Weekend Trend Following Market Commentary 7/18/2014

Big Picture:

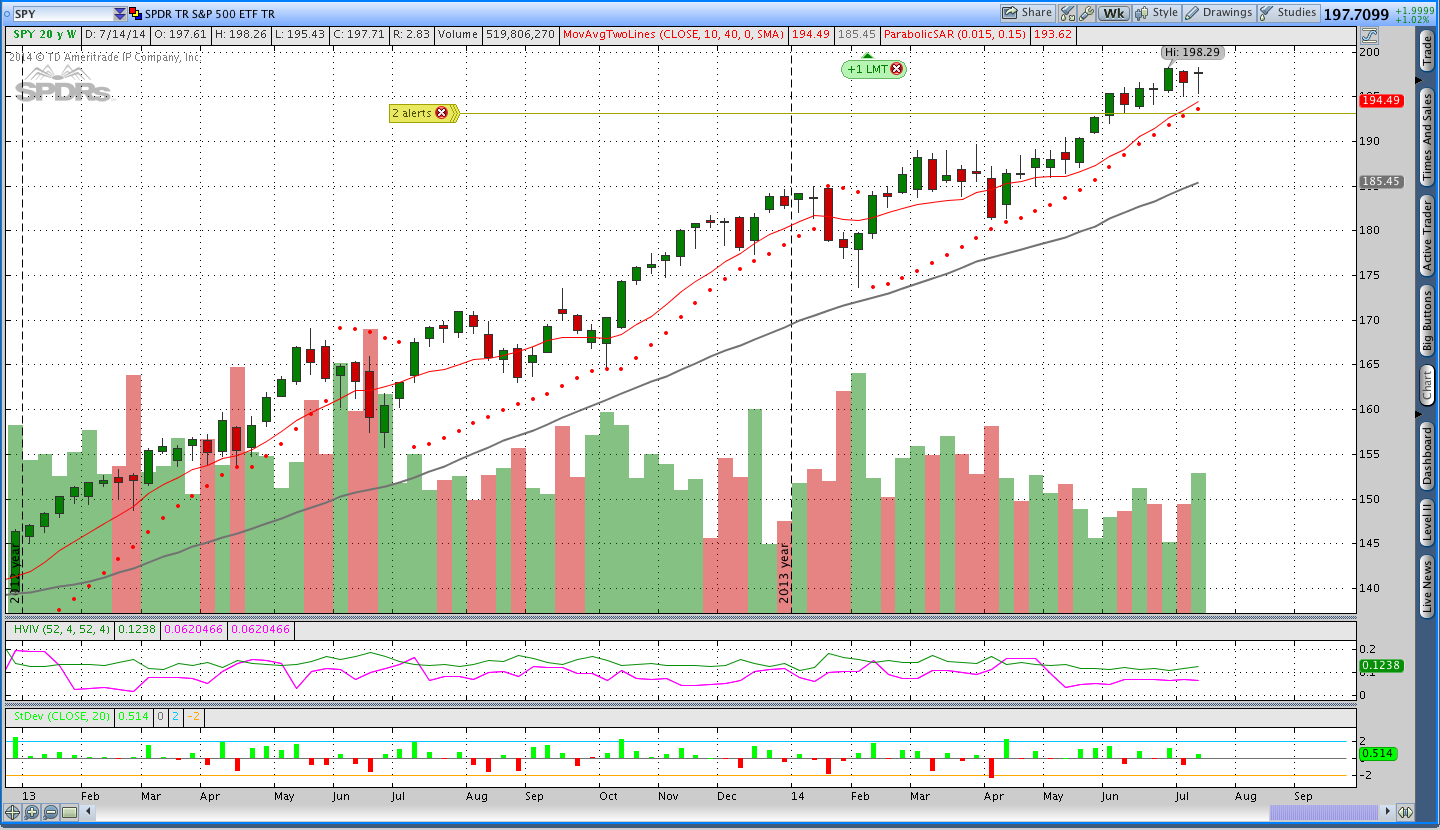

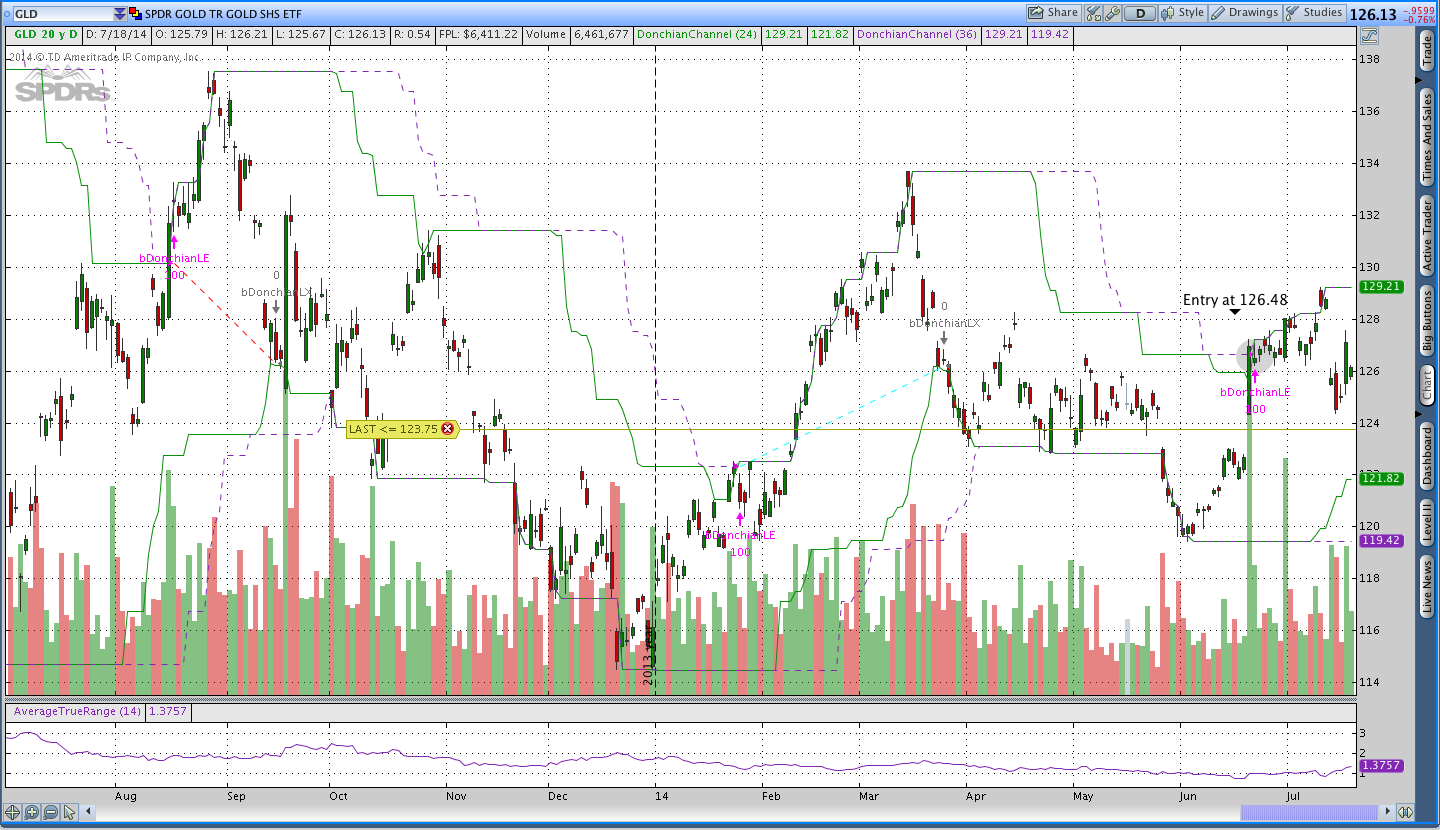

Well, sometimes the downside hurts and this week it nailed the Weekly Theta trades. The S&P 500 finished off the week with a slight gain, but it took a fairly volatile path to get there. Gold was hit this week and finished down 2%. My long Breakout System trade in Gold is still open and sitting around break even. Bonds were up again and that flipped the pSAR from short back to long.

Implied Volatility:

Implied volatility was up nicely on Thursday and then fell off a cliff on Friday to finish the week unchanged. Everything is fine; nothing to see here folks. Stay long and carry on . . .

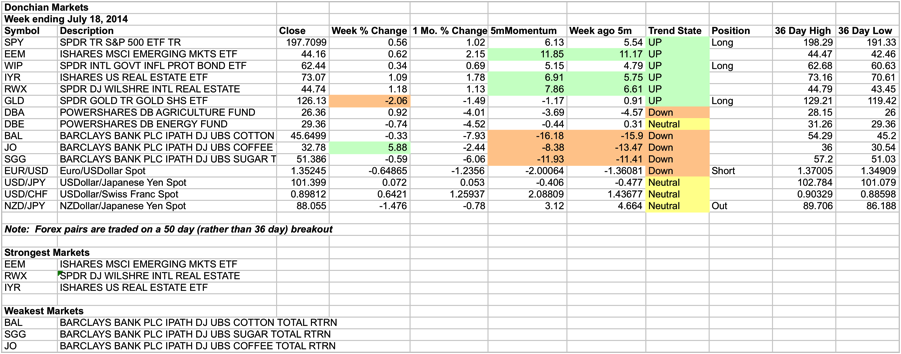

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

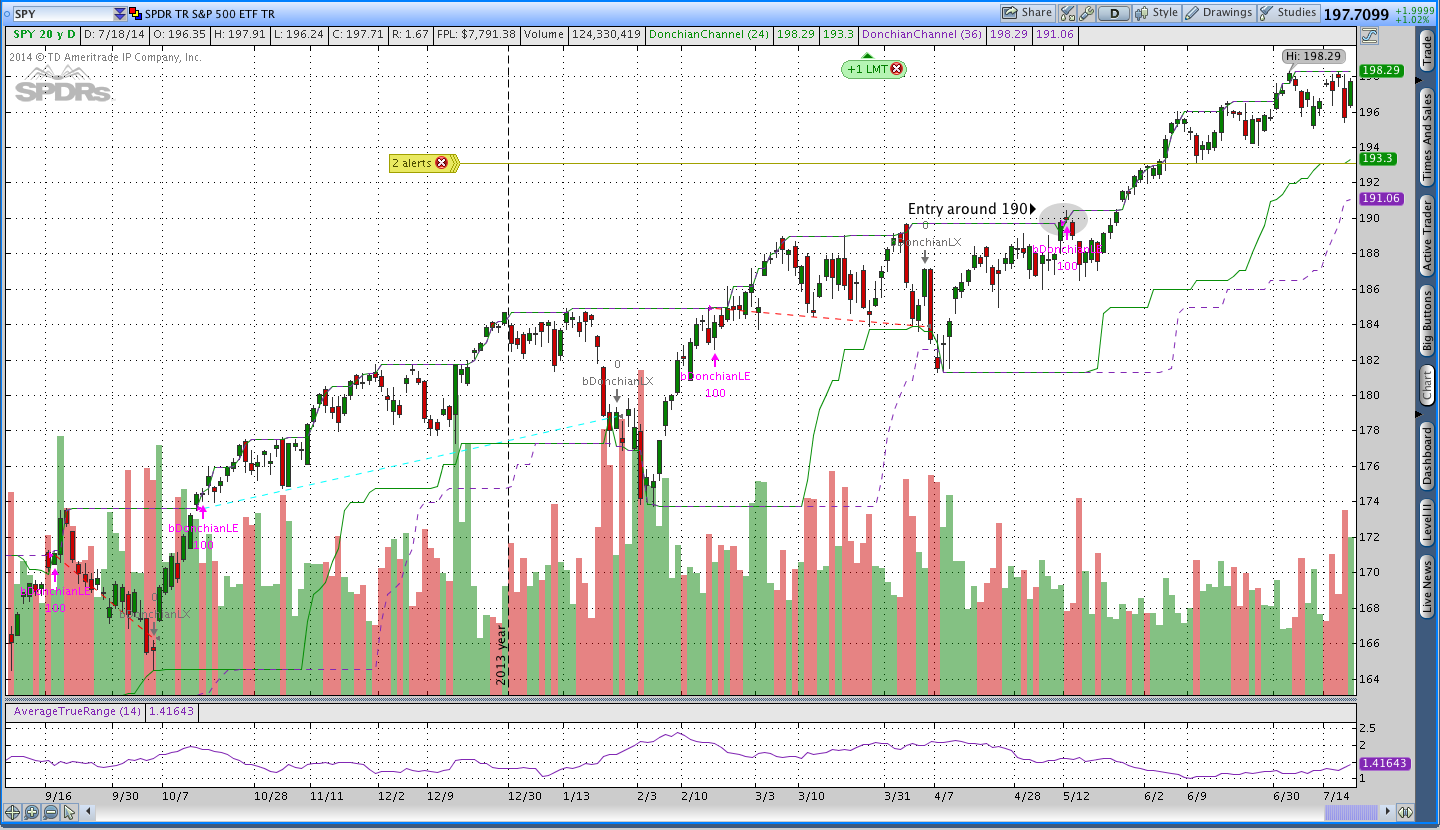

Stocks ($SPY and $SPX – S&P 500):

The S&P 500 was down significantly on Thursday towards the end of the day and that stopped out the Weekly Theta trades. Earlier in the day on Thursday I was filled on two put spreads (see the details in the weekly trades section of this post). Those trades were doing okay for part of the day, but the market sold off significantly after breaking 1970 and I was forced to cover. The problem for me is that I work a day job and, as a result, I was not able to get out in time and took a much bigger hit than I intended. Sometimes that’s the way things go when price moves against you quickly.

So what did I learn with the loss? I learned that in order to trade weekly options, you probably need to be able to monitor the market and have the ability to get in and/or out at any point during the day. That can be an issue for me because I don’t always have the ability to get in/out and I can’t watch the market all day. Most of my options trading is done in a way that major issues tend to develop over time rather than in the course of an hour. As a result, I can avoid most major issues.

I’m trying to decide whether I should trade the Weekly Theta system on a very small scale or not trade it. I can reduce the size by using a 5 point spread and/or only trade one SPX vertical, but I haven’t decided what I want to do just yet. I know the system works, but I also know that I can’t always monitor the market during the day.

Donchian Channel System Market Stats:

One thing to note about the Breakout System is that on a week to week basis there aren’t many changes and this was one of those weeks. The big winner on the week was Coffee, which rallied against the downtrend over 5%. The big loser on the week was Gold (damn). The strongest and weakest markets remained the same and the only change is the order of the weakest markets. Last week Coffee (JO) was the second weakest market and this week it fell to the third weakest with Sugar (SGG) moving up.

One thing to note about the Breakout System is that on a week to week basis there aren’t many changes and this was one of those weeks. The big winner on the week was Coffee, which rallied against the downtrend over 5%. The big loser on the week was Gold (damn). The strongest and weakest markets remained the same and the only change is the order of the weakest markets. Last week Coffee (JO) was the second weakest market and this week it fell to the third weakest with Sugar (SGG) moving up.

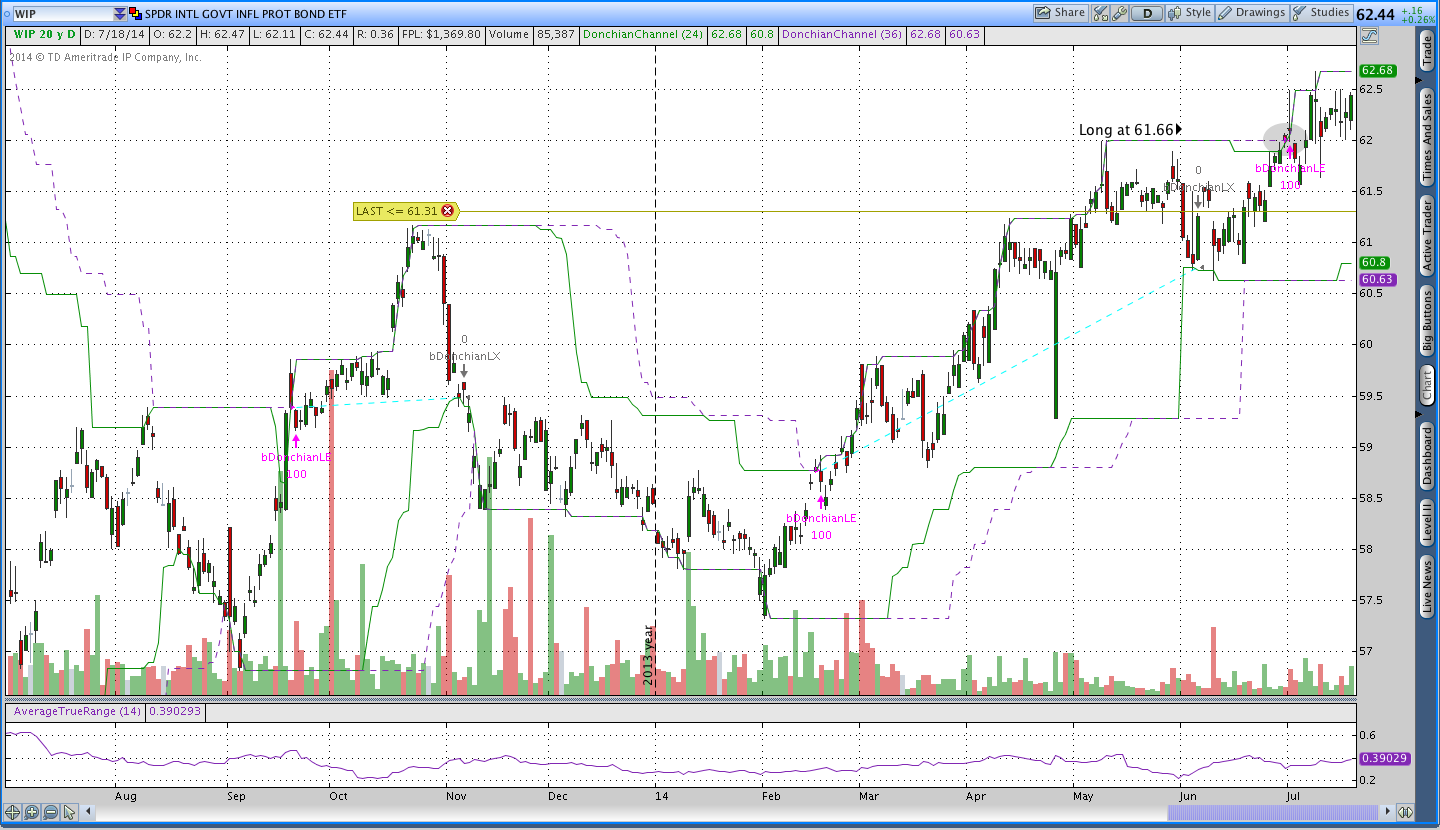

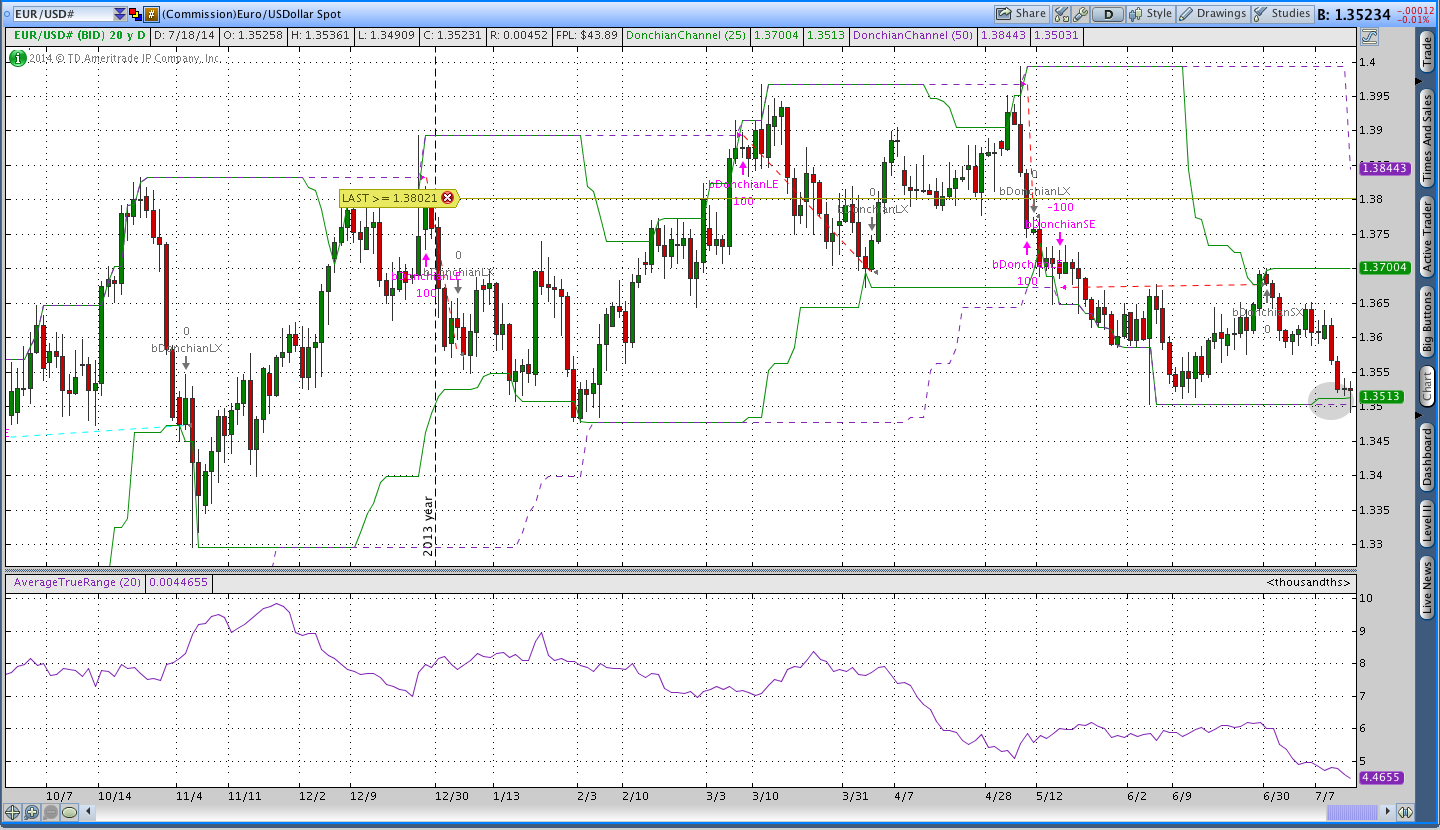

The charts below give you a quick run through of my open positions and the closed NZD/JPY trade. The shaded ovals indicate the entry and exit points, however, my actual fills can end up being slightly different. All entry points are disclosed below in the ETF/Forex Inventory.

Trades This Week:

SPX – Bought to close 1900/1890 Jul 14 Put Vertical at .10

SPX – Sold to open and bought to close 1930/1920 Jul4 14 Put Vertical for .45/1.35

SPX – Sold to open and bought to close 1925/1915 Jul4 14 Put Vertical for .45/1.15

SPY – Bought to close Aug 2014 173 Put at .10

NZD/JPY – Sold to close 5,000 notional units at 87.669

EUR/USD – Sold to open 5,000 notional units at 1.35028

Option Inventory:

SPY – Short Sep 2014 178 Put (sold for .65)

ETF & Forex Inventory:

SPY – Long 12 shares from 188.58

WIP – Long 100 shares from 61.66

GLD – Long 33 shares from 126.48

EUR/USD – Short 5,000 notional units from 1.35028

Looking ahead:

For those of you who didn’t catch it earlier in the week, I had an interesting post on trading Iron Condor’s and Butterflies. I’m starting to work on the follow up for that post to discuss managing the risk in those positions and hope to have it done sometime in the next couple of weeks. Another thing I’m looking at right now is a way to quantify pull-backs and over-extended markets for selling options in the pTheta system. Incidentally, that is more challenging than I initially expected.

If you enjoyed this post, please click above to like it on Facebook or Tweet it out. As always, thanks for reading and enjoy the rest of your weekend.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.

I trade weekly SPX options as well, and being in Singapore, I don’t watch the market the whole day. Like you, I do have a stop loss, but it is useless for protection if I’m not there to monitor and get out in time. So what I do, before I go to bed, is to set a contingent order to close my position at market if SPX breached a certain level. I realize that I would not know my exact loss this way, but I figured that is better than having the position explode while I’m sleeping!

I set the contingent level either by technical analysis (e.g. a short term support or resistance), or more often, an estimate of the level whereby my short strike would attain a delta of about 25 (I usually initiate my position with a short strike at less than 10 delta). I do that by first identifying the strike that is currently at 25 delta. I then take the difference between the current market level and that 25 delta strike. I would add the difference to the short put strike (or subtract the difference from the short call strike) and make that my contingent level whereby I would be stopped out while I am not watching the market.

So far, this has kept me out of serious trouble. Perhaps this might work for you.

Hi Andrew, thanks for the great feedback. Your idea to use a contingent order based on the level of SPX would definitely be better than just setting an alert and I’m going to explore it. Things move quickly with the weekly options so anything that will act on my behalf would be very helpful. I’ll need to see how/if that works in TOS over the weekend.

Initially I wanted to use some sort of stop limit order, but those can get triggered if there is a brief misprint in price and I definitely don’t want that to happen. Anything that keeps the risk under control is better than having the position explode when you can’t watch the market.

Thanks again and we’ll see how it goes this week . . .

-Dan

Dan,

I use TOS and it does have the ability to set contingent orders. Just click to close your position, and in the order entry tab, click on the little screw-like button on the very right. It will bring up a dialog box. It’s pretty straight forward after that. I’m sure the folks at TOS customer service would be glad to help if you run into problems.

I like your posts…. Keep it up!

Have a good weekend and happy trading!

Andrew

Nice, thanks for the walk through! I’m going to jump in TOS and check it out right now. I think that will allow the system to move forward and leave me feeling a little more comfortable with it. As a totally free plug for TOS, they do have excellent customer service and I’ve only had great experiences when I needed to get in touch with them.

If you ever have any suggestions or things you’d like to see on the blog, feel free to shoot me an email. It’s great to know that what I’m writing is adding value (especially because I enjoy doing it anyway). Thanks for reading and I’ll keep on writing. Enjoy the rest of your weekend.

Dan