$IWM Put Butterfly Options Expiration Adjustment

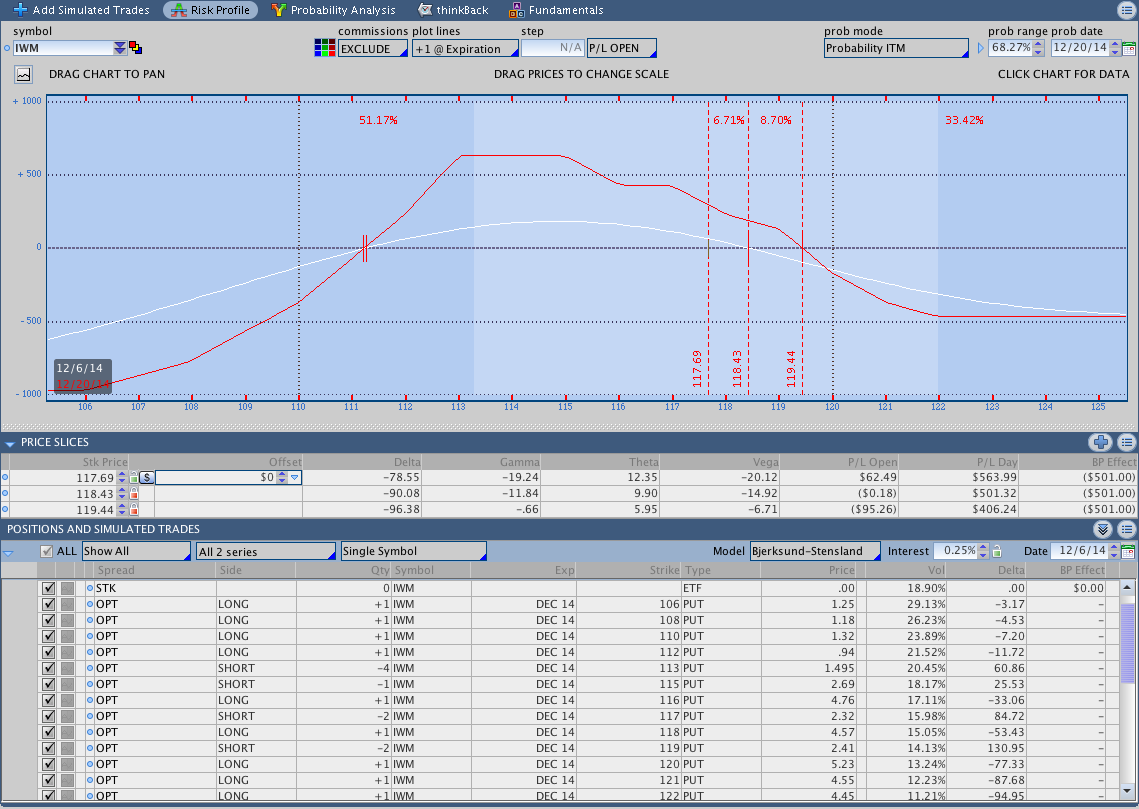

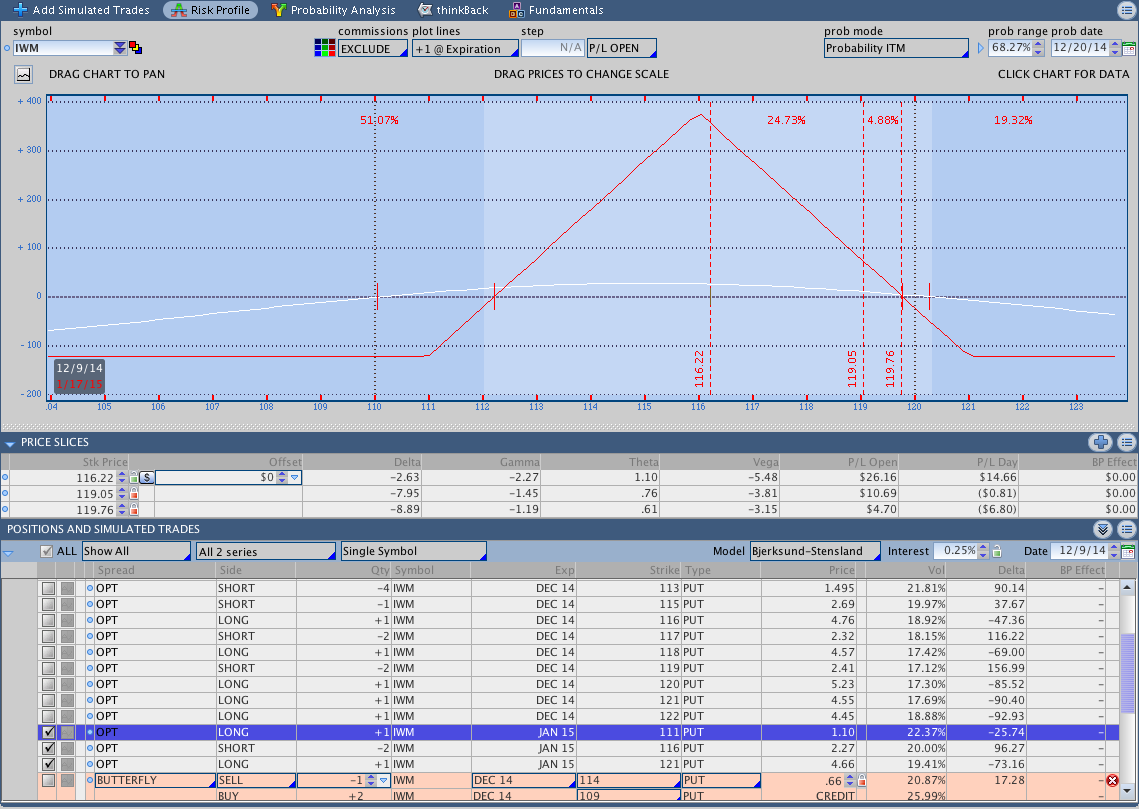

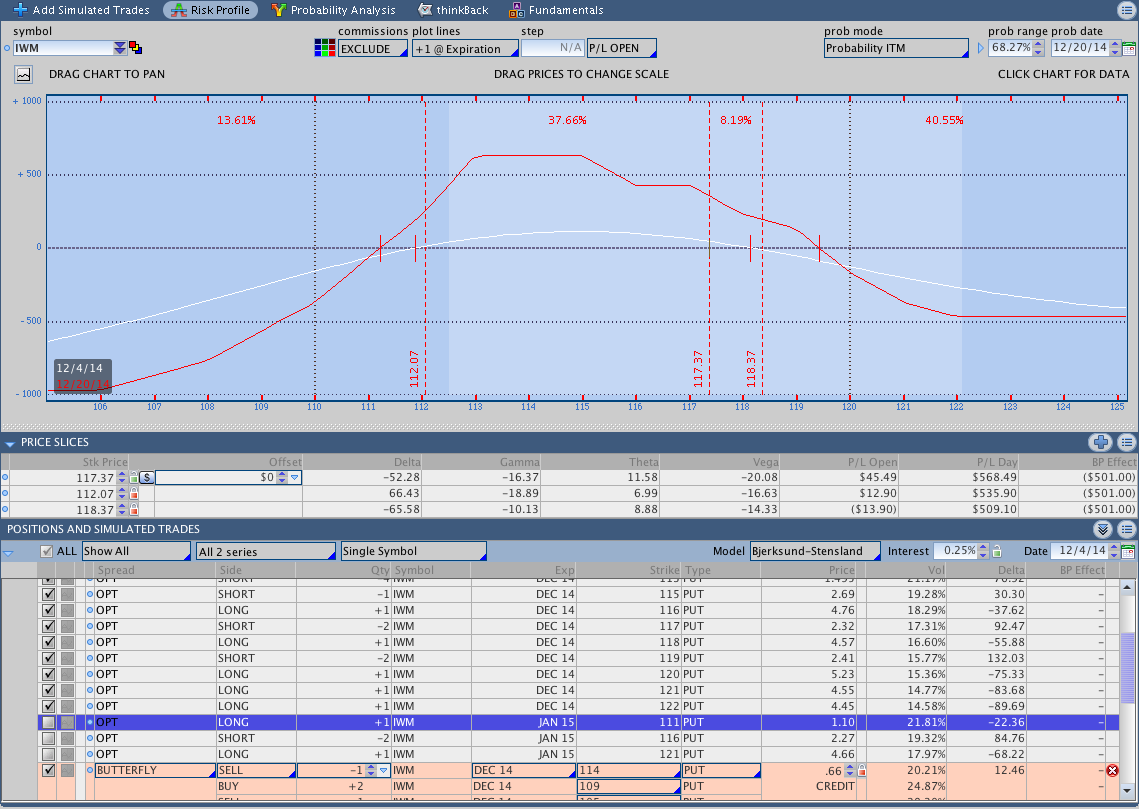

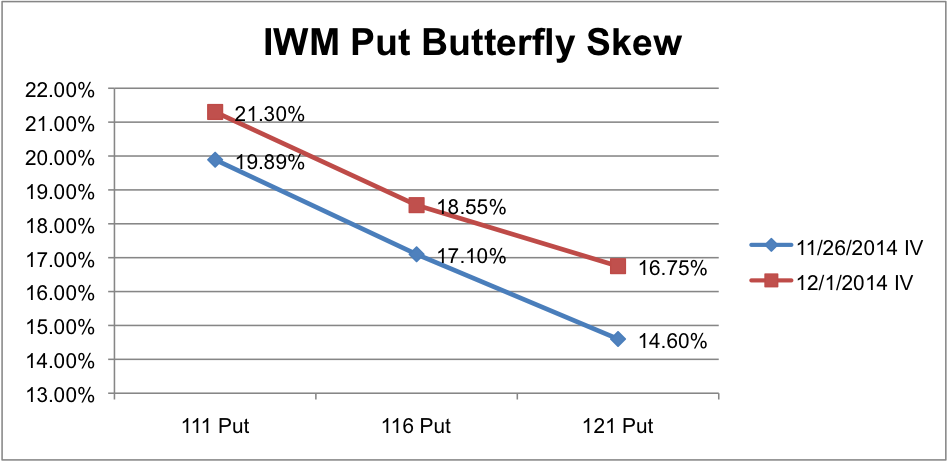

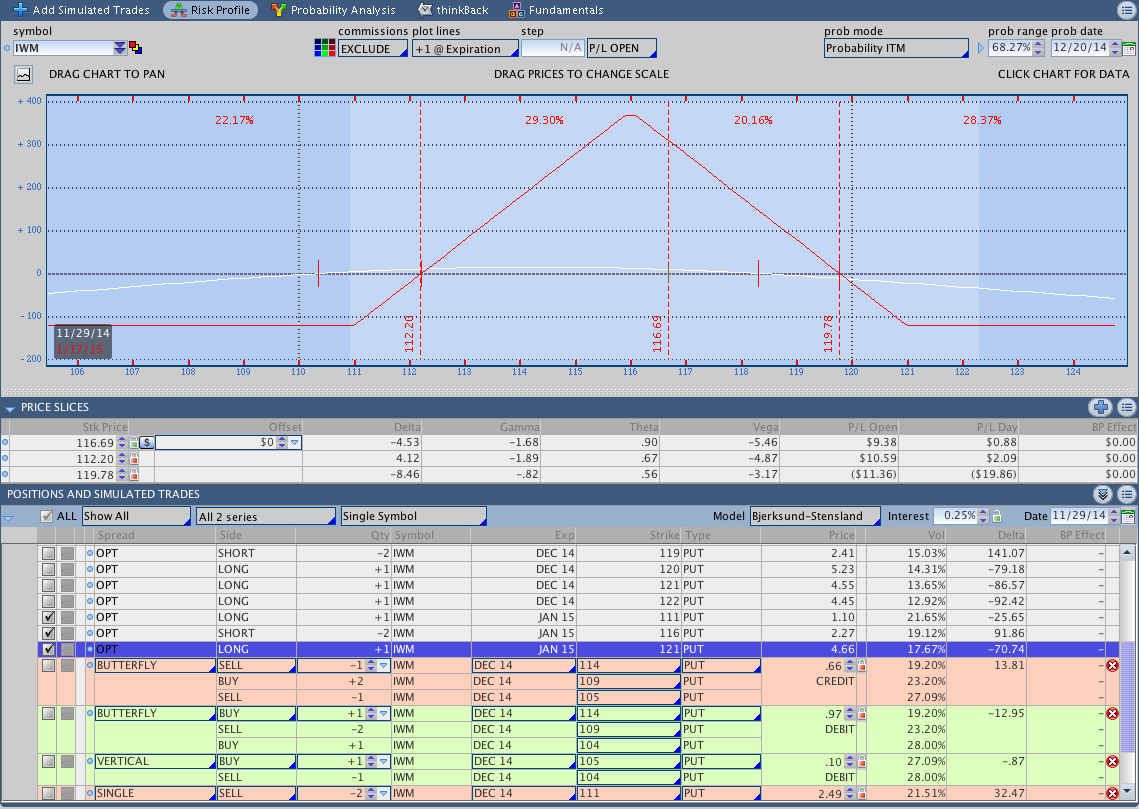

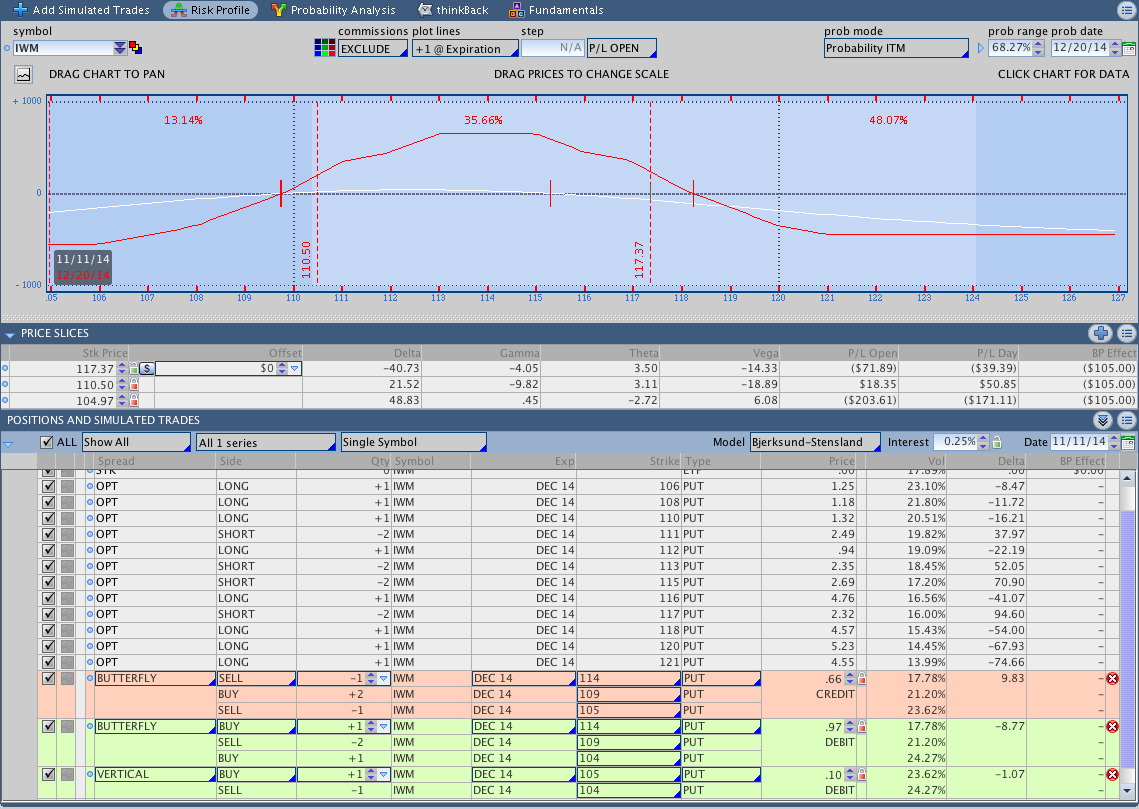

$IWM December Put Butterfly Update: We had a nice gap lower in the Russell 2000 this morning and that put price right in the middle of the expiration break even points for the December position. In the video below I take a look at an adjustment that cuts the downside risk and closes out part […]