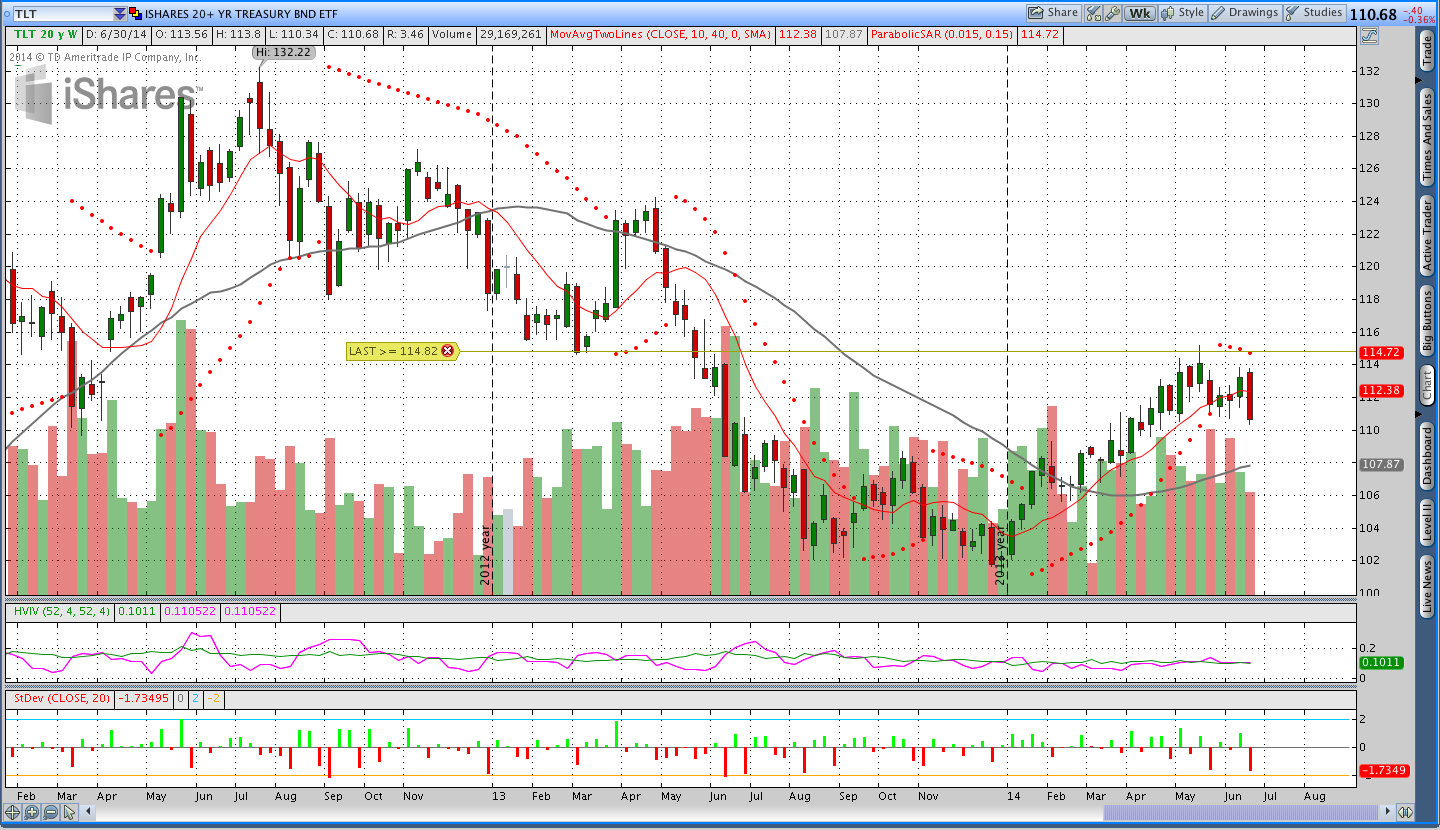

Weekend Market Commentary 7/3/2014 – S&P 500 Continues Higher . . . 2K Coming?

Big Picture:

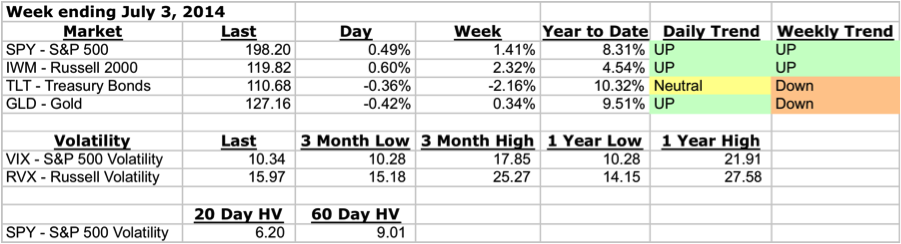

Happy 4th of July everyone. This was a short week with the holiday, but the indecision I mentioned last week was resolved and the S&P traded to new all time highs (again). The SPX closed the week at 1985, putting it a short distance away from the 2,000 level. I would not be surprised to see 2,000 sometime soon. I tried to sell some verticals on Tuesday for the Weekly Theta system and wasn’t filled because the market traded higher and I didn’t have the ability to move my orders during the day. I ended up selling the 1930/1920 put spread on Wednesday and, fortunately, the market continued higher Thursday morning.

Happy 4th of July everyone. This was a short week with the holiday, but the indecision I mentioned last week was resolved and the S&P traded to new all time highs (again). The SPX closed the week at 1985, putting it a short distance away from the 2,000 level. I would not be surprised to see 2,000 sometime soon. I tried to sell some verticals on Tuesday for the Weekly Theta system and wasn’t filled because the market traded higher and I didn’t have the ability to move my orders during the day. I ended up selling the 1930/1920 put spread on Wednesday and, fortunately, the market continued higher Thursday morning.

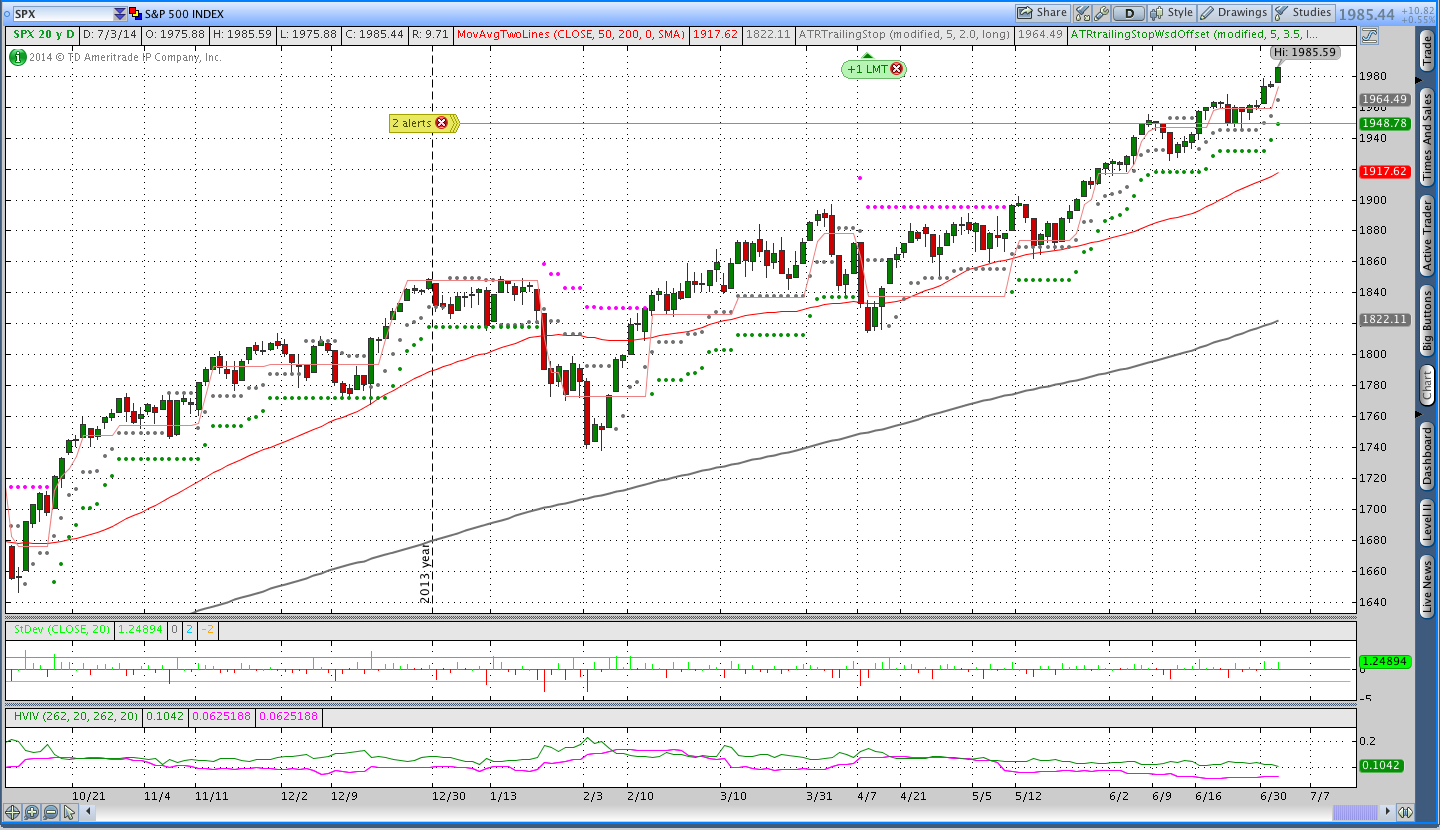

Bonds (TLT) had a pullback that allowed me to cover my remaining short call. The selloff in Bonds left the market with a close below the 50 day moving average and price may be starting to turn after a strong start to the year. Gold traded higher earlier in the week and then gapped lower to give up some of the gains.

What Do You Think About This?

I am considering a slightly different format for the weekly market commentary and I’m interested to hear what you think. Up to this point, I’ve covered three markets and haven’t mentioned the Donchian channel system very often. The format I’m considering would cover the S&P 500 in detail (as I’m doing now) and then go through the Donchian channel trades and markets. If you like or dislike that idea, please let me know in the comments or via email. Thanks!

Implied Volatility:

Implied volatility (via the VIX) made new 3 month and 1 year lows on Thursday. Low volatility can continue for an extended period of time and right now nothing suggests the market is getting tired.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

Stocks ($SPY and $SPX – S&P 500):

This week any uncertainty about a pullback was resolved to the upside when the S&P 500 made new all time highs. On Tuesday I was trying to sell various vertical spreads for the Weekly Theta system, but was unable to get filled. Even though I will generally chase the market a little bit to get a fill, on Tuesday I was unable to watch the markets during the day and didn’t get a chance to move my orders. On Wednesday morning I sold one weekly vertical to have a small position. I like to take small positions and add to them as the market moves and this week I never got the chance to add to the trade.

For anyone who doesn’t know, I started a regular weekly video post to cover the Weekly Theta options trades. Once I get filled on a weekly options trade, I’m both Tweeting it out and updating the post.

Gold ($GLD – SPDR Gold Shares ETF):

Gold traded higher early in the week and then gapped lower at the end of the week to give up some of the gains, but still ended a little higher. Even though the pSAR indicator is short, it seems like gold is more neutral at this point.

Bonds ($TLT):

Bonds finally sold off a little bit this week and it looks like they might be in for a little bit of a correction or consolidation.

Trades This Week:

SPX – Sold to open 1930/1920 Jul2 14 Put Vertical at .45

SPX – Bought to close 1910/1900 Jul1 14 Put Vertical at .10

SPY – Bought to close Aug 2014 177 Put for .28

GLD – Covered short Aug 2014 134 Call for .55

TLT – Covered Short Sep 2014 118 Call for .19

EUR/USD – Bought to close 5,000 notional units at 1.3677

WIP – Bought to open 100 shares at 61.66 (Donchian channel system)

Option Inventory:

SPY – Short Aug 2014 173 Put (sold for .60)

SPX – 1930/1920 Jul2 2014 Put Vertical (sold for .45)

ETF & Forex Inventory:

SPY – Long 12 shares from 188.58

DBE – Long 111 shares from 30.37

WIP – Long 100 shares from 61.66

NZD/JPY – Long 5,000 notional units from 89.289

Looking ahead:

This week I’m going to be looking for some new SPY or SPX pTheta trades. I’m considering selling vertical spreads in SPX for the pTheta system rather than selling naked options as a way to better utilize margin. I’ll also be looking for a new Weekly Theta trade and hoping to cover the existing trade on Monday.

I’ve been going back through my trading results for the first half of the year and I’ve found some interesting patters that I’m planning to share with everyone sometime in the next week or so. The result of that analysis is that I’m starting to think I would be better off trading multiple options systems on the S&P rather than the same system across numerous markets. More to come . . .

Just a reminder, let me know what you think of covering the S&P 500 in detail and then looking at the Donchian channel markets. You can post your thoughts in the comments below or shoot me an email.

If you enjoyed this post, please click above to like it on Facebook or Tweet it out. As always, thanks for reading and enjoy the rest of your weekend.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.