Weekend Market Commentary 6/20/2014- Stocks, Gold, Bonds ($SPY, $GLD, $TLT)

Big Picture:

Stocks were able to grind a bit higher this week and Bonds basically sat around unchanged. However, Thursday was a big day for Gold, which was up over 3% and took me out of my small short position. That being said, the longer term trend of Gold is still lower. I do think it’s possible that we’re starting to see some sort of bottoming taking place, but the market is not in an uptrend . . . at least not yet.

As far as trades go, this was a pretty quiet week for me. I wanted to sell a weekly $SPX vertical, but we never had the pullback needed to meet the risk parameters for the trade. I’ll include a little commentary on that below. You can expect a post this week to discuss the results from the Weekly Options System backtest.

Implied Volatility:

Implied volatility in stocks fell down again this week and made a new three month low. I’m starting to wonder if the VIX will hit single digits at some point in the near future.

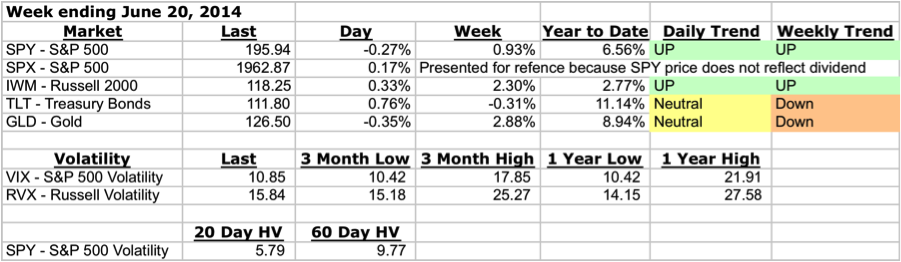

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

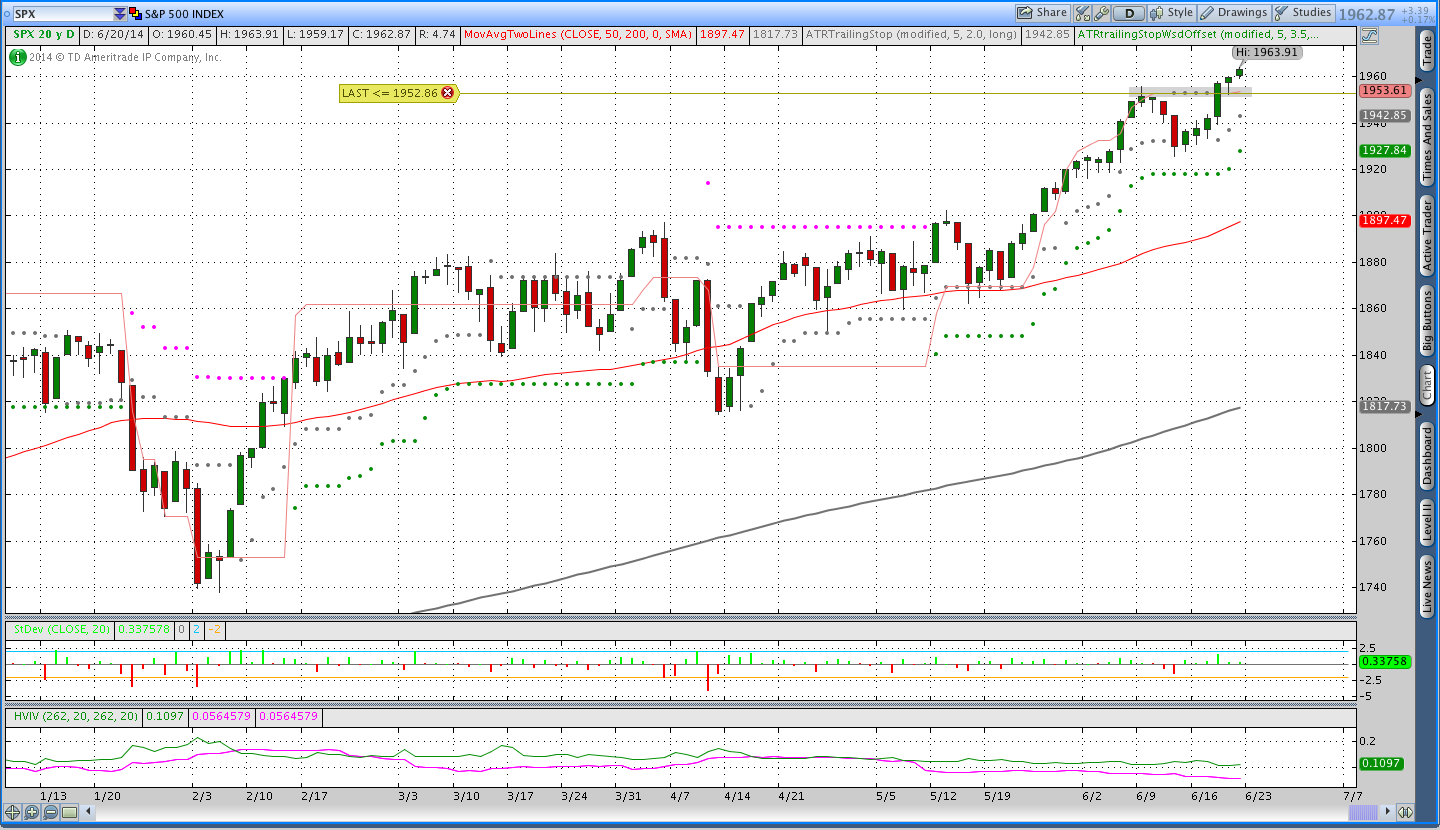

Stocks ($SPY – SPDR S&P 500):

On Thursday I began hoping and looking for a pullback to below the 2.5 standard deviation line to sell a weekly vertical spread in $SPX, but it never happened. In the chart of $SPX below you can see the level I was waiting to see price trade below (around 1952). As a reminder, I’m starting to live test a weekly options trading system that sells vertical spreads in $SPX when price is above the 3.5 x ATRts and below a 2.5 standard deviation offset. Additional information on the weekly options system can be found here.

Gold ($GLD – SPDR Gold Shares ETF):

Gold moved a bit higher last week and this week got a big pop on Thursday. The move was around a 5.5 standard deviation move. The last time Gold had an upside move above 5 SD was in the fall of 2011 when the market was topping. I covered the short GLD call because the risk stop was hit, and I did not resell it. I may sell another call at a higher strike this coming week.

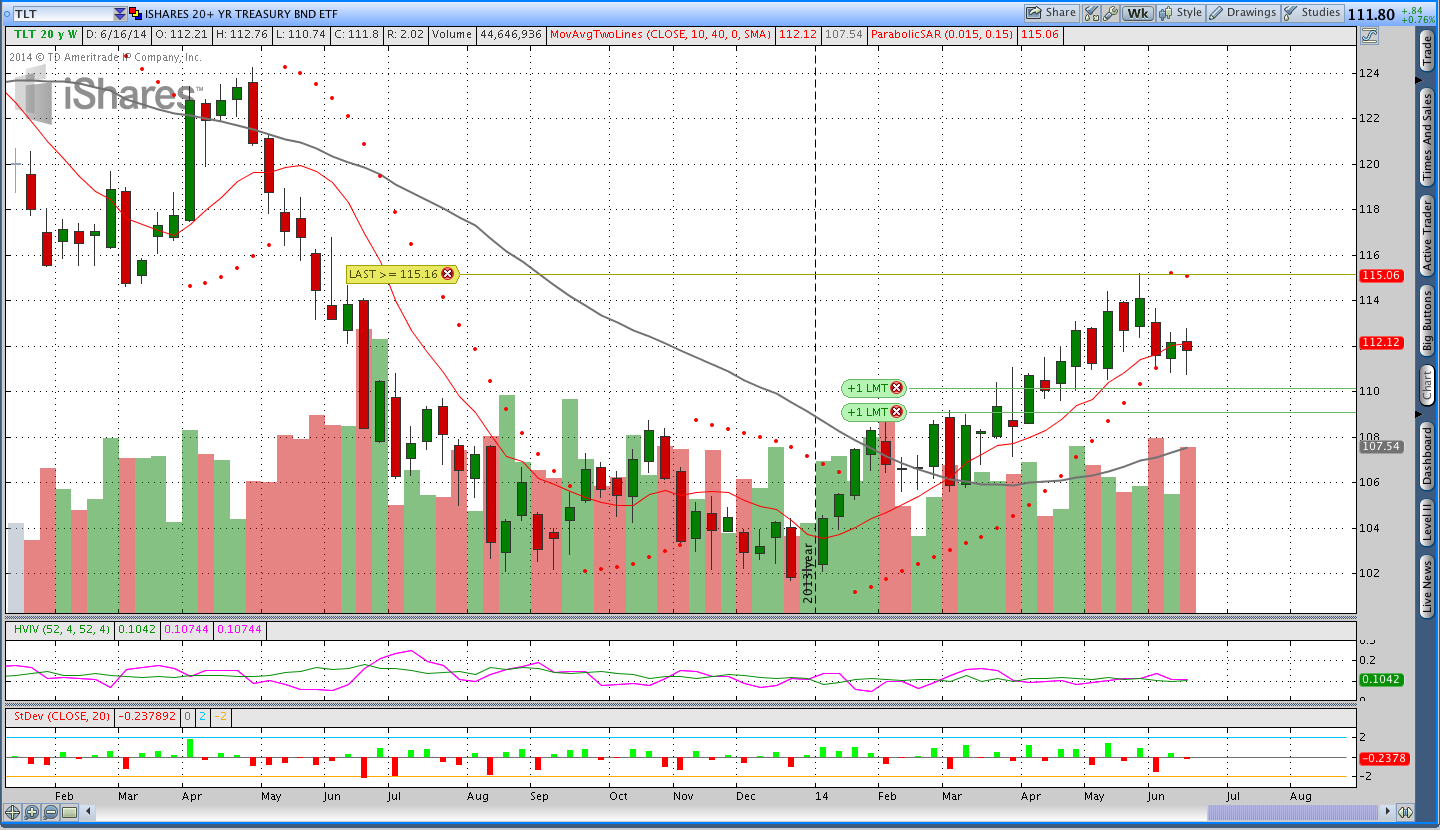

Bonds ($TLT):

Bonds saw a little intraday volatility this week, but price ended the week close to unchanged. Time has started to benefit the short calls I’m holding and the danger of being stopped out based on the dollar risk stop has subsided.

Trades This Week:

GLD – Covered short Sep 2014 134 call for .96

Option Inventory:

SPY – Short Aug 2014 173 Put (sold for .60)

SPY – Short Aug 2014 177 Put (sold for .51)

TLT – Short Sep 2014 117 Call (sold for .46)

TLT – Short Sep 2014 118 Call (sold for .40)

ETF & Forex Inventory:

SPY – Long 12 shares from 188.58

DBE – Long 111 shares from 30.37

EUR/USD – Short 5,000 notional units from 1.3673

USD/CHF – Long 6,000 notional units from .8953

Looking ahead:

This week I’m hoping to get a valid signal in $SPX for the weekly options system. I’ll also be posting the results from the backtest this week. Out of curiosity, would anyone like to see a regular Wednesday night post to discuss the weekly options system? That system looks for vertical spreads to sell on Thursday and those trades should be anticipated a day in advance.

If you want me to start running a Wednesday night post to talk about weekly options, let me know in the comments below or shoot me an email (info at thetatrend dot com).

Thanks for reading and have a great weekend.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.

Thanks to everyone who sent emails regarding a weekly option post. I’ll be rolling out a post to discuss a trade in weekly options sometime soon. If you didn’t send me an email and have something you’d like to see or a format that you think would be good, feel free to let me know.