Weekend Market Commentary 6/27/14 – Stocks, Bonds, Gold ($SPX, $SPY, $TLT, $GLD)

Big Picture:

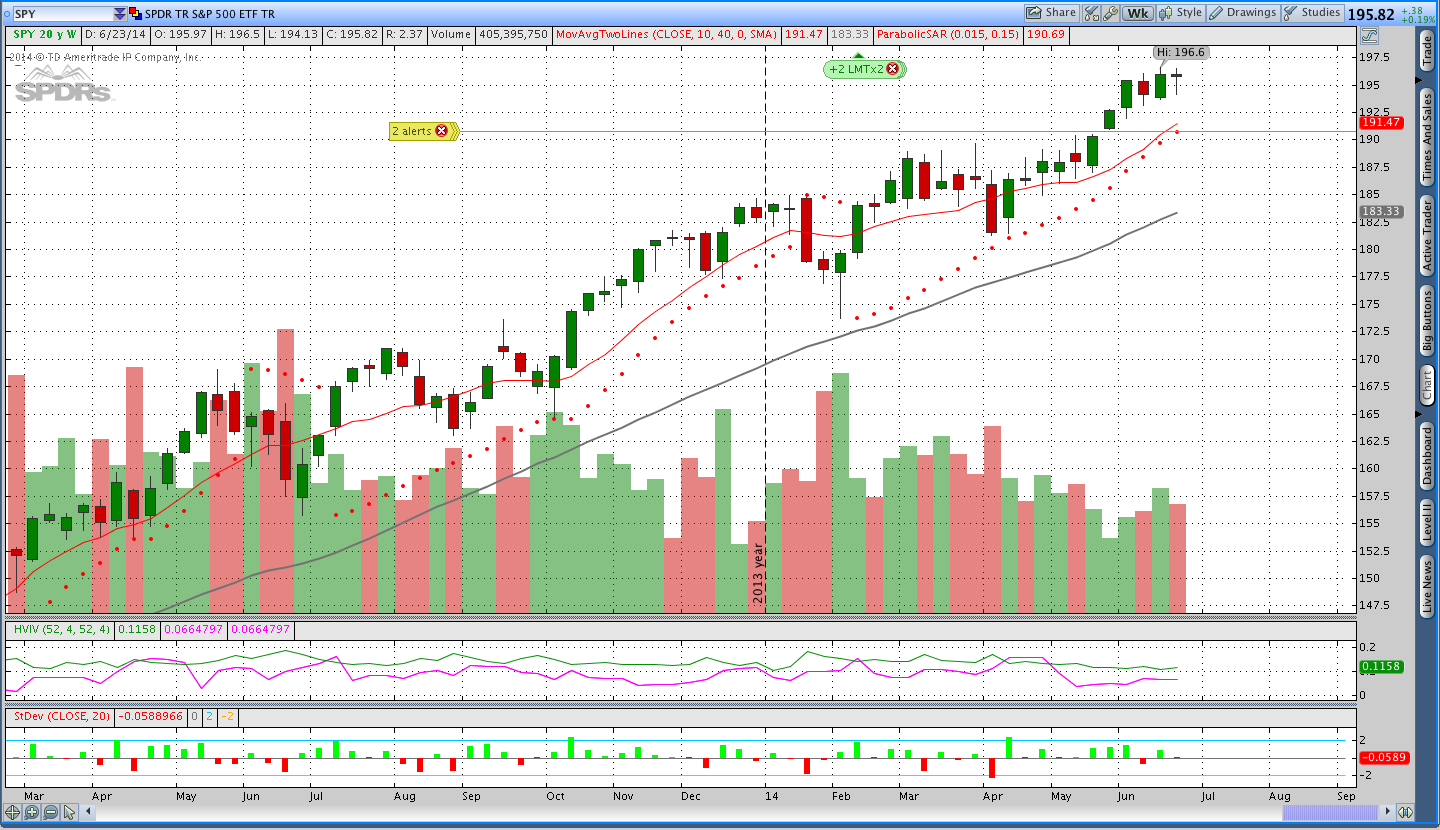

It looks like there’s a little indecision in the markets. Both SPY and GLD ended the week essentially unchanged, but SPY seemed weak. There were a couple of significant intraday sell-off’s in the S&P that make me wonder if there wasn’t some institutional selling taking place. It’s too early to know if the market is just shaking the trees and getting ready to head higher, but I think there’s reason for a little bit of caution in the short term.

Bonds have been strong and continued the march higher. I covered one of my short calls because the risk threshold for the trade was hit and sold a GLD call. I was also filled on two SPX put spreads for the Weekly Theta system and was able to cover one of them yesterday (Friday) after pulling in 80% of the credit. The trades were filled during the sell-off Thursday morning and initially were under some good pressure. I’m glad the market was able to stabilize and push higher into the weekend.

Implied Volatility:

We saw a little bit of an uptick in implied volatility this week and I’m not surprised given the intraday sell-off’s in the S&P. The uptick was small, but that combined with the indecision suggests that there’s a little more uncertainty going into this weekend.

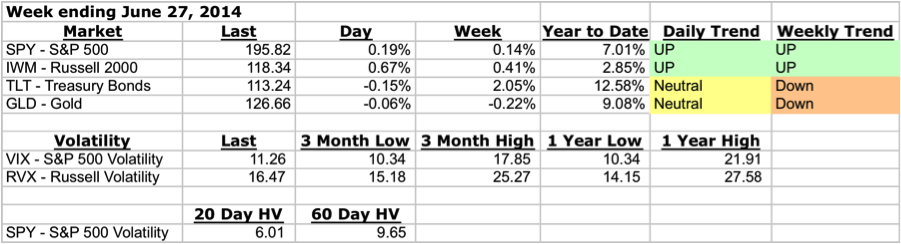

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

Stocks ($SPY and $SPX – S&P 500):

This week there were two sudden sell-offs in the S&P 500. On a weekly basis, the market climbed back to unchanged and there isn’t much to say other than the action wasn’t exactly confidence inspiring. The intraday chart of SPX below goes through some of the levels I’m watching for the Weekly Theta trade. As long as there isn’t a gap lower early next week, I should be able to take the trade off without pain and start looking for a new weekly options trade.

Gold ($GLD – SPDR Gold Shares ETF):

After a huge move in Gold last week, this week was pretty quiet. Prices ended the week unchanged and I sold a new short call for the pTheta system.

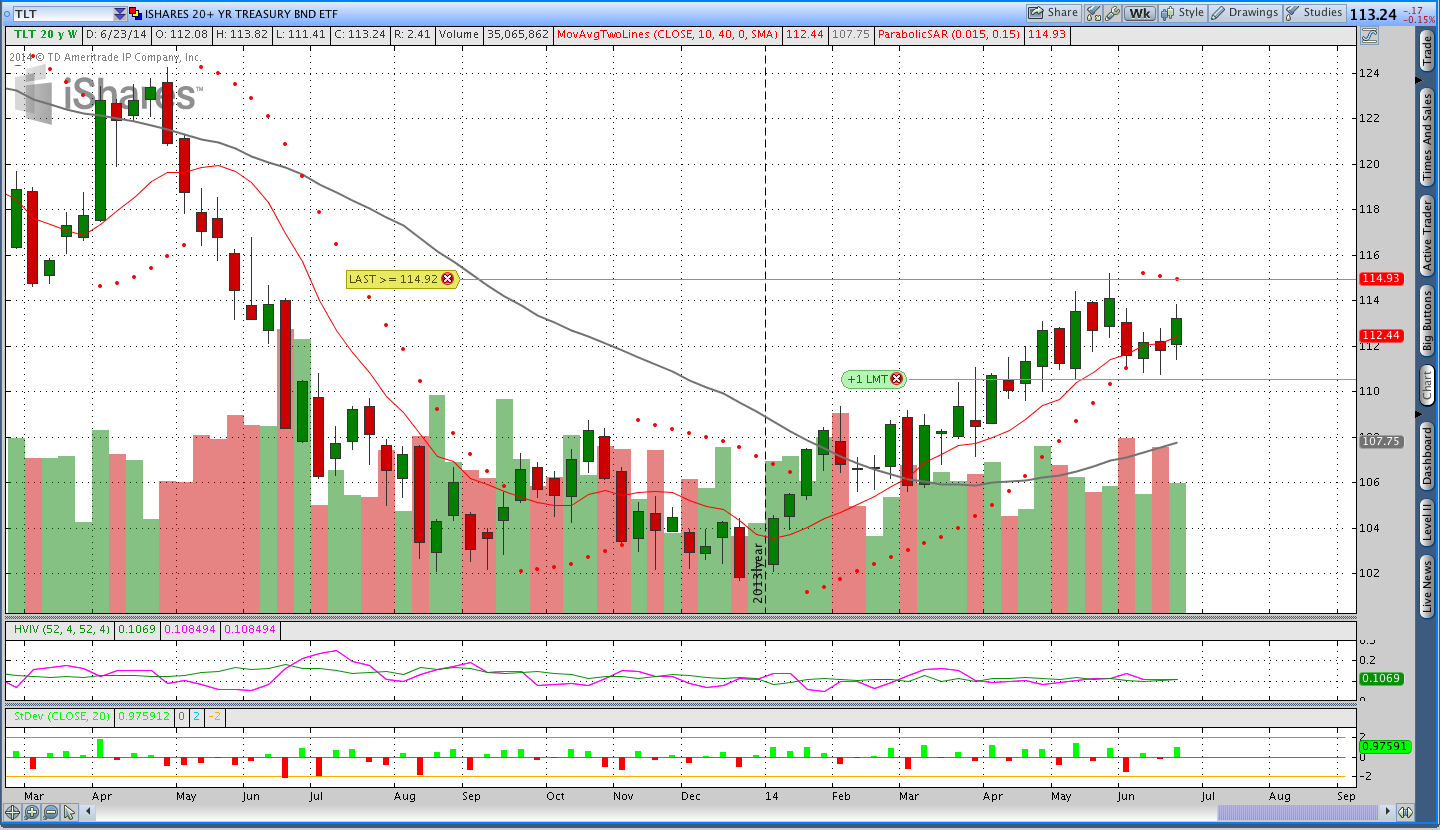

Bonds ($TLT):

I wish bonds would fall down. This week TLT pushed higher, yet again, and I was forced to cover one of my short calls. On a daily timeframe the market seems neutral, but the 12% year to date return suggests TLT has been a little stronger than neutral. The pTheta signal flipped from long to short a few weeks ago, however, price has moved higher from the stop level since that time. The low implied volatility in bonds combined with the slow grind up has been challenging for the pTheta system.

Trades This Week:

GLD – Opened short Aug 2014 134 call for .45

TLT – Covered Short Sep 2014 117 Call for .75

SPX – Sold to open 1905/1900 Jul1 14 Put Vertical at .35 and closed the following day for a .10 debit

SPX – Sold to open 1910/1900 Jul1 14 Put Vertical at .45

USD/CHF – Sold to close 6,000 notional units at .8907

NZD/JPY – Bought to open 5,000 notional units at 89.289

Option Inventory:

SPY – Short Aug 2014 173 Put (sold for .60)

SPY – Short Aug 2014 177 Put (sold for .51)

SPX – 19010/1900 Jul1 2014 Put Vertical (sold for .45)

GLD – Short Aug 2014 134 call (sold for .45)

TLT – Short Sep 2014 118 Call (sold for .40)

ETF & Forex Inventory:

SPY – Long 12 shares from 188.58

DBE – Long 111 shares from 30.37

EUR/USD – Short 5,000 notional units from 1.3673

Looking ahead:

This week is a little different with the holiday on Friday. I’m going to be looking for a SPX weekly options trade a little bit earlier in the week and ideally want to take a position by Wednesday morning at the latest. I’ll be continuing to watch the TLT call because the risk based stop is close to getting hit. For those of you who are reading the Weekly Theta posts, please let me know if there’s anything you’d like to be done differently or if you’d prefer the information to be presented in another format. I will also tell you that I’m already starting a new backtest with the hope of improving the Weekly Theta system.

If you enjoyed this post, please click above to like it on Facebook or Tweet it out. Thanks for reading and have a great weekend.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.