Weekend Market Commentary 1/10/2014 – Stocks, Bonds, Gold ($IWM, $RUT, $SPY, $TLT, $GLD)

Big Picture:

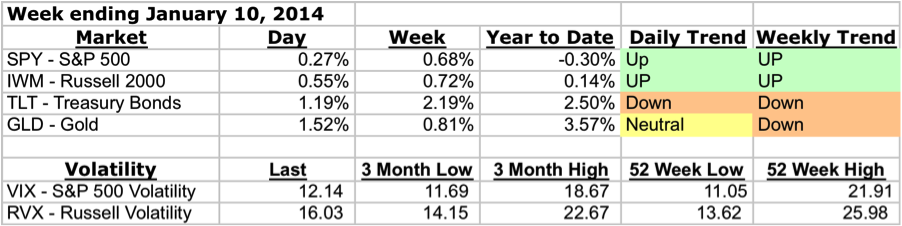

The tides might be changing. Stocks were up a little bit this week, but both Bonds and Gold ended with big moves higher. It looks a slowing in the downward trend might be taking place in those markets. Despite being short Bonds and Gold, all of my options positions are still positive. Stock volatility was down big on Friday with the small move higher in stocks and is now on the low end of the 3 month range as we head into expiration week.

The tides might be changing. Stocks were up a little bit this week, but both Bonds and Gold ended with big moves higher. It looks a slowing in the downward trend might be taking place in those markets. Despite being short Bonds and Gold, all of my options positions are still positive. Stock volatility was down big on Friday with the small move higher in stocks and is now on the low end of the 3 month range as we head into expiration week.

I said it last week and I’ll say it again, the Donchian Channel system is off to a bad start on the year. The reality of trading a system with fewer than 50% winning trades is that you can’t get discouraged when things aren’t going your way. If anything, you should try to be happy about it because it generally means the system should turn around. Wow, I feel so much better about it now . . . maybe not.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

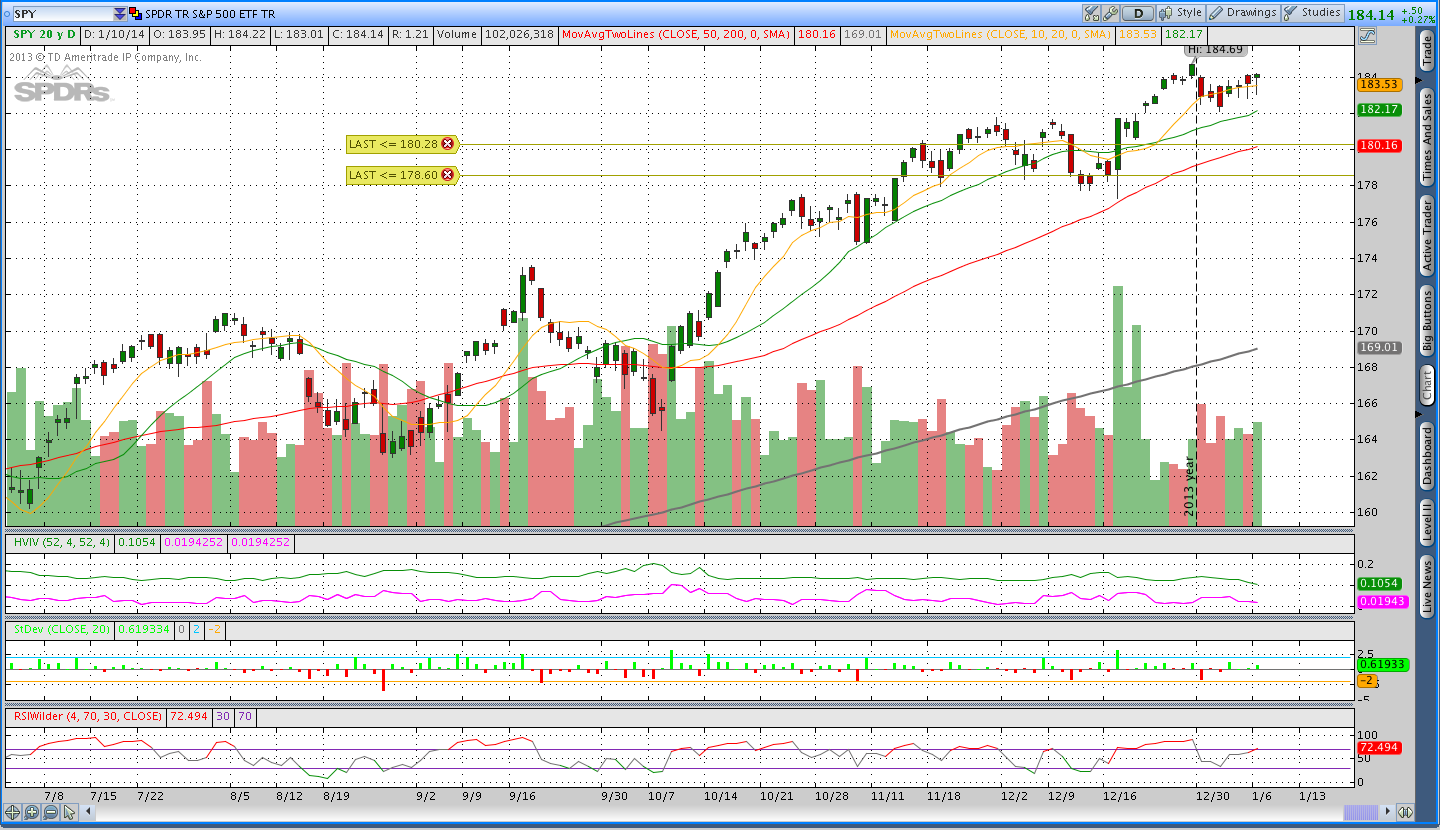

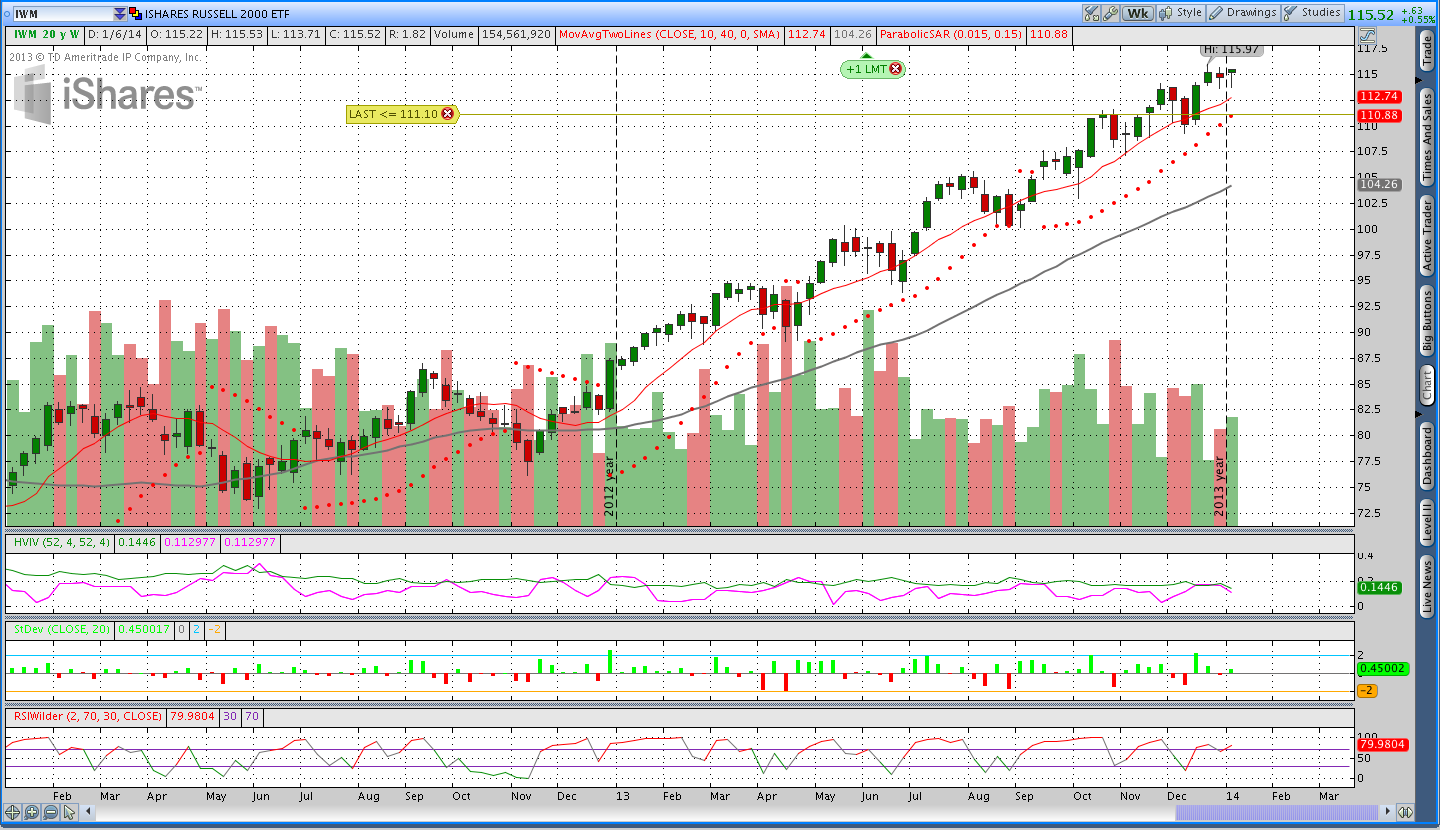

Stocks ($SPY – SPDR S&P 500 ETF and $IWM – iShares Russell 2000 Index ETF):

Stocks seemed quiet this week and didn’t have a significant move. It looks like we’re in a period of consolidation on the daily chart and from a short options standpoint, that’s great. The VIX and RVX pushed lower on Friday, which is making new premium selling less attractive. However, next week is options expiration and as long as the pTheta system points higher, I’m looking to sell an April put. I am also eyeing a short strange in $SPY, but the low volatility is making that less attractive.

My general feeling about stocks is that they’re trying to figure out what to do with the 2013 gains. Because we’re in a period of consolidation following a big run, a move in either direction is possible. That being said, the longer term trend is still higher.

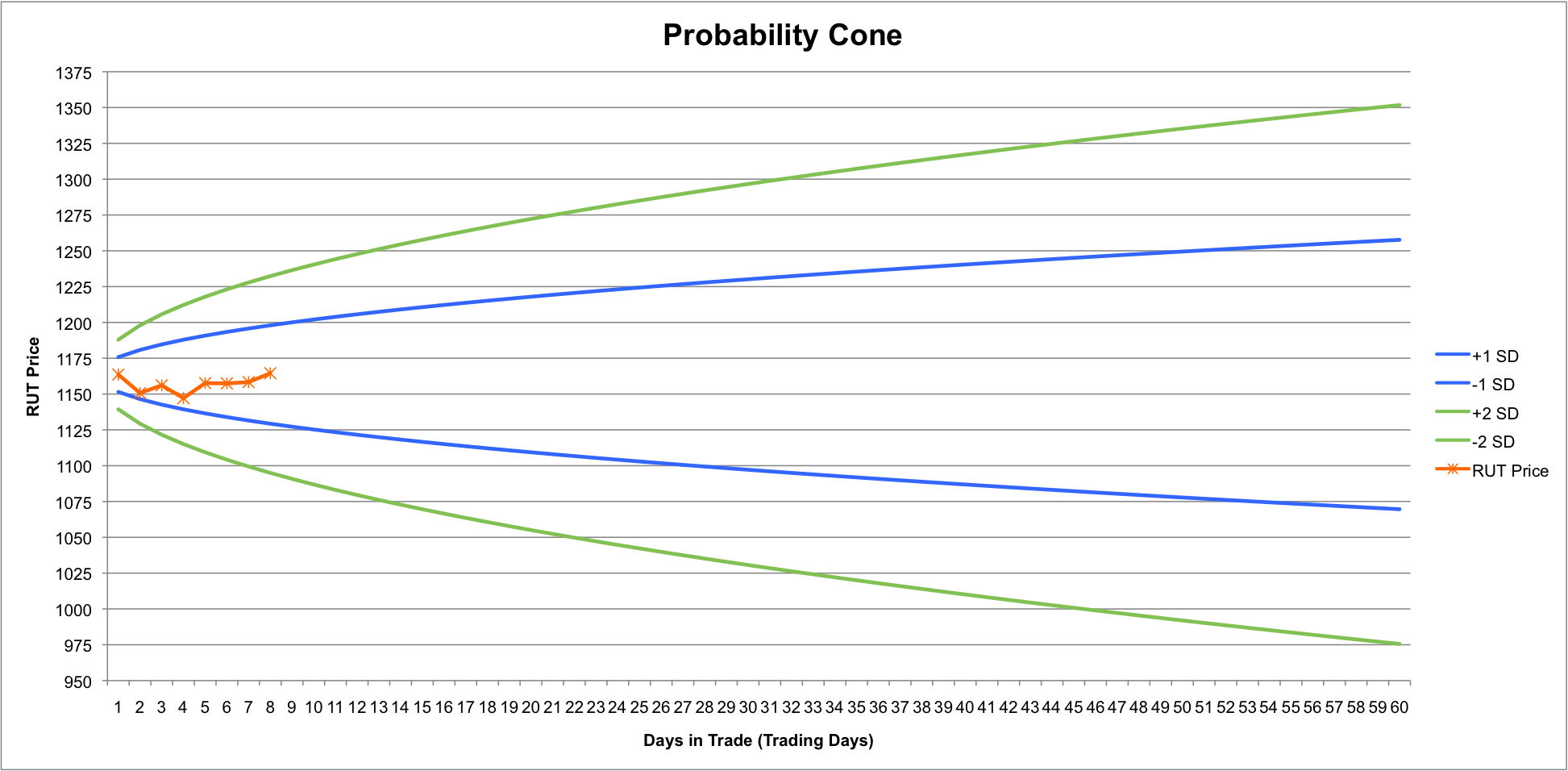

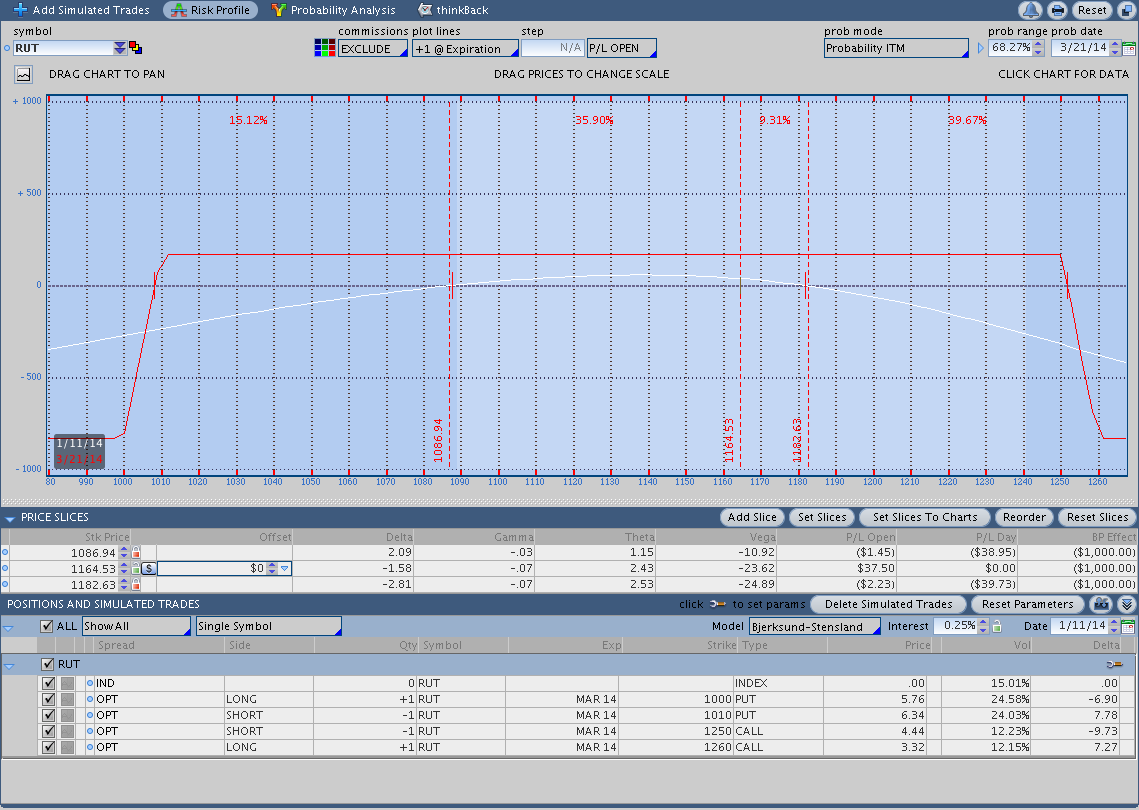

$RUT Iron Condor Trade Update:

Quiet sideways markets always help Iron Condors and this week was no exception. We saw the Russell 2000 drift slightly higher over the course of the week and volatility came down as the week went on. As you can see in the probability cone below, $RUT is essentially back to the entry level on the trade and a little way away from causing any problems. The T+0 breakeven points have widened to 1086-1182. With $RUT sitting at 1164, the potential for trouble is more immediate on the upside.

So far this Iron Condor has been uneventful and has’t required much attention. My only regret at this point is not selling a naked strangle instead . . .

Gold ($GLD – SPDR Gold Shares ETF):

We’re a whole 10 days into 2014 and Gold is up on the year. Following the employment numbers on Friday, Gold popped higher. I’m still short the March 139 call, but it looks like that trade may be coming to a close soon. Gold is moving up towards the Parabolic SAR on the weekly timeframe and if that’s hit, I’ll be selling a naked April put and closing out the naked call. If we don’t hit the stop soon, I’ll be looking for an April call to sell.

Bonds ($TLT – iShares Barclays 20+ Year Treasury Bond ETF):

Bonds made a big move higher on Friday and I saw the open profit shrink on the 106/110 call spread. My stop level for the credit spread is around 105 and hitting that level soon would leave the trade with enough money to pay for the commissions. We’ll see what happens.

Trades This Week:

JO (Coffee) – Bought to open 58 shares at 23.38

USD/CHF – Bought to close 3,000 notional units at 1.36 for a net loss of 94.94 and another 1% loss on the sample account

Option Inventory:

IWM – Short Mar 2014 94 Put (sold for .70)

GLD – Short March 2014 139 Call (sold for .53)

TLT – Feb. 2014 106/106 Call Credit Spread (sold for .70)

RUT – March 2014 Iron Condor 1000/1010/1250/1260 (sold for 1.70)

ETF & Forex Inventory:

NZD/JPY – Long 3,000 notional units at 80.56

USD/JPY – Long 4,000 notional units at 100.61 and long another 4,000 at 101.64

BAL (Cotton) – Long 50 shares from 53.19

JO (Coffee) – Long 58 shares from 23.38

Looking ahead:

Next week is expiration week, which means we’re around 90 days to expiration for April. (Man, I wish it was Spring) That means that I’m looking for new positions for the pTheta system in $SPY, $IWM, and $GLD. The weekly trend hasn’t changed for any of those markets, but the run in stocks is pretty mature and parabolic SAR is getting very close to being hit. The risk:reward in new stock trades is very attractive right now and that also means that the likelihood of a stop hit is high. Keep an eye on Twitter if you want to know what I’m selling and thanks for reading.

One last thing . . . if you’ve read this far and still have lingering questions, feel free to post them in the comments below.

Want to know what’s going on at Theta Trend and see new systems as soon as they’re posted?

Sign up for my email list and stay up to date with the latest happenings.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.