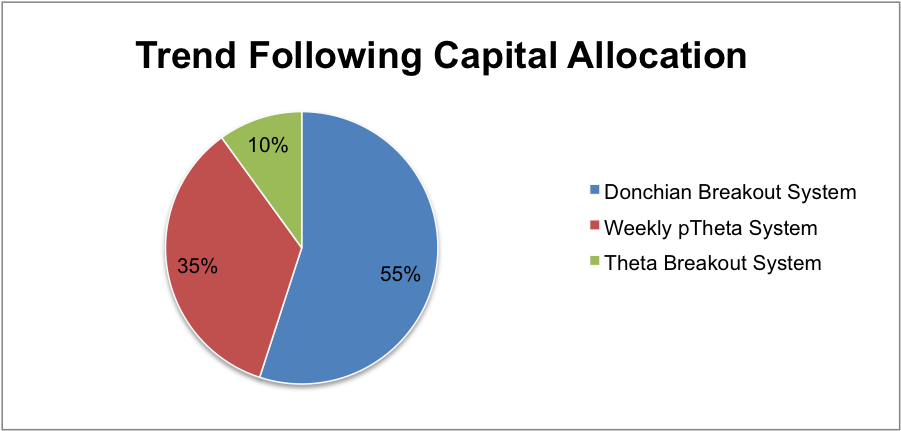

I’m going to simplify things in 2014 and trade 3 systems: the Donchian Breakout system, Theta Breakout, and Weekly pTheta (yeah, I put cute little stars next to the systems to make them easy to find).

The systems I chose have been the most popular systems and I have been trading the Donchian channel system for several years so it’s easy to continue. We’ll use the $10,000 account size I previously discussed to measure risk, which makes 1% risk (the maximum initial risk per trade) a clean $100.

A Little Philosophy:

I view trend following as a complete approach to trading. Most trend following systems trade numerous, uncorrelated markets in an attempt to diversify and increase returns. Trading multiple trend following systems adds a new layer of diversification and selling options is intended to smooth returns.

I view trend following as a complete approach to trading. Most trend following systems trade numerous, uncorrelated markets in an attempt to diversify and increase returns. Trading multiple trend following systems adds a new layer of diversification and selling options is intended to smooth returns.

Most trend following systems, including my Donchian channel system, tend to have clumpy returns. When a big trend develops, you have large returns, but those periods are preceded and followed by periods of small losses when trends fail. By selling options, I’m hoping to reduce the impact of small losses while still maintaining the upside potential of a trend following system. Conceptually, when a new breakout takes place, I’ll be taking a long position and simultaneously selling options if possible. Additionally, I’ll be selling far out of the money options every month in 2-3 markets.

A full list of markets and the systems is shown towards the bottom of this post. While any of the trend following systems I’m using could be traded independently, the combination of systems is what creates a complete portfolio.

Account Allocation:

The equity allocations described above are suggestive only and based on selling naked options in the weekly pTheta system. Essentially, naked options require more margin than credit spreads and use a good amount of account equity for a small number of positions.

System 1 – Donchian Channel Breakout System

I have been trading a Donchian Channel breakout system for several years and will continue to do so for the blog. Most of the recent trades discussed on Theta Trend have been in Forex and I’ll start including signals for other markets. While the number of markets the system trades seems large, the time it takes to manage the system is minimal. Every day I look the markets, set alerts, and raise stop levels. Specific details about the Donchian Channel system can be found through this link.

Because this system is being traded on ETF’s and borrowing can become an issue, this system will only take long positions in ETF’s. However, the system will trade Forex long and short. The capital allocation above is a better reflection of the cash that should be available for the Donchian system rather than the value of the positions. Positions are all sized using an initial 1% risk per trade and the capital required for those trades varies based on the individual market. Specifically, I’m referring to the capital required for the volatility adjusted position.

System 2 – Modified Theta Breakout

The Theta Breakout system will be traded using credit spreads on SPY (or SPX) and TLT rather than outright naked options. Using spreads will reduce the margin allocated to the system and enable the portfolio to trade the weekly pTheta system below. The system will be selling vertical spreads following new 50 day breakouts with a 3.5 x Average True Range trailing stop. The Theta Breakout system is a shorter term options trend following system and the weekly pTheta system has a longer holding period.

System 3 – Weekly pTheta System

The weekly pTheta system makes up the regular monthly options part of the portfolio. I’ll be looking for naked options trades in IWM or SPY and GLD on a monthly basis. The short options will be roughly 10 delta with 90 or so days to expiration. If the risk/reward is more favorable in cash settled indexes like RUT or SPX, I’ll trade credit spreads in those markets.

More information about the weekly pTheta system will be available this month. For the time being, I’ll say that I’m using a weekly chart and a slow Parabolic SAR to keep trades rolling across multiple expiration cycles.

2014 Markets and Systems:

The following list outlines the individual markets and systems we’ll be trading in 2014. An effort has been made to diversify across numerous asset classes without getting too carried away.

| ETF/Index | Description | Donchian Breakout System | Theta Breakout | Weekly pTheta |

|---|---|---|---|---|

| SPY / SPX | SPDR S&P 500 ETF | X | X | X |

| IWM / RUT | iShares Russell 2000 Index | X | ||

| EEM | iShares MSCI Emerging Markets Index | X | X | |

| WIP | SPDR DB Intl Govt Infl-Protected Bond | X | ||

| TLT | iShares Barclays 20+ Year Treasury Bond | X | X | |

| GLD | SPDR Gold Shares | X | X | |

| IYR | Shares Dow Jones US Real Estate | X | ||

| RWX | SPDR Dow Jones Intl Real Estate | X | ||

| BAL | iPath DJ-UBS Cotton TR Sub-Idx ETN | X | ||

| JO | iPath DJ-UBS Coffee TR Sub-Idx ETN | X | ||

| SGG | iPath DJ-UBS Sugar TR Sub-Idx ETN | X | ||

| DBA | PowerShares DB Agriculture ETF | X | ||

| DBE | PowerShares DB Energy ETF | x | ||

| EUR/USD | Euro / US Dollar Spot | X | ||

| USD/CHF | US Dollar / Swiss Franc Spot | X | ||

| NZD/JPY | New Zealand Dollar / Japanese Yen | X | ||

| USD/JPY | US Dollar / Japanese Yen Spot | X |

Look Out:

Keep an eye on the blog in the next couple of weeks for some new results pages to pop up. I will be adding pages to track the results from the individual systems and the portfolio in aggregate. Additionally, I’ll be releasing specific rules for the Weekly pTheta system.

One last thing . . . if you enjoyed this article, please share it above on your favorite social media (Twitter, Facebook, etc). Thanks.

Dan, this experiment is going to be really really interesting and will provide real value to your readers. I know it will take a lot of work to keep posting info about the systems every week. Thanks a lot in advance for all the effort!

Thanks LT and it will definitely be an interesting year. I always find things easier to understand when I look at a plan in advance. My hope here is that everyone understands where we’re going and that there’s a bigger picture for what we’re trying to accomplish. Thanks again for your comments and feedback. -Dan

Great write-up, I’m looking forward to the follow-ups! Do you have performance metrics you could share for the strategies you’ve traded before?

Thanks! The main backtesting I’ve done for the Theta Breakout can be found here:

http://www.thetatrend.com/backtest-results-short-options-trend-following-new-questions/

and there’s a little more here:

http://www.thetatrend.com/gamma-insights-initial-theta-breakout-backtest-results/

I’m also planning to release some initial pTheta results pretty soon, so keep an eye out for that. (hopefully within the next day or two)

Both the Theta Breakout and pTheta systems are new and I’ve just started trading them so we’ll both get to see the results in 2014 . . .

I previously backtested the Donchian system and optimized it using Amibroker, but that was a couple of years ago. I want to take some time this spring to revisit the Donchian breakout system in Amibroker. In the meantime, you might check out http://www.automated-trading-system.com and look at his Trend Following Wizards results. Really good stuff over there.

My Donchian channel results in excel are messy, but I don’t mind sharing the excel with you if you’d like to see how it traded over the past year or so. Shoot me an email and I’ll send it your way. dan at thetatrend dot com