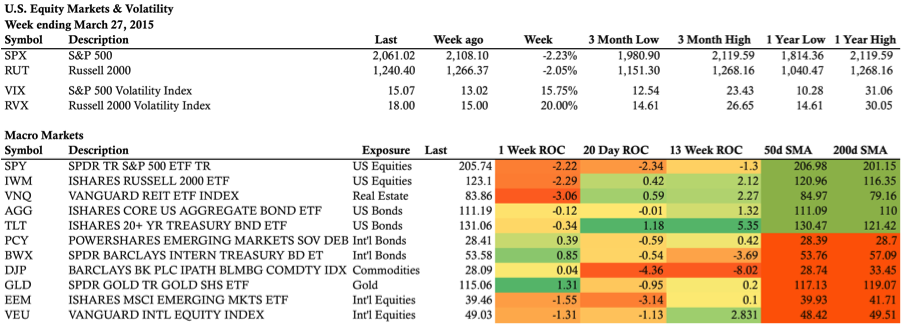

Weekend Market Commentary 3/27/15 – $RUT, $RVX, $SPX, $VIX

Big Picture:

It’s been a couple of interesting weeks from both a market and personal perspective. I’ve been on the road for almost two weeks now and last night I arrived in Tucson, Arizona. After leaving Sun Valley, Idaho my original plan was to head to Austin, but things weren’t coming together when I got there and it didn’t feel right. After struggling for a little over a week in Texas, I decided it was time to try one of my other potential destinations and I headed to Tucson. After making the decision to come to Tucson, everything has come together naturally and it looks like I’m staying.

It’s been a couple of interesting weeks from both a market and personal perspective. I’ve been on the road for almost two weeks now and last night I arrived in Tucson, Arizona. After leaving Sun Valley, Idaho my original plan was to head to Austin, but things weren’t coming together when I got there and it didn’t feel right. After struggling for a little over a week in Texas, I decided it was time to try one of my other potential destinations and I headed to Tucson. After making the decision to come to Tucson, everything has come together naturally and it looks like I’m staying.

In life and in trading, events and actions shouldn’t feel like a struggle. When something feels like too much of a struggle, it suggests that we’re doing something that is inconsistent with our expectations or desires. We can adjust our expectations in response to what happens, but it is much harder to change what we fundamentally want (our desires). Even though our desires seem like they should be obvious, they can be surprisingly hard to understand. In many cases, we pursue things we think we want even though what we want is a byproduct of what we’re chasing.

Many people become interested in trading or investing because they “want to make money,” but people usually want the benefits of money more than money itself. In other words, people want the freedom money buys rather than money. When you approach trading from the perspective of wanting to make money, you’re coming from the wrong place. Trading is a game where the road to winning involves making positive expectancy bets. Over time money comes, but it only comes through a good process and not through a forced effort to make money. The most successful traders have a process that is consistent with their personalities and simply enjoy executing and improving the process. Money, the false desire, is the byproduct of a good process and time.

This week the markets pulled back a bit and the Russell 2000 had it’s first big down day in quite some time. Despite the pullback, implied volatility has been slow to respond. The disconnect in implied volatility suggests suggests that we might see more sideways action in the market. The market is roughly in the middle of a rising channel and on a longer term timeframe the market is still bullish and near all time highs.

Market Stats:

Implied & Historical Volatility:

The move lower on Wednesday brought an increase in 20 day Historical Volatility, which is now back to almost 15% after being below 10% a couple of weeks ago. However, the increase in HV has not been met with the same increase in Implied Volatility. What that means is that a couple of weeks ago the premium of Implied Volatility to Realized Volatility was much richer than it is now. That gap has narrowed by the market moving more with a smaller reaction in options prices.

Under the hood . . .

The “Under the Hood” section of the commentary focuses on actual trades that are in the Theta Trend account.

The past two weeks have been fairly active from a trading standpoint and I’ll need to do a recap of the RUT April Butterfly once it’s closed. I opened a new May position last week and that trade is doing fine and hasn’t required any adjustments.

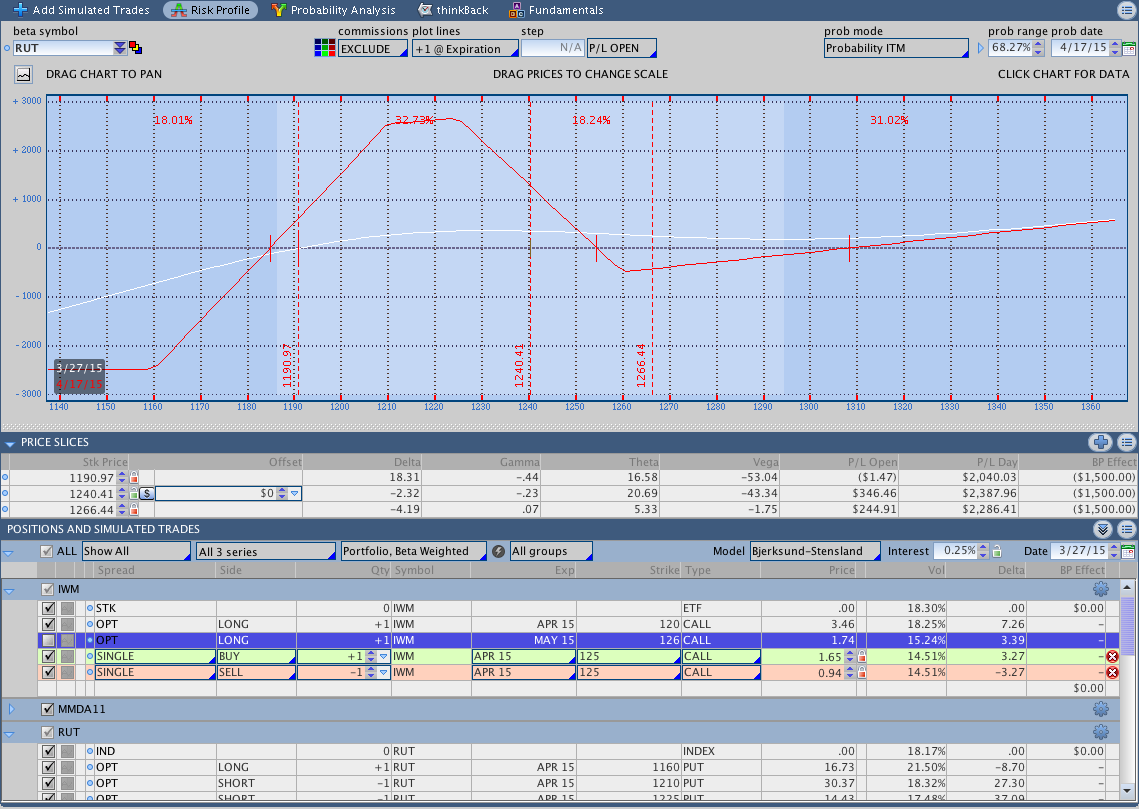

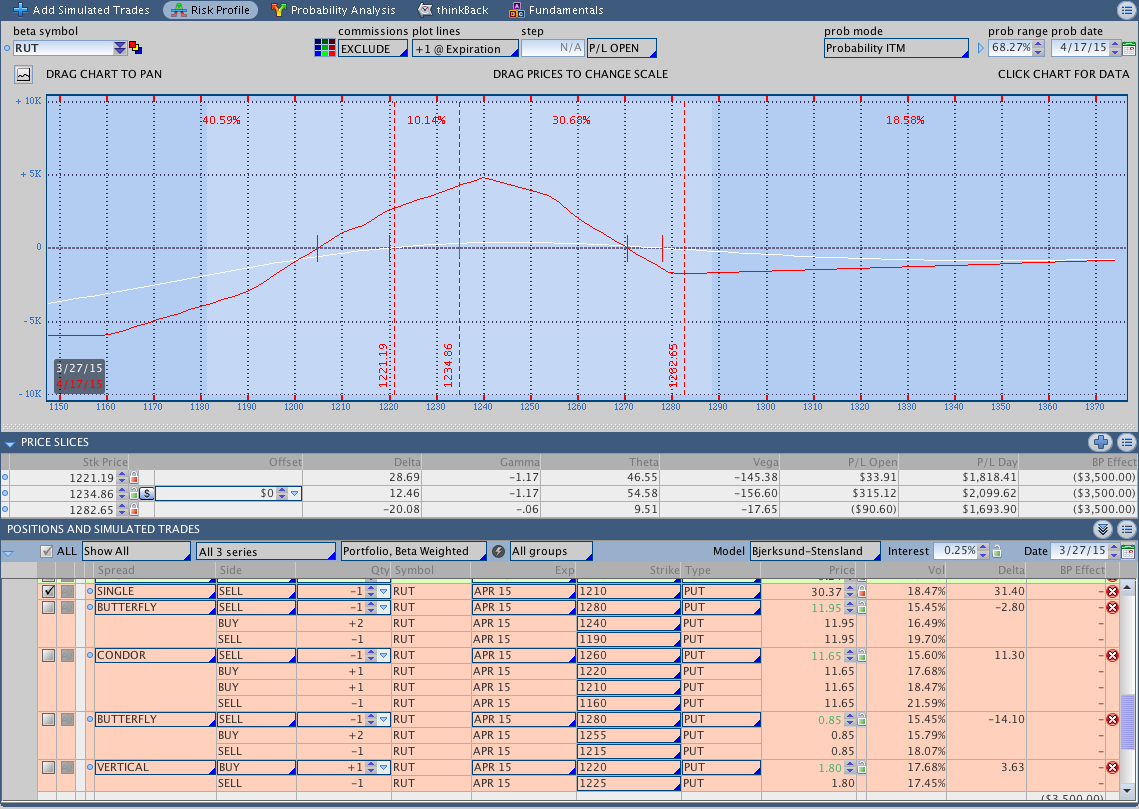

$RUT April 2015 Options Put Butterfly:

The April $RUT Butterfly was challenged on the upside last week and I was forced to chase the market higher. This week RUT sold off and the position went from being very short delta to being long. As a result, I partially closed the position because the downside risk was too great. The image below shows the position after chasing the market higher and prior to the partial close. Price went from the 1260’s to the 1220’s and while that is still well within the expiration break evens, a gap lower would have severely hurt the position.

The image below shows the adjusted position on Friday. I closed two of the three Butterflies and rolled up one of the short puts. The position is now fairly flat delta and I feel comfortable sitting in the trade a little longer to collect some additional Theta. I moved my downside risk point from 1220 to around 1190 and I should have time to adjust the upside if necessary. Images of the positions include all adjustments.

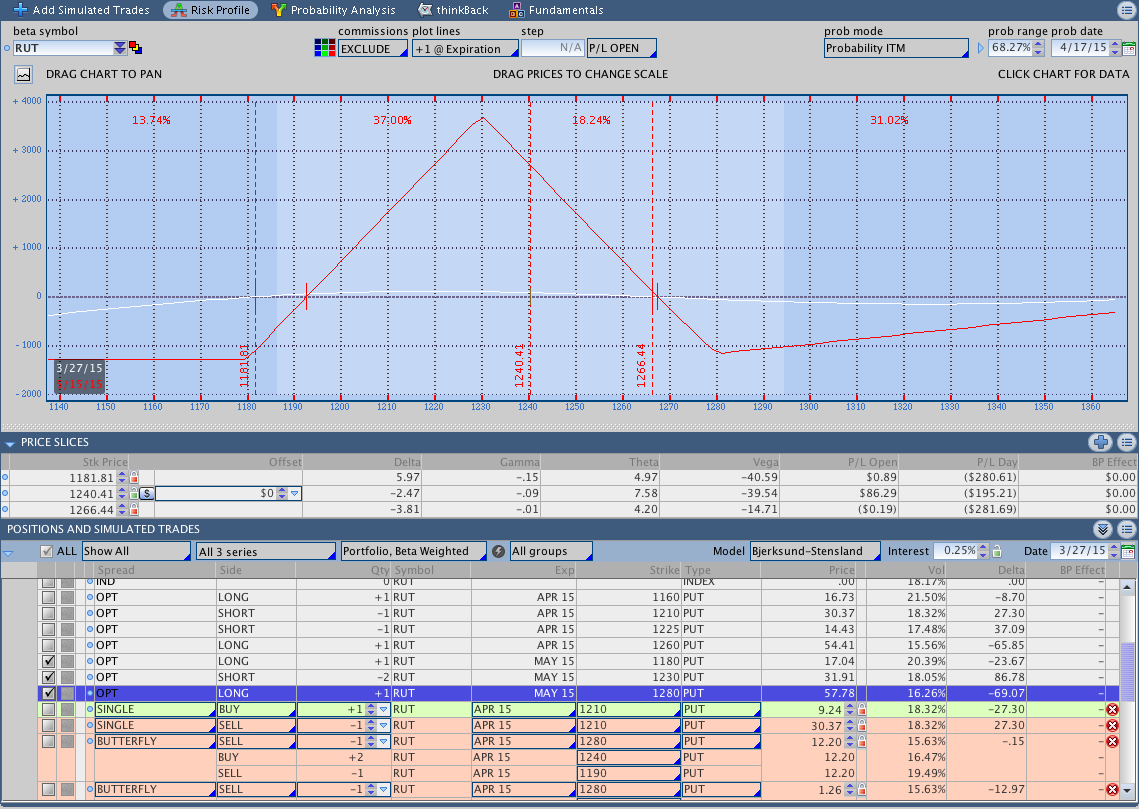

$RUT May 2015 Options Put Butterfly:

Last week I opened a RUT May Butterfly. Due to my surprisingly poor market timing, that trade was immediately threatened on the upside. Fortunately, price never hit the upside adjustment point and sold off heavily this week leaving the position in good shape. An image of the trade is shown below.

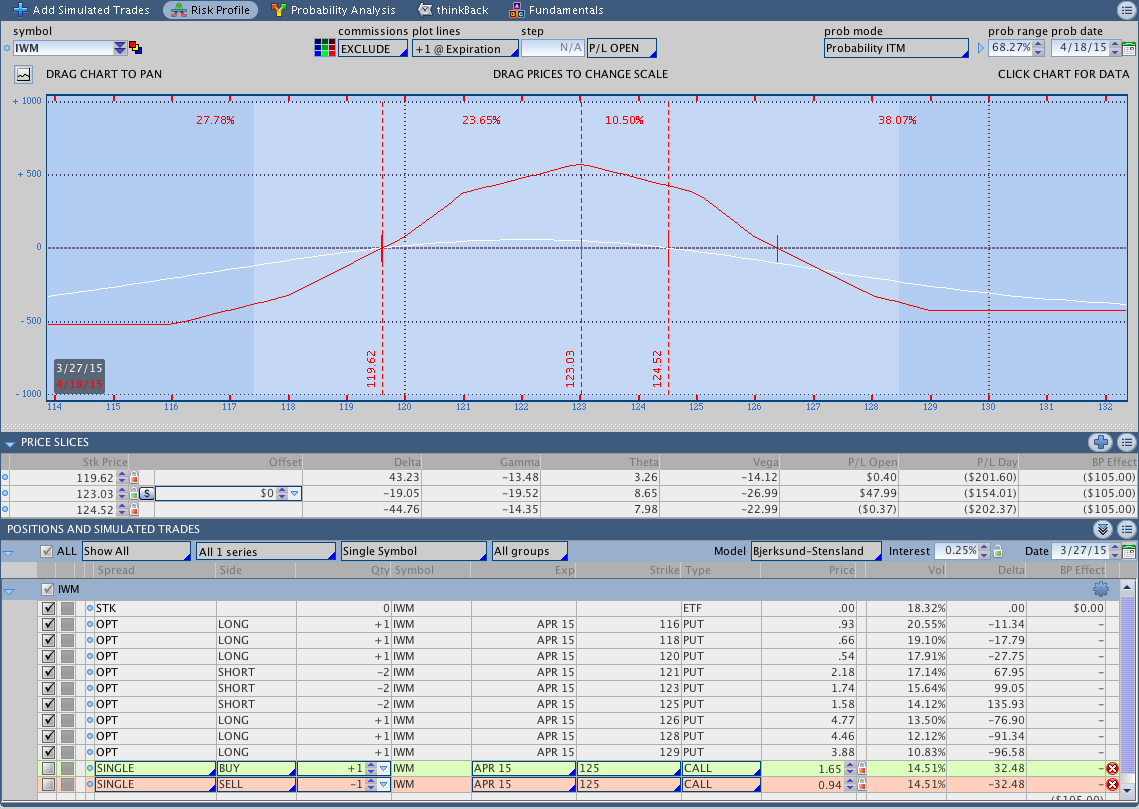

$IWM April Butterfly:

The IWM April Butterfly is still open and looks good. I’ve added to the trade twice with the up moves in the market and the pullback this week helped the position.

Trades This Week:

RUT – Bought to Open (-2.91) and Sold to Close (+1.26) 1215/1255/1280 April Put Butterfly (upside adjustment and partial close)

RUT – Sold to close 1190/1240/1280 April Put Butterfly for a 12.20 Credit

RUT – Sold to Roll April 1220/1225 Put Vertical for a 1.55 Credit

IWM – Bought to open 120/125/129 April Put Butterfly for a 1.26 debit

ETF, Options, & Forex Inventory:

SCHA – Long 57 Shares from 57.179

RWO – Long 92 Shares from 48.49

RWO – Long 5 Shares from 50.92

TLO – Long 63 Shares from 78.94

RUT – April 2015 Put Butterfly

RUT – May 2015 1180/1230/1280 Put Butterfly bought for a 11.00 debit

IWM – May 2015 126 Call bought for a 1.74 debit (May Butterfly Hedge)

IWM – April 2015 120 Call bought for a 3.46 debit (April Butterfly Hedge)

IWM – April 2015 116/121/126 Put Butterfly Bought for a 1.34 debit

IWM – April 2015 118/123/128 Put Butterfly Bought for a 1.64 debit

IWM – April 2015 120/125/129 Put Butterfly Bought for a 1.26 debit

Looking ahead, etc.:

This will be an important week for equity markets. I’m expecting sideways action in the Russell and the S&P, but that will change very quickly if the markets break lower. Fundamentally, I have no idea what’s going on in the world because I haven’t had a chance to read the news in a while, but it doesn’t really matter anyway. Price is all that matters and unless the S&P firms up, I think the Russell will have some trouble making new highs.

Have a good weekend and thanks for reading.

Please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.