Weekend Market Commentary 2/12/2016 – $RUT, $RVX, $SPX, $VIX, $VXV

Big Picture:

When the market seems uncertain, it’s helpful to step back and ask yourself what participants might be thinking at different price levels rather than just focusing on what the market is doing. The market talks to us in terms of support, resistance, consolidation, and trends, but the movement is the result of people (and machines designed by people) hitting buy and sell. Different participants have different objectives, but they all experience emotions. Emotions tend to drive behavior and when the market sentiment shifts it frequently means the emotion of participants has shifted.

When we see a change take place in the market it makes sense to consider why the change has come about, who is causing it, and how different participants might feel about the change. The intraday turn in the market we saw on Thursday was validated on Friday and the obvious feeling for many participants is relief.

The financial industry is built on the promise that investors can buy stocks that will increase in value over time. The promise of increasing prices over time is made with great certainty, but timing is frequently absent from the conversation. The industry has major problems if prices don’t rise or people question the validity of the promise. Naturally when stocks decrease in value, that creates fear, stress, and anxiety. In the stock market, most participants feel relief when a decline slows, stops, and reverses.

Relief comes about for different reasons, but it involves the reduction or removal of stress and anxiety. In trading, we tend to feel relief when the market has pushed our position to the edge of our comfort zone and backed off. When our positions are under pressure, we need to be careful not to view the pain as happening “to us” because that means we’re placing ourselves in the way of the market. It’s important to remember that we’re just playing a game with money and the market does not exist to validate us.

Rather than getting caught up in the emotions of trading and the market, it’s important to remain objective about what’s really happening. The rally on Thursday and Friday came about, at least in part, because sellers failed to push the market lower.

The failure to hold at or below new lows creates a reason to question the downside in the short run. On Friday, the market traded around the weekly volume weighted average price before trading higher into the close. That activity was constructive and validated the failure to hold new lows, but it’s still early to call a reversal in the longer term trend. Failure to push lower does not automatically mean significantly higher prices are inevitable. Price is equally (if not more) likely to consolidate as it digests the ugly start to 2016.

Ultimately, where the market goes today, tomorrow, or next year is less important than how we react. As I’ve talked about on the daily videos and last weekend, we’re just trying to recognize changes and where the potential for change exists rather than predicting what might happen. As non-directional options traders we can move with the market and as long as we can remain open minded and control risk, we have the potential to succeed.

The reality is that nobody knows where price will go until after the fact. The price action on Friday was productive and brought the markets back into their previous ranges, but the tide in 2016 has consistently been going out. Right now it makes sense to be cautious on both sides of the market. The ranges are wide and there’s the potential for pain in both directions.

Volatility:

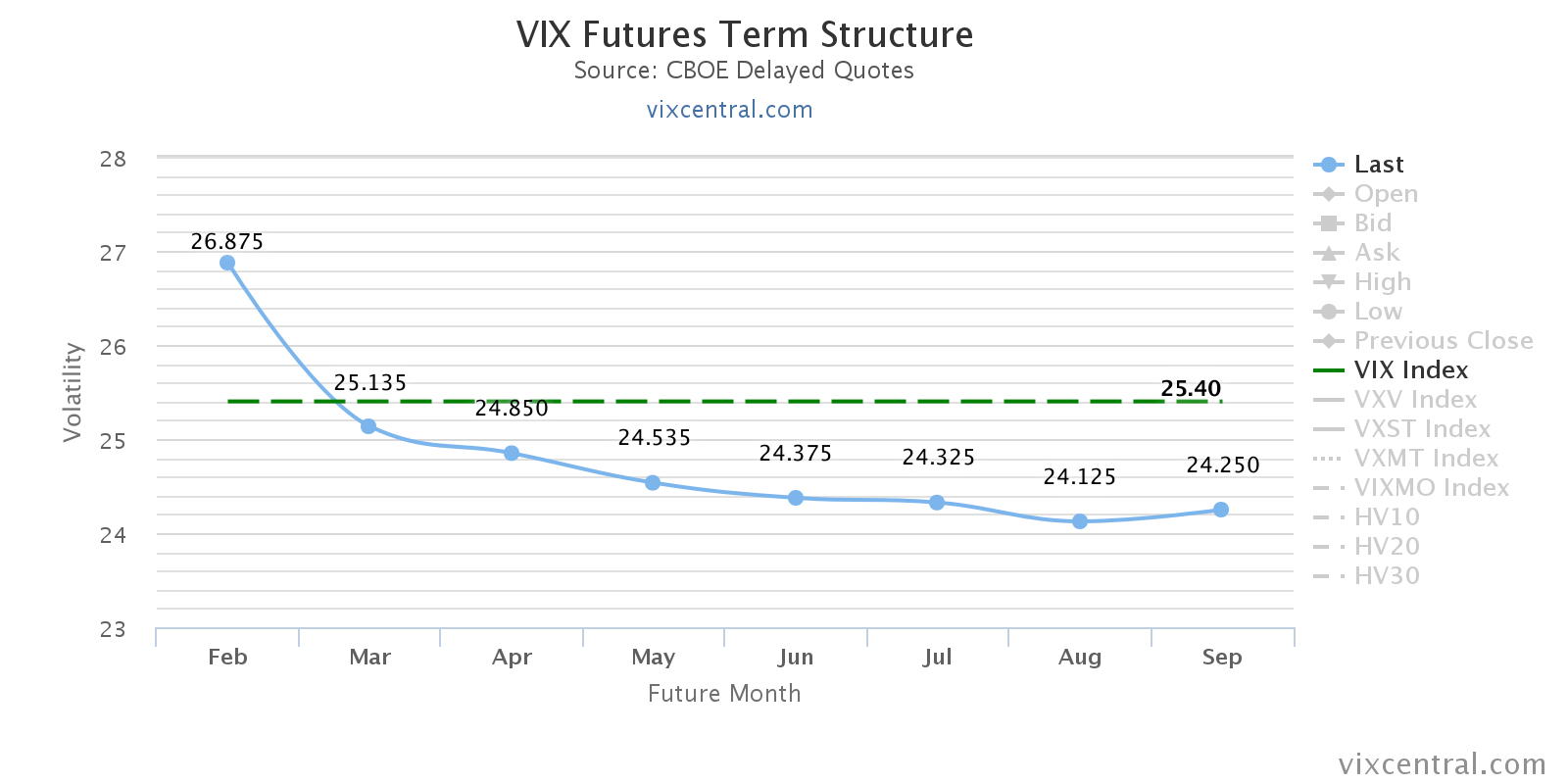

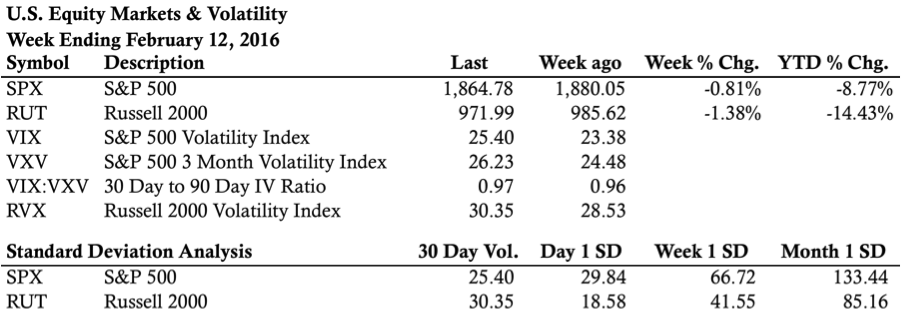

Volatility has been a very telling indicator this year and something to watch closely. For the time being, volatility is still relatively controlled, but it did end the week at an elevated level and the VIX Futures term structure remains in Backwardation. Additionally, both the SPX and RUT have demonstrated steadily rising implied and realized volatility all year. Absent a high volatility V-Bottom rally, we need to see volatility begin to trend lower with a return to Contango to trust any move higher.

As it relates to price, volatility is suggesting that the market is not completely healthy yet. At the same time, the market is not in panic mode and has not been in panic mode at all this year. If you want to humanize the market, you could think about volatility as having a moderate cold. It’s not completely healthy, but it isn’t incapacitated or sick in bed either.

Market Stats:

Levels of Interest:

In the levels of interest section, we’re drilling down through some timeframes to see what’s happening in the markets. The analysis begins on a weekly chart, moves to a daily chart, and finishes with the intraday, 65 minute chart of the S&P 500 (SPX) and the Russell 2000 ($RUT). Multiple timeframes from a high level create context for what’s happening in the market.

S&P 500 – $SPX (Weekly, Daily, and 65 Minute Charts):

Russell 2000 – $RUT (Weekly, Daily, and 65 Minute Charts):

Live Trades . . .

The “Live Trades” section of the commentary focuses on actual trades that are in the Theta Trend account. The positions are provided for educational purposes only.

——————————

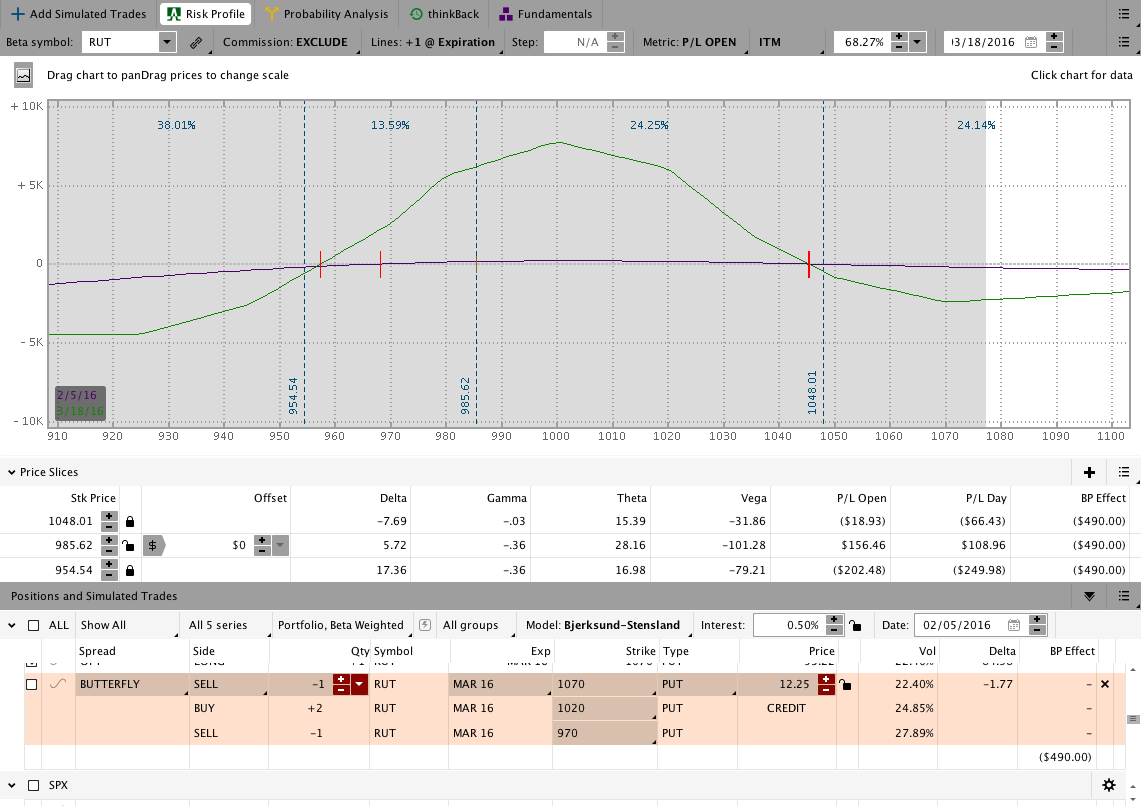

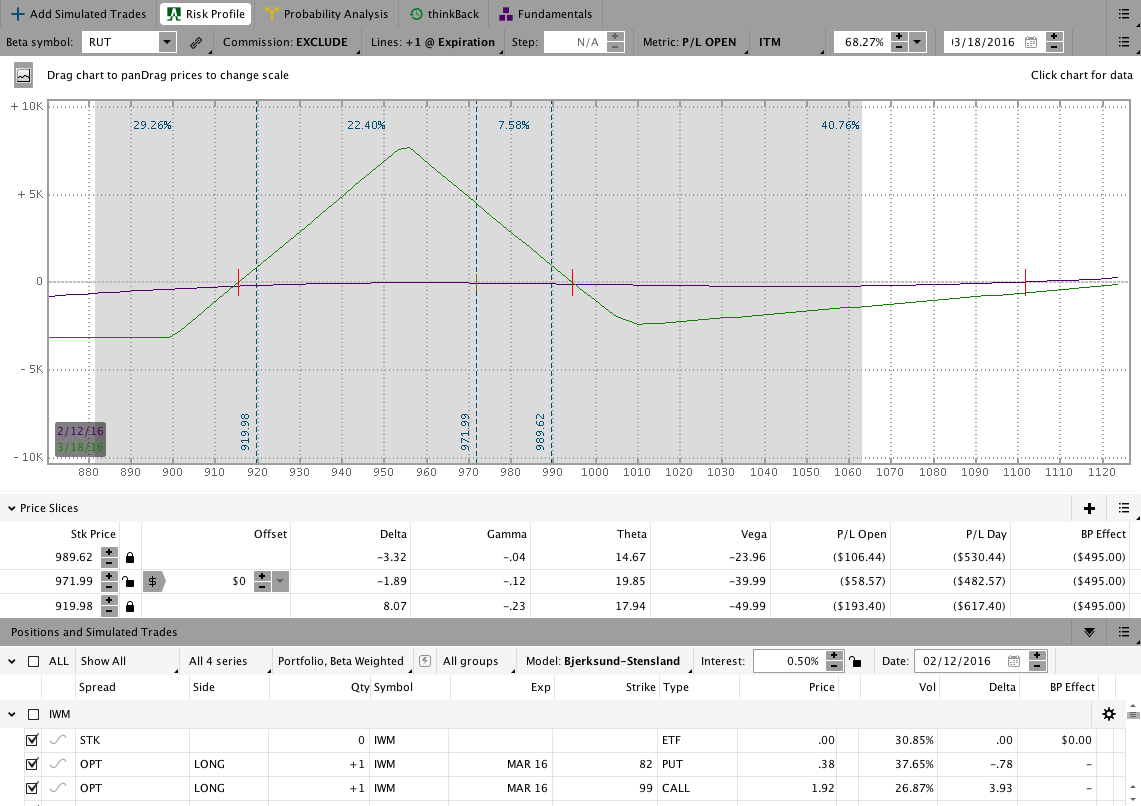

The March 2016 CIB trade is open and the position came under pressure this week with the move down. The position went from a full sized, 3 Butterfly position to 2 Butterflies centered at a lower strike. The position went into the weekend with a slight open loss, but we’re still very much in the game. We’ve been in the trade for a while now and have survived large moves in both directions without significant heat, which is a goal of the trade.

Since we’re well inside of 40 DTE, my hope is to get out of the position sometime in the next week or two. Due to the challenging nature of this cycle, this has been a great learning opportunity both for me and for those of you who have been following the trade.

Keep in mind that I’ve been updating the Live Trade Page every day so check out that page for a more comprehensive update on the position.

If you want to learn a safer, less painful way to trade options for income, check out the Core Income Butterfly Trading Course.

March 2016 Core Income Butterfly Trade:

As a reminder, this is what the position looked like a week ago:

The Results Spreadsheet is up to date as of Friday. All of the trades mentioned there are actual trades that I’ve taken. There are no paper trades or fuzzy fills, they’re all real.

Looking ahead, etc.:

This week I’ll be managing the CIB and other open positions. The market has been trading in a wide range that has been challenging, but we’re hanging in there. We learn more from the challenging periods than the calm ones.

Have a great weekend and please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.