Options Trend Following Trade Alerts QQQ and UNG

Overview:

We were filled on a Nasdaq (QQQ) trade in the December Quarterly Options and had our stop triggered in Natural Gas (UNG). As a result, we will be exiting the Natural Gas trade this morning, October 29, 2013. If you enjoy this or any of my posts, please click one of the social media icons above to share it/them. Thanks.

Nasdaq Trade:

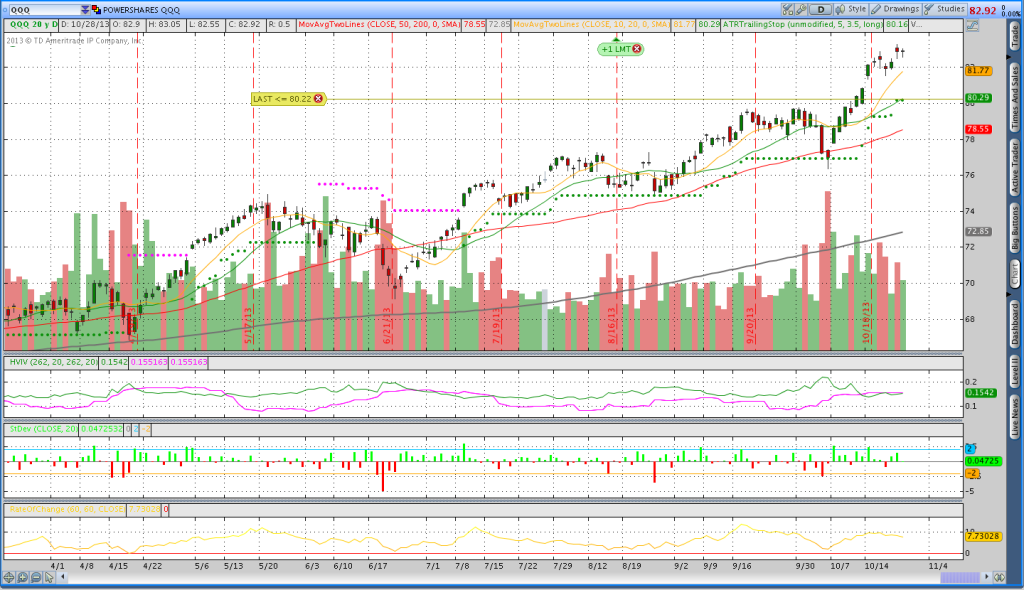

Yesterday was a choppy day for quite a few markets. However, one of the trade orders was filled during the day when there was a slight selloff in equities. We ended up getting filled on a QQQ trade in the December Quarterly options. We sold the 80/75 Put vertical for a .75 credit with about 63 days to expiration. If you take a look at the chart below, you’ll see that price is still overextended and I wouldn’t be surprised if this trade took a little heat. Once prices get overextended in either direction (up or down) they tend to correct through either time or a price breakdown. My hope is that the Nasdaq corrects through time rather than through price, but all that really matters is that price holds above our stop level at 80.22.

Natural Gas Trade:

Well, it shouldn’t come as a huge surprise that our stop was hit on the UNG trade. We are still short the 18/14 December Put vertical, but it will be closed out this morning. Natural Gas seems to chop quite a bit and our stops are frequently hit. This particular trade was under pressure for most of the time it was open and it will be closed out this morning. In the chart below, you can see the definite close below the average true range trailing stop indicating that the party is over (and it wasn’t even a great party).