Understanding Everything and Nothing At All – Weekend Market Commentary

Choose your own adventure . . .

I hope everyone had a good summer and if you’ve been trading that your trading has been going well. Over the past two months I have been largely flat (with the exception of two trades that we’ll discuss below), but I have done more than a little bit of self reflection, thinking about my trading, and watching EUR/USD collapse while SPY made a move higher only to turn around and end up at the same level as in late July.

The following two paragraphs discuss some of the things I’ve been thinking about over the summer. You’re welcome to bypass them and jump a few paragraphs down to the more normal weekend market commentary.

So, what gives?

It’s been about two months since I last posted here and during that time I spent a good amount time entertaining the idea of launching another blog in the Personal Finance space. You see, I’m a CPA and work as a tax accountant by day and I though that space would be a natural extension of what I do for a living. However, at least for now, I decided to put that content on hold. The real problem is that following markets is much more interesting than tax and personal finance. There, I said it.

But what about money?

One of the things I think about on a regular basis is why we pursue money, wealth, and “stuff.” The reality is that money, in and of itself, will never give us the things we want. Money is just a means and a tool for other things. In trading, money is the score.

On a basic level, I don’t think people really want more money as much as they want the things they think money will buy them . . . in my case that’s freedom. For many other people, when they tell you they want money, they really want status and they usually want to display that status through stuff they “own.” As a society we tend to to pursue goods more than money, think houses, cars, and stuff. Those things are supposed to be an outward display of success or prosperity, but many people have traveled down the wrong road and are making those purchases on credit. The major problem is that purchases made on credit are not the same as purchases made in cash because they trap and tie you to the debt.

On a basic level, I don’t think people really want more money as much as they want the things they think money will buy them . . . in my case that’s freedom. For many other people, when they tell you they want money, they really want status and they usually want to display that status through stuff they “own.” As a society we tend to to pursue goods more than money, think houses, cars, and stuff. Those things are supposed to be an outward display of success or prosperity, but many people have traveled down the wrong road and are making those purchases on credit. The major problem is that purchases made on credit are not the same as purchases made in cash because they trap and tie you to the debt.

Debt can easily become a form of slavery because it creates a financial obligation rather than financial freedom. Debt is a restriction on your actions because you are obligated to service that debt as a first course of action. Once that first course of action has been taken, your freedom to do other things with money has been limited. Unfortunately, individuals living in McMansions with leased Range Rovers aren’t the only ones making poor choices, our government has overextended us as a country and we’re in a frighting amount of debt.

What does this have to do with trading and what’s the 80/20 here?

This has everything to do with trading. As I mentioned above, in trading money is the way we keep score. We keep score through open P/L, account size, percentage return, drawdown, and a number of other measures. I think many people gravitate towards trading because they believe they will make money and that will satisfy whatever they want from money. I’d argue that trading for money is the wrong motivation because you’re focusing on an outcome rather than a process. Trading itself is a process and when our focus is on improving that process rather than the outcome (the score), the outcome should take care of itself.

Over the summer I looked at my results by system and my feelings (I know, getting pretty touchy feely here) toward the individual systems. The systems that are clearly working are the Donchian Breakout system and the pTheta system on the S&P 500 and Gold. As a result, I’m going to shift my focus to trading those systems and improving them. I will probably continue to look for new ideas because I just can’t help myself, but my focus will be on trading and improving those systems. Both systems have areas for improvement and we’ll be exploring those areas in the next few months.

Another area that I have an interest in is understanding how world markets are moving simulateneously and creating a big picture context. The return summary I’ve used in the weekend market commentary fits the bill and I’d like to build a longer term trend following system around that concept. I will also say that the Monthly Rotation System is likely to show up again in one form or another.

Enough of that, let’s get to the markets

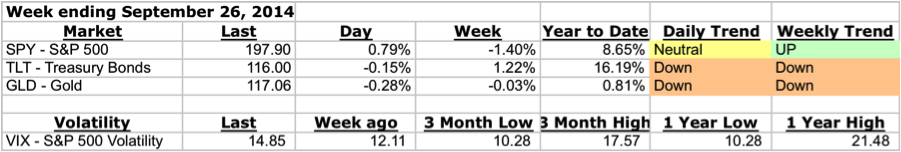

The S&P 500 ($SPY) was off over 2% around mid week, but made a push back on Friday. Bonds have continued to show strength and Gold is sitting around prior lows. The Dollar is strong in general lately and that has led to some nice moves in the Forex markets while commodities have continued to get beaten down. The full stats are shown below.

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

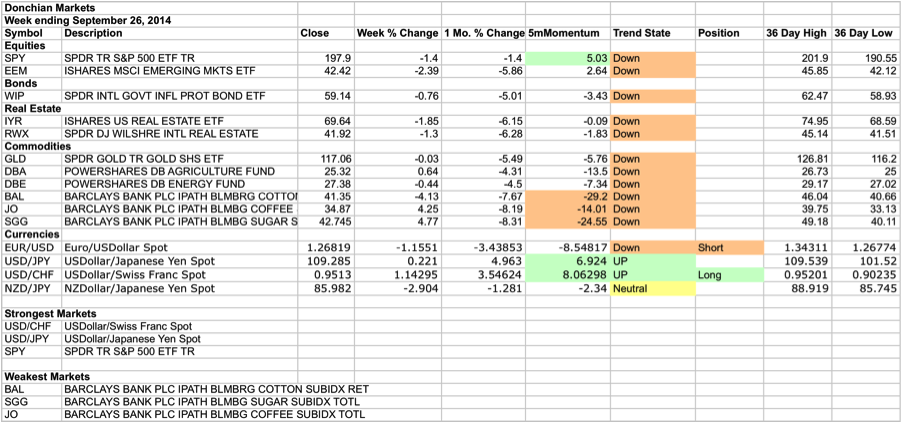

Stocks ($SPY – S&P 500):

On Thursday the S&P 500 had a nice break lower. I took the opportunity to sell a Nov 14 $SPY put for the pTheta system. On Friday the market traded higher and the position has a small open profit. At this point, SPY looks somewhat neutral on a daily timeframe, but the longer term trend is still up. We haven’t seen the 200 day moving average since late 2011, but that doesn’t automatically mean the market will (or should) head lower. It certainly could, but it doesn’t mean that it will.

In the weekly chart below, note that the weekly candle has a wick on the bottom where the buyers came in and bid things higher on Friday. SPY continues to hold up well.

Breakout System Market Stats:

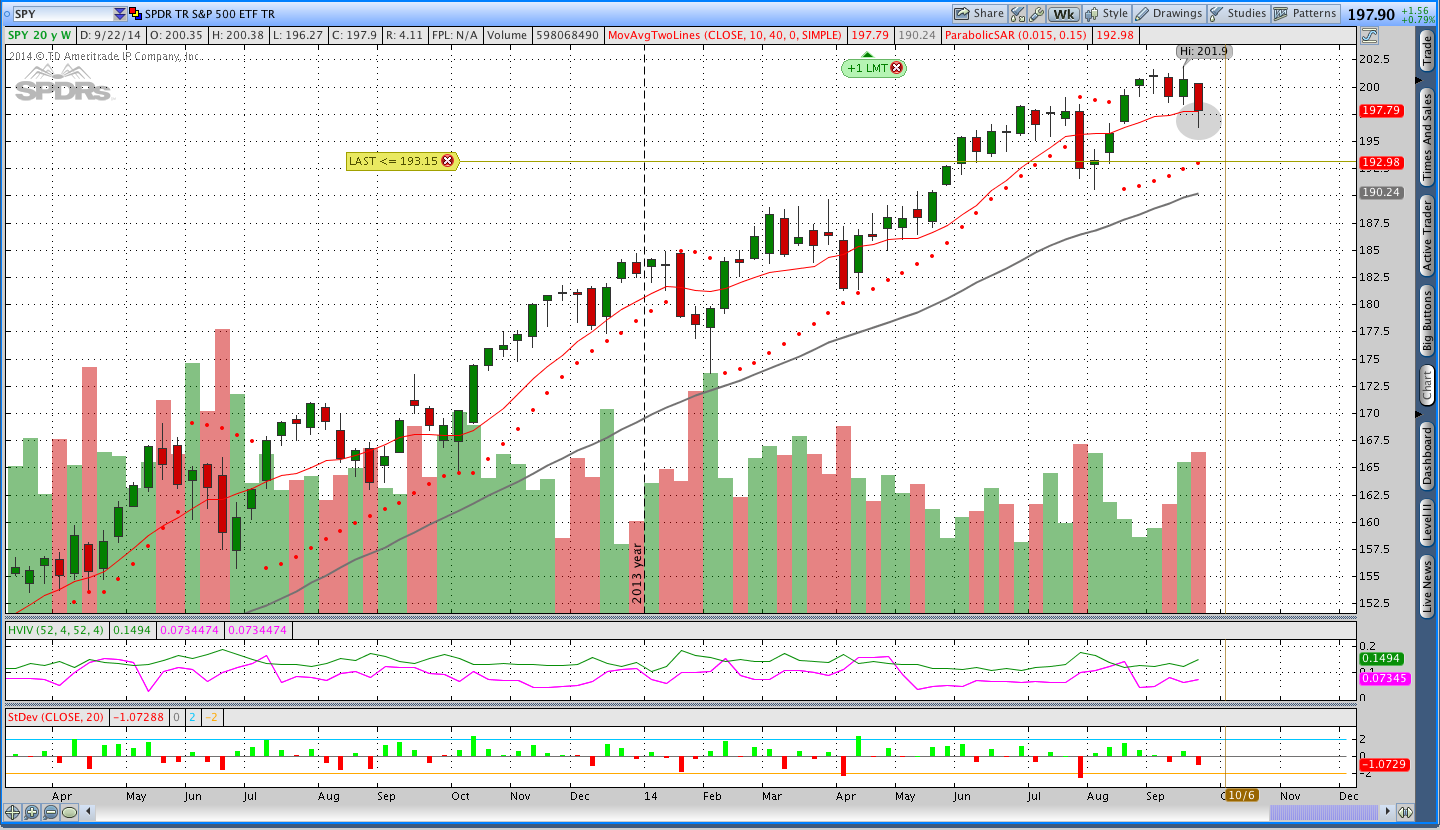

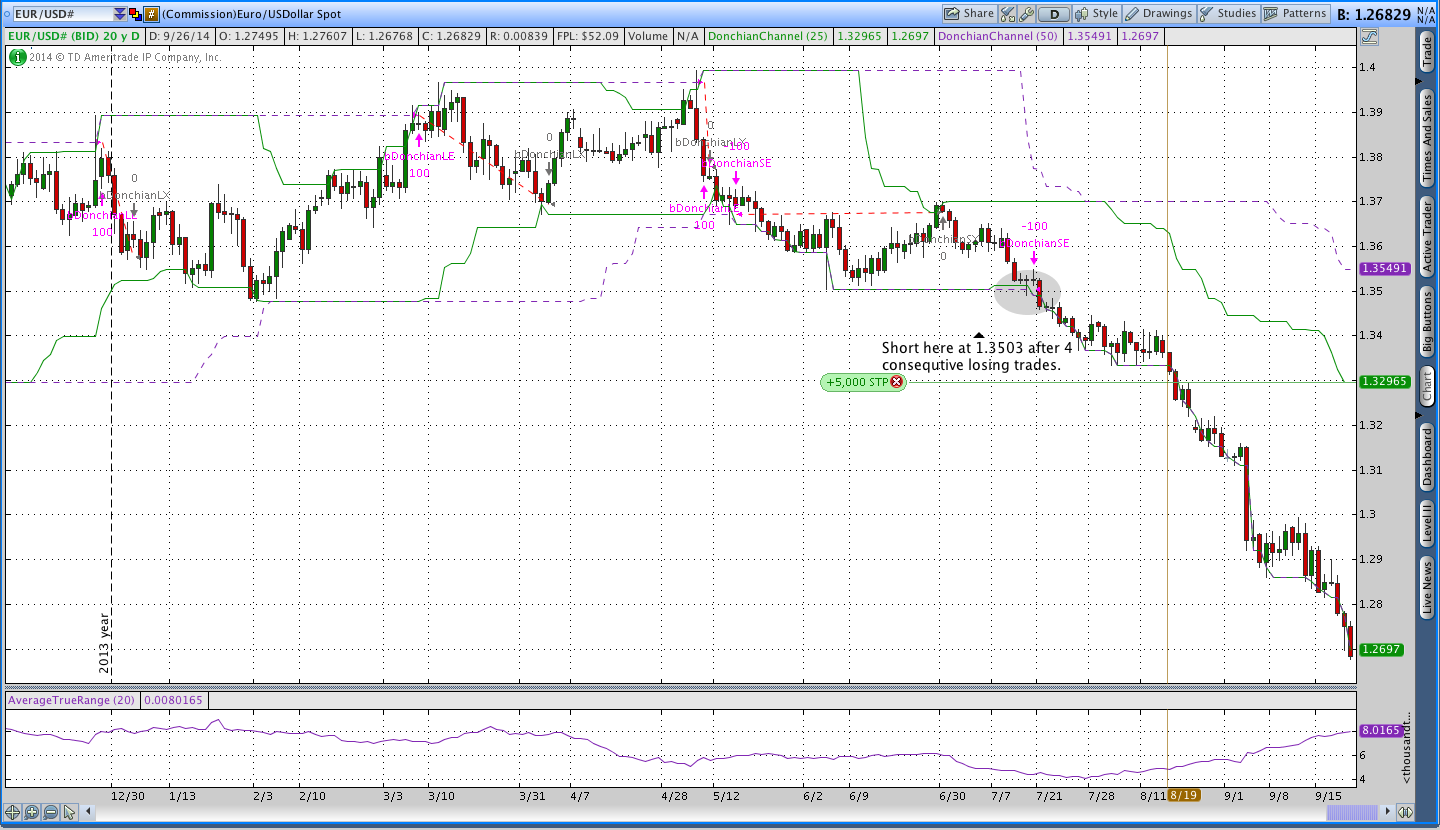

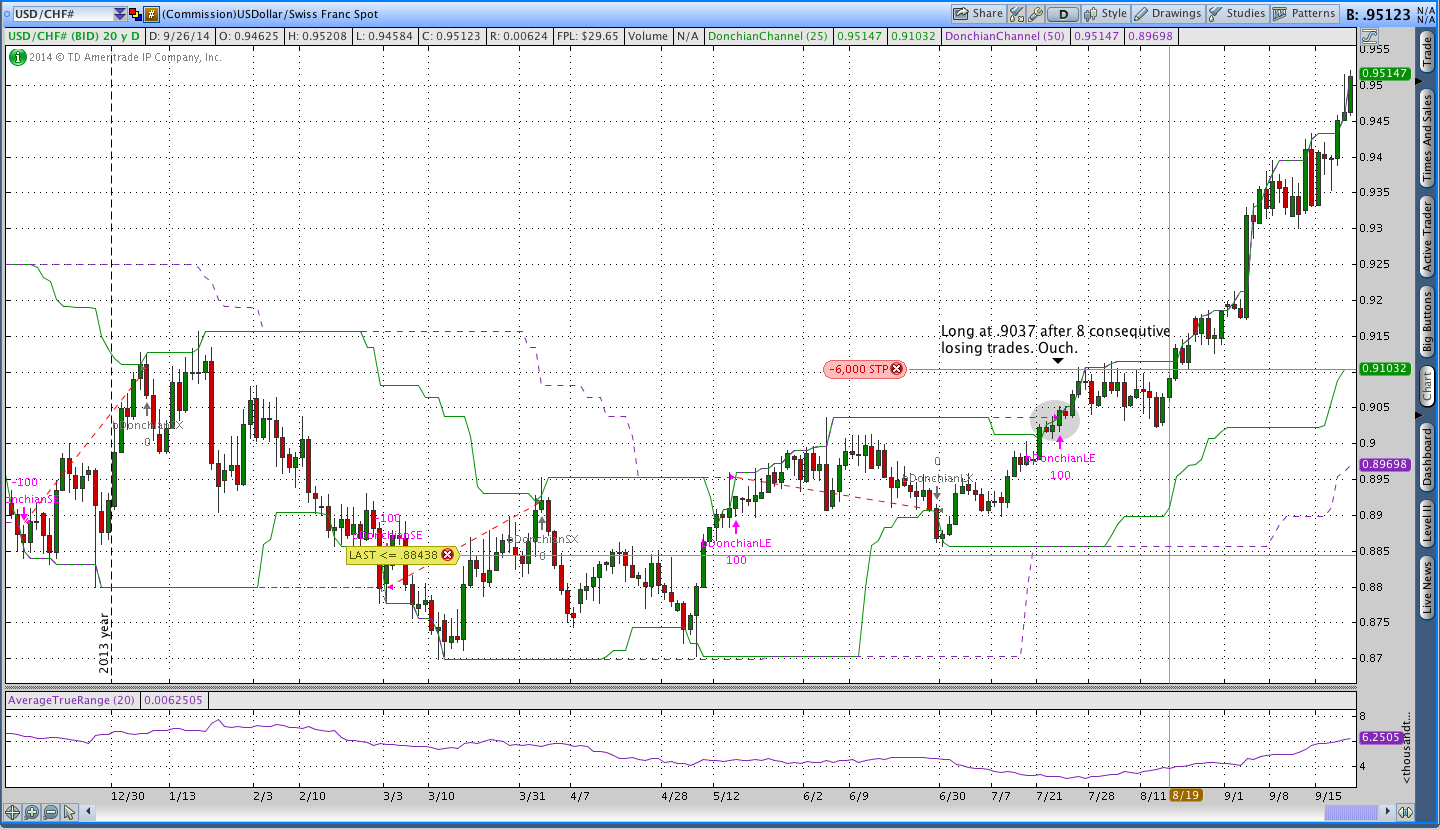

The Donchian Channel System is primarily long only (with the exception of FX) to avoid the need to borrow ETF’s. Right now there isn’t much to say about the system because almost everything is moving lower. I have open trades in EUR/USD and USD/CHF that are working to pay off the big hole that losing forex trades have created this year. It’s worth noting that prior to these winning trades EUR/USD had 4 consecutive losing trades while USD/CHF had 8 in a row. The consecutive losing trades is what can make the Donchian Channel system harder to trade because most people want to have more winning trades.

The three strongest and weakest markets are telling us that the dollar is strong right now and most other things are in pain. What’s the reason for the strength in the dollar? Who knows, we’re just concerned with trading it.

Images of the two open Donchian channel trades are shown below. Just remember, while the moves shown below are sexy, there were quite a few consequtive losing trades and a bit of pain to get to this point.

Trades This Week:

SPY – Sold to open Nov 2014 175 Put for .64

Option Inventory:

SPY – Short Nov 2014 175 Put (sold for .64)

ETF & Forex Inventory:

EUR/USD – Short 5,000 notional units from 1.35028

USD/CHF – Long 6,000 notional units from .9037

Looking ahead:

A short trade in NZD/JPY is possible sometime soon with price trading close to the 50 day low. There have been 5 consecutive losing trades in NZD/JPY this year so maybe it’s time for that market to move as well, but only time will tell. I’m eyeing a short call in GLD, but the market is fairly extended to the downside right now and that makes the risk up to the pTheta stop a little larger than I’d like.

Keep an eye on the blog later this week because I’ll be revisiting the Monthly Rotation System as we wrap up September and head into October.

If you enjoyed this post, please click above to like it on Facebook or Tweet it out. As always, thanks for reading and enjoy the rest of your weekend.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.