Weekend Market Commentary 9/18/15 – $RUT, $RVX, $SPX, $VIX, $VXV

Big Picture:

Speed can be good or bad. I probably don’t need to tell you that the markets are in a state of elevated volatility right now, but it is worth pointing out that volatility can take place in both directions. The past two weeks have included a fast move to the upside with a tumble lower on Thursday and Friday. For non-directional traders (including myself) that means there was upside pressure followed by downside pressure.

When the market begins moving fast in two directions, it can become increasingly challenging to manage non-directional positions. That being said, it all comes together when you have a plan and remain calm. The price action this week caused me to move up my October Butterfly and then we had a fast sell off. I wish I could have sat through the up move without adjusting, but the position would have been in big trouble and it would not have been responsible from a risk standpoint. However, the adjustment I made on Thursday was up a good amount of money on Friday and I was able to take it off to lock in profits and reduce my risk going into the weekend.

The reason I mention the adjustment is because there was a time in my trading when I didn’t know what to do. Additionally, knowing what to do is as much about mental state as knowing “the rules” for the trade.

As traders we sometimes think that knowing the rules will immediately help us succeed, but that’s really not the case. Knowing the rules is necessary, but not sufficient, for success. Understanding the rules, risk, YOURSELF, and knowing when to adapt is the only way to find long term success.

Questioning My Non-Existent Religion:

A while back I had a conversation with someone about Trend Following traders. He said that Trend Following returns were bogus because the guys changed their systems over time and provided returns that were not based on a single system. He is a buy and hold guy and he said that we can’t compare Trend Following returns to buy and hold because the systems are constantly changing.

For a while, his statements made me feel like my non-existent religion had been questioned and I was troubled. One day I had the realization that the systems absolutely should change over time. The traders who make money consistently approach the markets as they would approach business. In the world of business, the market place changes, new demands emerge, innovation happens, and the only way to make money is to adapt. No business is successful over a long period of time without adapting and changing.

So what does that have to do with the markets now? We’re coming out of a period with steadily rising markets that began in 2009. During that time we’ve seen a couple of mini-crashes including the recent one in late August. There is no way for anyone to know if the recent sell-off will continue or reverse.

What we do know is that volatility has been and continues to be elevated. Additionally, the VIX:VXV ratio is still higher than you see in a calm market. The market looks visibly troubled across multiple timeframes and that has nothing to do with the story in the news (whatever the media happens to say it is today).

All we can do is trade the environment we’re in and control our risk both in dollar and directional terms. You have not done the work that is essential for success if hope becomes a part of evaluating your position. Don’t hope. Trade the existing market environment and adapt.

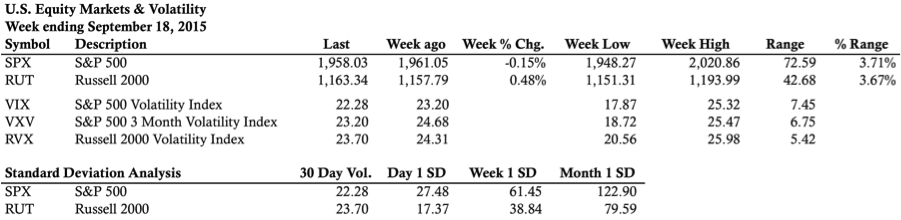

Market Stats:

Levels of Interest:

In the levels of interest section, we’re drilling down through some timeframes to see what’s happening in the markets. The analysis begins on a weekly chart, moves to a daily chart, and finishes with the intraday, 65 minute chart of the Russell 2000 ($RUT). Multiple timeframes from a high level create context for what’s happening in the market.

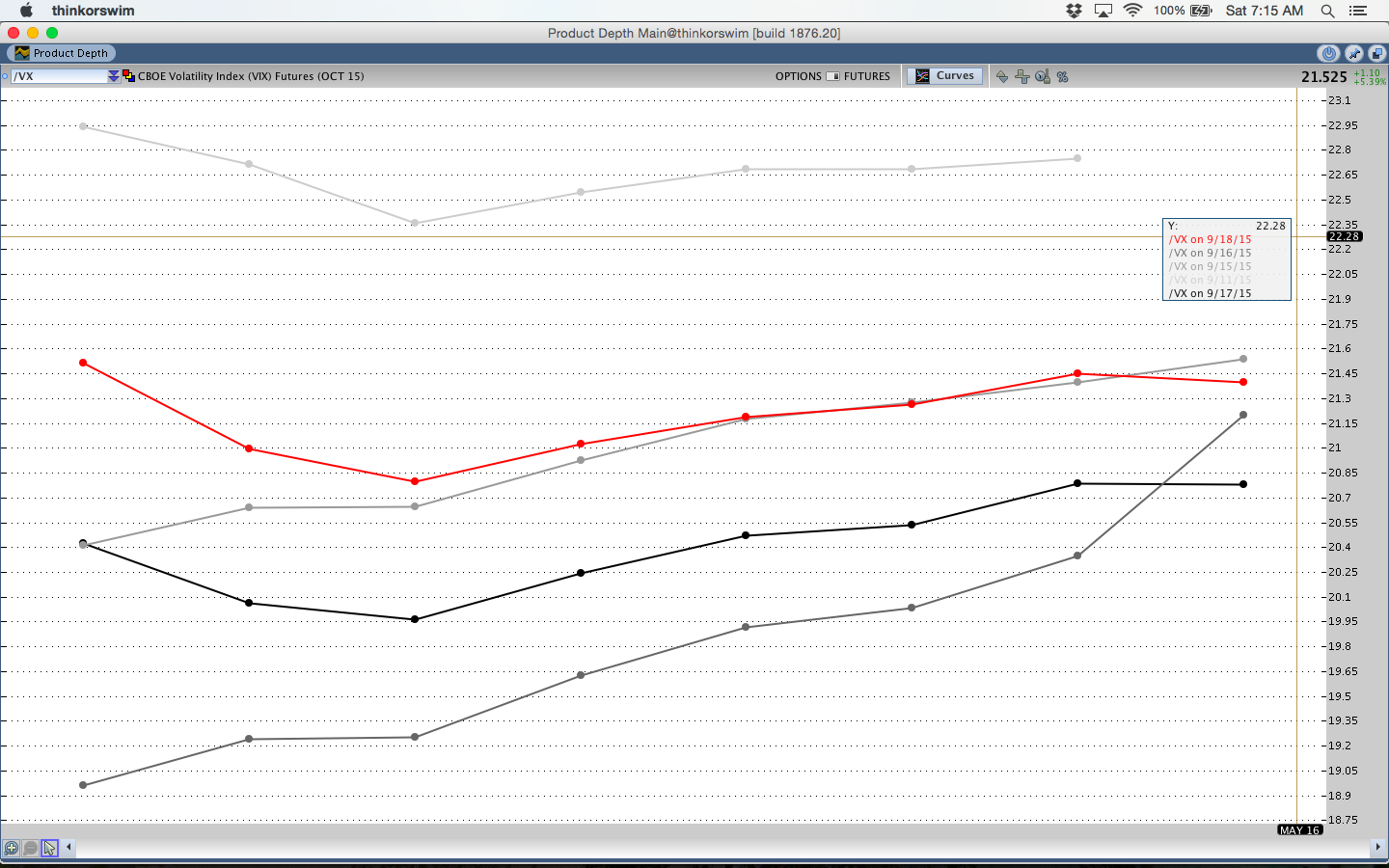

Volatility:

In a calm market, the front month VIX Futures contract generally trades at a lower price than the subsequent months (Contango). Right now the term structure is still in Backwardation (Friday is the red line). The curve shifted lower across the board this week with the drop in implied volatility.

Live Trades . . .

The “Live Trades” section of the commentary focuses on actual trades that are in the Theta Trend account. The positions are provided for educational purposes only.

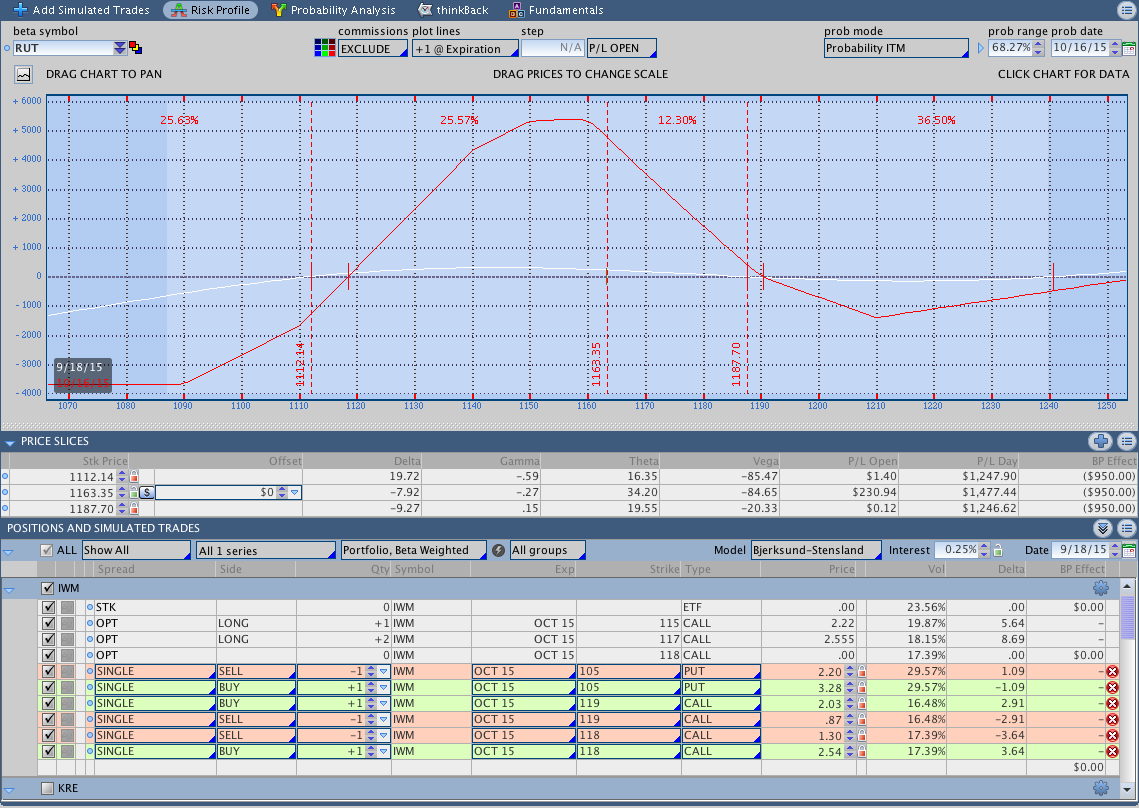

I had a very busy week of trading with the push higher into the Fed and then the subsequent sell off. I closed my Iron Condor positions early in the week for acceptable profits and the only trade in my main account is the October Butterfly. I have a couple of small Butterfly positions in another account.

On Thursday, prior to the push higher, I discussed some Butterfly adjustments in this post. Initially, I ended up rolling up a short put and rolling up the lowest Butterfly to a new Butterfly centered at 1180. Following the sell off on Thursday and Friday, I was able to close out the 1180 Butterfly and long call for a quick $190 profit.

The image below shows the October Butterfly after all adjustments. The trade is coming into the money now and we’re inside of 30 days to expiration. Going forward I’m just going to be keeping the Greeks under control and looking for an opportunity to exit.

The trade has an acceptable Delta, but I’m not thrilled about the upside around 1190. If the market trades higher, I’ll be rolling up a short put to flatten out the T+Zero line.

Looking ahead, etc.:

This could be a pivotal week for the markets or potentially not. The reality is that we won’t know until it happens. My sense is that the markets are still digesting the recent moves and there are probably some wounded long participants who are hanging on with hope that things will move higher. Again, hope is not a strategy.

Right now the market is moving around with a significant amount of volatility and I’m glad to be in relatively neutral trades with controlled short Delta. The size of the moves can lead to fake outs and that may have happened to any new longs that are holding from Thursday afternoon.

My recommendation is to stay nimble because things can change quickly.

Thanks for reading and have a great weekend.

Please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.