Weekend Market Commentary 10/16/15 – $RUT, $RVX, $SPX, $VIX, $VXV

Big Picture:

Every day we wake up and the market (and life as well) gives us a new opportunity. When I began trading non-directional options strategies I spent more than a little bit of time trying to will the market to remain still. Do I even need to tell you how that worked out for me?

Every day we wake up and the market (and life as well) gives us a new opportunity. When I began trading non-directional options strategies I spent more than a little bit of time trying to will the market to remain still. Do I even need to tell you how that worked out for me?

Over the years I’ve come to recognize that the market moves. Sometimes is moves a lot, sometimes a little, and occasionally it moves in the right direction for my positions. Any time you put on a trade and the market moves, you have a new opportunity. Your opportunity could be closing the trade for a gain, a loss, adding, adjusting, or something else entirely.

Earlier this week I had a conversation with someone about how my trading “works” and I mentioned that I start my positions as a Butterfly and a long call. His initial reaction was that I must like low volatility and periods when the market remains calm. He also suggested that I must be betting that volatility will stay low. Neither of those statements is accurate.

I’m agnostic about what the market does, frequently wrong about direction on the daily timeframe, occasionally right about direction intraday, and the vast majority of the time I have no real opinion about volatility. It’s essential to approach the market without expectations and be open to whatever scenario plays out.

Trust me, I always know exactly how the market will behave. Unfortunately, I don’t know how it will behave until after it happens.

I spend the majority of my time trying to learn how to react to movements in the market. I’m not worried about predicting what will happen or choosing the perfect position. I just want to be in a position that can adapt to changes.

Change in the markets creates new opportunities and successful traders recognize and capitalize on change. Unsuccessful traders wish the change didn’t happen.

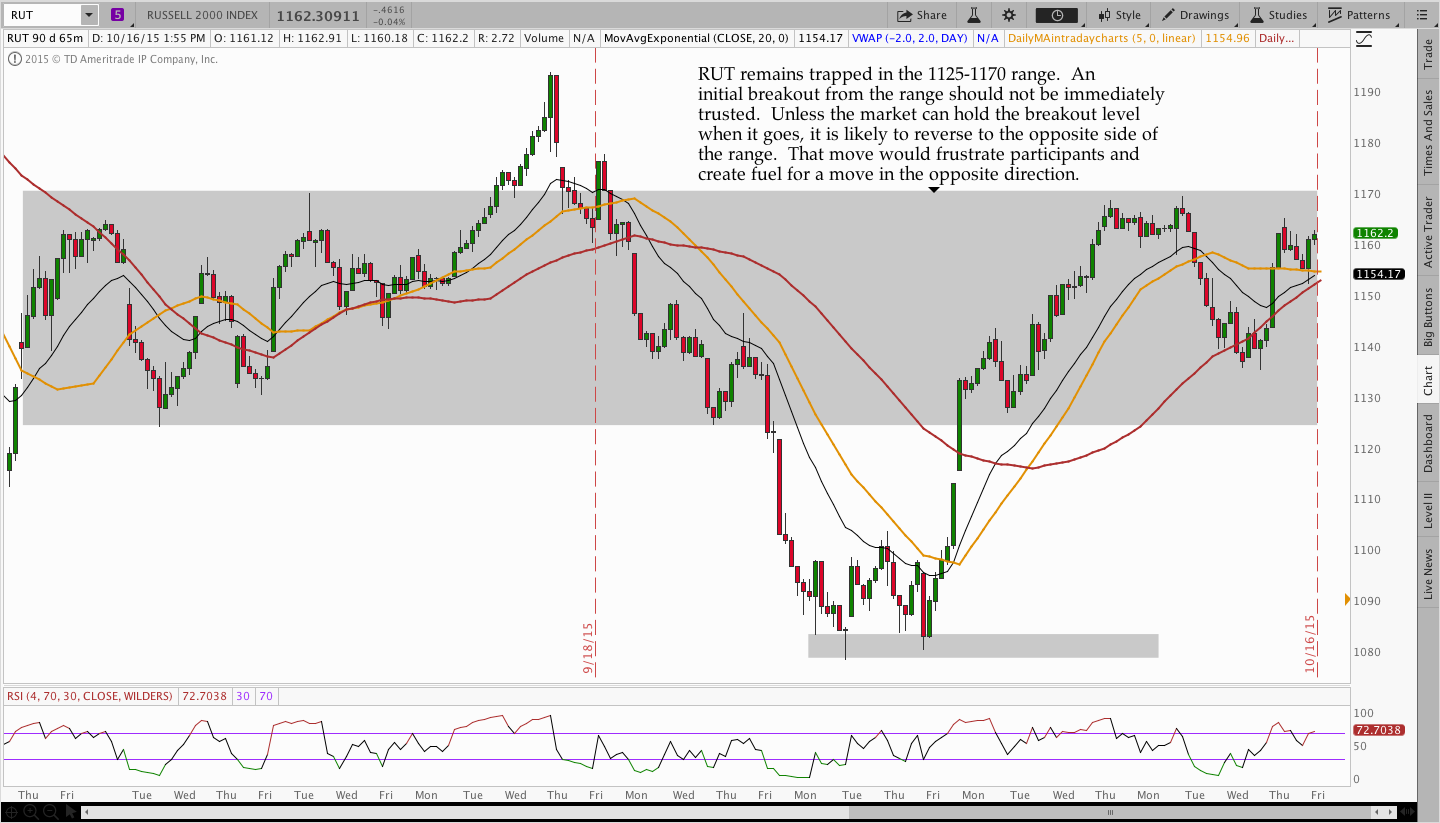

Around midweek the Russell 2000 fell down from the 1160’s to the 1140 area, but the market was unable to move lower. That move allowed me to close the November CIB early for a gain in excess of the target and go into the weekend almost totally flat.

The market hasn’t shown us all of the cards yet and I see quite a few mixed signals. When the market is giving us mixed signals it’s a good time to be very flexible with our opinions. Implied volatility has been collapsing and the markets went into the weekend relatively strong. At the same time, the market is below declining longer term moving averages and coming into an area of potential resistance.

The move higher feels like a bull trap to me, but I’ve been wrong more than once before and I wouldn’t even bet on my own opinion. I will, however, bet on my non-opinion.

The media constantly bombards us with directional calls and expert views on the market. I hate that shit. When they’re wrong, there’s no follow up. When they’re right, the person is considered omniscient.

The harsh reality is that we’re just looking at chance events and nobody has any idea what the market machine will spit out next. All we can do is adapt to new information and react to change.

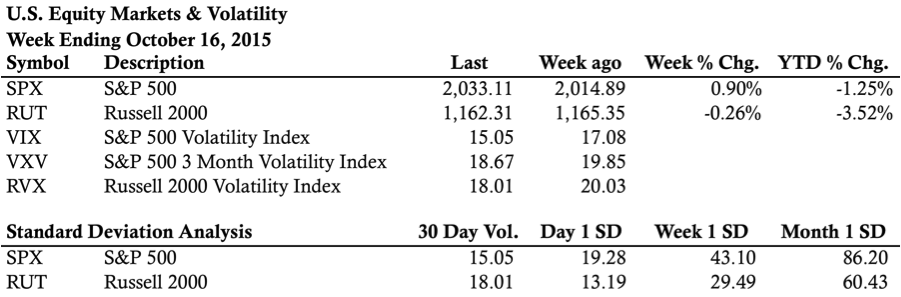

Market Stats:

Levels of Interest:

In the levels of interest section, we’re drilling down through some timeframes to see what’s happening in the markets. The analysis begins on a weekly chart, moves to a daily chart, and finishes with the intraday, 65 minute chart of the Russell 2000 ($RUT). Multiple timeframes from a high level create context for what’s happening in the market.

Live Trades . . .

The “Live Trades” section of the commentary focuses on actual trades that are in the Theta Trend account. The positions are provided for educational purposes only.

—————————–

The November CIB was closed this week and exceeded the profit target. This post is a review of the trade.

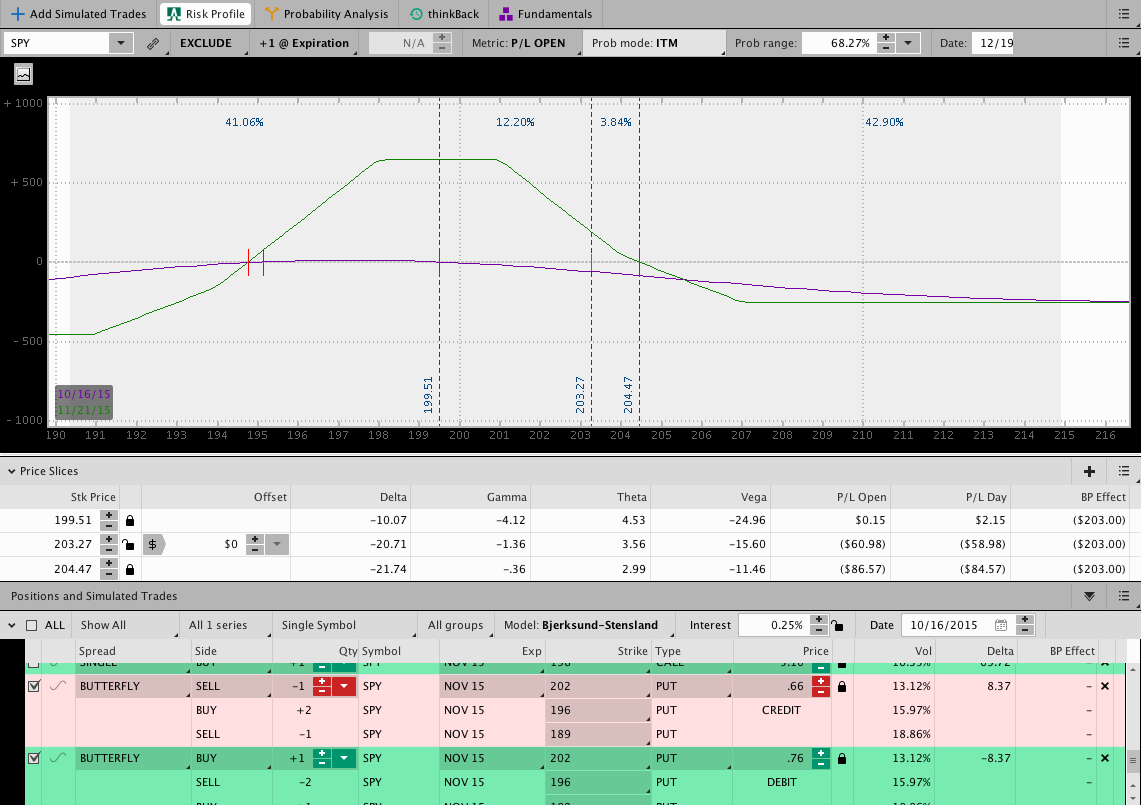

An updated image of the Migrating Butterfly is shown below. As a reminder, I’m trading this strategy in a very small IRA as a way of forward testing it. The trade was adjusted again this week by rolling the 196 Butterfly up to 201.

This trade is similar to the CIB, but lacks a long call and only increases in size to two Butterflies. The trade is underwater right now and is going to need a pullback for this month to work out. Fortunately, the trade is getting closer to expiration and the T+Zero line will begin to rise more quickly.

Looking ahead, etc.:

I’m light on positions right now and that’s okay. It’s always a good thing when I’m flat because I hit a profit target early. There is a chance that I’ll open the December CIB sometime this week, but it depends on what happens in the market. Waiting another week is also a possibility and I’m not in a panic to get in. If I do get open a new position, I’ll be sure to Tweet it out so make you’re following me on Twitter.

Have a great weekend.

Please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.