Weekend Market Commentary 1/4/2014 – Stocks, Bonds, Gold ($IWM, $RUT, $SPY, $TLT, $GLD)

Big Picture:

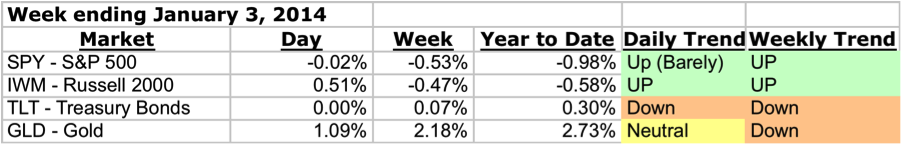

Happy New Year and thanks for reading the weekly recap. This week was fairly quiet with the exception of Gold, which was up 2% on the week. Stocks saw a little bit of a pullback and Bonds are sitting essentially unchanged.

Happy New Year and thanks for reading the weekly recap. This week was fairly quiet with the exception of Gold, which was up 2% on the week. Stocks saw a little bit of a pullback and Bonds are sitting essentially unchanged.

I had some trades triggered in the Donchian Channel system and that system is off to a bad start on the year. Fortunately, the open options trades are up money and the Yen trades have been working well.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

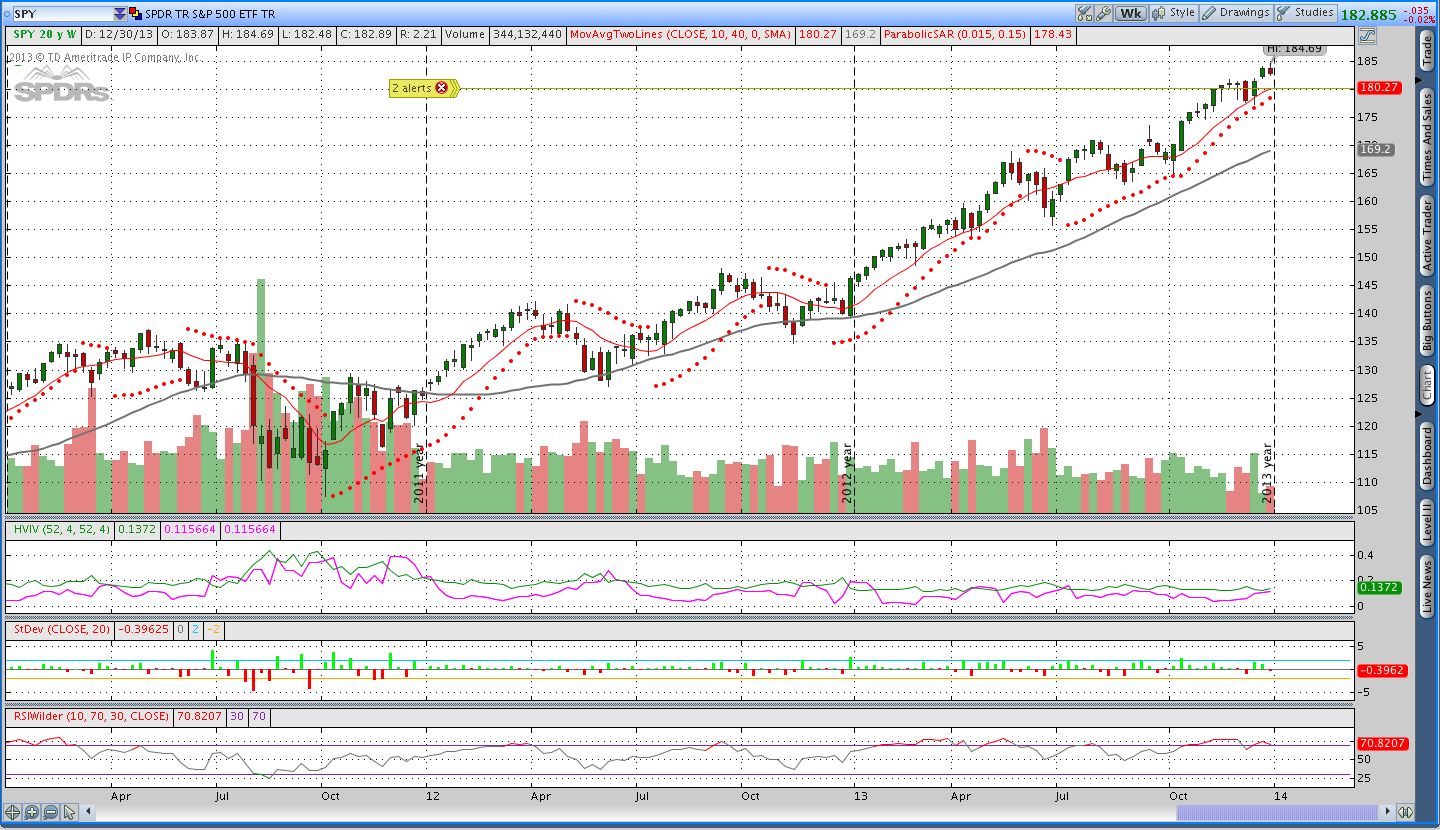

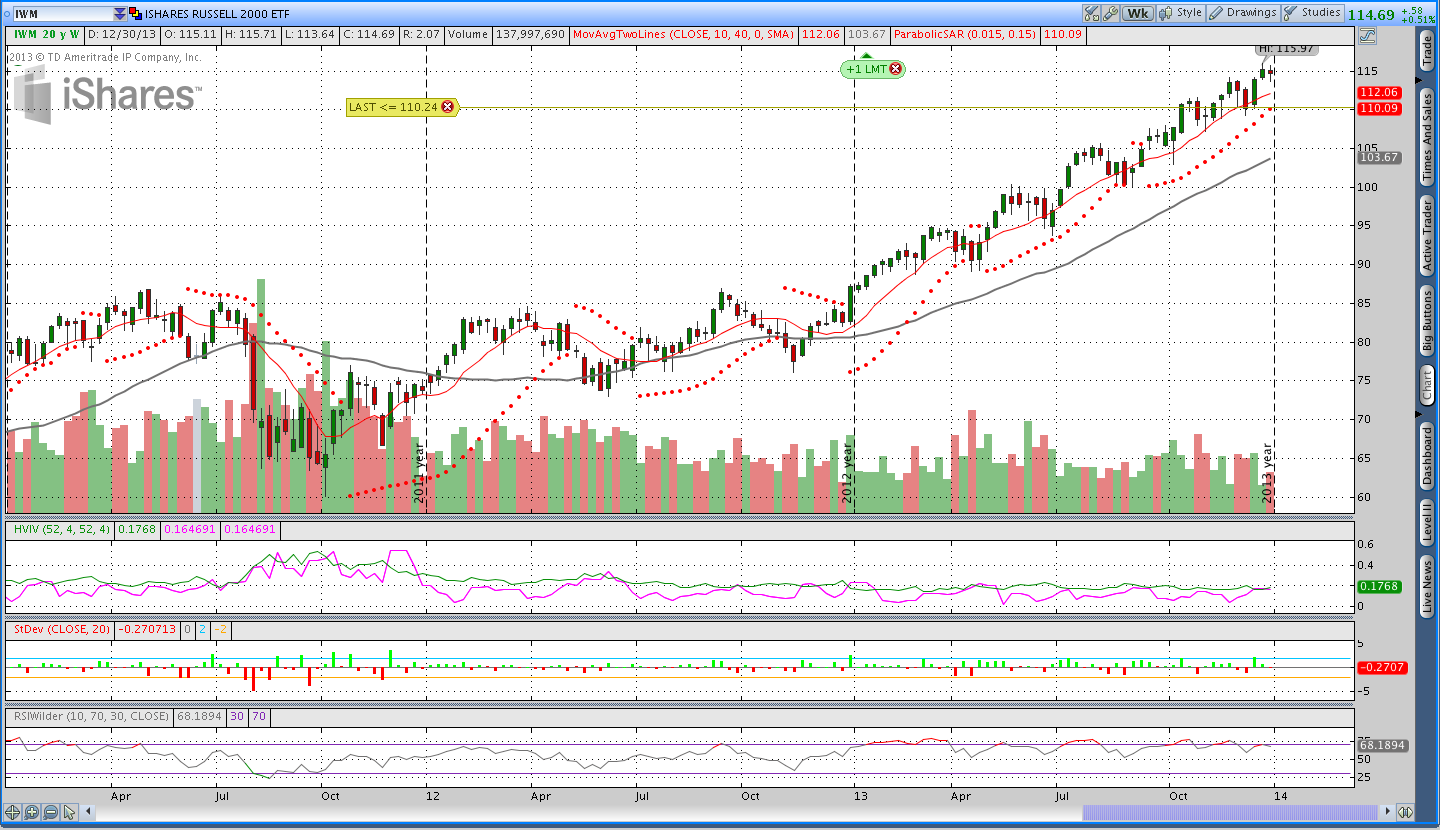

Stocks ($SPY – SPDR S&P 500 ETF and $IWM – iShares Russell 2000 Index ETF):

Stocks showed some weakness towards the end of the week, but the move lower was fairly small in percentage terms and very controlled. It’s too early to tell if the pullback is significant or if we’re just seeing some consolidation at the highs. Next week should be a little more telling when more market participants are around. I’m still long the Russell 2000, but I also added a $RUT Iron Condor this week (see the trade update below).

Both $SPY and $IWM remain in uptrends on the weekly chart. While it’s only been a couple of months since I began trading it, the pTheta naked options system has been very comfortable to trade. Because the options I’m selling are so far out of the money, the positions take a minimal amount of heat even when the markets have down weeks. The only time the system is hard to trade is when there is a sudden move against a naked option shortly after selling it.

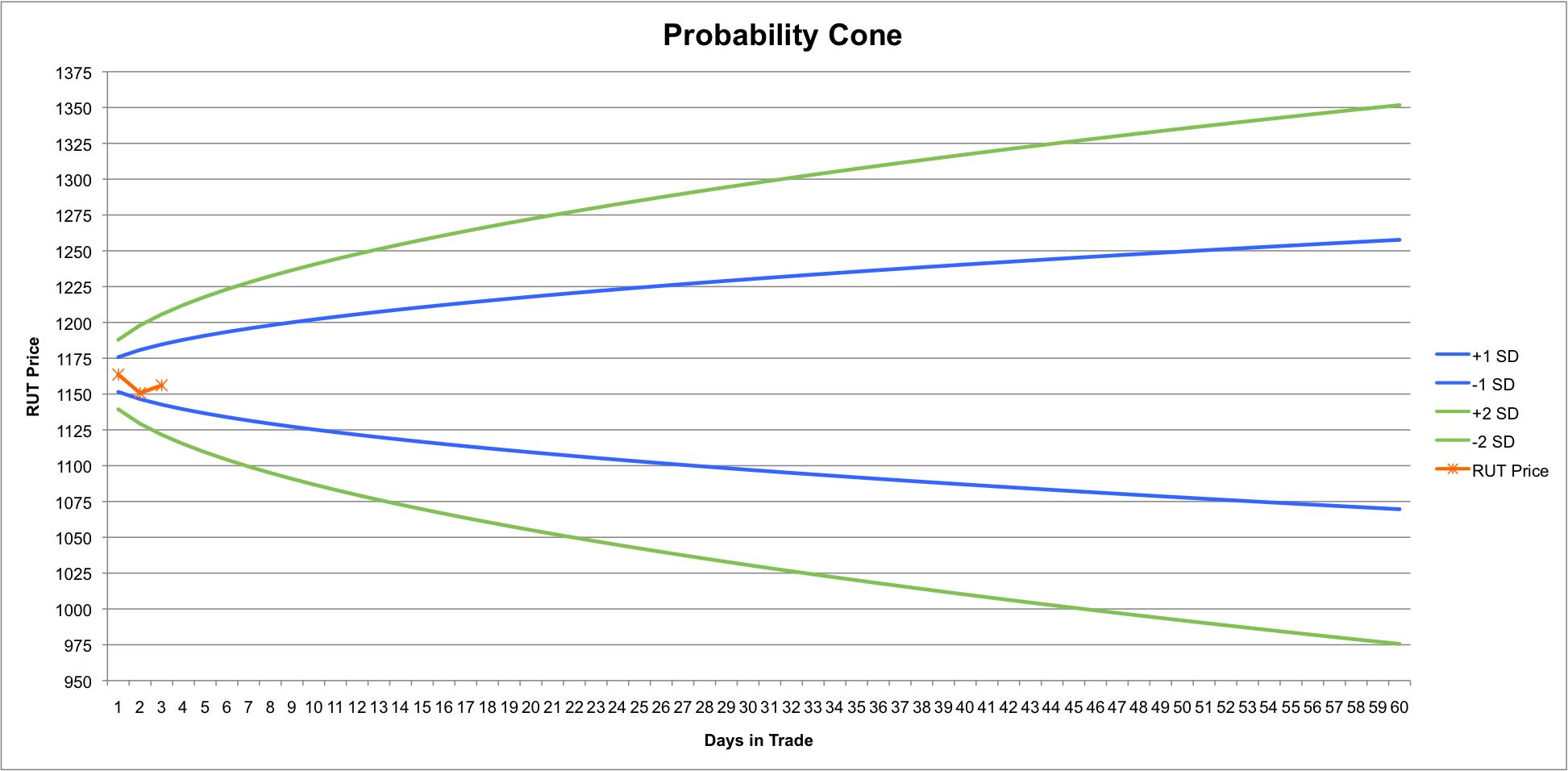

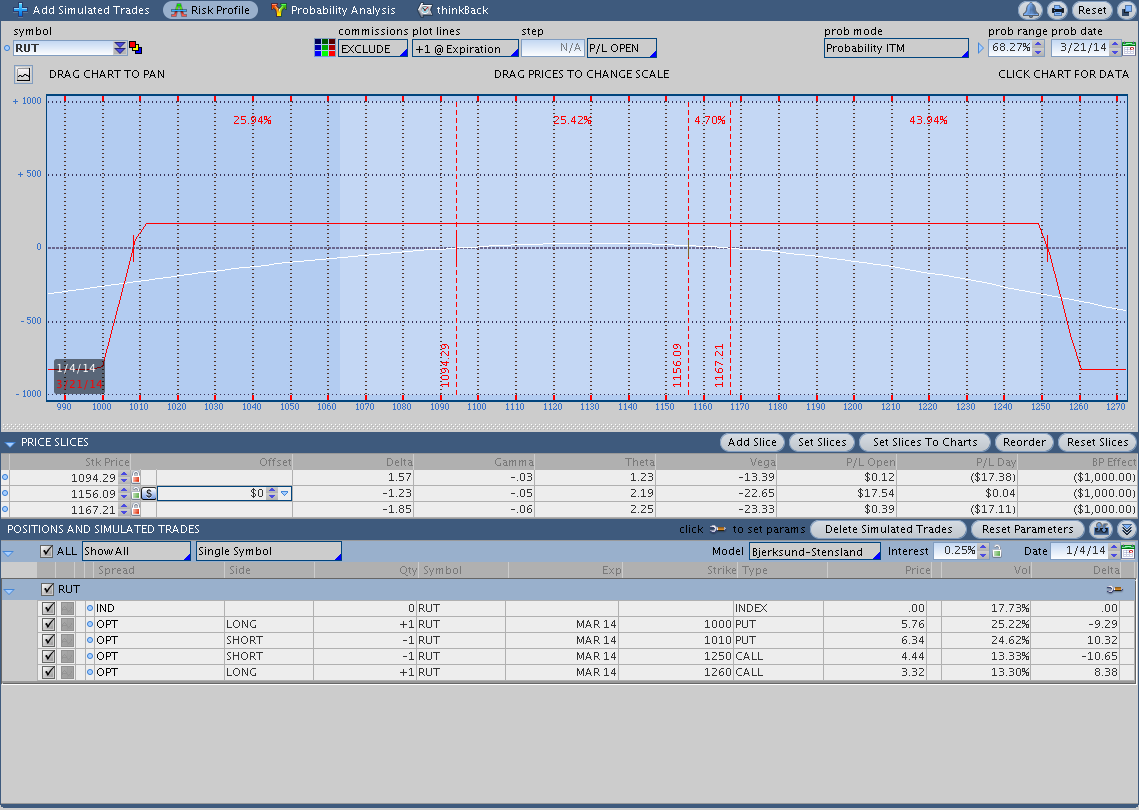

$RUT Iron Condor Trade Update:

We’re only a couple of days into the Iron Condor trade below and it’s too early to know much about how it will work out. As of now, the trade is well centered in the probability cone and is up a little bit of money. We’ll see how the trade progresses next week. If you have any questions about the Iron Condor, feel free to post them in the comments below the post. The best Iron Condors are always uneventful.

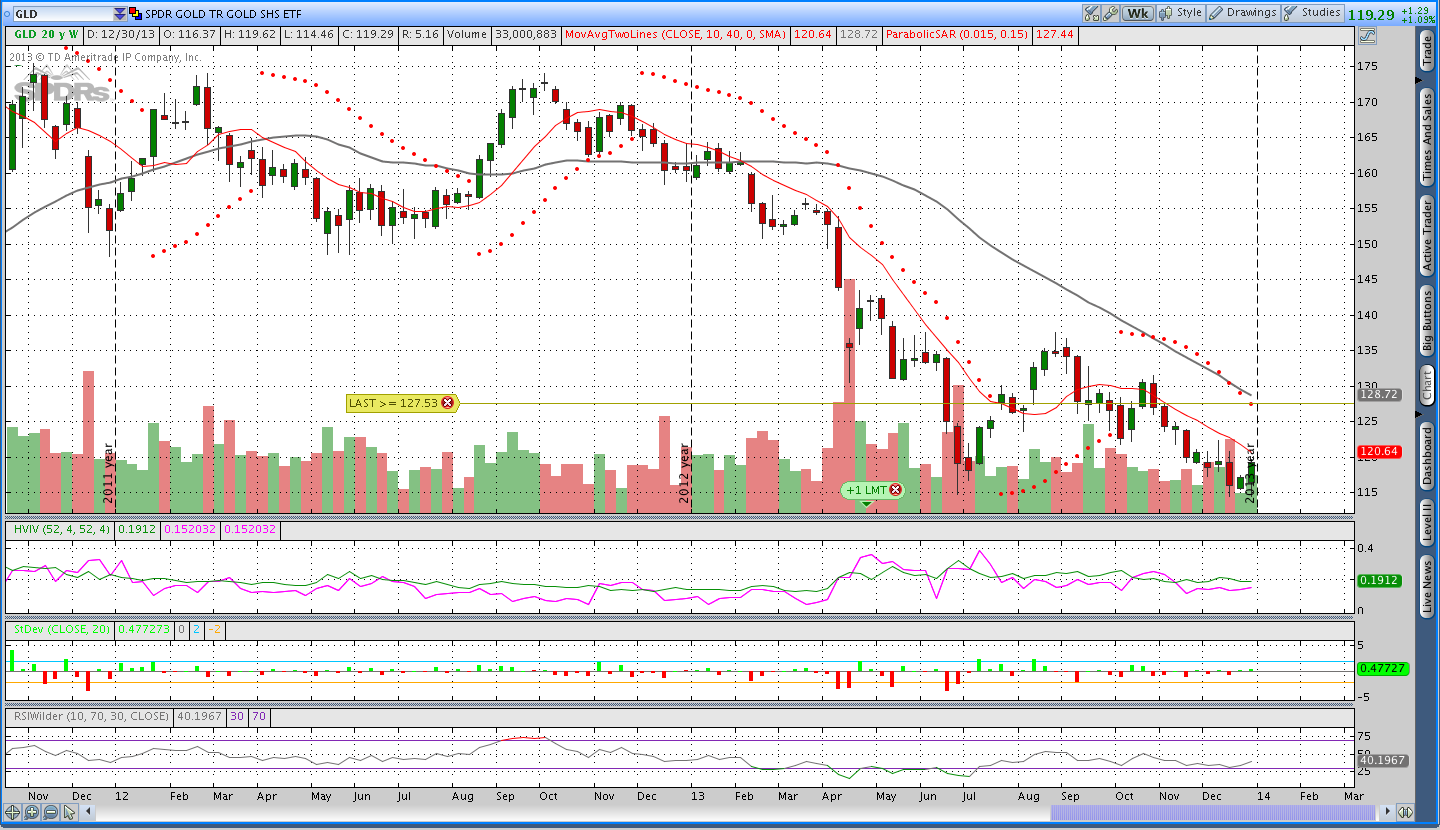

Gold ($GLD – SPDR Gold Shares ETF):

Last week I talked about Gold setting up for a fast move and potentially undercutting it’s low and then racing higher. It’s probably a little early to say if that has begun, but Gold was up a touch over 2% on the week and it’s possible.

On the daily timeframe, Gold closed above the ATR trailing stop and that puts it into neutral territory. The move up in Gold began on Thursday and that makes me wonder if we’re seeing some institutions beginning to accumulate positions because it’s the beginning of the new year. I’m still short Gold via a naked March 2014 Call and as of now that position is still in the green.

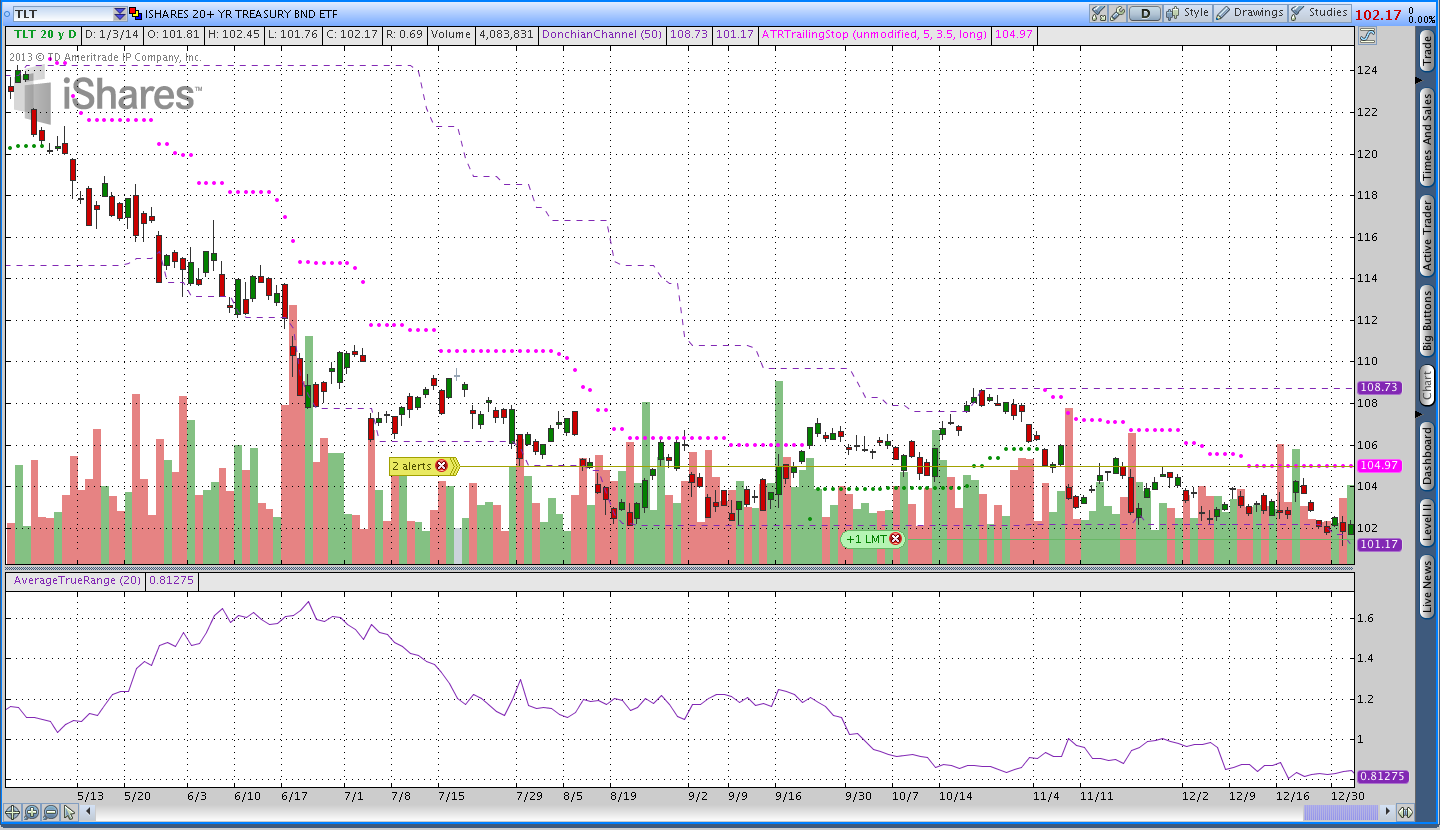

Bonds ($TLT – iShares Barclays 20+ Year Treasury Bond ETF):

Bonds had a very quiet week and ended essentially unchanged. The daily and weekly timeframes continue to suggest we should see lower prices, but we’ll need to see how things shake out next week. I was and continue to be short bonds.

Trades This Week:

BAL – Bought to open 50 Shares at 53.19 with an initial stop at 51.40

DBE – Sold to close 109 Shares at 28.53 for a net loss of 93.93 or just under 1% for the sample account

EUR/USD – Sold to close 4,000 notional units at 1.36 for a net loss of 94.94 and another 1% loss on the sample account

RUT – Sold to open a March 2014 Iron Condor for 1.70 1000/1010/1250/1260

Option Inventory:

IWM – Short Mar 2014 94 Put (sold for .70)

GLD – Short March 2014 139 Call (sold for .53)

TLT – Feb. 2014 106/106 Call Credit Spread (sold for .70)

RUT – March 2014 Iron Condor 1000/1010/1250/1260 (sold for 1.70)

ETF & Forex Inventory:

NZD/JPY – Long 3,000 notional units at 80.56

USD/JPY – Long 4,000 notional units at 100.61 and long another 4,000 at 101.64

USD/CHF – Short 4,000 notional units from .8874

BAL – Long 50 shares from 53.19

Looking ahead:

Next week I wouldn’t be surprised to see a little volatility come back into the markets. Even though stocks were up big in 2013, the trend remains higher and, as of now, there is no price based reason to be bearish. Gold could be starting to stage a move higher, but the market was so broken last year that it may take some time for it to heal.

I saw a largely positive reaction to the Iron Condor trade this week and I’m going to incorporate them going forward. Right now I’m working on two new options trading systems. Both are trend following in nature and one uses Iron Condors. Keep an eye on the blog for more information about both as we go into 2014. Thanks again for reading and enjoy the weekend.

One last thing . . . if you’ve read this far and still have lingering questions, feel free to post them in the comments below.