Weekend Market Commentary 1/23/15 – Dipping In The Punch Bowl

Big Picture:

Central Bank intervention works and sometimes it works a little too well. However, what happens when Central Bank policy fails to generate growth? Japan is the canary in the coal mine for that scenario and a country that we should all be watching closely. At some point, the U.S. will probably have the misfortune of finding out what happens when monetary policy stops working, but for now everyone wants to follow the lead of the U.S. and dip their cup in the punch bowl.

Central Bank intervention works and sometimes it works a little too well. However, what happens when Central Bank policy fails to generate growth? Japan is the canary in the coal mine for that scenario and a country that we should all be watching closely. At some point, the U.S. will probably have the misfortune of finding out what happens when monetary policy stops working, but for now everyone wants to follow the lead of the U.S. and dip their cup in the punch bowl.

This week the European Central Bank announced their quantitative easing program. That announcement was met warmly by markets and with an unexpected decrease in Canada’s interest rate. There are rumors that the Bank of England may be considering a similar move. The accommodative monetary policy has pushed interest rates around the world to extremely low levels and Bonds are well bid. Remember that interest rates and Bond prices are inversely related so a decrease in interest rates leads to an increase in Bond prices.

The enthusiasm in equity markets for looser monetary policy was accompanied by another drop in the Euro. The chart below is a Euro Hedged European Equities ETF ($HEDJ). The Euro is incredibly weak right now and, as a result, it’s more illustrative to look at an ETF that isn’t suffering from the effects of a weak currency.

Last week I mentioned that it looked like there was some risk taking in Emerging Markets ($EEM). With the help of a little international QE, I was proven right this week with both Emerging Markets ($EEM +3.22%) and Emerging Markets Debt ($PCY +1.02%) performing well. As of the close on Friday, Emerging Markets Debt ($PCY) yields a little over 4%, which is the highest yield of any asset class in the Basic Rotation System. Yield around the world is historically low and I wouldn’t be surprised to see a continuation of the move in Emerging Markets Debt as investors around the world go on the hunt for yield.

The State of the Union Address took place in the U.S. this week with President Obama announcing a host of social(ist?) policies without a serious discussion of the economic implications or a plan to pay for the policies. My belief is that he knows his policies will fail to pass and in 2016 the Democrats will point to the policies as something the Republicans didn’t support. The Democrats look like the givers who care about the “little guy” while the Republicans end up looking like the parents who won’t let their kids have the gift. Political posturing is appalling and, unfortunately, many people are too emotionally invested in the policies to see it.

In my mind, both parties are equally bad and I’m not taking a political stance on any of the policies. I always think about things in terms of money and I don’t like pushing through policies that will increase spending when we have no ability to pay down existing debt. Additionally, it doesn’t make sense to support tax policies that decrease GDP and are unlikely to leave anyone better off. I have big concerns about the future of the U.S. and most of those concerns center around excessive debt in an ever increasing number of forms. My fear is that nobody walks away unharmed.

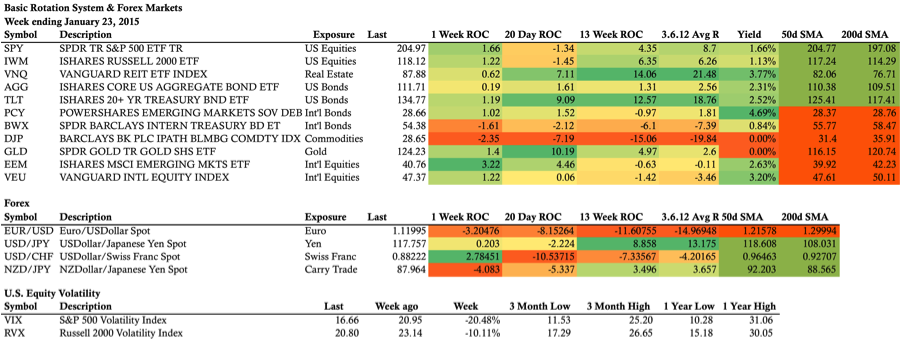

The Weekly Stats:

ETF Rotation System Positions:

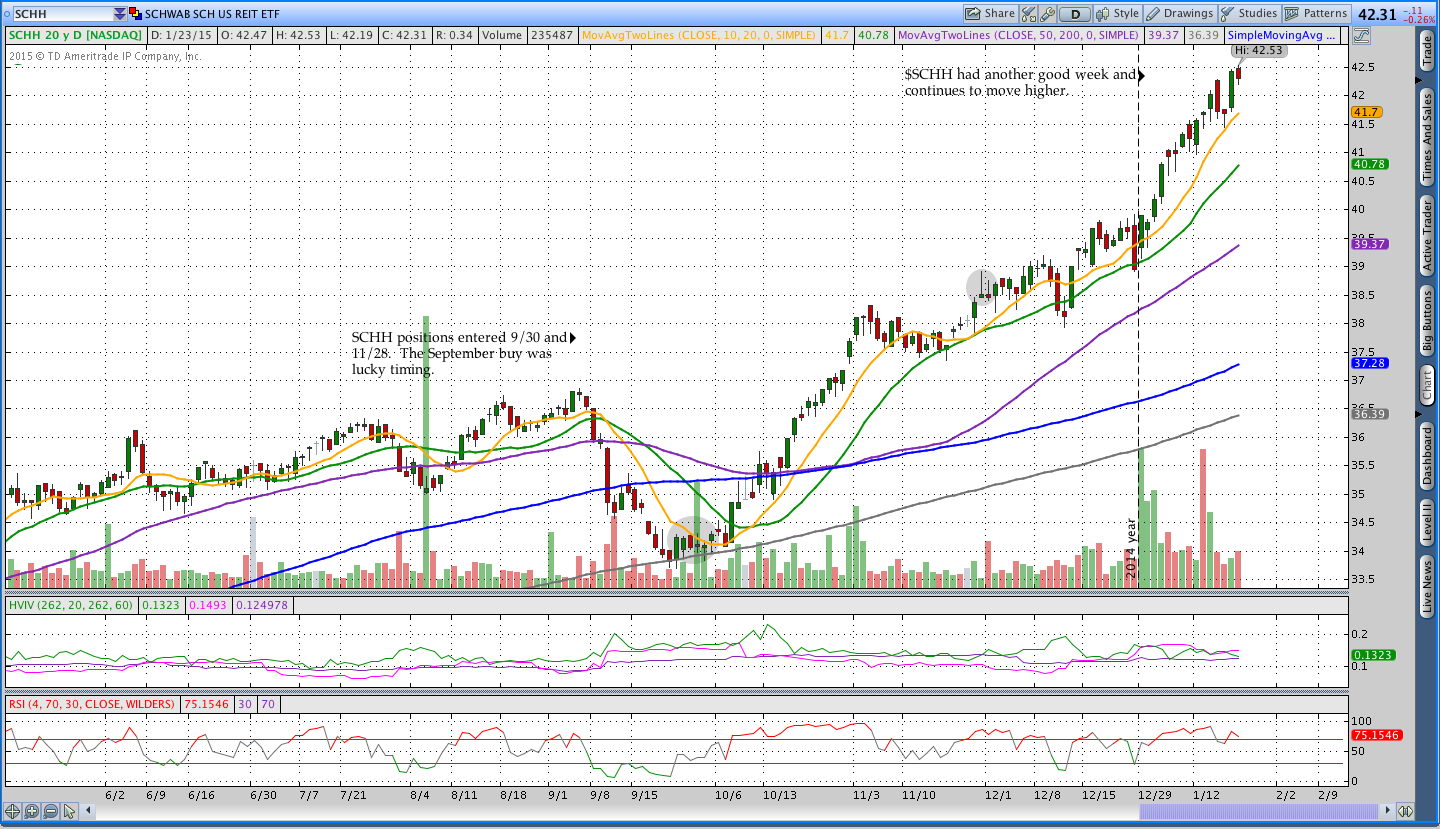

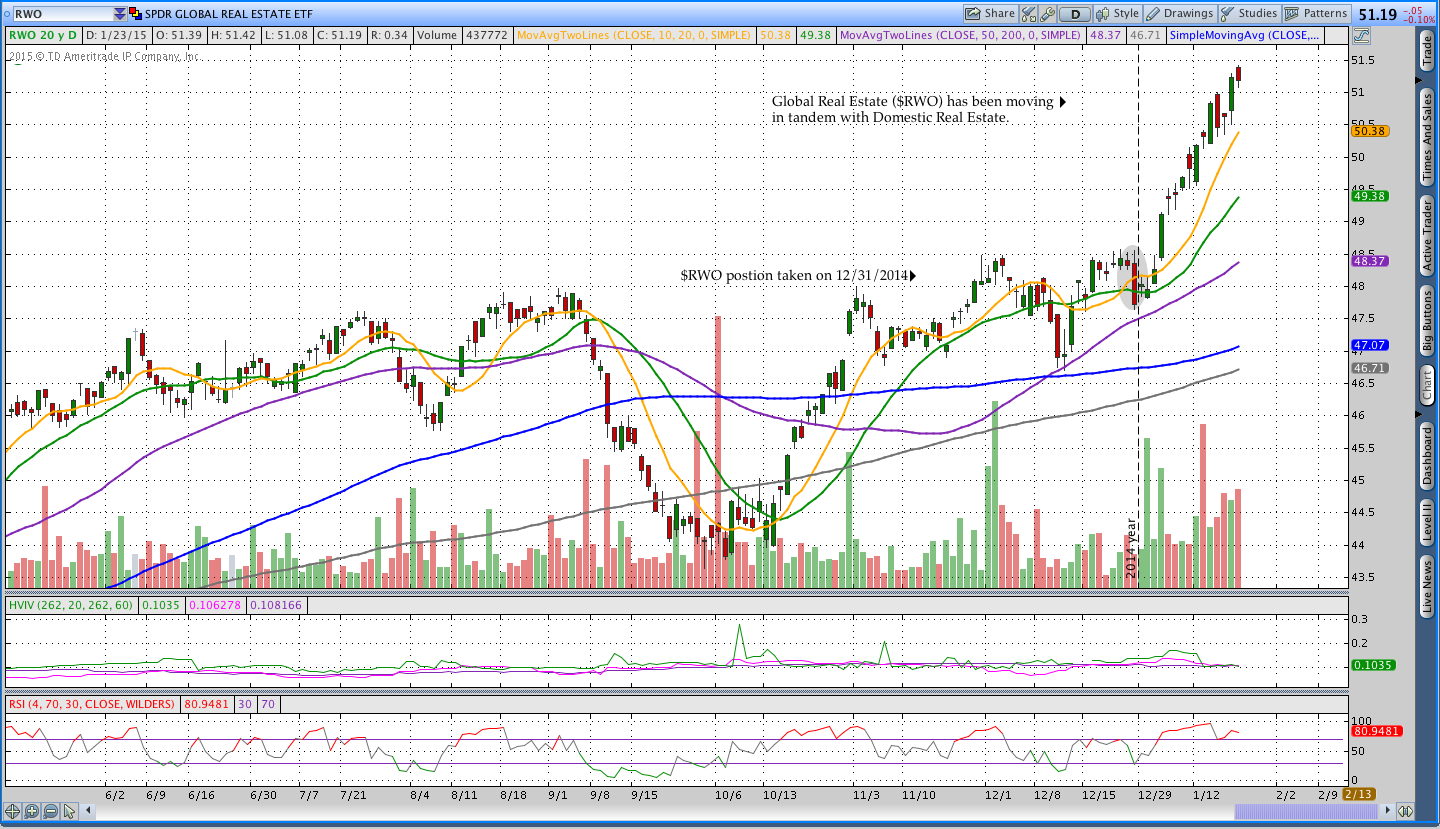

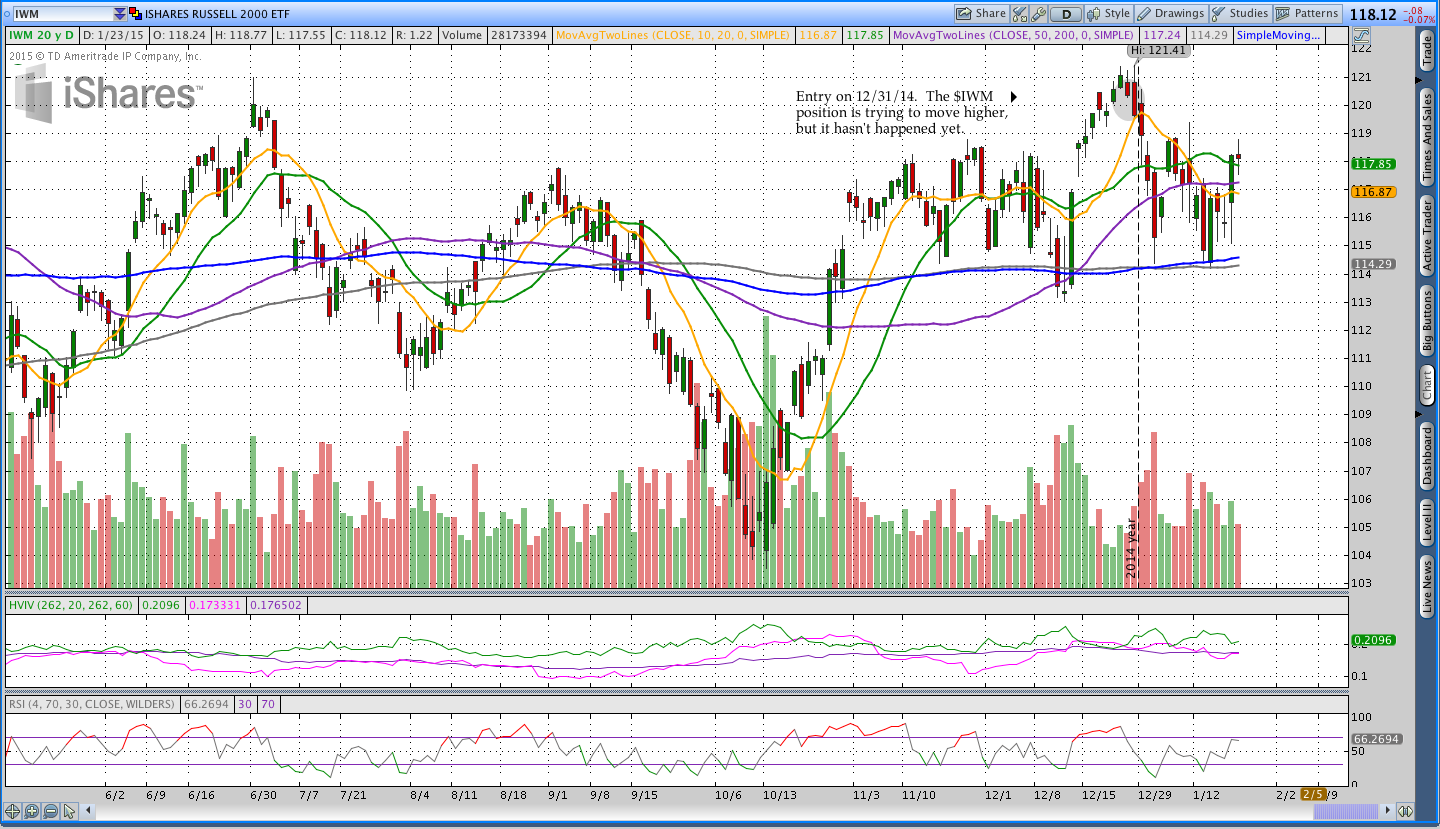

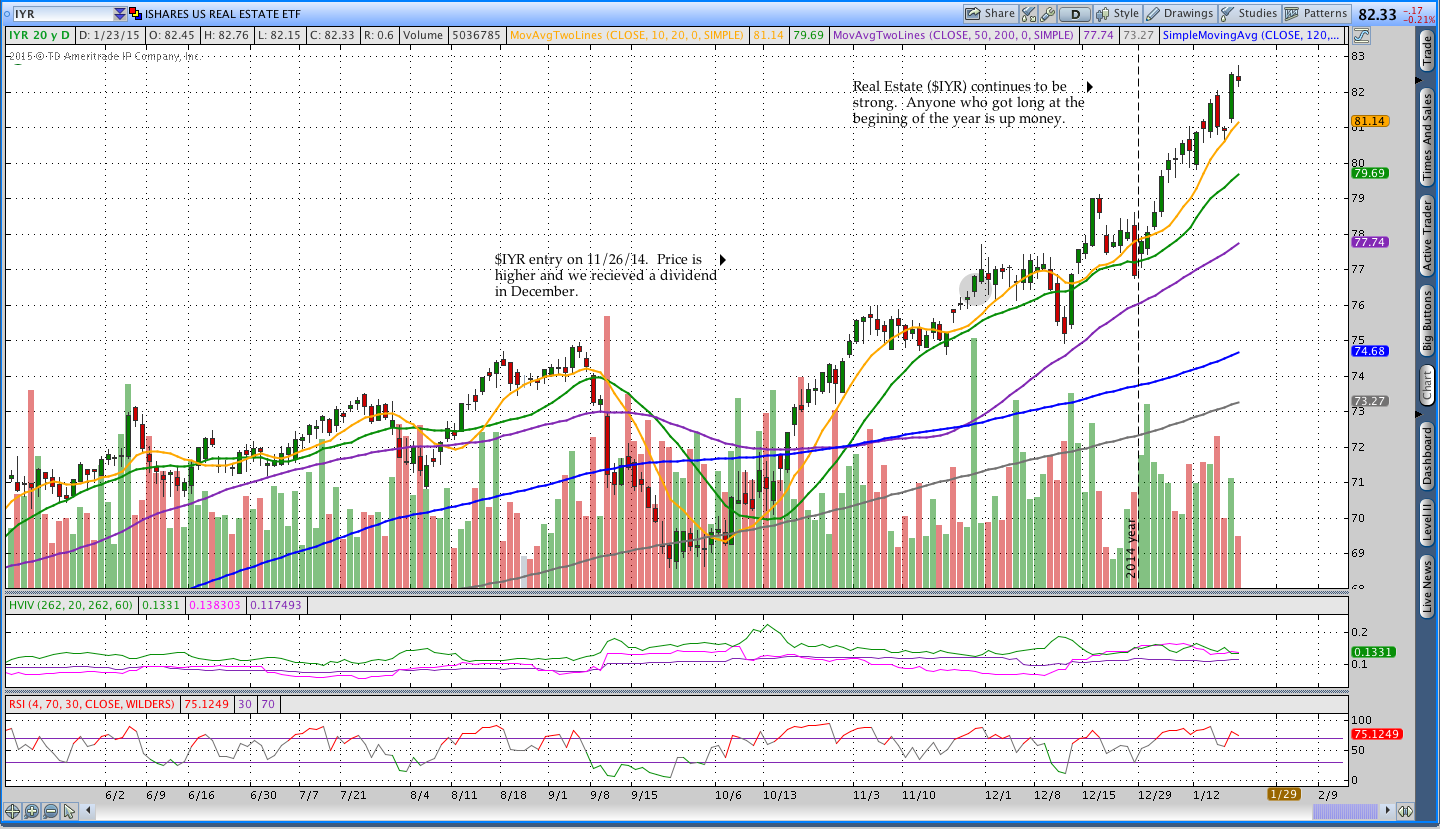

With a little help from the ECB, U.S. Equity markets lifted this week and that helped the Russell 2000 ($IWM) position. Real Estate ($IYR and $SCHH) and Global Real Estate ($SCHH) both pushed slightly higher again this week and those positions are now a good distance from the entry points.

Click here to see a copy of the December 2014 Market Momentum Newsletter that covers the systems in more detail.

Schwab Commission Free ETF Rotation System Positions:

Basic ETF Rotation System Positions:

Donchian Breakout Trades:

Trades This Week:

None

ETF, Options, & Forex Inventory:

IYR – Long 32 Shares from 76.7699

IWM – Long 20 Shares from 120.67

SCHH – Long 41 Shares from 34.009 (previously 58 shares)

SCHH – Long 72 Shares from 38.73

RWO – Long 92 Shares from 48.49

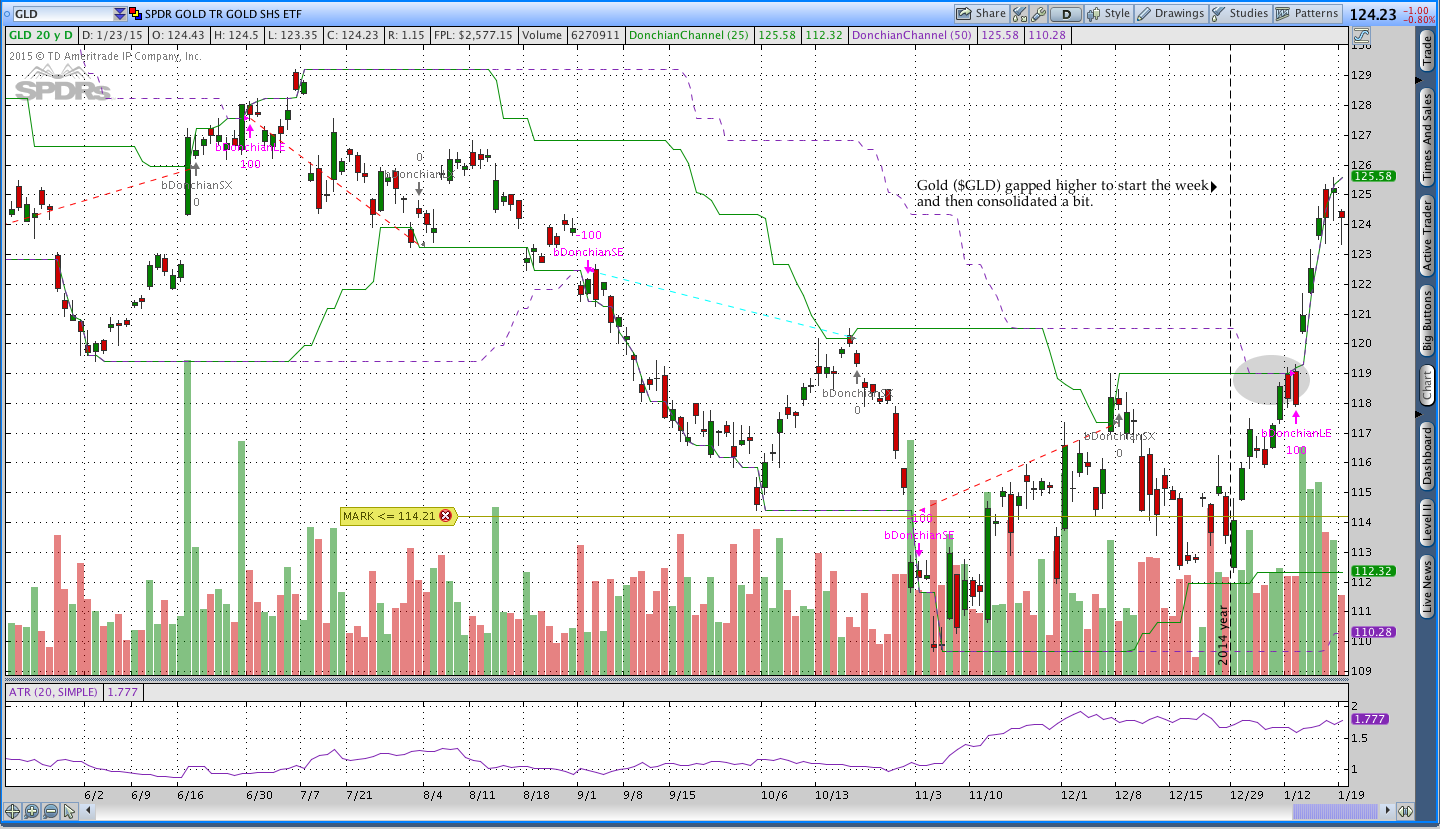

GLD – Long 18 Shares from 118.99

SLV – Long 60 Shares from 16.49

Looking ahead:

This week I’ll be pushing out the January issue of the Market Momentum Newsletter and taking some new positions. Specifically, I’ll be taking initial positions in the account I’m going to be trading for Covestor. As of Friday, it looks like the Russell 2000 will fall out of the top two slots for the Basic System, but that could certainly change by the end of the week.

The S&P 500 finished a bit higher this week ($SPY +1.66%) and that was accompanied by a big drop in implied volatility ($VIX -20.48%). That combination makes me wonder if we won’t see some more upside in U.S. Equities next week. Thanks for reading and have a good weekend.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.