Range of Profit on Things With Wings: A Look at $RUT Iron Condors and Butterflies

Overview:

Many options traders like to trade non-directionally and gravitate towards Iron Condors because they provide a wide profit range without having a directional bias. The general philosophy is that if you can sell some out of the money vertical spreads and price doesn’t move as far as your short strikes, you can make money at expiration. While I have spent time trading Iron Condors, I’ve always found the likelihood of running into trouble problematic. As a result, I’ve focused on selling premium in a more directional manner so that my risk is only on one side of the market.

Many options traders like to trade non-directionally and gravitate towards Iron Condors because they provide a wide profit range without having a directional bias. The general philosophy is that if you can sell some out of the money vertical spreads and price doesn’t move as far as your short strikes, you can make money at expiration. While I have spent time trading Iron Condors, I’ve always found the likelihood of running into trouble problematic. As a result, I’ve focused on selling premium in a more directional manner so that my risk is only on one side of the market.

While being short premium in a trend following manner works well when the market is trending or slightly neutral, it is less desirable when the market goes against the trend. My opinion is that a non-directional trading system could provide another system to diversify risk. This post is a look into some research that is likely to become the foundation of a non-directional trading system. I’m evaluating different positions below to compare the characteristics of RUT Iron Condors and Butterflies.

When trading non-directionally, I don’t like to sit in trades through expiration. As a result, I wanted to take a look at the various positions a couple of weeks into the trade to compare the various profit ranges and potential profit. My goal is always to be out as fast as possible and I want to trade a position that will facilitate getting in and getting out quickly.

Positions Chosen:

We’re going to be taking a look at three different positions. All of the positions have 49 days to expiration and use RUT closing prices as of 7/10/2014 when RUT closed at 1161. The positions are a 10 Delta Iron Condor, an ATM Put Butterfly, and a Put Butterfly placed 20 points below the market (ATM-20). I chose the positions because they’re commonly discussed in income trading communities as trades to “put on every month.”

Issues:

The biggest risk for most non-directional spreads at the time a trade is entered is to the upside. There are ways to mitigate the risk or tweak your position to make the T+0 delta more neutral, but the option skew tends to create a situation where the trade has more risk to the upside. The Put Butterfly placed 20 points below the market has the best risk/reward profile (ignoring probabilities) and theoretically should be the easiest to adjust in a way that keeps the trade in the money.

Two Weeks In:

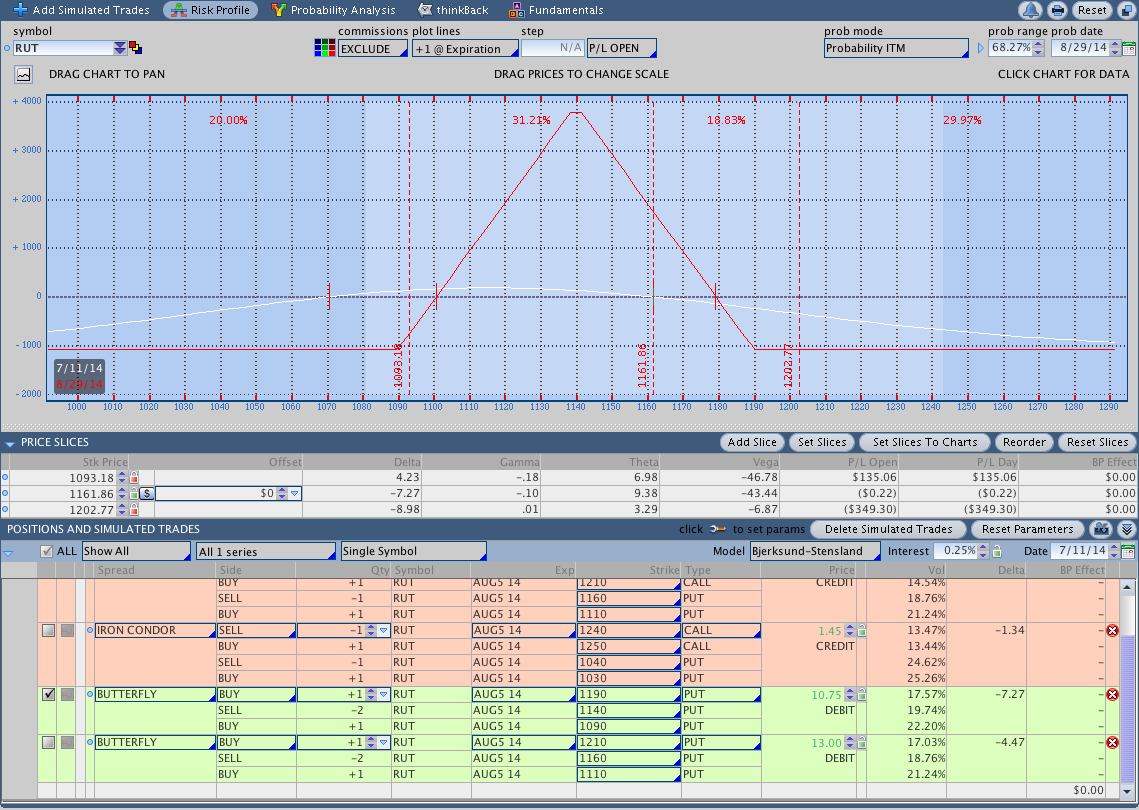

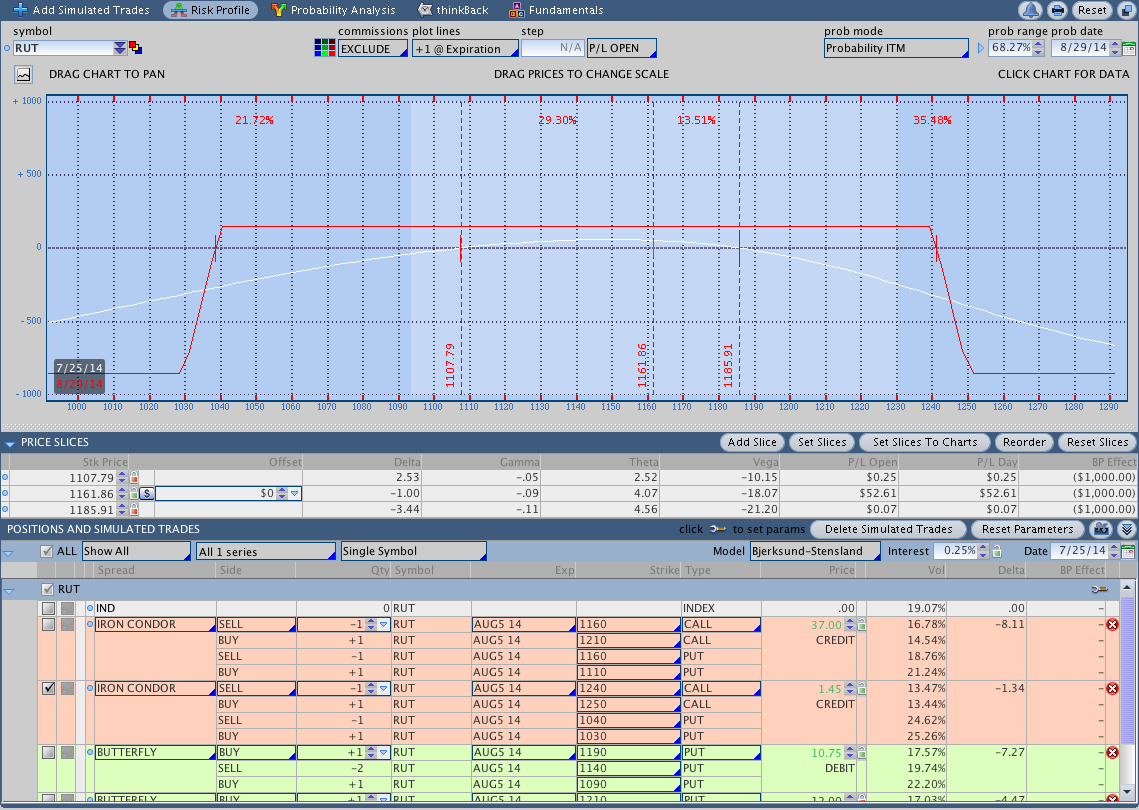

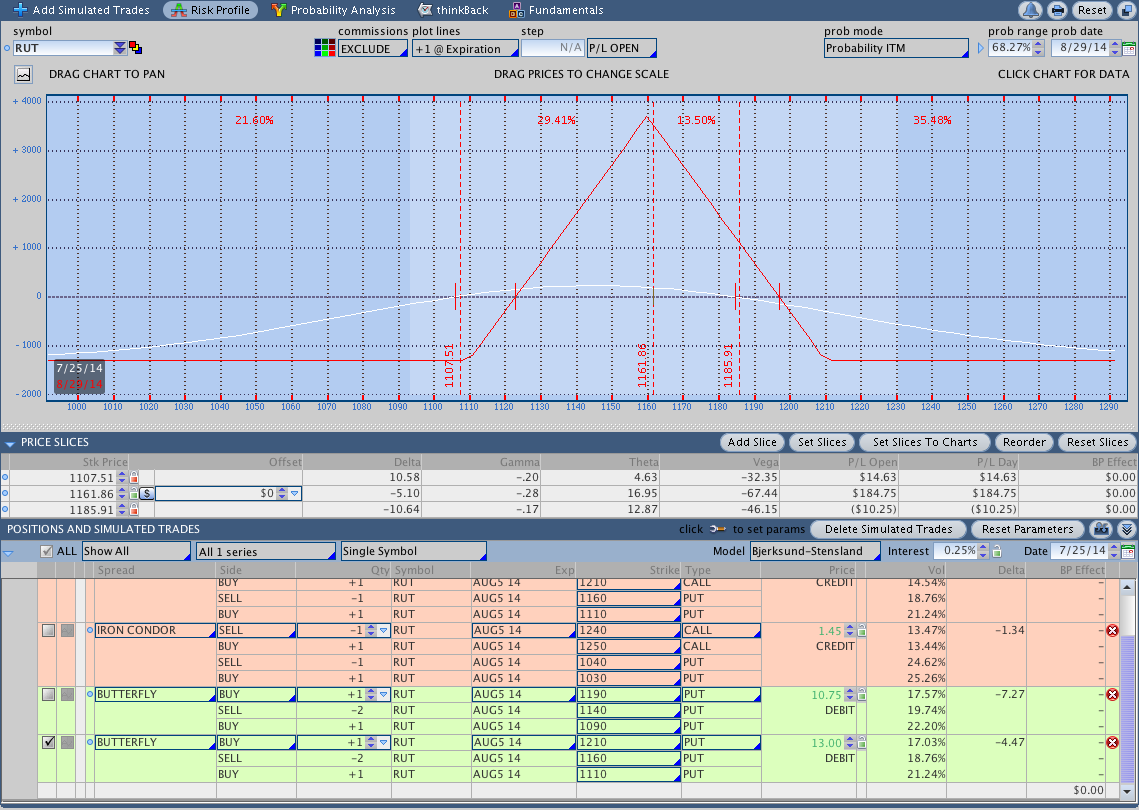

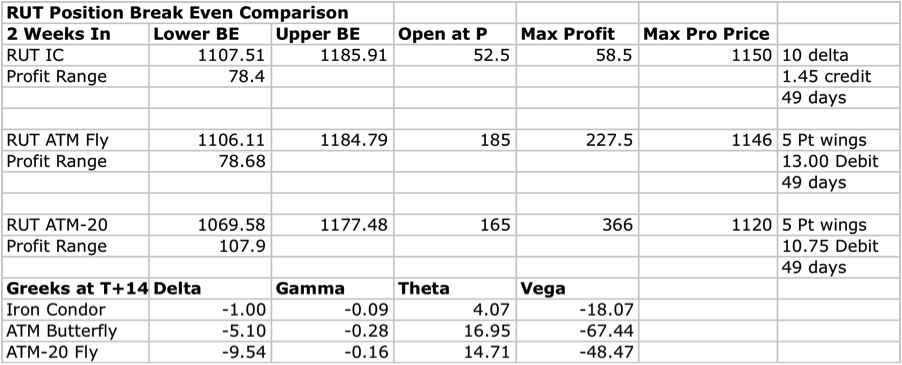

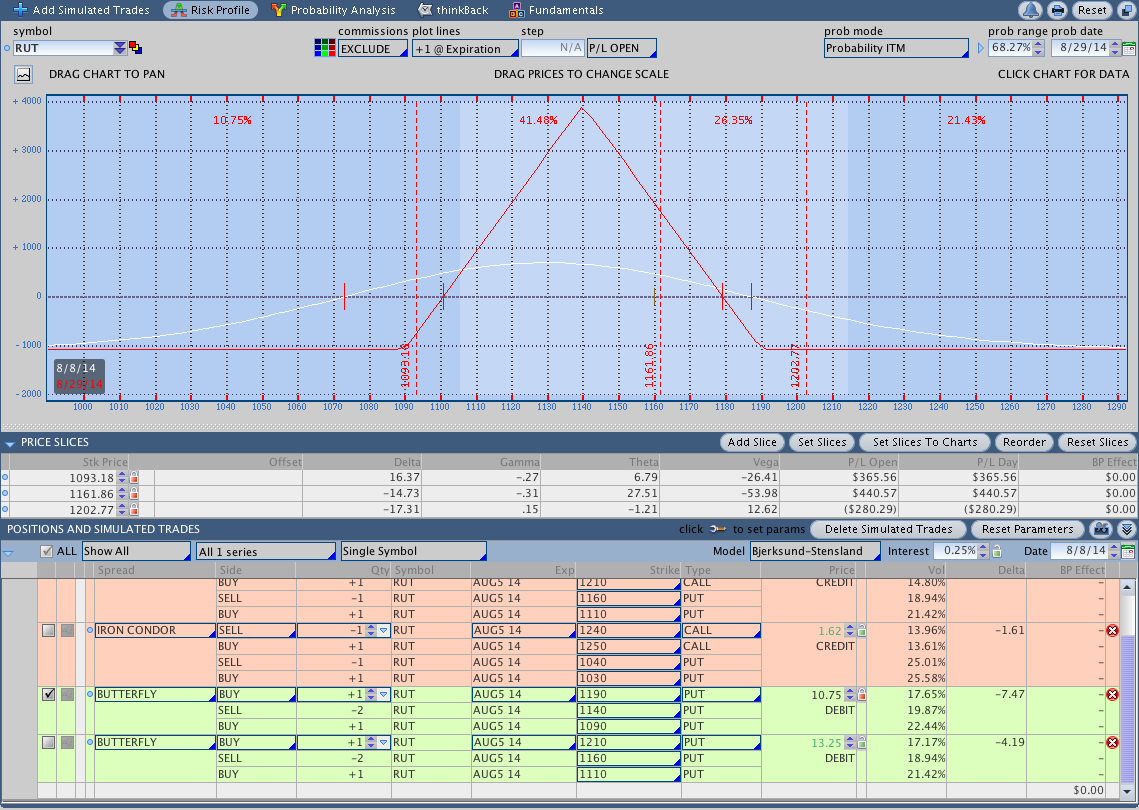

One of my main questions is where the positions sit a couple of weeks into the trade. Specifically, what is the T+0 line on day 14 (the T+14 line). The result is a little surprising. In the image below I’m comparing the three positions. I’m giving the break-even values for the T+14 line, the open profit if RUT stays at 1161, and the max profit and the location of that max profit. Intuitively, the max profit is the highest point on the T+14 curve.

The most interesting thing about the data two weeks into the trade is that, in terms of profit range, there is very little difference between an ATM Put Butterfly and the Iron Condor. The biggest difference is that the ATM Fly has a higher potential profit. The widest range of profit is provided by the ATM-20 Put Butterfly, but that profit range is positioned slightly lower.

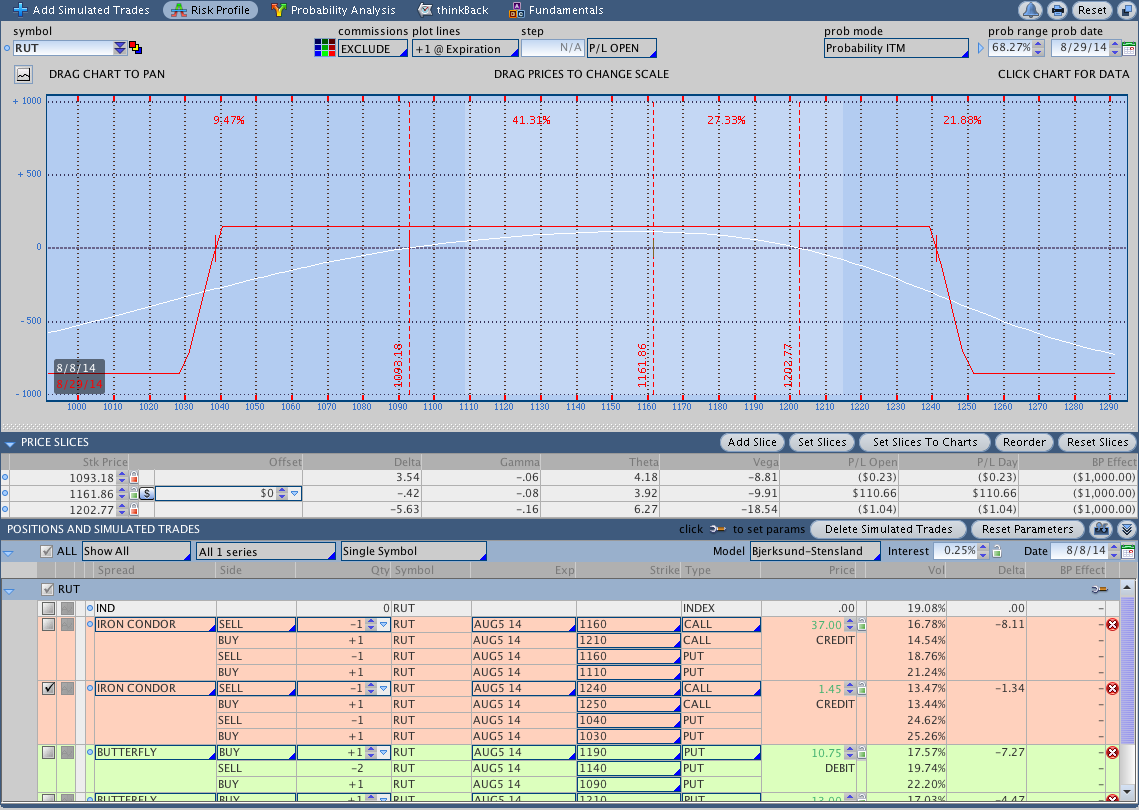

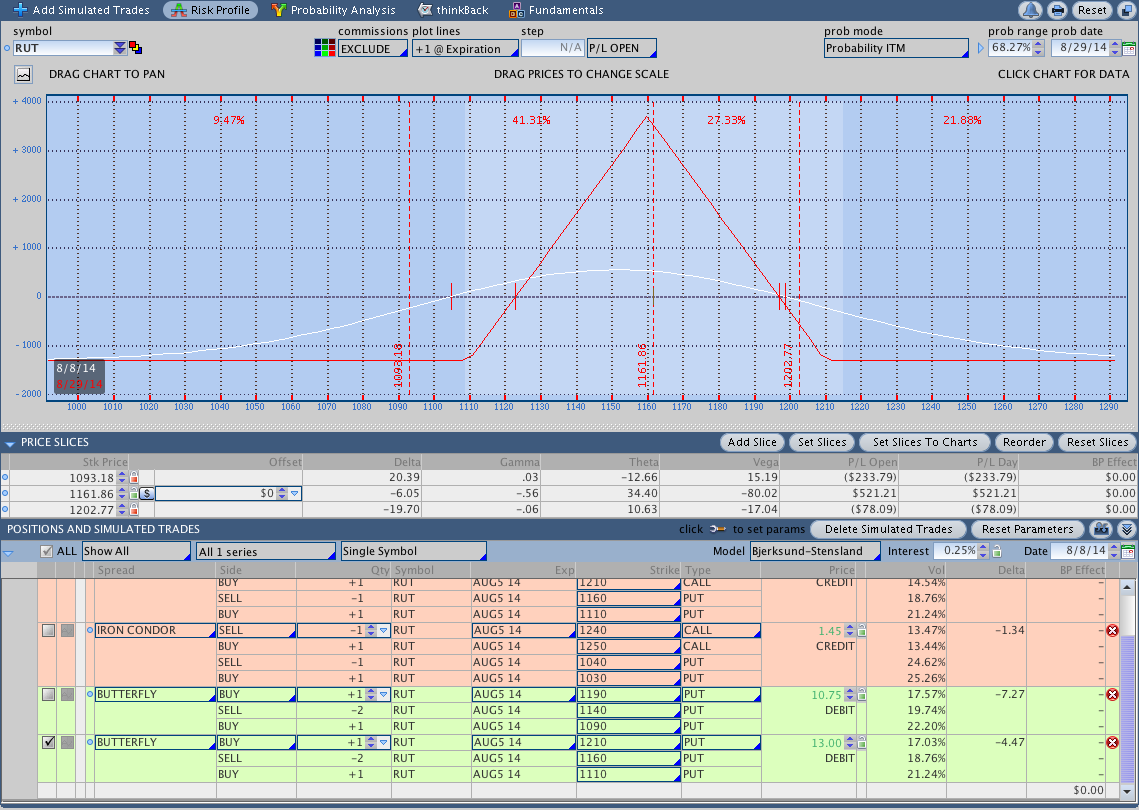

The images below compare the RUT Iron Condor, the RUT ATM Butterfly, and the RUT ATM-20 Butterfly. The vertical lines are set to the Iron Condor Break even points 2 weeks into the trade and at the current price. The lines were left in place on the images of the Butterflies for comparison.

Four Weeks In:

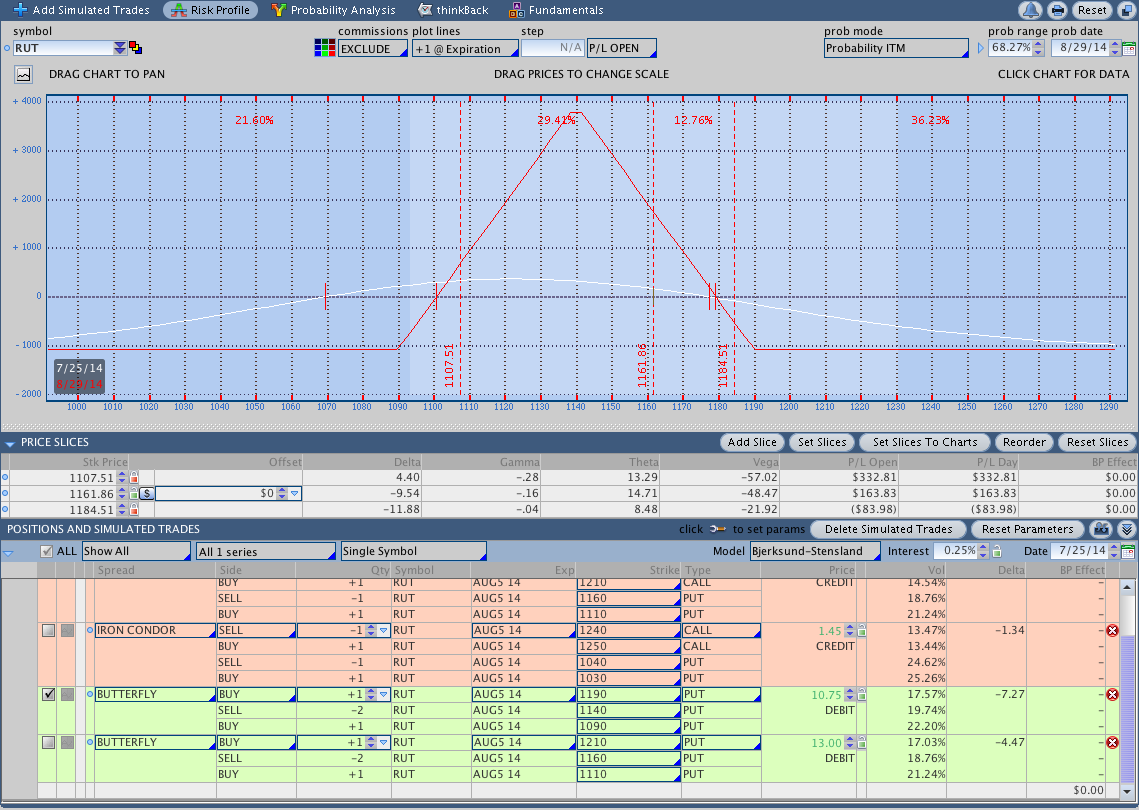

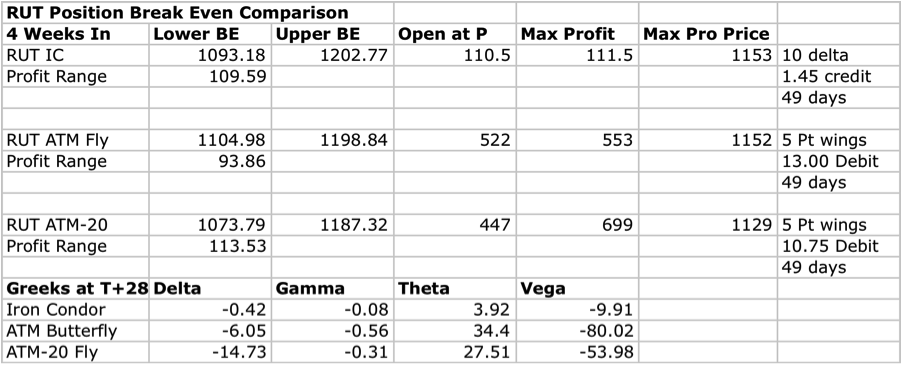

After 4 weeks I want to either be out of the trade or exiting soon. The results below show the profit ranges at T+28 days when the positions have 21 days to expiration. At 4 weeks in, the Iron Condor is starting to widen out and the range of profit has grown considerably. That being said, the range provided by the ATM-20 Butterfly is still very attractive. In terms of profit range, the biggest difference between the two trades is that the Butterfly has a lower upside break-even point.

The images below run through the three positions four weeks into the trade or T+28.

Take Away:

Iron Condors tend to get a lot of attention because of the wide profit range and the high probability of achieving that profit. The reality is that the ATM-20 Butterfly has a similar profit range and the potential to hit a dollar based profit target faster. The big tradeoff for the additional theta is much higher vega and gamma.

With both the Iron Condor and the ATM-20 Butterfly, the initial risk in the trade is greatest to the upside. Specifically, if price moves sharply higher after entering the trade, the position will quickly go underwater. As a result, it makes sense to construct the position in a way that mitigates upside risk by either buying calls, shares of IWM, or bringing the long upside wing in 5 or 10 points. That being said, tweaking the position in a way that mitigates risk is the topic of another post.

One final thing to note is that one RUT Butterfly is not quite the same as one RUT Iron Condor. The greeks are very different and, consequently, the trades would “feel” very different to trade. The greeks presented in the tables above are based on RUT not moving, which is both an ideal scenario and unrealistic. The main point of this post was to analyze the potential profit range to determine a starting point for a non-directional trading system and that analysis has shown that an ATM-20 Butterfly may be a good place to start for a non-directional trading system.

Are you trading Iron Condors or Butterflies? Tell me what you’re trading in the comments below and/or what you’d like to see covered in coming posts.

Thanks for reading and please share this article using the toolbar above if you enjoyed it.

Nice analysis. You did well to begin with the static example as the base part of the analysis. You referenced a follow-up that I very much look forward to reading – especially tweaking the position in a way that mitigates risk. One attractive aspect of butterflies – imo – is not merely the higher profit potential but the chance for a few big winners to make up for the inevitable losses. Combining those winners with your risk mitigation techniques should prove the butterfly to be the superior structure. Furthermore, I suspect that just as condors are often “legged-into”, the butterflies could be “winged into” and that would perhaps afford a blend of the directional methods you are using. Thus, I would love to see a series of analyses of the focused approach to butterflies: 1) the static butterfly, 2) the mildly fluttering butterfly, 3) the directional flying butterfly and 4) the netted butterfly.

Hi Mike and thanks for the feedback. You’re correct that there will be a follow up post to discuss tweaking the position to mitigate risk. That post should begin with an overview of what the risk really is and then consider different options for dealing with it. I agree with your analysis that the potential winners can overcome the losers more easily than with IC’s. Essentially, the risk/reward is much more favorable. What I find very interesting is that not only do Butterfly’s have more favorable risk/reward, they also have a profit range that is close to an Iron Condor. The biggest difference between the two positions is in the greeks, however, the bigger greeks make trading a Butterfly in a smaller product (like IWM) more attractive than trading an IC in IWM. At any rate, stay tuned for the follow up and thanks for the comment.

-Dan

Hi Mike and thanks for the feedback. You’re correct that there will be a follow up post to discuss tweaking the position to mitigate risk. That post should begin with an overview of what the risk really is and then consider different options for dealing with it. I agree with your analysis that the potential winners can overcome the losers more easily than with IC’s. Essentially, the risk/reward is much more favorable. What I find very interesting is that not only do Butterfly’s have more favorable risk/reward, they also have a profit range that is close to an Iron Condor. The biggest difference between the two positions is in the greeks, however, the bigger greeks make trading a Butterfly in a smaller product (like IWM) more attractive than trading an IC in IWM. At any rate, stay tuned for the follow up and thanks for the comment.

-Dan