Losing Trade Scenario Analysis and Short Vertical Hedging

It’s great to talk about winning trades, but we can usually learn more from our losing trades. A little time has passed since August 24th and I want to talk about my biggest losing trade of the year. The trade was intended to be an unbalanced Iron Condor in the RUT. I began the process of legging into the spread on August 18th, a little less than a week before the late August mini-crash. I know, I have amazing market timing.

It’s great to talk about winning trades, but we can usually learn more from our losing trades. A little time has passed since August 24th and I want to talk about my biggest losing trade of the year. The trade was intended to be an unbalanced Iron Condor in the RUT. I began the process of legging into the spread on August 18th, a little less than a week before the late August mini-crash. I know, I have amazing market timing.

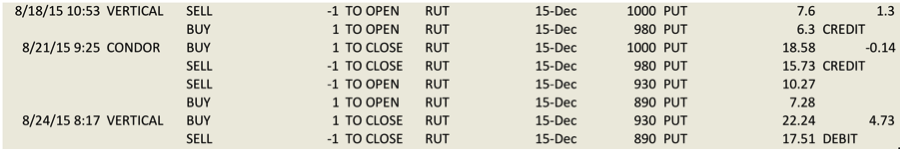

The trade began when I sold the $RUT 1000/980 Dec. 15 Put Vertical for 1.30. The short put was around 9 delta at entry so the trade was relatively high probability. At the time of entry, I didn’t choose to hedge the position. I rolled the spread down a few days later and increased my size. After that, Monday happened and I just got out because I was above my maximum intended loss for the position.

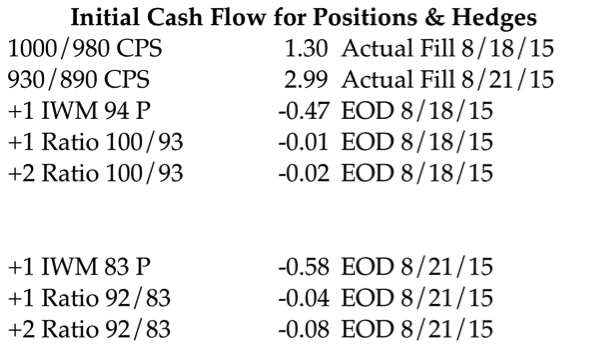

The image below shows the filled orders for the trade:

The speed of the sell off is what created a problem for the short vertical. As a result, I decided to take a look at a few different hedging options. The hedges I considered were buying a roughly 5 delta put, buying a single ratio spread, and buying two ratio spreads. The ratios were constructed as being long two puts around a 4-5 delta and short the 9 or 10 delta to finance the longs. My goal was to have essentially zero cost insurance. I also looked at the impact of purchasing the hedge when the trade was initiated on August 18th and on the day I rolled down, August 21st.

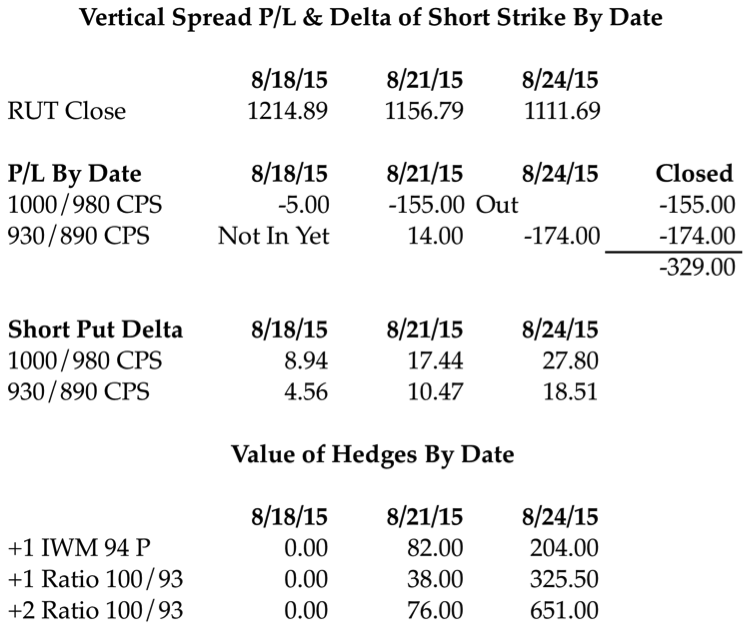

The table below summarizes the pricing for a few different options and the position itself. As you can see, the 5 delta put costs around .47, which is expensive relative to the 1.30 credit for the short vertical.

In the next table I summarized a few different scenarios. We’re looking at the P/L for the position by date as well as the Delta of the short strike. As you can see, I rolled the credit spread and doubled my size when the short Delta doubled. The open profit on the hedges is provided at the bottom of the table. Note that the ratios exploded in value especially when considered relative to their initial cost.

At this point, you have the background for a few different options. The real question we want to answer is what would have been a better way to trade the position.

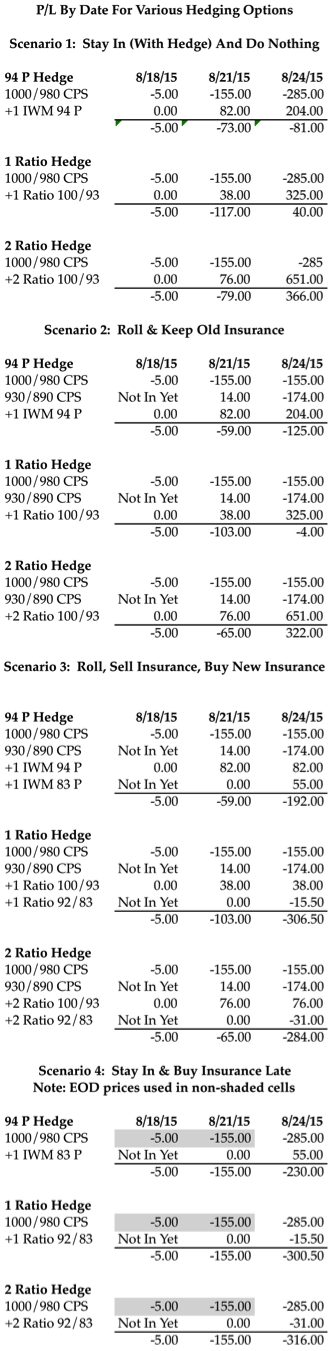

In the table below, I walk through four scenarios with the different hedges. In the first scenario I consider what would have happened if I had stayed in the original position with the hedge and not rolled on August 21st. The second scenario considers what would have happened if I had rolled on August 21st and kept my original hedge. The third scenario looks at the position if I had rolled both my position and hedge on August 21st. Finally, the fourth scenario considers what would have happened if I had stayed in my original position without rolling and purchased a hedge on Friday, August 21st when my short Delta doubled.

Lessons:

The tables above contain quite a bit of information to digest. The biggest take away for me is that most of the outcomes above show a loss. In other words, you are likely to lose money if the market trades strongly against your credit spread. That realization makes controlling the loss extremely important. Some people chose to “ride out” the pain in their open positions and that worked this time, but what if the market had continued lower? High risk trading is something I’m not comfortable with in my own accounts.

Another big take away from the table above is that buying insurance late is not very helpful. On August 21st, the market had already declined a good amount and out of the money puts were relatively expensive. At that point it would have been better to close the position rather than buy insurance.

My preferred scenario above is to have purchased insurance and stayed in the trade without rolling. That outcome shows a loss, but seems the most like something I would actually do in live trading. We have no way of predicting major declines in the market and sometimes we wait and hope trades will work themselves out. Sometimes that works and sometimes it doesn’t.

One of the reasons I’m not a big fan of the ratio spreads is that they introduce additional risks into the equation. Specifically, the ratio spreads above generally worked out because price moved so quickly after entry. However, in cases where that doesn’t happen, a ratio will tend to have a sagging T+Zero line and lose money on a mild decline. You can also see that buying a ratio spread after implied volatility expands is not very helpful.

Risk:

We (as in options traders AND human beings) have a tendency to underestimate risk. Options income trading has the potential create a false sense of security when we’re on a long winning streak. All winning streaks come to an end and it’s important to manage risk in positions so that we aren’t destroyed when they do end.

I took a loss that was reasonable within the context of my winning months, but not reasonable within the context of my credit spreads. I should have simply exited rather than rolling. As my results for the year show, the bulk of my returns have come from Butterflies rather than Credit Spreads or Iron Condors. However, the reason for the less than stellar Credit Spread returns has more to do with my own psychology rather than the trades themselves.

What do you think? How would you have traded the position and why? Let me know if the comments below and thanks for reading . . .