Iron Condor Trading Rules and Stalking a RUT Iron Condor

Intro:

I have a long history and something of a love/hate relationship with Iron Condors. One of my first option trades was a DIA iron condor during the financial crisis. I went back and looked and at the time I opened that trade, implied volatility was in the low 50% range and it fell to the high 30’s during the trade so it made the trade super, super easy and I felt, obviously, like a genius. Unfortunately, feeling like a genius is trading is generally a bad thing and over the next few months as the market rocketed higher I found out why.

Overview:

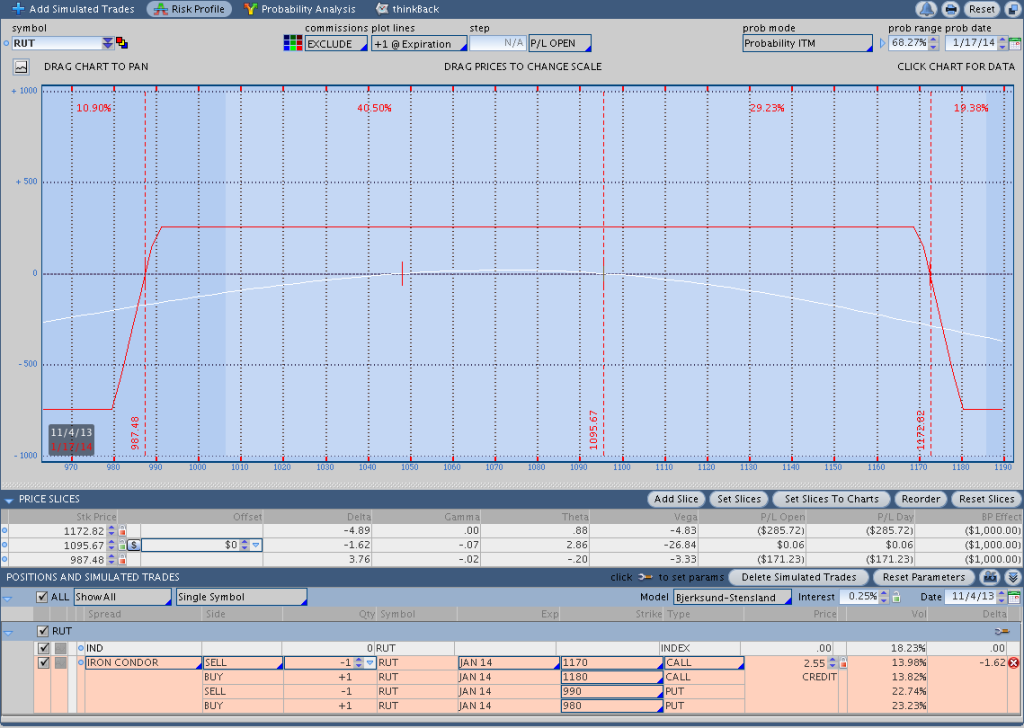

This post gives an overview of my rules for trading iron condors. There are quite a few variations and types of iron condors and this type of iron condor may or may not be the best fit for your personality. When I began trading iron condors I sold quite a few different deltas and days to expiration before landing on my preferred delta and timeframe. This article is also written with the assumption that you’re at least familiar with what makes up an iron condor. An iron condor is a multi-legged option spread made up of an out of the money call vertical and put vertical, both sold for a credit. An image of a RUT iron condor is shown below for reference. The iron condor pictured has 73 days to expiration and is roughly a 15 delta condor, meaning the short strikes have around a 15 delta.

Underlying Vehicles:

The iron condors I trade are always in an a cash settled equity index product like RUT, SPX, OEX, NDX, or MNX. I generally prefer the RUT because the implied volatility is a bit higher, but there are situations when it makes sense to use another index instead. You can also trade iron condors using ETF’s, but I feel that the commissions become too great of a factor and prefer a larger product.

Iron Condor Entry Rules:

I like to sell iron condors on equity index products (see underlying vehicles above) sometime between 55-75 days to expiration. I also like to sell iron condors with a short option delta of 15-20.

Iron Condor Profit Target and Adjustment Rules:

When selling an iron condor, my goal is to collect 60% of the initial credit. Since I sell most of the spreads for a credit of 2.25-2.50, this works out to a profit target of $135-$150 per iron condor. If I ever hit 50% of my goal within the first 10 days, I close the spread. My adjustment rules are simple and based on the ideas of Dan Sheridan of Sheridan Mentoring and Mark Sebastian of Option Pit and The Option Trader’s Hedge Fund. Regardless of the adjustments you use when you’re adjusting an iron condor, it is essential that you adjust the trade early enough. If the trade is already at your max loss, it’s time to close the trade rather than adjust it.

Dan recommends adjusting iron condors when the short option delta increases by 10 and Mark recommends a 1/3, 1/3, 1/3 approach. While Dan’s adjustment point is a good start, I prefer to take less heat and am usually looking to adjust before my short delta has increased by 10. Mark recommends adjusting iron condors at 1/3 loss increments. At 1/3 of your maximum loss you adjust, at 2/3 of max loss you adjust again, and if you hit the max loss you’re out.

Iron Condor Adjustments:

My preferred Iron condor adjustment is the purchase of a back ratio or a long option. The back ratio buys me time, requires a small amount of cash, and also reduces vega exposure. When I adjust an iron condor, I’m hoping to flatted the profit/loss line today and not worried about expiration because I don’t intend to hold the spread until expiration.

Rolling:

I do not believe in rolling out, up, or down losing spreads. My personal philosophy is that if I am wrong enough to lose on the spread, I’ll take the loss and move on. When traders roll vertical spreads they usually increase the number of spreads, which increases the risk on the trade. Increasing the risk on the losing side of an iron condor is something I’m not comfortable with.

RUT Trade Analysis:

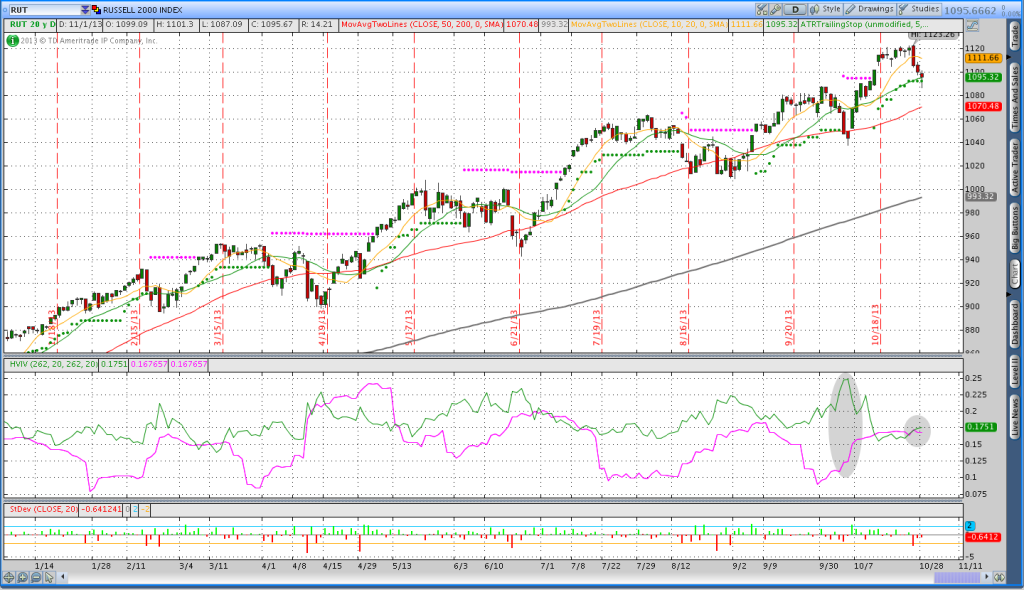

The image below is a price chart of RUT, the Russell 2000 index. The follow list is my though process for evaluating iron condor trades:

- Implied volatility should be average or higher than average relative to the past 3-6 months. As of today, implied volatility is around 17%, which is lower than average over the past few months.

- Implied volatility should be greater than historical volatility. The study on the chart below plots HV (pink) and IV (green). There are also two shaded ovals. The first oval indicates a more favorable IV environment because IV is much greater than HV. Currently IV is roughly equal to HV, which is not ideal. The first oval would also have been a great time to enter an iron condor because implied volatility fell relatively rapidly and that would have helped a new condor become profitable quickly.

- Price is a subjective thing to consider when evaluating an iron condor and, ultimately, we want price to remain unchanged. That being said, I like to note the direction of the trend (if any). In this case, RUT is in a clearly defined uptrend on the daily chart with rising 50 and 200 day moving averages. Only the 10 day moving average is turning down, but unless things really fall apart, I would say the trend direction should be neutral to higher.

Right now the January RUT options have 73 days to expiration so I’m in the window for when I begin looking at trades. I’d like to see implied volatility creep a little higher before entering a trade without a huge increase in historical volatility. I’ll be watching RUT over the next 10 days for a good opportunity to enter and will tweet and post when I enter a trade.

Recap:

There is a lot to digest in this post and the rules for iron condors and adjustments are pretty brief. If you have any questions, feel free to post them in the comments below or get in touch on the About Me page.

Additional Resources:

Dan Sheridan and Mark Sebastian have extensive information on the their websites about trading iron condors. Mark Sebastian is also the author of The Option Trader’s Hedge Fund, which is an awesome book that covers various spreads, adjustments, and some of the big picture aspects of trading options.

Disclaimer:

Like all things on this blog, this is not investment advice or a recommendation to take any trade. Make positive expectancy decisions.