Emerging Markets (EEM) Options Trend Following Trade Alert

Overview:

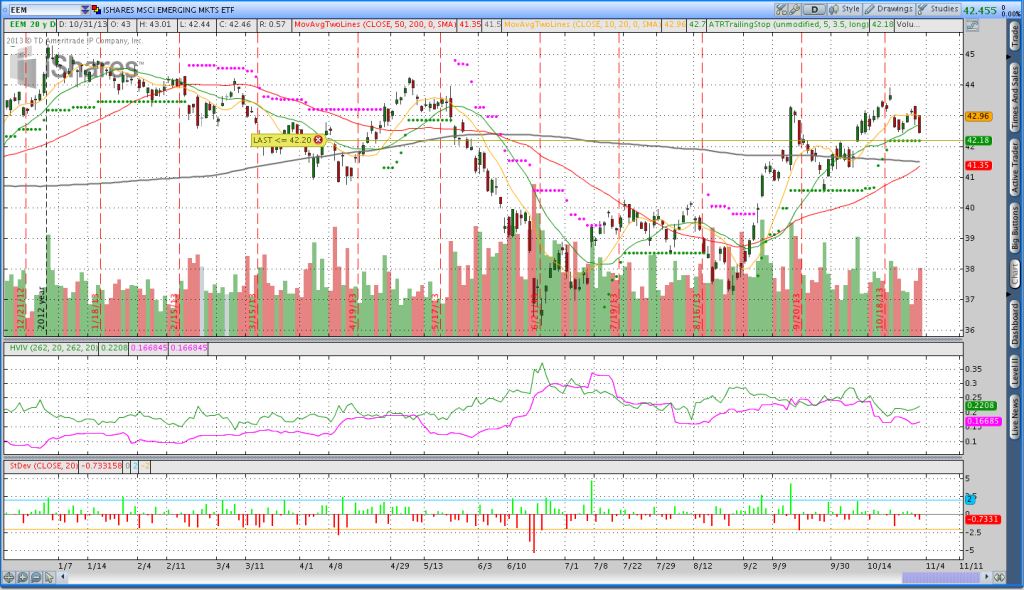

Yesterday (October 31, 2013) I was filled on an EEM options trade about 30 minutes before the markets closed. Price broke down intraday and the risk reward became favorable enough to sell a put spread. See the trade details below chart.

Details:

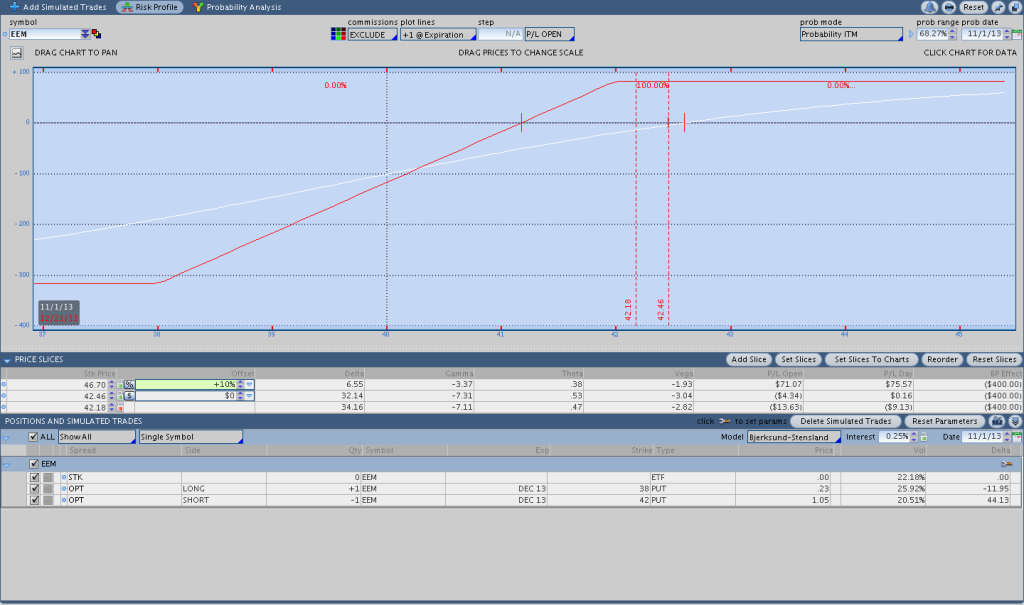

Sold the EEM 42/38 December Put vertical for an .82 credit. EEM made a pullback down towards the average true range trailing stop and the risk/reward became favorable to enter a trade. The only danger with entering a spread on a pullback like this is that price can continue down to the trailing stop and trigger an exit. The image below shows the risk graph for the trade. In the risk graph, you can see that if price immediately trades to the stop level I’m looking at a loss of around $14 or $20 after commissions. While the trade might have a lower probability of working out, the very favorable risk/reward makes it a bet I’m willing to take.