10 Tips For Trading Options With a Small Account

Let’s be very clear about something, trading options isn’t easy. My belief is that anyone who is interested in options trading should start small and get a feel for how options trading works. Many traders are drawn to options because they offer leverage and the ability to construct market neutral positions. In other words, you don’t need to predict direction or you only need to be a little bit right on direction. Your goal as a new options trader should be to assume a level of risk in your trades that is boring while you get a feel for how trades work and what fits your personality.

Let’s be very clear about something, trading options isn’t easy. My belief is that anyone who is interested in options trading should start small and get a feel for how options trading works. Many traders are drawn to options because they offer leverage and the ability to construct market neutral positions. In other words, you don’t need to predict direction or you only need to be a little bit right on direction. Your goal as a new options trader should be to assume a level of risk in your trades that is boring while you get a feel for how trades work and what fits your personality.

The following list goes through some important concepts a new or aspiring options trader should understand.

1. Risk in a Small Account

Options trades that use low priced stocks and ETF’s can be sized so that the dollars risked per trade will be relatively small. However, the percentage of account equity at risk will frequently be larger. That larger percentage at risk makes it extremely important not to take significant losses. For example, an ETF strategy that risks $100 per trade is just 2% of a $5,000 account, but is 10% of a $1,000 account. Options positions can be constructed that risk a low dollar amount per trade, but dollars at risk is just a starting point for managing risk.

2. Know Your Maximum Percentage of Equity Loss

It’s relatively easy to know your maximum risk in an options trade because many trades have defined risk. However, most options traders do not trade in a way that allows positions to reach the maximum loss. Positions are frequently managed so that the maximum loss and target gain differ from the risk graph. If you know your maximum loss in terms of dollars, it’s important to translate that into a percentage of account equity. You can take many more 1%-3% losses in a row without destroying your account equity.

The challenge with giving a one size fits all number for the maximum percentage at risk per trade is that the number depends on your percentage gains and your winning trade percentage. That being said, keeping your risk below 5% of account equity per trade is a good starting point. The Theta Trend system document has a chapter on Expectancy that goes into risk and position sizing in more detail.

3. Understand Your Loss In Terms of the Position

Suppose you set up a dollar based maximum loss for a new options position and know what that means as a percentage of account equity. The next step in trading an options position is understanding what changes will bring about that loss. For example, if price moves up 1% will you hit your maximum loss or will it take a much larger market move? If price only needs to move a small amount to hit your target loss, you are probably assuming too much risk.

4. Volatility

Options traders are always watching volatility because it impact their positions. That being said, volatility will have a smaller impact on your profitability if you’re trading options with 30-60 days to expiration and trading small. Using time spreads and longer dated options will increase the significance of volatility.

5. Anticipate Capital Needs and Adjustment Money

Diversification across markets, expiration cycles, and strategies are all ways to reduce risk. In a small account, diversification becomes more challenging because the margin for trades will take up a larger percentage of account equity. Additionally, it’s important to not take on a position that is so large that it can’t be adjusted. It’s important to anticipate that capital you’ll want to use in the next expiration cycle as well as the capital you want sitting in cash for adjustments.

6. Trading Butterflies in a Small Account

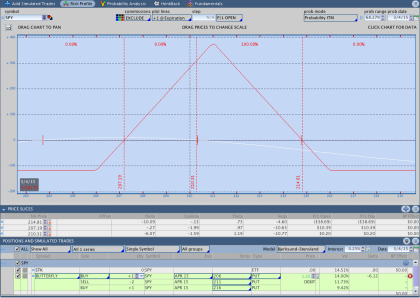

The Butterfly is one of a few options strategies that works well in a small account. A sample Butterfly strategy for a small account would purchase a 45-55 day Butterfly slightly below the money in an equity market ETF like SPY or IWM. If price trades higher, a second Butterfly can be purchased to stretch out the expiration break even lines. If prices trades higher again, the first Butterfly can be rolled up.

The goal of the strategy is to keep the market trapped under the expiration break even lines without taking too large of a loss. The benefit of trading the strategy is that the position will generally make money on the downside due to skew. One of the good things about trading a Butterfly is that the risk/reward ratio is relatively favorable, which makes the strategy more forgiving.

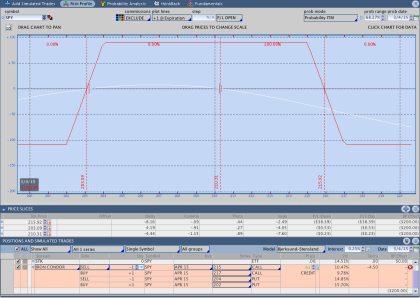

7. Iron Condors

The Iron Condor is another good strategy and a viable solution for trading options with a small account. Many traders learn to trade Iron Condors on ETF’s like SPY, QQQ, or IWM. After some success, traders move into larger products like SPX, RUT, NDX, or MNX. With the liquidity of SPX options and small 5 point strike spacing, SPX is a good product for trading Iron Condors in a small account.

Many traders like to initiate high probability Iron Condors by selling deep out of the money options. The trades make money a high percentage of the time, but sometimes require adjustments to keep risk under control. As a result, it’s important to keep some portion of a small account in cash for adjustments.

A little more information on Iron Condors can be found here.

8. Weekly Options

Weekly options provide the opportunity to make quite a few trades every month. However, Weekly Options have some additional risks that make them more dangerous for a small account. Positive Theta Weekly Options positions frequently carry high directional risk (think gamma) that can potentially destroy a small account. Suppose you sell a 5 point wide, 10 delta SPX vertical with a week to expiration. That vertical will likely be sold for around a .45 credit with a maximum risk of 4.45. The problem with that type of a position is that even though you might want to close the position for less than the maximum loss a gap against the position can lead to a larger than planned loss. As a result, a smaller amount of capital should be allocated to strategies that use Weekly Options and that can be challenging or impossible with a small account.

Additional information on trading Weekly Options can be found here, here, and here.

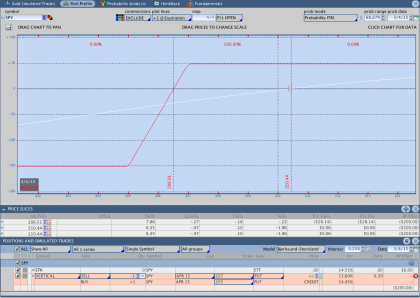

9. Directional Trading

There are both positive and negative Theta ways to trade options directionally. Positive Theta directional trading allows options traders a way to be only partially right or even wrong on direction and still come out ahead. The vertical spread allows options traders a way to directionally trade a market without the need to be completely correct on direction. For example, a 25 delta vertical put spread with 40 days to expiration has a roughly 75% chance of expiring. The trade will make money if the market moves up, stays about the same, or even goes down slightly. The trade will make money as long as price remains above the short strike at expiration.

Download the Theta Trend Document for a good overview on positive Theta, directional options trading here. The document provides a system for positive Theta, directional options trading that can be traded very small using options on ETF’s.

10. Commissions (What you’re really been thinking about this whole time)

The reality of trading options with a small account is that commissions can reduce returns and become a significant factor in your trading. If your profit target on a trade is $50 and you pay $12 in commissions, a significant portion of your capital will go to your broker. A per contract rate of $1.50 or less allows you to trade a few strategies, but be aware that adjustments will get expensive for low profit target trades.

Feel free to post any questions you have in the comments below and thanks for reading.