Weekend Market Commentary 12/26/2014 – $TLO, $SCHH, $SPY, $IYR

Big Picture:

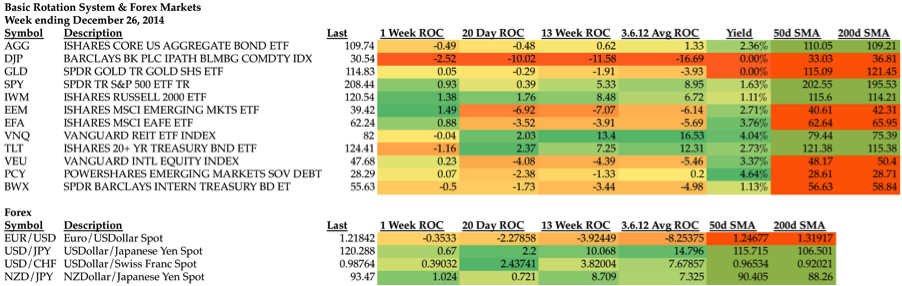

Happy Holidays everyone. As expected, this has been a fairly quiet week in the markets. We’ve seen a little bit of continued strength in U.S. Equities, which makes everyone hoping for a Santa Claus Rally feel good. Long term Treasury Bonds ($TLT) took a little bit of a hit this week, but are still strong over a longer look-back period. The Dollar as measured by other currencies and commodities is still showing a good amount of strength. Unless something changes early next week, it looks like my open Forex positions will spill over into 2015.

Happy Holidays everyone. As expected, this has been a fairly quiet week in the markets. We’ve seen a little bit of continued strength in U.S. Equities, which makes everyone hoping for a Santa Claus Rally feel good. Long term Treasury Bonds ($TLT) took a little bit of a hit this week, but are still strong over a longer look-back period. The Dollar as measured by other currencies and commodities is still showing a good amount of strength. Unless something changes early next week, it looks like my open Forex positions will spill over into 2015.

A little while back I read a news article about Citi Bank moving their headquarters to the U.S. Capital Building in Washington D.C. That move confirms the very entrenched relationship between big banks and the U.S. Government. A Citi representative said it best, “Instead of constantly flying out from New York to give members of Congress their marching orders, Citigroup executives can be right on the floor with them, handing them legislation and telling them how to vote. This is going to result in tremendous cost savings going forward.” That move is very scary from a “free market” perspective (if you can even call the markets that). My feeling is that when the fallout from our excessive debt burden comes, it will be bad. The problem is that we don’t know when that will happen.

The Weekly Stats:

ETF Rotation System Positions:

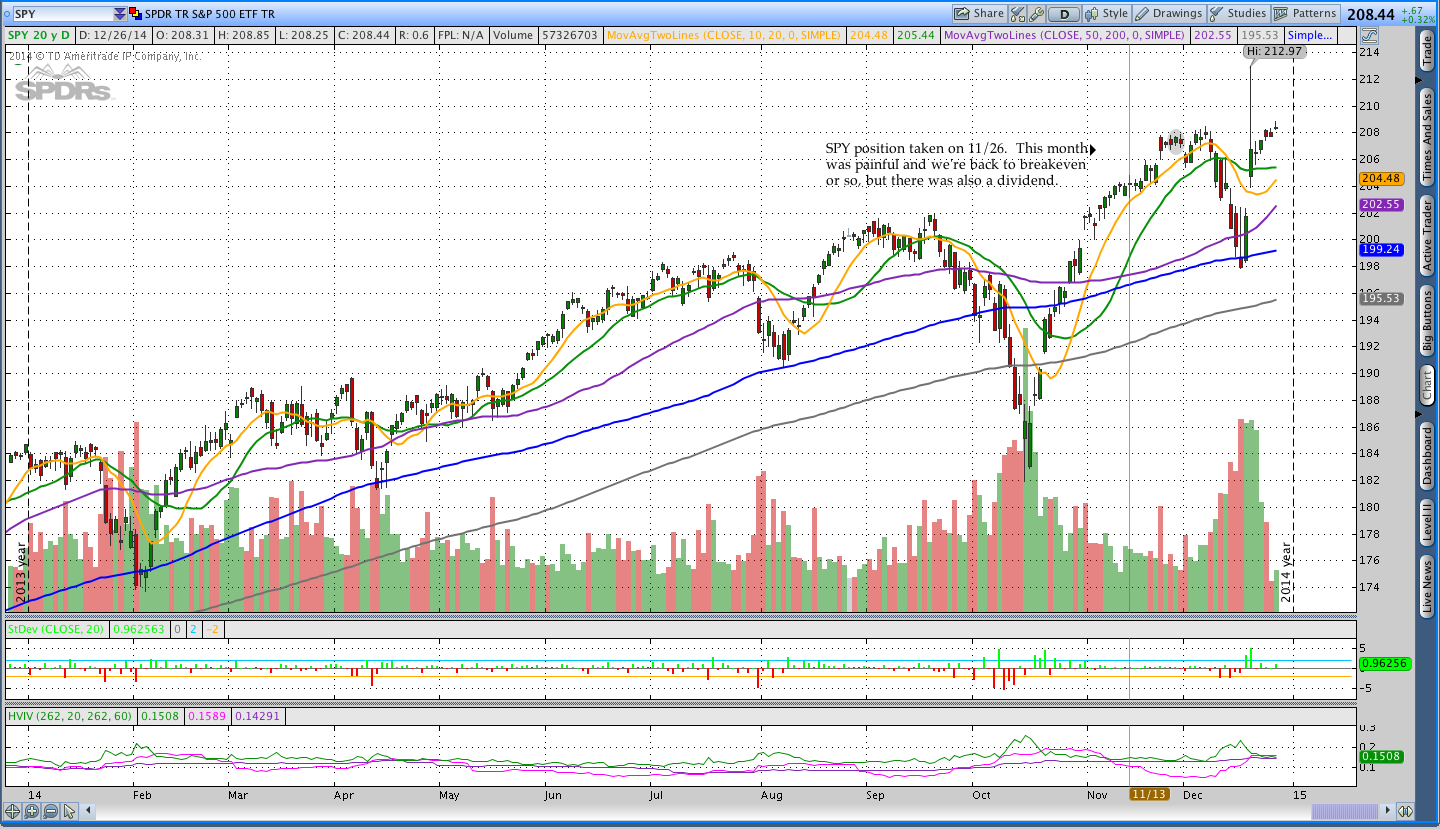

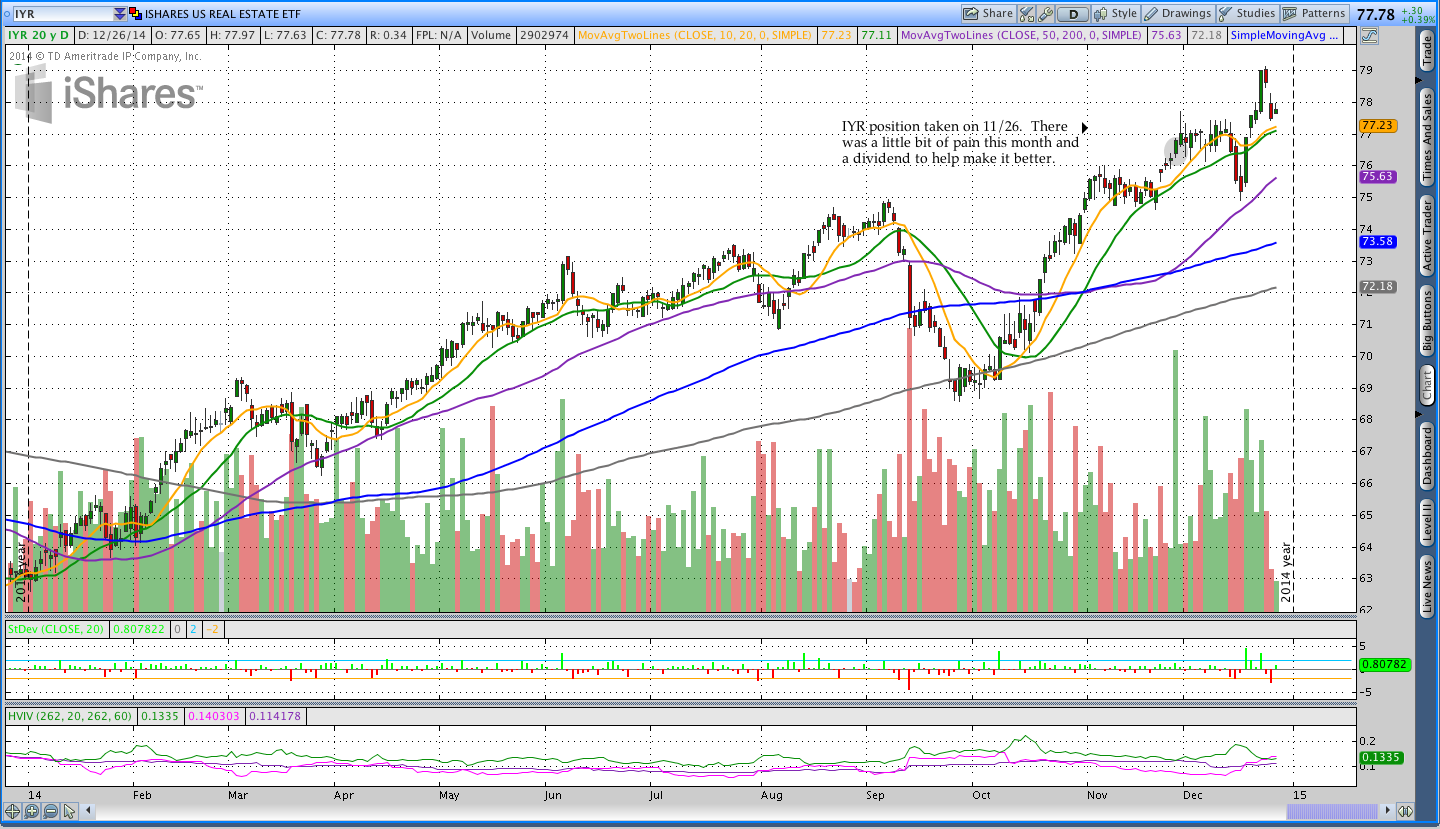

The Schwab Rotation System is currently long $TLO (Long Bond) and $SCHH (Real Estate). The Basic ETF Rotation System is long $SPY and $IYR (Real Estate).

The $TLO position took some heat this week, but is still up money overall. $SPY and $IYR both went ex-dividend this week and $SCHH went ex-dividend a week earlier. The dividends were enough to cover commissions and push the positions into the green a little more. I’ve found that I really like holding assets that pay dividends and/or interest. I think we’ll probably be opening a discussion about yield at some point in 2015.

Schwab Commission Free ETF Rotation System Positions:

Basic ETF Rotation System Positions:

Check out the following pages if you’re looking for more information on the ETF Rotation Systems:

Schwab Commission Free ETF Rotation System Results

Forex Breakout System:

The Forex trades are still moving along and not under any pressure. The primary trend in the Dollar continued this week and that helped the trades.

Trades This Week:

IWM – Sold to Close the January Butterfly position for a small loss

ETF & Forex Inventory:

SPY – Long 12 Shares from 207.38

IYR – Long 32 Shares from 76.7699

TLO – Long 29 Shares from 67.809

TLO – Long 41 Shares from 70.82

SCHH – Long 58 Shares from 34.009

SCHH – Long 72 Shares from 38.73

EUR/USD – Short 5,000 notional units from 1.35028

USD/CHF – Long 6,000 notional units from .9037

USD/JPY – Long 2,000 notional units from 110.084

NZD/JPY – Long 2,000 notional units from 89.036

Looking ahead:

This week we’ll head into 2015 and I’m ready. I’m firming up plans for Covestor to follow an account and that should be in place by the end of January. Allowing them to follow an account will create a public track record. Unfortunately, the account won’t be publicly visible, but I’ll discuss the performance and trades here. That account is going to be trading a modified ETF Rotation System. The second issue of the Market Momentum newsletter will be available either tomorrow or early next week and I’ll send out an email when it’s available.

In other site related news, I’m now a contributing writer at See It Market and you can see my first post here. There’s a lot of good information on their site and I’d recommend checking it out if you haven’t already. Happy Holidays and enjoy the rest of your weekend.

If you enjoyed this post, please click above to share it on Facebook or Tweet it out. Thanks for reading!

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.