Weekly Trend Following Trade Recap – Beat up in the Quarterly Options

Overview:

Yikes, the week ending November 8th, 2013 was not gentle to Theta Trend. I closed out two trades for losses after having the stops hit. Both the EEM and GLD vertical spreads were closed and the only option trade still running is the QQQ vertical. There is also a quick mention of the FAN trade that was opened as part of the Top Performing ETF’s Monthly Rotation System.

EEM (Emerging Markets, think foreign stocks) originally had a trend reversal in early September so our trade on Halloween was a little late in the game. Fortunately, I entered the trade when price was close to the average true range trailing stop so the loss was small.

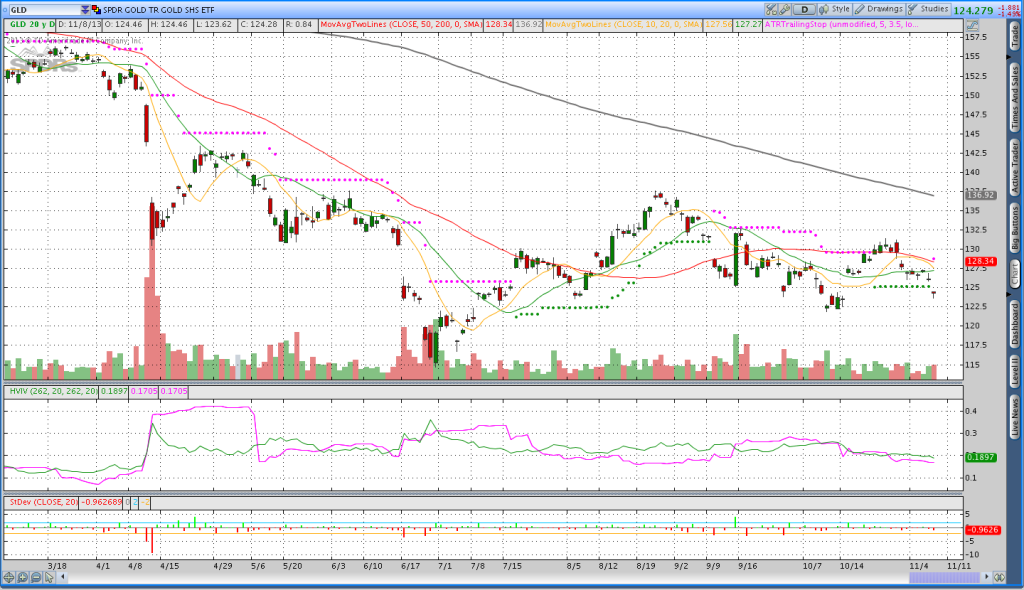

The GLD (Gold) trade is a good example of a false signal. I sold the 125/120 GLD Put vertical back on October 29th and the trade was closed on Friday near the end of the day. The long trend state, as indicated by the average true range trailing stop, was pretty short lived and when that happens there isn’t much to be done other than close the trade and move on.

Check out the video below for a more in depth discussion and make sure to share this using the social media buttons above. Enjoy.

The image below shows the failed long trend in Gold. I’m starting to wonder if we’re heading back down to the 115 level. Guess we’ll see.