Manage Yourself – Weekend Market Commentary 8/21/15 – $RUT, $SPX, $RVX, $VIX

Big Picture:

Sure, we could certainly talk about the markets going down yesterday, but it’s probably more helpful to talk about the emotional aspects of trading a non-directional, short options position. This week presented some good challenges. Most of the traders I know, myself included, took some pain on the downside. We rolled, hedged, and scrambled to get out of the way of something that resembled bird shit falling and picking up speed. Did it hit yet? That’s the question and, of course, we don’t know.

Sure, we could certainly talk about the markets going down yesterday, but it’s probably more helpful to talk about the emotional aspects of trading a non-directional, short options position. This week presented some good challenges. Most of the traders I know, myself included, took some pain on the downside. We rolled, hedged, and scrambled to get out of the way of something that resembled bird shit falling and picking up speed. Did it hit yet? That’s the question and, of course, we don’t know.

It’s somewhat ironic that earlier in the week I put up this post where I said that it’s been a relatively easy year for non-directional traders. I also said the market environment would change, but I didn’t know when it would change. Note that it’s generally much better to know “when” than “what.”

Learn from this:

Things can get unpleasant in a hurry when markets move fast and you’re short options. When I started trading Iron Condors back in 2007-2008, I used to sit and watch the market relentlessly race higher. I sat there staring at the chart, hoping for a pullback, and trying to come up with a plan to hedge on the upside. It was really stressful, scary, and emotionally painful.

I also used to spend a significant amount of time analyzing the risk graph and trying to build the ideal position. I looked at price levels endlessly, chose short strikes, reconsidered my choices, and worried like crazy that I was going to be proven wrong. Basically, I lived on the Analyze tab in TOS. It seemed like no matter what position I created back then the market would do something completely “irrational” and I started to wonder if the thing was out to get me.

Over time, I developed systems, rules, and learned to emotionally manage myself better. Thankfully, I don’t feel like that anymore, even if I’m losing money. Yes, sometimes I lose money on trades and that’s fine. Just know that there are ways to do it well that will let you play tomorrow and ways to do it poorly that won’t.

One of the obvious characteristics of non-directional spreads like Iron Condors and Butterflies is that they’re fairly high probability. The high probability of the trades tends to attract traders that are more methodical and don’t like to lose. When the trades come under pressure, it can make you feel like the promise of high probability has been violated (and it’s usually undesirable to be violated – there are exceptions, of course). The reality of trading a non-directional options strategy is that you WILL be proven wrong at some point and it’s just a question of “when.” Again, when.

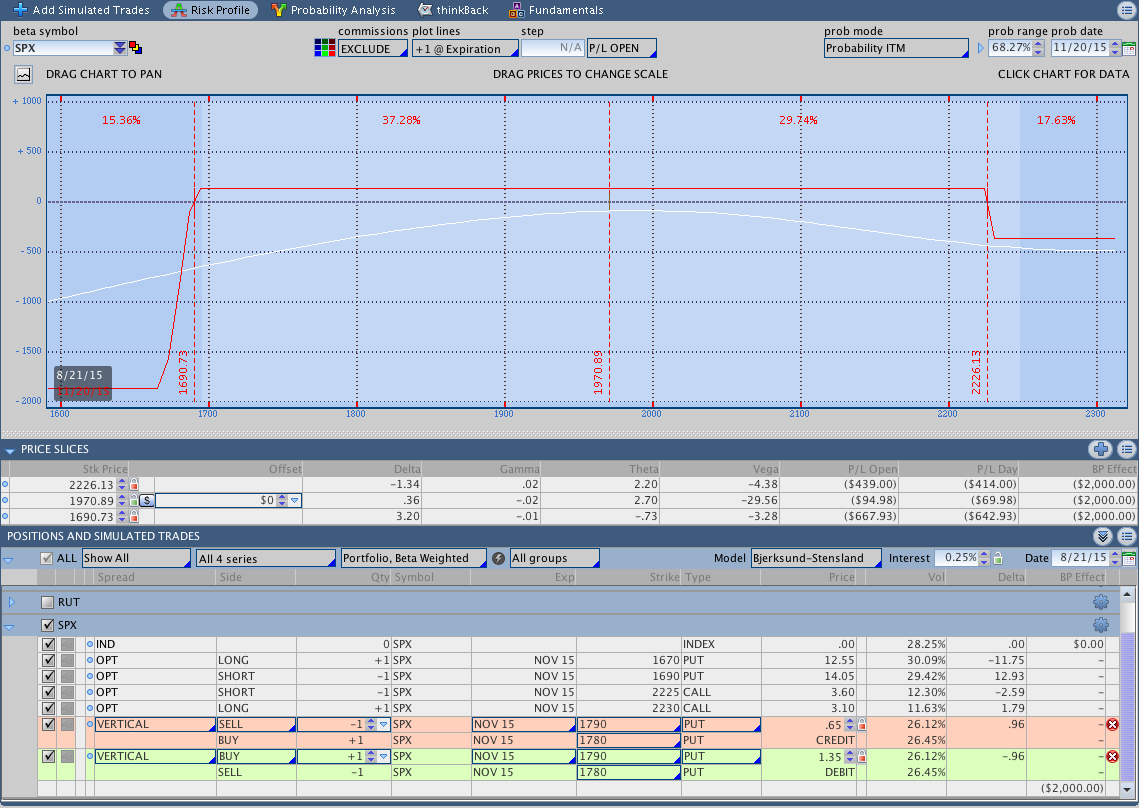

Fast weeks in either direction give us an opportunity to test the guidelines we’ve laid out in advance. As an example, let’s talk about one of the trades I have open. I came into this week with a November unbalanced Iron Condor in SPX. We saw an explosion in implied volatility as the market fell and my short put delta when from around 9 to 16 in a hurry. I simply rolled down the put side of the spread because that was the rule I set for myself in advance. I didn’t get wildly excited, worry about the bottom falling out of the market, or scramble around trying to figure out what to do and/or how far the market might fall. The trade is down some money, but that’s okay because it’s within my comfort level and the trade guidelines.

One of the big challenges with short options is that when price races towards that short it’s essential not to panic and have a predetermined plan. The plan itself usually matters less than having one in advance.

Feel free to let me know how your trading week went in the comments below. On to the markets . . .

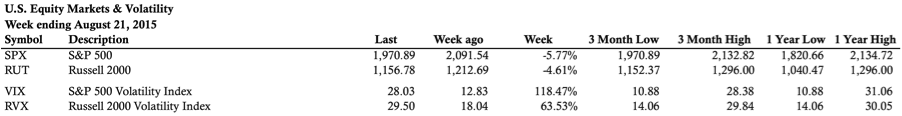

Market Stats:

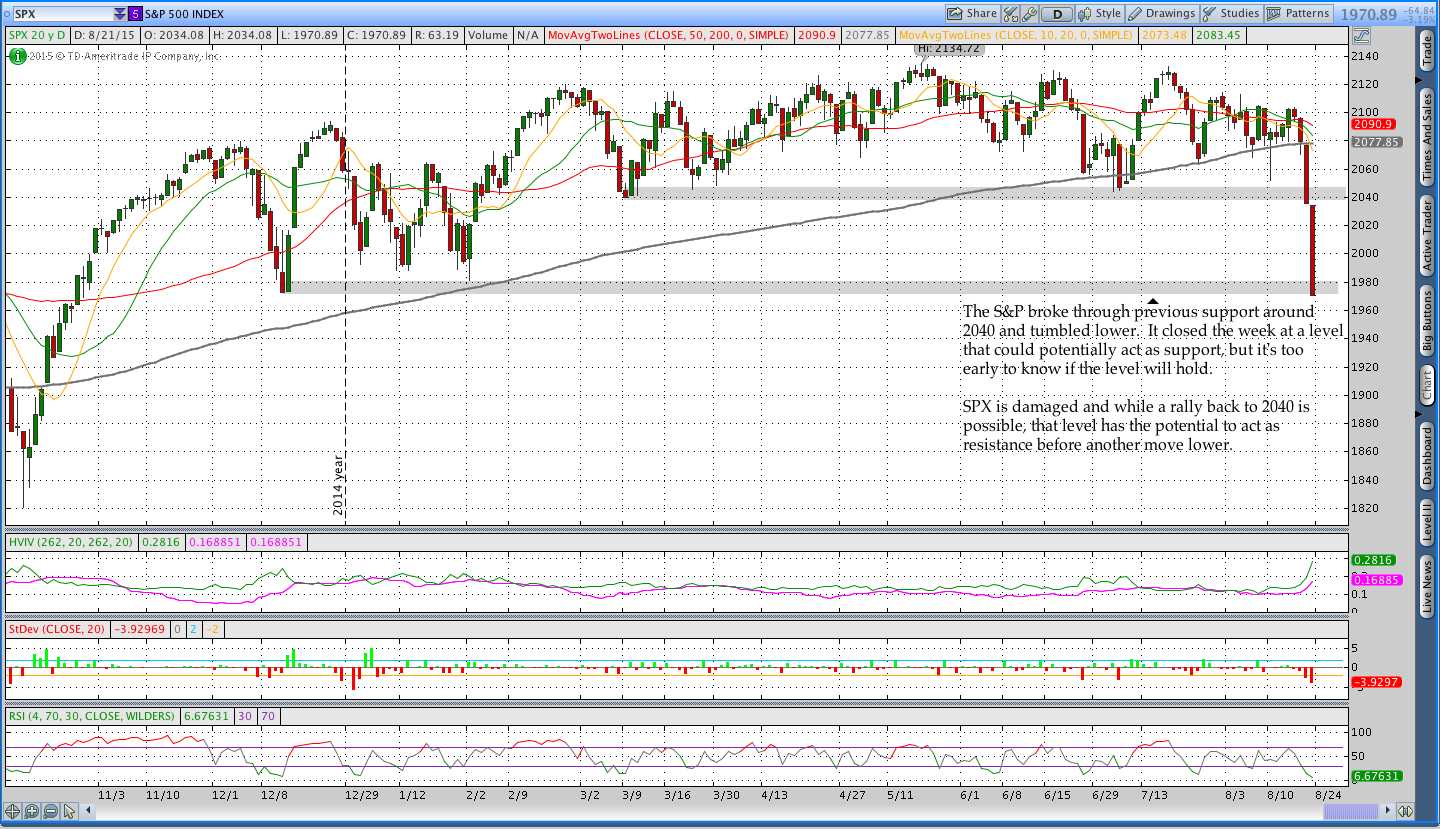

Levels of Interest:

Implied & Historical Volatility:

Implied & Historical Volatility:

We saw an explosion in implied volatility this week and that wasn’t really surprising given the move on Friday.

Under the hood . . .

The “Under the Hood” section of the commentary focuses on actual trades that are in the Theta Trend account.

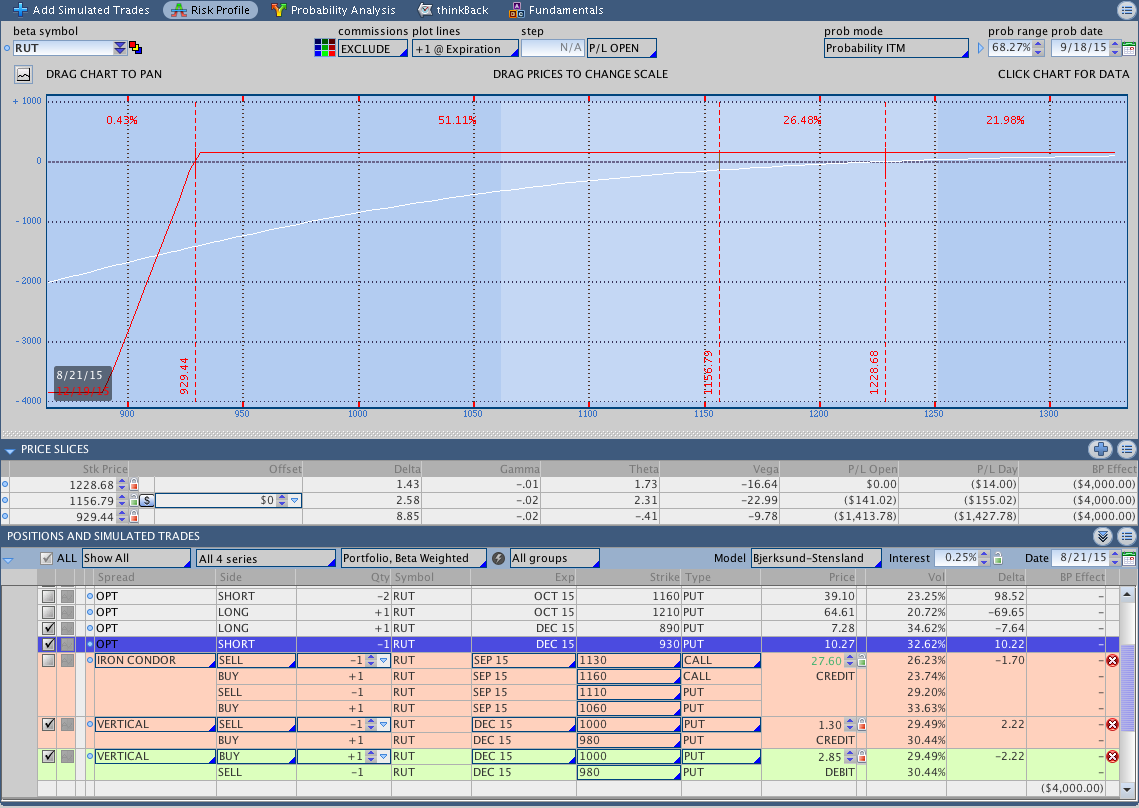

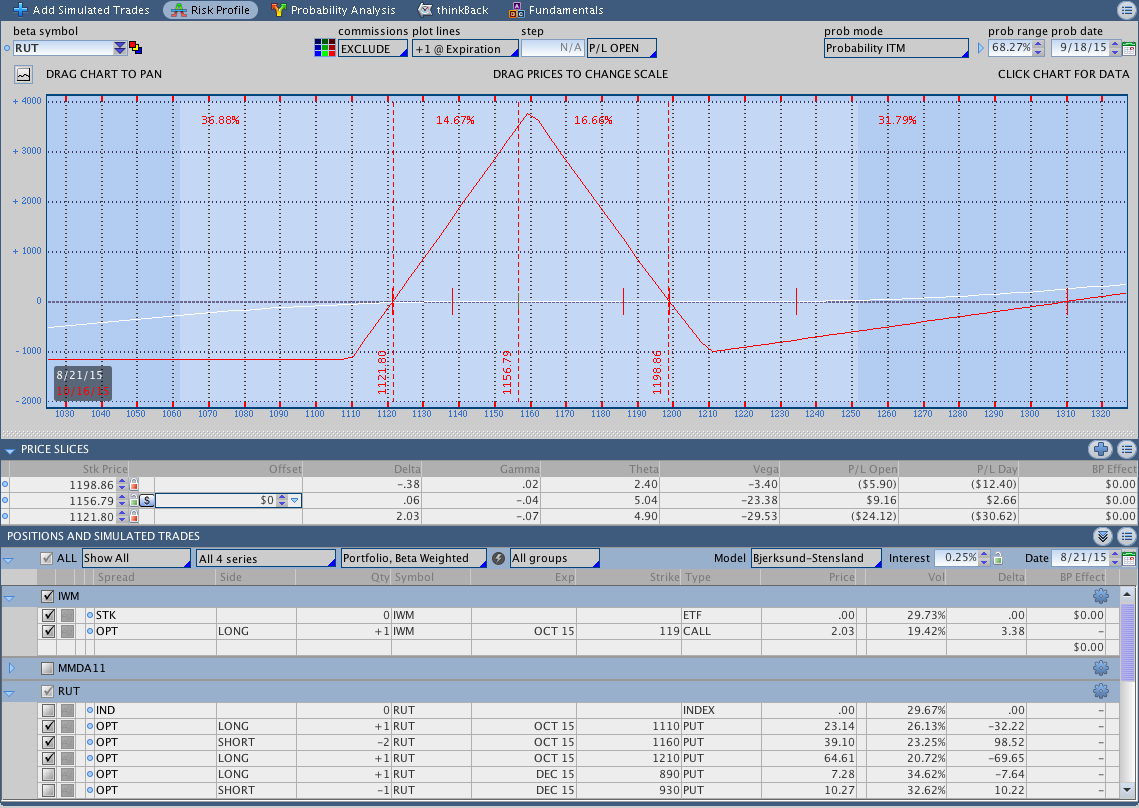

$RUT December 2015 Unbalanced Iron Condor (Put side only for now):

I proved to have exceptionally poor timing this week and opened the put side of a long dated RUT Iron Condor this week. I haven’t had a chance to sell the call side yet and the trade is close to my max loss point despite a roll lower. I’m going to need the Russell to slow down on the downside for this trade to have a fighting chance. The surge in implied volatility allowed me to move my short strike from 1000 to 930 on Friday.

$SPX November 2015 Unbalanced Iron Condor:

The image below is the November SPX Unbalanced Iron Condor. The trade is also under pressure with the move lower. The put side was rolled down once and the image includes that roll.

$RUT October 2015 Butterfly:

Butterflies have been my bread and butter trade all year and I just opened an October position. The trade is healthy and my main concern at this point is on the upside. Note that I have a strong preference for trading Butterflies over Iron Condors . . . especially when the markets start to get wild.

Looking ahead, etc.:

It was a challenging week all around and I’m definitely wondering what Monday holds for us. I wouldn’t be surprised to see either a slight gap up or another gap lower on Monday. The markets are clearly short term oversold, but that does not mean that they can’t go lower next week. It’s a good time to be cautious, follow your trading guidelines, and remain calm.

Let me know how your trading week went by posting in the comments below and thanks for reading!

Please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.