This page is an archive of the 2014 Capital Allocation and is no longer an accurate reflection of portfolio allocations. The 2015 Capital Allocation can be found here.

The Big Picture:

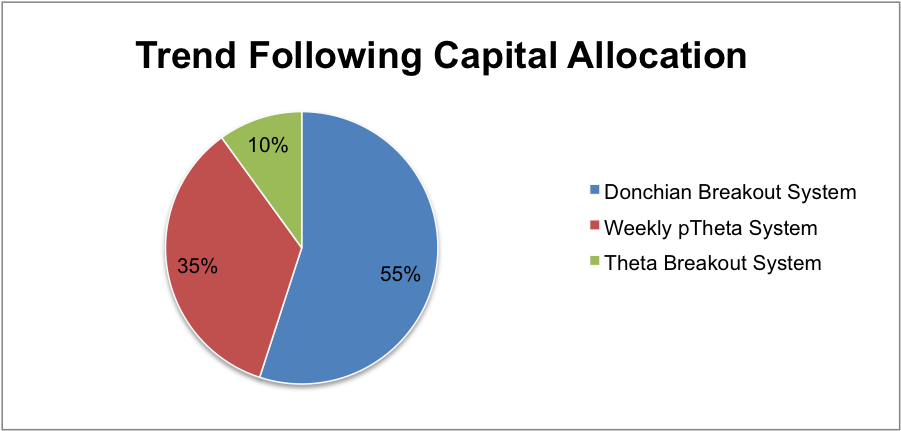

This page is going to be the source for trade results going forward in 2014. The image above describes the approximate capital allocations to the systems I’m trading. Note that the allocations are variable and the Donchian breakout system can be totally flat. Check back for updates to this page in late 2013 and early 2014.

Donchian Breakout system:

The Donchian system is a classic trend following breakout system. My system trades ETF’s and Forex and takes positions on a new 50 day breakout with a 25 day trailing stop. Additional details about the system can be found through this link.

Donchian Breakout System Results

Theta Breakout:

My Theta Breakout system is a supplement to the Donchian Channel system. Theta Breakout sells naked options or credit spreads in the direction of the trend following a new Donchian Channel breakout. The system trades at a 50 day breakout with a 3.5 x Average True Range trailing stop. System details live here.

Weekly pTheta:

The weekly options trend following system is always in the market and either long or short. pTheta sells far out of the money naked options or credit spreads on a few select markets and uses Parabolic SAR to determine trend direction. You can read more about the system here.

One thought on “2014 Capital Allocation”

Comments are closed.