Looking To Short Gold – Naked Option Trade Watch

Update – Sold the March 2014 139 Call described below for .53

What I’m Thinking:

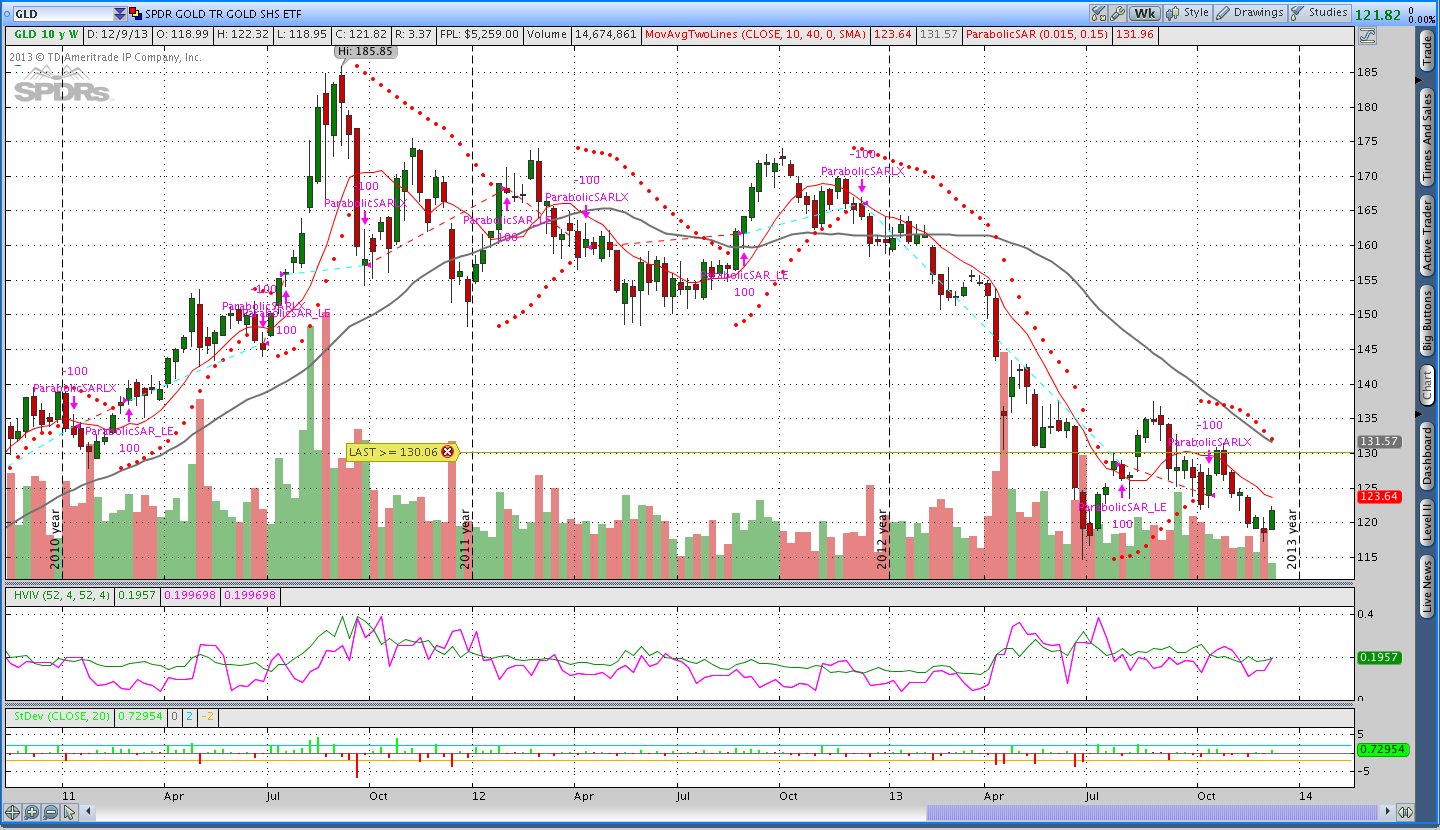

Does anyone remember the Naked Options post about the Russell 2000 (IWM)? Specifically, I was looking at selling options based on the technicals of a weekly chart using a Parabolic SAR to determine trend direction. I’ve been doing some initial backtesting of that system and so far I like what I see. At any rate, the trade below is based on that system.

Gold (GLD):

Gold has been in a pronounced downtrend all year (this shouldn’t be news to anyone). However, in the past couple of months price seems to have found an area that is providing a little support, but my trend indicators are saying that more downside is possible. Specifically, I mean that the Theta Breakout systems says we should be short and the weekly Parabolic SAR also says we should be short.

Yesterday we had a bounce higher in gold and that’s making a new short trade attractive. Specifically, I’m looking at selling a March 2014 10 delta call and if the trade gets filled I’ll tweet it out. Yesterday the March 139 call closed at .52 with 100 days to expiration. I’m looking for around a 10 delta (and ideally a little lower than higher) that I can sell for .55 to .60. We’re about 15 minutes before the open and Gold futures are flat.

Managing the Trade:

I’m selling a little further out in time with this trade and I’m willing to roll the position once. If my short Delta increases from 10ish to 17, I’ll be rolling the position up and doubling size. However, if the trade hits my maximum loss or the Parabolic SAR before I’m able to roll, I’ll just get out. Keep an eye on Twitter if you want to know if/when I get filled.