Abbreviated Weekend Commentary 3/4/2016 – $RUT, $RVX, $SPX, $VIX, $VXV

Overview:

I’m away from home this week so today we’ll go with the short form weekend commentary with charts and some brief comments. The full commentary will be back next weekend.

The relentless rally in RUT caused us to close the April trade this week at around the max loss. Even though we don’t like taking losses, it’s part of preserving capital to stay around and trade another day. I’m working on a recap for that trade this week and we’ll see what we can learn. I haven’t had a chance to go through the position in detail yet so I won’t offer any thoughts at this point.

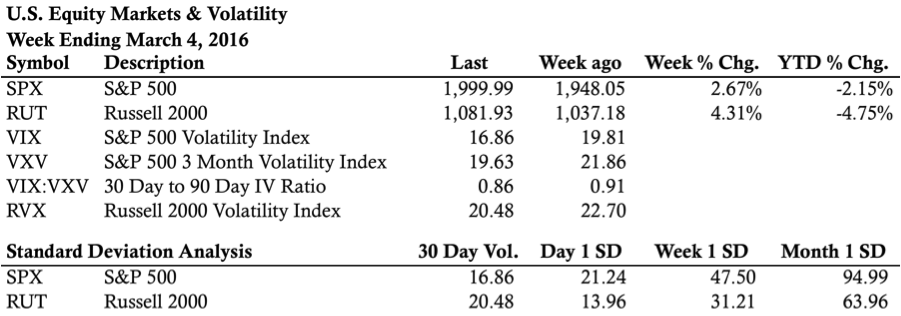

Market Stats:

Volatility:

Level Of Interest:

In the levels of interest section, we’re drilling down through some timeframes to see what’s happening in the markets. The analysis begins on a weekly chart, moves to a daily chart, and finishes with the intraday, 65 minute chart of the S&P 500 (SPX) and the Russell 2000 ($RUT). Multiple timeframes from a high level create context for what’s happening in the market.

S&P 500 – $SPX (Weekly, Daily, and 65 Minute Charts):

Russell 2000 – $RUT (Weekly, Daily, and 65 Minute Charts):

Looking ahead, etc.:

Next week I’ll continue to mostly watch the market and get a recap out for the April trade that was stopped out this week. It’s the first public loss for the system, but it was a good loss to take given the persistent move higher in RUT. I do not hold positions beyond max loss and “hope” the market will come back.

Quick, fast, and brief. Have a good weekend!

Please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.