Weekend Market Commentary 4/8/2016 – $SPX, $RUT, VIX, $VXV

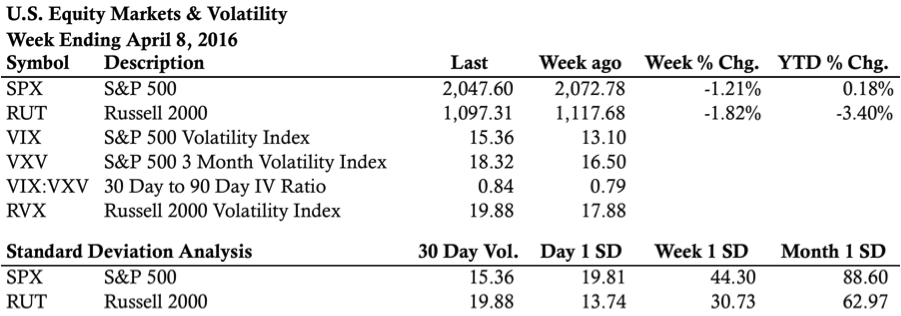

Market Stats:

Big Picture:

If we were sitting around at dinner right now, I’d be satisfied with the appetizer and ready for more. As many faithful readers know, I’m frequently bearish and almost always like it when we get red candles. At the same time, we all know that the entire investment industry is built on buying stocks and even I can recognize that they’ve gone up in price over time.

Occasionally readers like to call into question my bearish nature and strong aversion to carrying positive delta. As many of you know, I’m most comfortable when I’m positive theta and short delta. While those Greeks could certainly be taken as an indication of “Bearishness” (whatever the hell that is), they really just represent the characteristics of a position. Frankly, I try to stay positive theta, short delta even when I’m short term “bullish.” All that means is that I’m moving the curve and sitting around waiting for a pause or pullback.

I’d love to carry positive delta at times (well, maybe not, but I’ll humor you), but the implied volatility of out of the money calls makes it less favorable. Additionally, for various reasons it doesn’t fit well with my psychology and that’s completely okay. It’s not that I’m a pessimist, it’s just that I’m too skeptical to get puffed up in excitement over stocks going up and, honestly, I prefer to hold contrary views. I recognize those traits and they’re probably another long conversation better suited for a black leather couch and well beyond the scope of this site.

The reality is that there are no right or wrong ways to trade. There’s what works for you, what doesn’t work for you, and, most importantly, positive expectancy. Nothing works 100% of the time and anyone who tells you otherwise is selling you something you really shouldn’t buy.

The markets chopped about this week and came in slightly, but you probably already know that. On a short term basis, it’s too early to get overly excited about the downside or, frankly, the upside. The markets can move up, down, and sideways and traders tend to base their expectations (less confident word for predictions) on the most recent movements. Right now both the S&P 500 and Russell 2000 are moving sideways and volatility remains relatively low in confirmation of that movement. For now there’s nothing to do but wait.

Volatility:

We saw a slight increase in implied volatility and the VIX:VXV ratio this week, but that movement wasn’t enough to get overly excited about the market moving lower. For now volatility seems to be reacting as we’d expect with a slight pullback.

On a historical basis, the VIX:VXV ratio is still very low and well below the 0.92 ratio that accompanies more significant declines.

Levels of Interest:

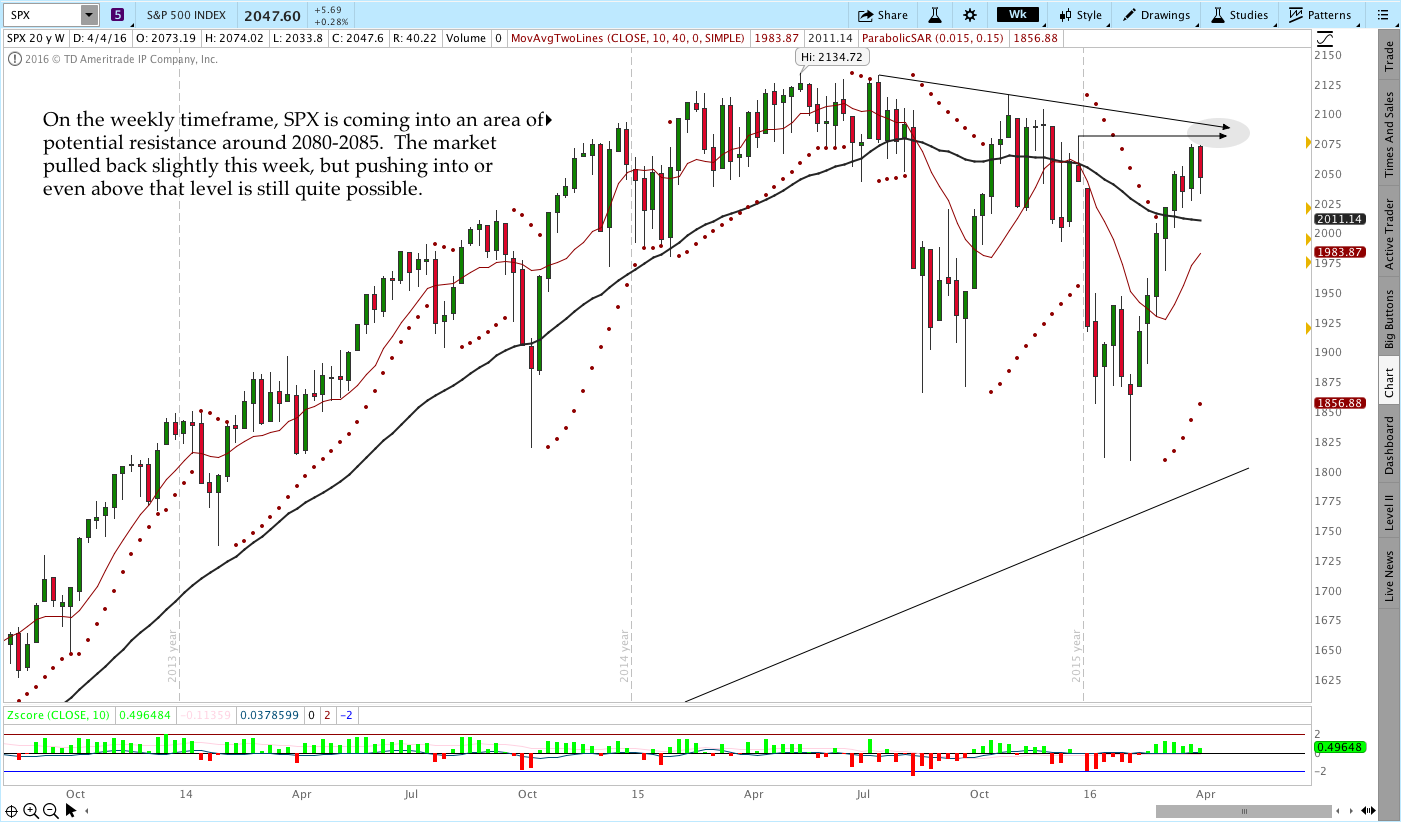

In the levels of interest section, we’re drilling down through some timeframes to see what’s happening in the markets. The analysis begins on a monthly chart, then weekly chart, moves to a daily chart, and finishes with the intraday, 65 minute chart of the S&P 500 (SPX)). Multiple timeframes from a high level create context for what’s happening in the market.

S&P 500 – $SPX (Weekly, Daily, and 65 Minute Charts):

Russell 2000 – $RUT (Weekly, Daily, and 65 Minute Charts):

Live Trades . . .

The “Live Trades” section of the commentary focuses on actual trades that are in the Theta Trend account. The positions are provided for educational purposes only.

——————————

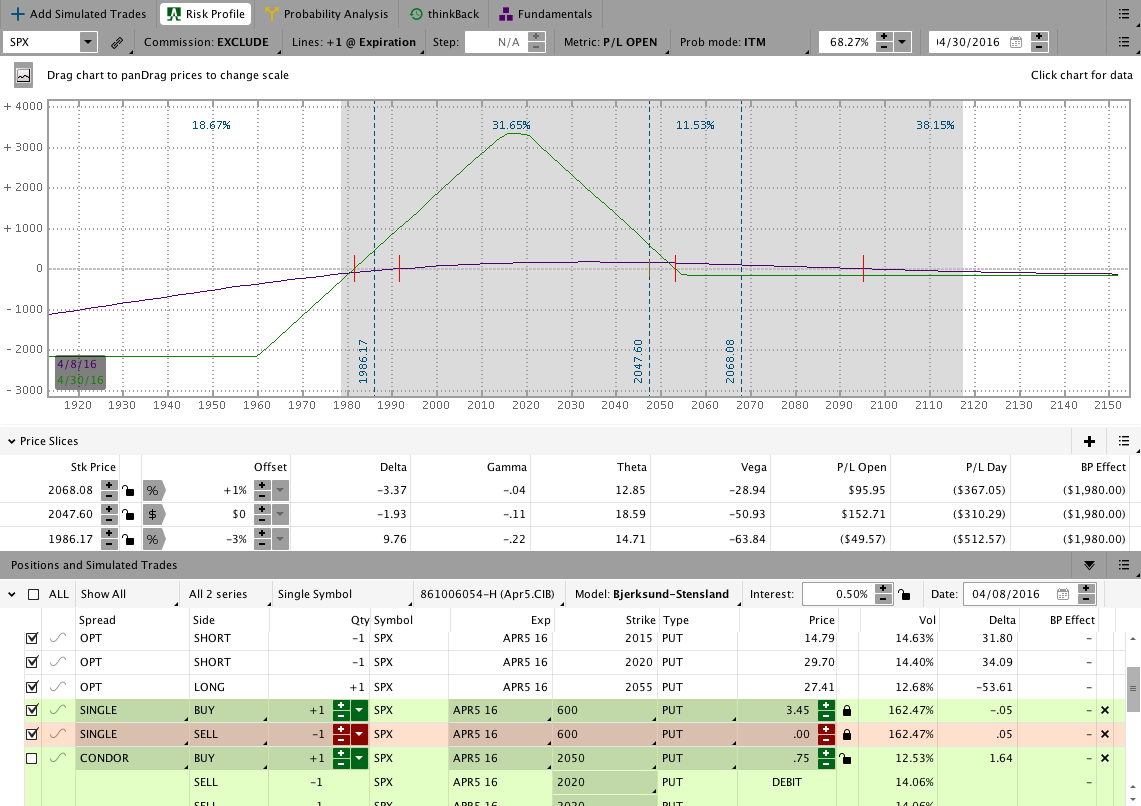

With the S&P 500 chopping about and the April5 CIB getting very close to expiration, we converted the trade to a Broken Wing Butterfly this week to protect the open profit. You’ll want to check out this post if you missed in where the conversion is explained.

For more information on this trade, check out the Live Trade Page with daily video updates and comments.

$SPX April5 2016 Core Income Butterfly Trade:

If you want to learn a safer, less painful way to trade options for income, check out the Core Income Butterfly Trading Course.

Looking ahead, etc.:

Next week we’ll be looking for an opportunity to exit the April5 CIB. I have a lot of open inventory right now that we haven’t been talking about and a little more of a pullback in RUT to test the lower side of the balance area would be welcomed.

Have a great weekend and please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.