How Should I Invest Part 3: Understanding The Vehicles

Overview:

In the last post on investing, we took a look at Compound Interest. We learned that, over time, Compound Interest is an incredibly powerful force that can help us increase the value of our investment significantly more than we would expect. Additionally, the benefits of compounding are amplified by starting as early in life as possible and owning investments that both generate interest and appreciate in price.

However, it’s worth noting that interest doesn’t necessarily need to be in the form of interest for it to be compounded. When an investment generates cash, it is said to have some type of yield. Yield is a way of measuring the return on an investment. Yield can come in many forms including interest, dividends, or even distributions. From an investment perspective, the form of the yield doesn’t matter as much as reinvesting the earnings. We won’t discuss taxes in this post, but the form of the yield does have some implications from a tax perspective.

However, it’s worth noting that interest doesn’t necessarily need to be in the form of interest for it to be compounded. When an investment generates cash, it is said to have some type of yield. Yield is a way of measuring the return on an investment. Yield can come in many forms including interest, dividends, or even distributions. From an investment perspective, the form of the yield doesn’t matter as much as reinvesting the earnings. We won’t discuss taxes in this post, but the form of the yield does have some implications from a tax perspective.

In this post we’re going to take a look at some of the vehicles we can use for investing. All of the vehicles mentioned below have the potential to generate some form of yield.

Stocks (aka Equities):

When people think about financial markets, they almost always think about stocks. Part of the reason for that generalization is that the media is constantly talking about the stock market as though it’s the only market available for investing. However, it’s important to realize that there many other markets for investing including Bonds, Commodities, Currencies, and International Stocks. At any rate, common stock is an equity investment in a particular company. When you buy a stock, you’re becoming a fractional owner of the company.

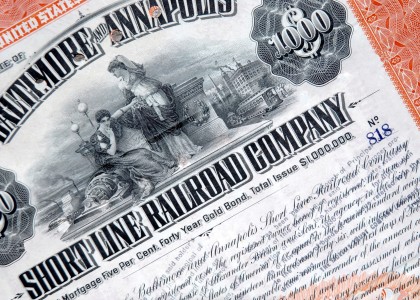

Bonds:

Bonds come in many forms and are debt. When you purchase a bond, you’re essentially lending money. Companies and governments both issue bonds to raise money. They issue bonds that are sold and then pay interest on those bonds. When the bond is sold, the issuer receives money and the investor has purchased a stream of payments.

An intuitive example of a bond is your home mortgage. When someone wants to buy a home they frequently go to the bank to borrow money. The bank gives you money up front for the purchase and you pay interest on a monthly basis. When you take out a mortgage, you’re essentially issuing a bond to an investor (the bank).

Note: This is a very simplistic look at bonds and there are many types of bonds with different payment arrangements.

Mutual Funds:

Most, if not all, investors have access to Mutual Funds. If you have job with a 401k, you probably have access to a list of mutual funds that you can use for investing. A mutual fund is a pool of money that purchases assets with some desired market exposure. A mutual fund can take money and purchase stocks, bonds, commodities, or even a combination of different markets.

The trading characteristics of mutual funds are slightly different than stocks. Mutual fund trades take place at the end of the day and frequently have holding period requirements. In other words, if you purchase a mutual fund and sell it shortly after purchase you may be subject to an early redemption fee.

Exchange Traded Funds:

Exchange Traded Funds (ETF’s) are a new investment vehicle that trade in a way that is similar to stocks. ETF’s are similar to mutual funds in that they frequently invest a pool of money to gain some type of market exposure. ETF’s cover an increasingly wide range of markets including stocks, bonds, commodities, and international markets. Most ETF’s are designed to track a benchmark index like the S&P 500 ETF ($SPY) or the Long Term U.S. Treasury Bond ETF ($TLT). As a result, purchasing an ETF is an easy way to gain exposure to a benchmark index.

That’s all great, but here’s the problem:

The problem with the entire discussion above is that access to investment vehicles does not guarantee that we can earn a positive return on an investment. For example, what happens if we purchase a stock that pays a dividend with a yield of 5% and the stock declines in value by 50% over the course of the year? At the end of the year, we’re left with half of our initial investment. We can certainly reinvest the 5%, but it won’t overcome the loss of value in our initial investment. Knowing that, our ultimate goal should be to purchase investments that are either stable or appreciating in value over time and generate some sort of income that we can reinvest.

A note about price appreciation:

In all of the examples up to this point, we’ve been talking about investments that generate income. However, some investments do not generate income and that’s completely acceptable. If the price appreciation of an investment is significant, earning income on the investment becomes less important because the investment can ultimately be sold for a large gain. An example of a stock that reinvests earnings in itself rather than paying dividends is Warren Buffet’s Berkshire Hathaway ($BRK.A or $BRK.B).

In the next post of the series, we’re going to take a look at a simple system for investing using ETF’s.

If you’re enjoying this series, please share it using Twitter or Facebook and thanks for reading.

Want to receive an alert as soon as the next post in the series is published?

Sign up for my email list and I’ll let you know as soon as the next post in the How Should I Invest series is released.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.