Help! The Weekend Market Commentary – 11/28/2014

Big Picture:

Happy Thanksgiving everyone. Today I need a little help and some feedback from all of you. I’m in the process of putting together what will become a monthly newsletter. The newsletter is going to cover momentum investing across a wide range of markets and will accordingly be called the Market Momentum Newsletter. I put together a sample issue that you can download here. Please take a look at the sample issue and let me know what you like, dislike, and/or what you’d like to see covered in more detail. You can post your thoughts in the comments below or send an email to info at thetatrend dot com. Note that the newsletter is likely to become a paid service in the future, but for now it’s free.

While this was a fairly quiet week for the equity markets, we saw some decent moves during the short session on Friday in IWM, GLD, and TLT. The Russell 2000, IWM, sold off on Friday and that helped the Put Butterfly position. Unfortunately, I was forced to adjust that position on Tuesday. I also opened a new Put Butterfly for January.

The Monthly Rotation Systems are running in both my retirement account and also the Theta Trend sample account. In my retirement account I’m trading the Schwab Commission Free System and I have a slightly different system going in the Theta Trend Account. There will be some additional information about that system coming sometime soon.

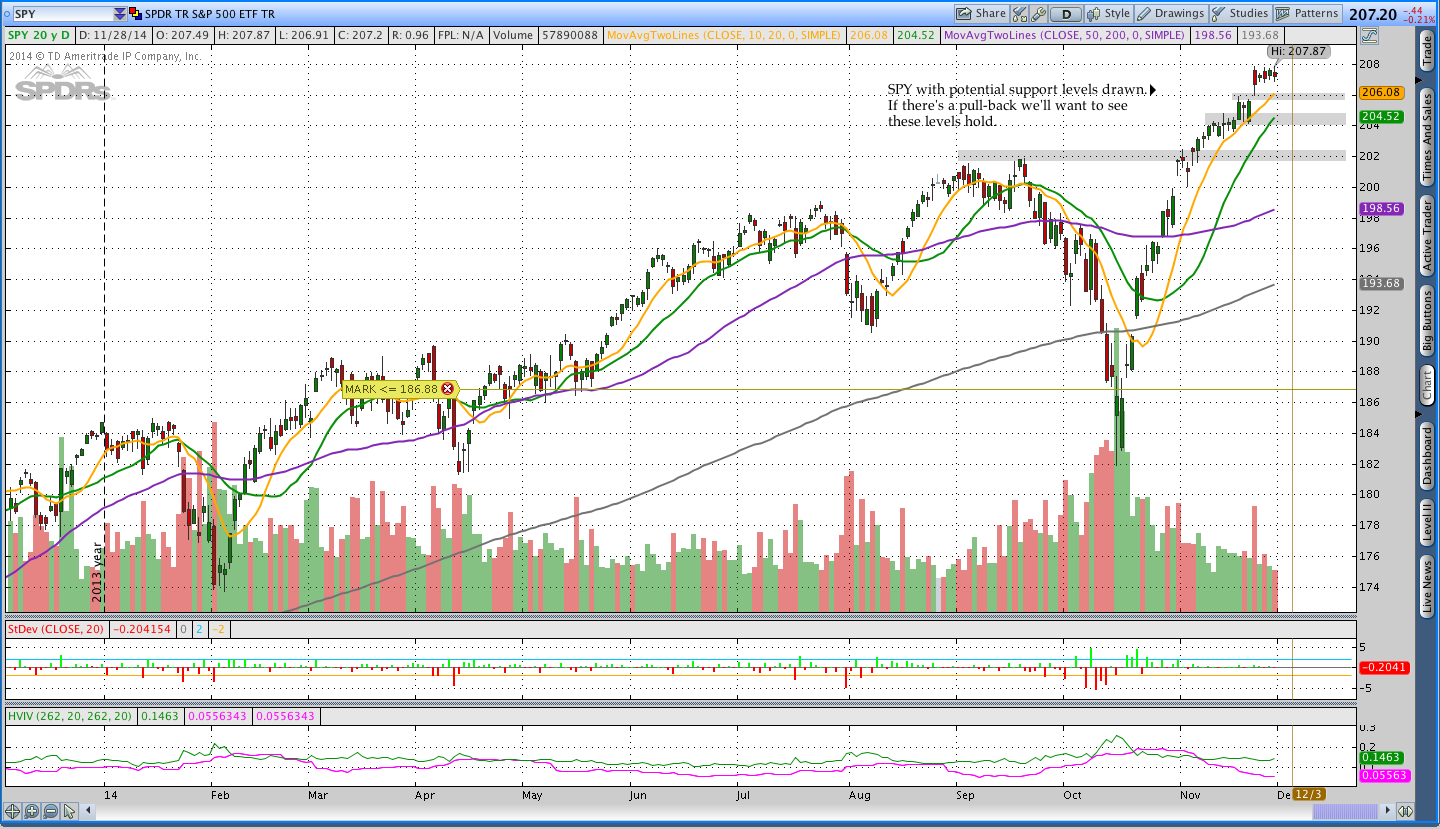

The S&P 500 ($SPY) is up around all time highs and appears to be consolidating through time. There was a little bit of selling on Friday and the market is fairly extended, but SPY is still above the 10, 20, 50, and 200 day moving averages and looks strong. See the image below for areas of potential support. If there’s a pullback in SPY, we’ll want to see the levels shown below hold. The most significant area of support is down around 202, which corresponds to the September highs.

Implied Volatility:

There was an uptick in IV this week with the selling on Friday, but Implied Volatility is still on the lower end of the three month range.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

$IWM December 2014 Put Butterfly Update:

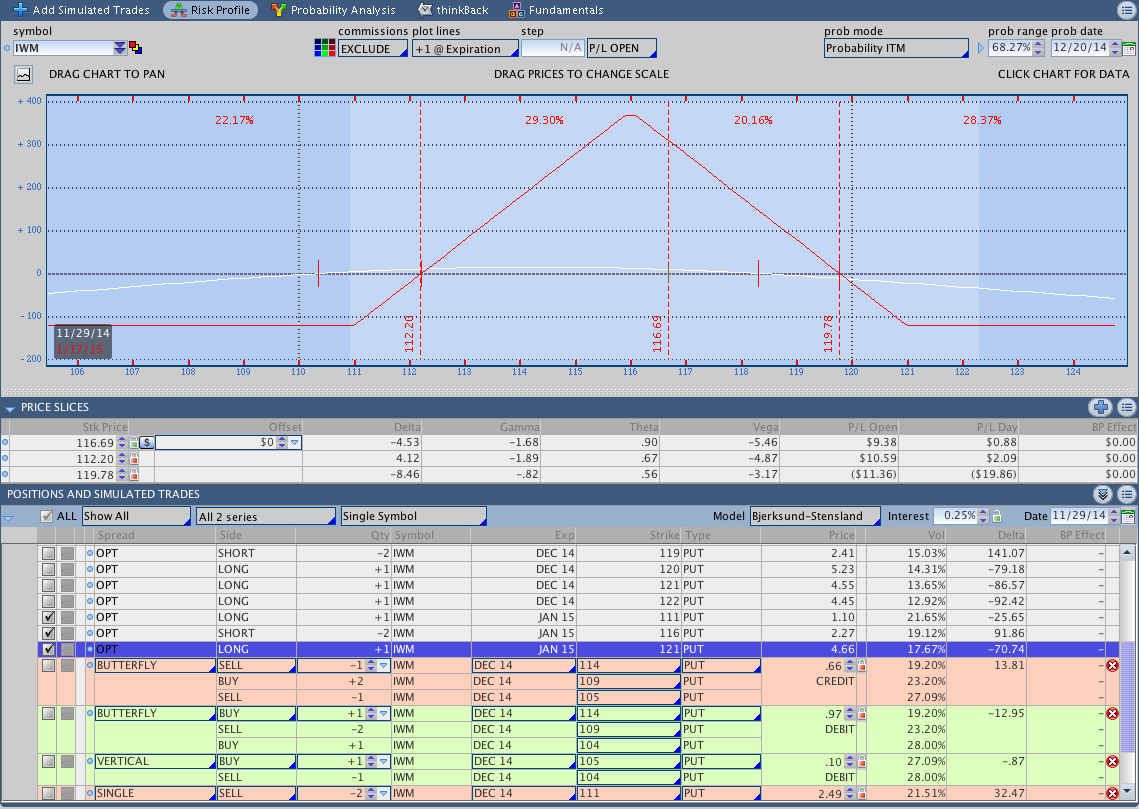

The December $IWM Butterfly was adjusted this week on Tuesday when $IWM was up above 118. On Friday $IWM sold off and the position started to look a little bit better. I adjusted the position by rolling the short 111 puts up to 113 and also added an unbalanced 115/119/122 Butterfly. An image of the current position, including all adjustments, is shown below.

We’re down to 20 days to expiration and Theta is starting to kick in. The biggest challenge this month has been keeping up with $IWM.

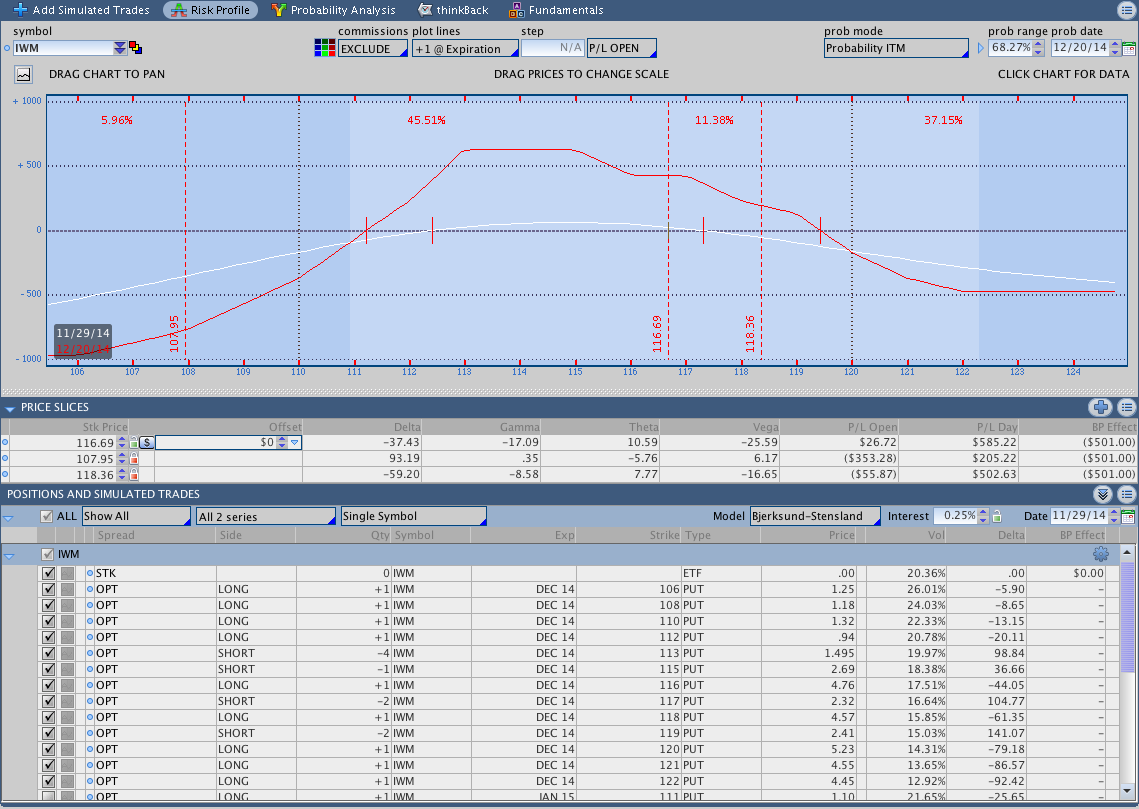

$IWM January 2014 Put Butterfly

I opened a January 2014 $IWM Put Butterfly this week. An image of that position is shown below. For now, there isn’t much to be said.

Schwab Commission Free Rotation System:

I’m not going to go into the stats for the Schwab Commission Free Rotation system this week because that system is being covered in the Market Momentum Newsletter. Please check out that newsletter and let me know what you think in the comments below or via email.

Forex Breakout System:

All of the Forex trades discussed last week are still open and there haven’t been any significant changes.

Trades This Week:

SPY – Bought to open 12 Shares at 207.38 (Basic Rotation System – more info soon)

IYR – Bought to open 32 Shares at 76.7699 (Basic Rotation System – more info soon)

IWM – Bought Dec 2014 115/119/122 Put Butterfly for .63

IWM – Rolled the Dec 2014 Short 111 Puts to 113 for a .22 credit

IWM – Bought Jan 2015 111/116/121 Put Butterfly for 1.22

Option Inventory:

IWM – Jan 2014 111/116/121 Put Butterfly (bought for 1.22)

IWM – Dec 2014 106/111/116 Put Butterfly (bought for 1.03) (the 111’s were rolled to 113)

IWM – Dec 2014 104/113/114 Put Butterfly (bought for 1.05)

IWM – Dec 2014 109/115/119 Put Butterfly (bought for 1.17) (one of the 115’s is covered now)

IWM – Dec 2014 112/117/121 Put Butterfly (bought for .85)

IWM – Dec 2014 115/119/122 Put Butterfly (bought for .63)

SPY – Short Jan 2015 186 Put (sold for .65)

ETF & Forex Inventory:

SPY – Long 12 Shares from 207.38

IYR – Long 32 Shares from 76.7699

EUR/USD – Short 5,000 notional units from 1.35028

USD/CHF – Long 6,000 notional units from .9037

USD/JPY – Long 2,000 notional units from 110.084

NZD/JPY – Long 2,000 notional units from 89.036

Looking ahead:

The holiday season is underway in the US and we’ll need to see how things play out in December. I’m not crazy about the trade location for the new rotation system trades, but part of trading the system is not overriding the rules so we’ll see what happens.

I need to get up some new position tracking pages for the Rotation Systems and I’m hoping to do that sometime in the next month. Please let me know what you think of the Market Momentum Newsletter and thanks, as always, for reading the blog.

If you enjoyed this post, please click above to share it on Facebook or Tweet it out. As always, thanks for reading and enjoy the rest of your weekend.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.