In Case You Don’t Know, You Don’t Need to Sell Puts $HVPW

Overview:

A few weeks ago I discussed the returns on the CBOE Put Write Index, which has historically outperformed the S&P 500. That index sells cash secured ATM puts every month and invests the cash in short term (1-3 month) interest bearing investments. Today we’re going to look at a new index and ETF that gives you the ability to have exposure to a put selling strategy by simply buying the ETF. Enter $HVPW.

What is the HVPW Index Fund?

The High Volatility Put Write Index ($HVPW) Fund is an ETF that attempts to mirror the performance of the NYSE Arca U.S. Equity High Volatility Put Write Index. The index sells cash secured, naked puts in 20 different stocks every month and holds cash in 3 month T-Bills, which is similar to the CBOE Put Write Index.

Option Trading Specifics:

$HVPW sells naked puts that are 15% out of the money with 60 days to expiration. The puts are sold on stocks with the highest 2 month implied volatility that meet certain liquidity requirements.

Without going into a lot of detail, the stocks $HVPW uses for put selling are high volume stocks with a market cap of over $5 Billion. Once the pool of stocks is identified, they are ranked based on 60 day implied volatility and the highest implied volatility stocks are chosen. The full liquidity requirements are listed in this pdf.

One interesting aspect of the index is that no price indicators are used and naked puts are sold on stocks with the highest volatility. Because higher volatility tends to accompany down moves in stocks, it’s interesting that the index uses a neutral to bullish strategy on stocks that have the highest implied volatility.

Performance Stats:

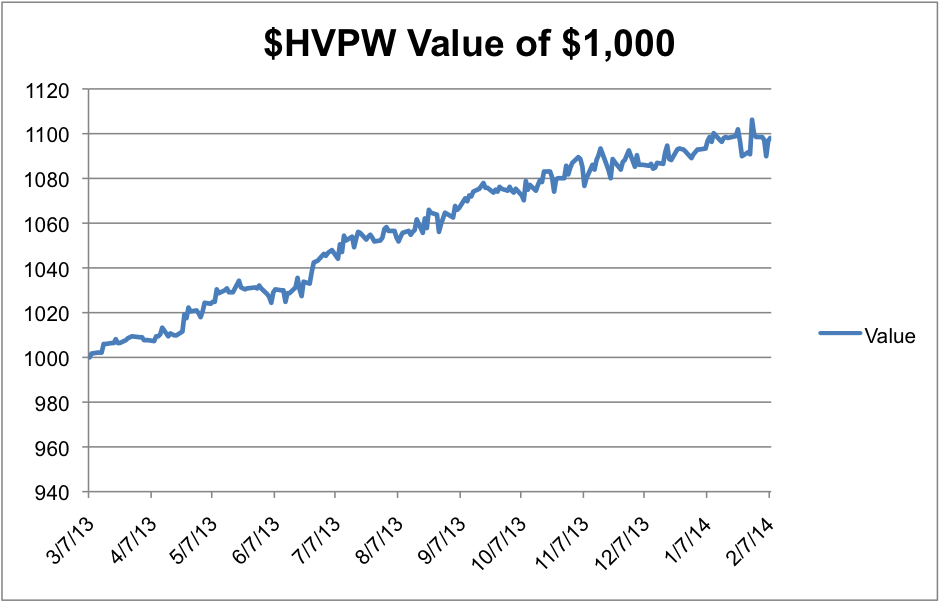

The High Volatility Put Write Index is relatively new and we only have a year of data for review. As you would expect from a strategy that sells puts in stocks, the past year has been positive. The most attractive aspect of the index is that it generated close to a 10% return with a very, very low draw down.

Note that the image above is the total return of the ETF and includes cash dividends.

| $HVPW - Return Since Inception (1 year) | |

|---|---|

| Total Return | 9.81% |

| Maximum Draw Down | (1.47%) |

| Annual Fee | 0.95% |

| Value of $1,000 on 2/7/14 (Invested at inception on 3/7/13) | $1,098.07 |

Potential Uses:

Beyond the ability to diversify an ETF portfolio, I think using $HVPW as a base for an options selling strategy would be interesting. If you think back to the CBOE Put Write Index, that index was investing in a yield generating investment and selling puts to increase returns. At Theta Trend, I have focused on selling options around an outright Trend Following trading strategy. The idea in both cases is to generate returns using a basic strategy and then use options to further increase returns.

Another idea for building your own index would involve putting together a basket of interest bearing investments to hold cash and then sell options to increase yield. Including $HVPW in the basket of interest bearing investments would both give a little extra exposure to High Volatility Puts and increase yield. Keep an eye on the blog in the next week or so for when I talk about how to build your own index . . .

Guess what, this is just one post in a series about selling puts. Want to know when the next articles are posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.