Weekend Market Commentary 6/7/14 – Stocks, Bonds, Gold ($SPY, $TLT, $GLD)

Big Picture:

Oh yeah, I’m back. After finishing up a fairly hectic tax season, I’m back to writing the blog. Since I last posted, there have been a few Donchian channel trades closed and a few new ones opened. Right now I don’t have very many positions open, but you can see a list of everything in my inventory towards the end of this post. Thanks for your patience and thanks to everyone who has found the blog while I was out and is enjoying the content. See the update to my contact info in the “Side-note” below.

On to the markets . . . The S&P has been broadly stronger than the Russell ($IWM) over the past couple of months, but this week the Russell looks like it’s showing some strength and the daily trend flipped from down to neutral. That being said, on the weekly timeframe, $IWM is still in a downtrend. Bonds got hit fairly hard this week and my naked puts are under a little bit of pressure. Gold is and has been weak, but it did pause a little this week.

Side-note: For those of you who don’t already know, I’m a CPA and work as a tax accountant by day. The blog went silent for a couple of months as I finished up tax season and, while I was still trading, the blog wasn’t updated. The biggest change is that somehow GoDaddy took away my dan at theta trend email address. If you want to contact me, I can be reached via info at thetatrend dot com.

Implied Volatility:

Implied volatility collapsed this week and the $VIX fell below 11, wild. IV is now at the bottom of the three month range or, more simply, really, really low.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

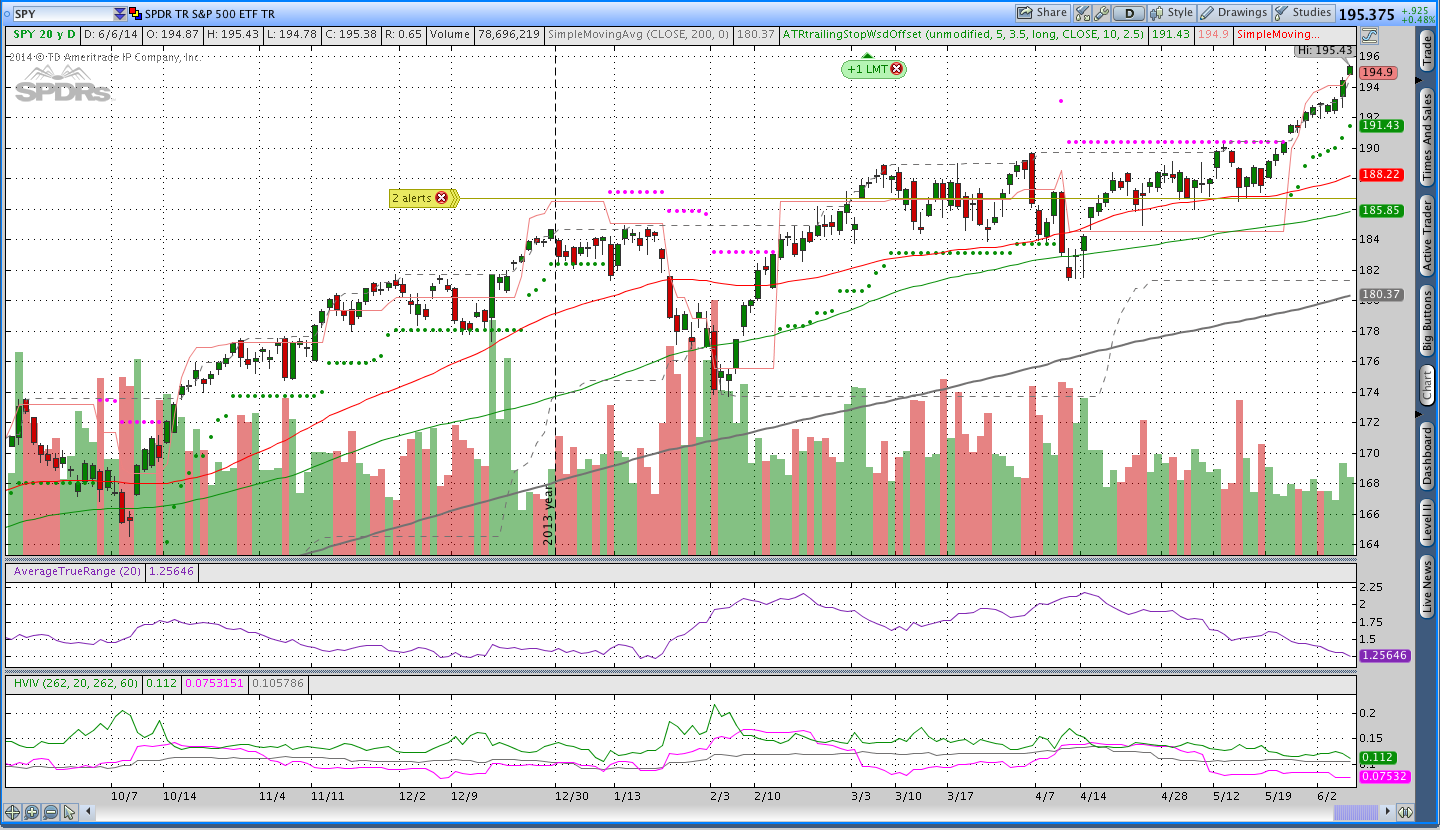

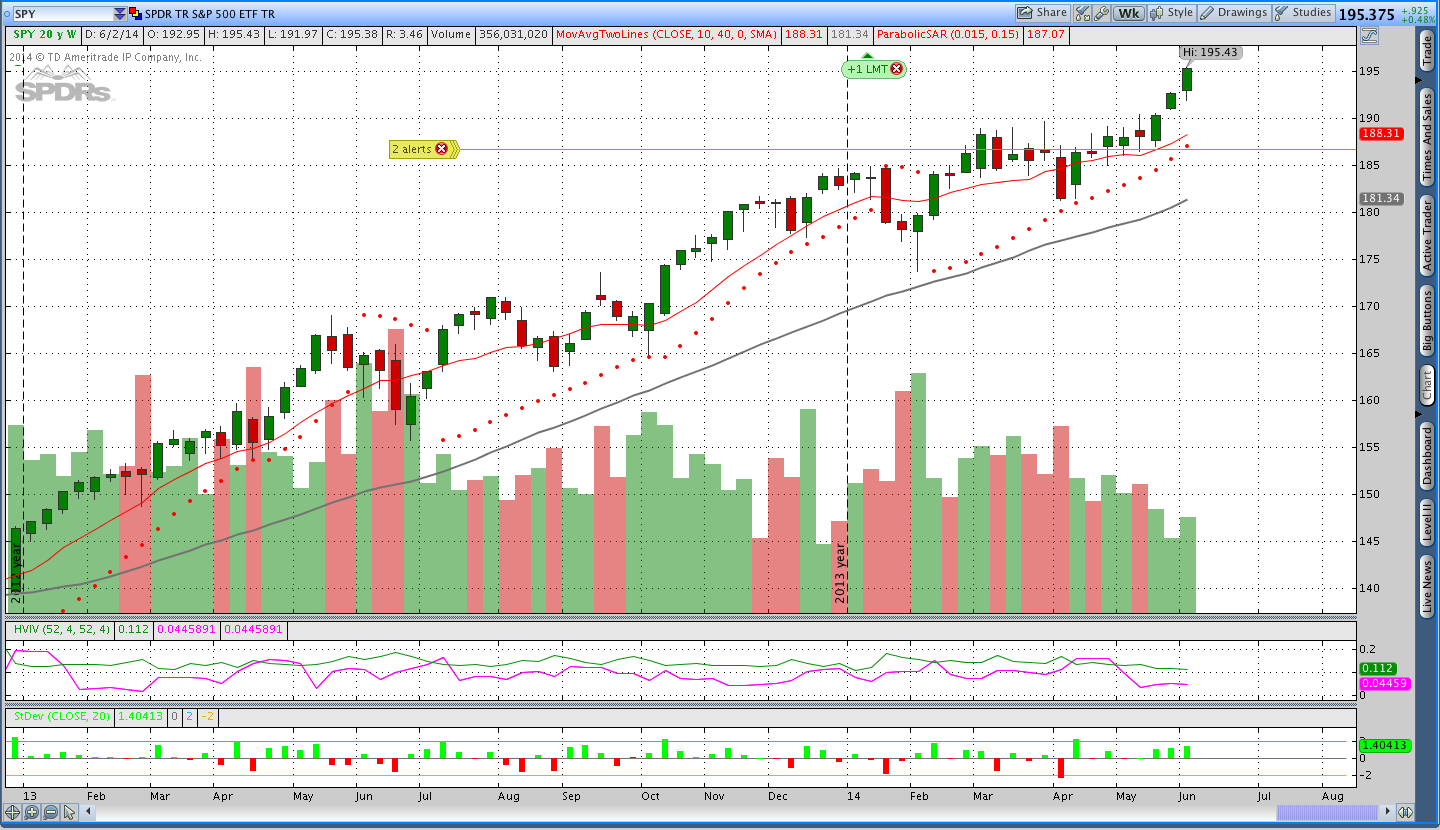

Stocks ($SPY – SPDR S&P 500):

A week or two ago there was a new 50 day breakout in $SPY. That breakout triggered a new Donchian Channel position. After the breakout, there was a little consolidation, but on Thursday $SPY pushed higher in a big way. That push continued on Friday and we finished the week at new all time highs.

The move we saw this past week is another reminder for me of why I stopped focusing on non-directional trading. I know some people are able to adjust their trades, but my preference has always been to just go along with the trend and sell out of the money options that are unlikely to be reached.

Gold ($GLD – SPDR Gold Shares ETF):

Gold took a moment to pause this week, but the trend is very clearly down. The 10 week (50 day) moving average is now below the 40 week (200 day). My personal opinion is that gold may be starting to find a little bit of a bottom, but I definitely won’t be taking any long trades until the trend reverses. If I want something to go up in price, I prefer to buy it when it is increasing, rather than decreasing, in price. Gold is still decreasing in price.

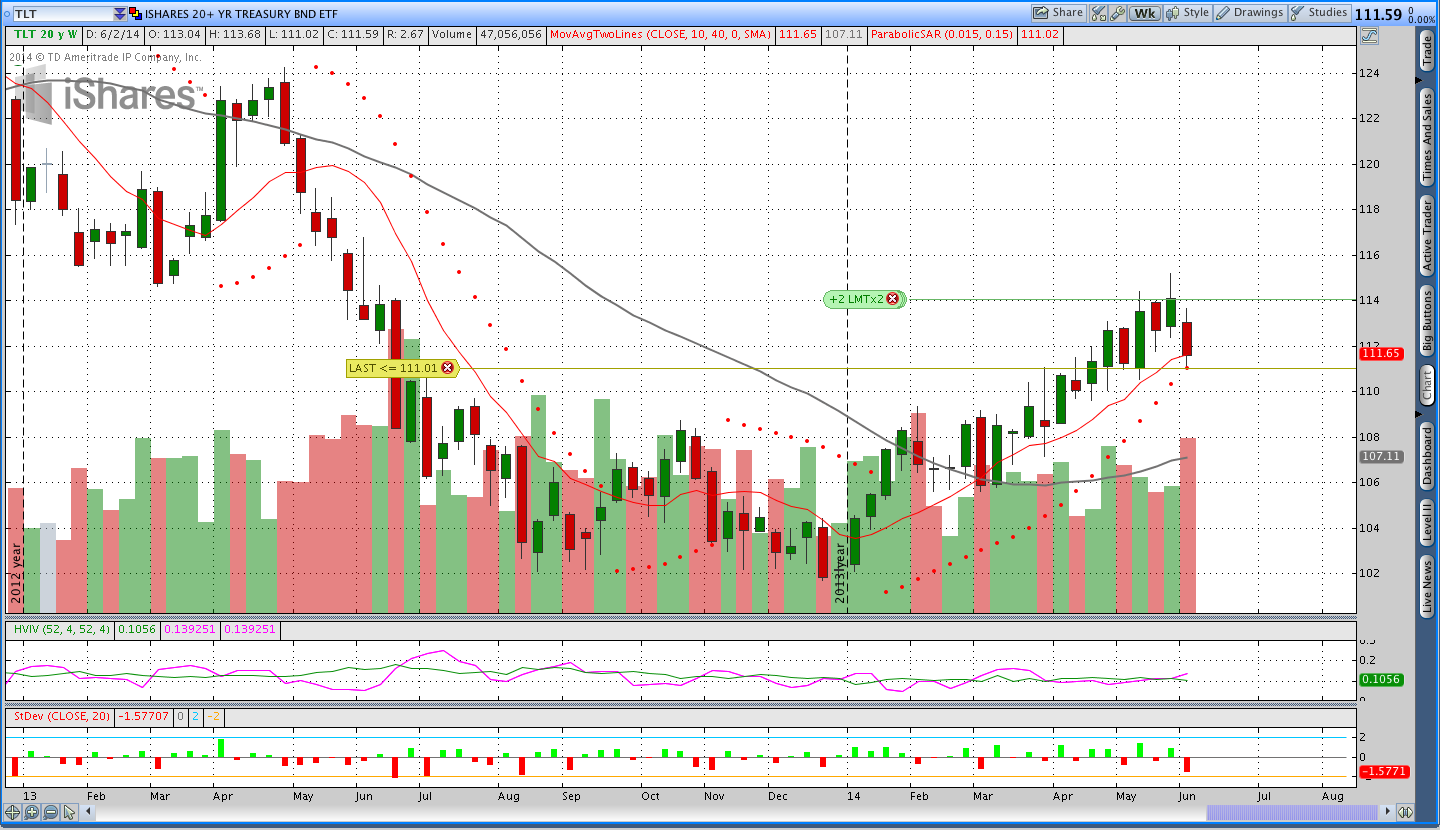

Bonds ($TLT):

Bonds pulled back this week and are in the neighborhood of the 10 week (50 day) moving average. I’m short a couple of puts that are under a little bit of pressure, but nothing serious. If price continues lower this coming week, I may be closing the trades.

Trading Results:

All of my spreadsheets are updated and you can see my results on the following three pages. Note that information about the three systems is linked on the individual result pages.

Donchian Channel Trades – Donchian channel breakout trading system results

pTheta Trades – This is an options trend following system I built that uses weekly charts to define trend and sells naked options

Credit Spreads and Iron Condor Trades – If/when I trade a credit spread, it gets tracked here. Some of these are non-directional and some aren’t.

Trades This Week:

TLT – Sold to open August 2014 105 put at .40

SPY – Sold to open August 2014 173 put at .60 (wish I had sold more)

SPX – Sold Jun2 2014 1880/1875 put vertical (weekly’s) for .35 and covered the following day for .10 (wasn’t getting filled at .05)

USD/JPY – Covered short 6,000 notional units at 102.697

Option Inventory:

SPY – Short Aug 2014 173 Put (sold for .60)

TLT – Short Aug 2014 105 Put (sold for .40)

TLT – Short Aug 2014 107 Put (sold for .40)

ETF & Forex Inventory:

SPY – Long 18 shares from 188.58

NZD/JPY – Short 5,000 notional units from 86.385

EUR/USD – Short 5,000 notional units from 1.3673

USD/CHF – Long 6,000 notional units from .8953

Looking ahead:

Everything has been rolling along smoothly so far this year. As a reminder, I size risk for all of my trades based on a $10,000 account. The benefit of using that account size is that it allows you to see how a small account would perform. The account is doing well this year and there are gains coming in from all three systems.

This week I’ll continue looking for a little better location in Gold to sell naked calls and possibly another put in SPY. There’s a chance that my TLT trade will get closed out as well.

Have a great weekend and please share this post with anyone you think would enjoy it. You can also share it using the social button toolbar above if that’s easier. Thanks for reading.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.