Broken Wing Butterfly Trade Recaps And Trading Rules – One Loser and One Winner

Strategy Overview:

In the past few months, I’ve been experimenting with Broken Wing Butterfly trades and this post looks at a couple of closed trades. My interest in the strategy has grown out of what I’ve seen the guys over at Capital Discussions doing with their trades. They have some great traders in their community and I highly recommend you check out what they’re doing. I’ve learned a lot from Tom Nunamaker, Dan Harvey, Ron Bertino, and Jim Riggio and suspect you will as well.

As discussed in this post, the range of profit on a BWB can be extremely wide. Additionally, the trades can be constructed in a way that there is little upside risk with a very flat (safe) T+Zero line. The BWB trades I’ve been testing (live and obviously for your benefit as well) have been quite varied. I’ve traded some BWB’s with the short strikes centered at 25 Delta, some that start with the upper long 20 points below the money, and I’ve used different days to expiration ranging from 35 DTE to 80 DTE. In all cases, I’m looking at BWB’s that are entered for a small debit of less than .75 and I’ve developed a preference for trading the BWB’s in SPX.

The reason I prefer SPX for the BWB’s is that the index is roughly twice as large as RUT and has 5 point strikes meaning there’s more granularity. That granularity helps with strike selection and makes it easier to build a more favorable risk profile. In general “cheap” trades that are closer to the money seem to reach a higher yield, which is consistent with what we’d expect. Trades with fewer DTE decay much more quickly, but the speed of decay comes with a smaller profit zone along the T+Zero line.

This post look at two recently closed trades. The first trade was a loser in RUT and the second was a winner in SPX. Both of the positions had to sit through some large down moves in the market.

The Loser – Russell 2000 ($RUT) Broken Wing Butterfly:

The RUT BWB started on January 6, 2016 when I bought the 70 DTE 990/1030/1060 Mar 16 BWB for a debit of 0.55. At the time, the market was trading around 1090 and seemed “oversold.” The short strikes of the Butterfly were around a 25 delta when I got involved, but the market went straight to the bottom of the position fairly quickly.

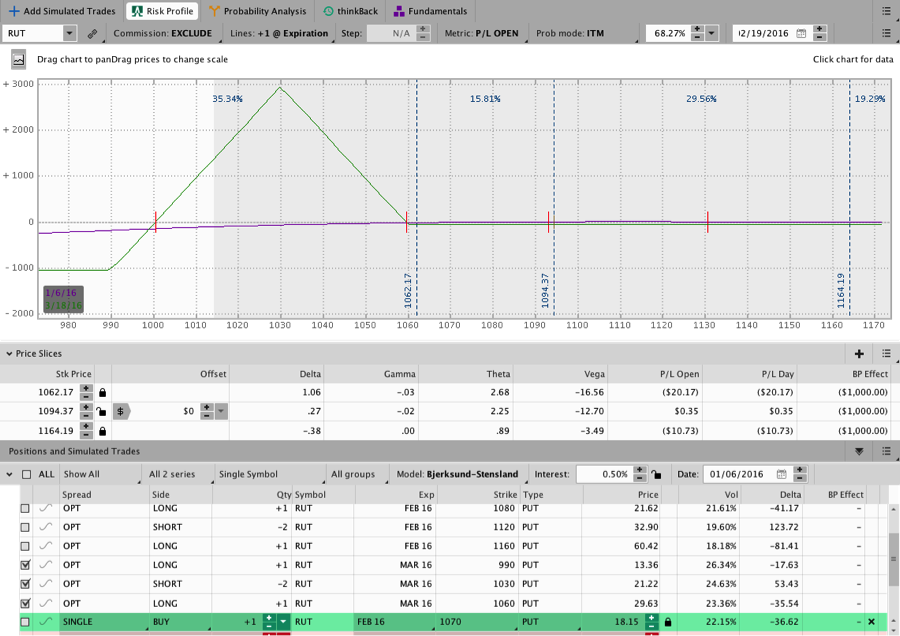

Image of the position on the day of entry:

The market headed south immediately after entry and RUT was quickly inside the body of the Butterfly. Despite the fast move lower, the trade really wasn’t down much money. The image below shows the trade after the market traded down 50 points or around 5% in about a week. The trade is still hovering around break even. Nice.

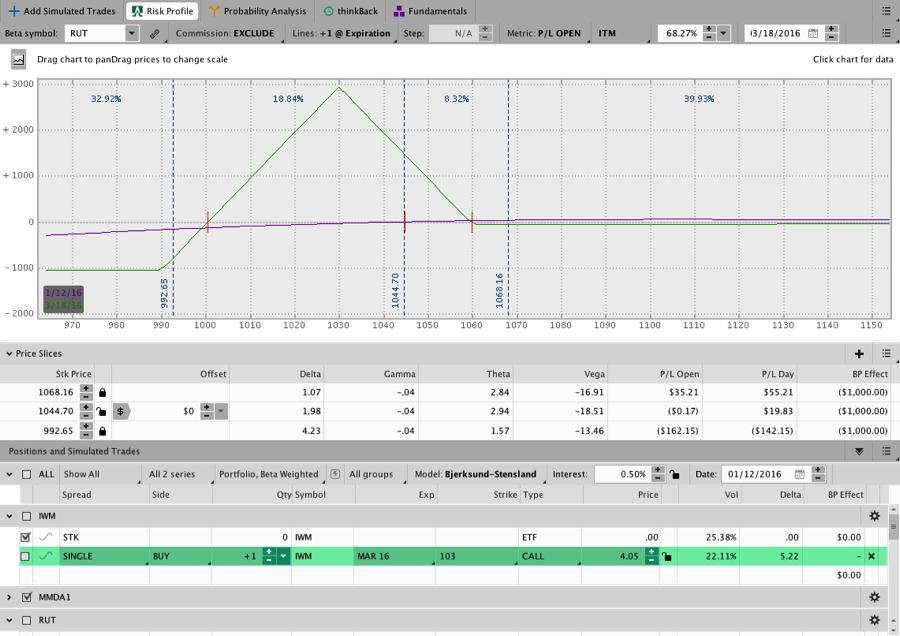

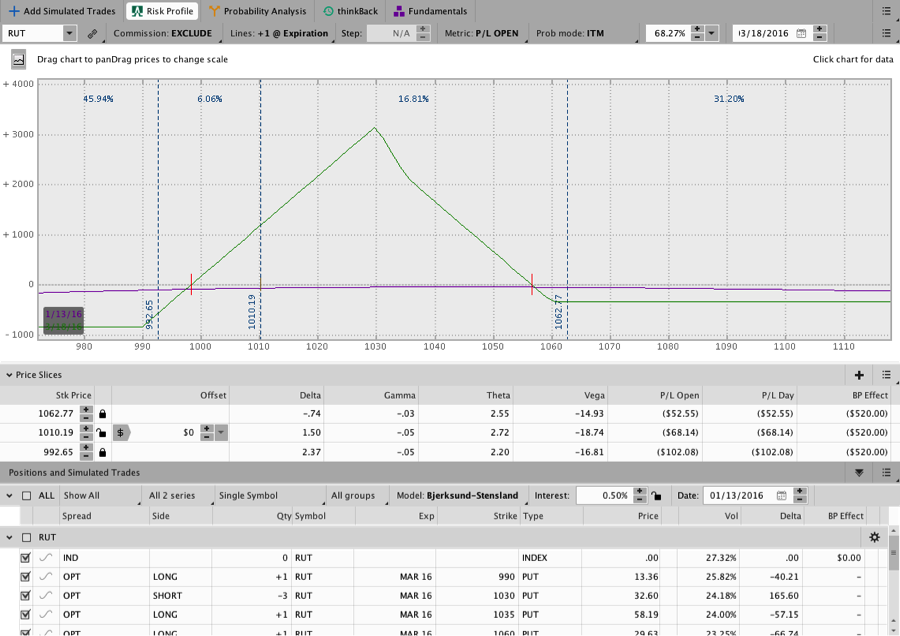

As we all know, the market continued lower and price quickly went below the short strike of the Butterfly so I bought a 5 point debit spread to hedge the downside. I planned to close the debit spread on a recovery, but the recovery never happened. The trade with debit spread is shown below.

A day or two after the image above was taken, RUT solidly violated the expiration break even on the downside and I chose to exit the position. I could have rolled the trade lower, but the loss on the position was only around $100 so I decided to just take the hit and move on.

Lessons Learned from the RUT BWB:

In the RUT trade, I should have simply rolled the position when price traded to the lower expiration break even. At the time the market seemed “oversold” and I expected a rebound so I decided to hedge and see if the trade could run longer. The problem is that the hedge did very little to help the position and was expensive to execute. As a result, I’ll just be rolling the positions lower in the future.

The CIB also rolls lower on the downside and I prefer the simplicity of repositioning rather than hedging. If the market reverses after the roll lower, the BWB has a small potential loss so we don’t need to be overly concerned about defending the upside. Since the trades are entered for such a small debit, there are numerous ways to pick up enough of a credit to lift the expiration break even above the zero line.

Another big take away from the trade is that despite being wrong from basically the moment of entry, the position takes little heat. Despite a big move lower shortly after entry, the position didn’t come under pressure until the market went to the lower side of the Butterfly. Had I rolled lower early on, the position would have been just fine and the loss on the roll would have been smaller and easily overcome.

The trade ended with a loss of $121 after commissions and the order specifics are listed on the Results Spreadsheet in the January closed trades section.

The Winner – S&P 500 ($SPX) Broken Wing Butterfly:

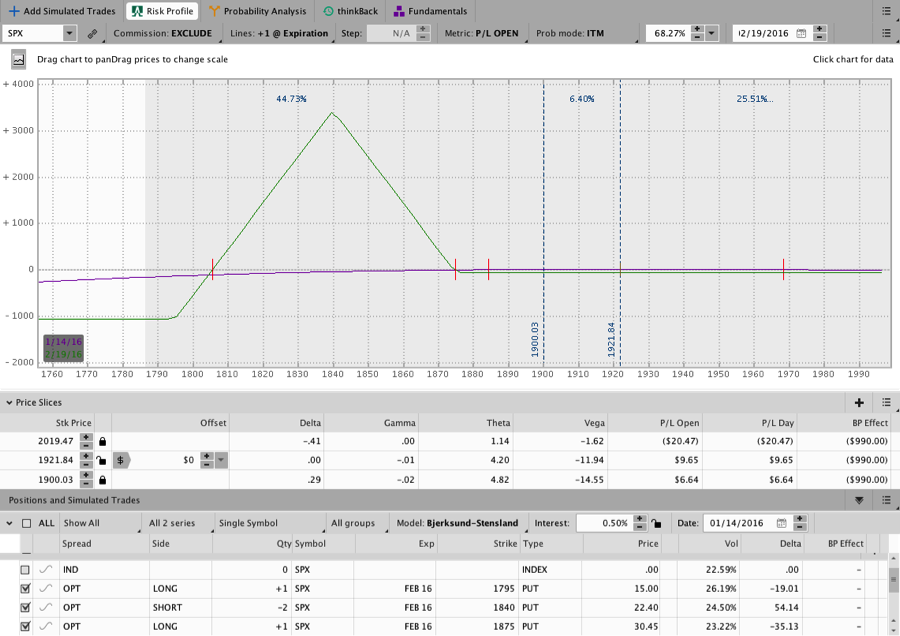

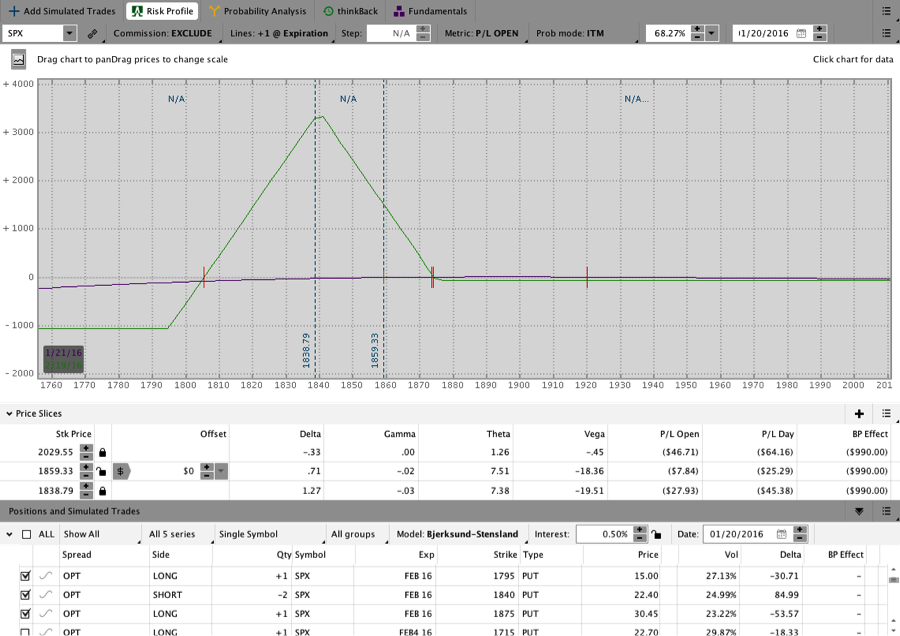

I definitely prefer winning trades. The SPX trade was another Broken Wing Butterfly that was entered on January 14th, 2016. The trade was entered with 25 delta short strikes (1795/1840/1875), 35 days to expiration, and for a debit of 0.65. SPX ended the day around 1920 on the day of entry.

From the 1920 area, SPX quickly moved down into the body of the Butterfly. A week later the market was into the top part of the Butterfly and trading around 1860. Despite the 60 point move lower the trade was only down about $10.

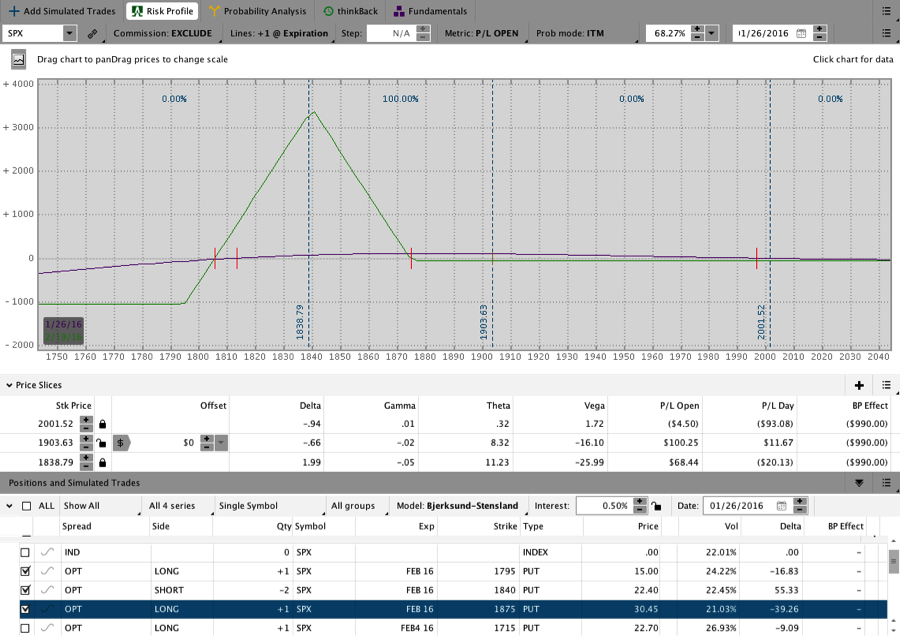

Around two weeks into the trade, the market recovered from lower levels and was trading back around the 1900 level. The T+Zero line was rising and, as shown below, the range of profit was wide. Since the trade was sitting right around the sweet spot of the T+Zero line, I took the trade off for a profit of $98 after commissions ($110 gross). The position had a good return in two weeks while taking very little directional risk or heat.

Broken Wing Butterfly Strategy Moving Forward:

Going forward, I’m going to continue trading SPX Broken Wing Butterflies as a way to diversify my trading. The trades are lower yield than the CIB, but compliment that position well. The CIB tends to benefit from down moves in the market, while the BWB’s can handle large up moves with little trouble.

Rather than saying I’m only going to trade X Butterfly at X DTE, I’ll be diversifying the positions in time as well. My rough plan is to get involved in a shorter dated (35ish DTE) one week and then a longer dated BWB the next week (50-80 DTE). My goal is to have around 4 different positions open at at time.

I’ll be selecting the trades based on my market opinion. When I’m more bearish, the trades will be further from the money. When I’m less bearish they’ll be closer. As a self-proclaimed perma-bear, most of the trades will be at least slightly away from the money. If we move into a more Bullish market environment (yeah right!), I’ll move the trades closer to the money.

Thanks for reading and please share this post if you enjoyed it!