Understanding Yield and The Pursuit of Income

Most investors love to receive dividends and income on their investments; it’s always a good thing when a little extra cash shows up in your account. Unfortunately, Central Bank rates around the world are at historically low levels making those payments smaller and less frequent. In fact, interest rates have gone beyond low and are now negative in some European countries. The challenge with low Central Bank rates is that interest rates in other markets also creep lower and that makes it difficult for investors to earn a meaningful income based return on their investments. While the lack of income can certainly be overcome with price appreciation, income with relative price stability allows investors to compound or pull cash out of their investments. In this post we’re going to talk about yield, why it matters, and then look at some ETF’s that are generating yields up of to 15%.

Yield Defined

On a very basic level, yield is the income earned on an investment divided by the price. Mathematically, that looks something like the following:

Yield = Annual Income / Investment Price

While the concept of yield is fairly simple, it’s important to understand the relationship between the variables. Specifically, if we increase income while keeping price constant, yield will increase. If income remains constant while price decreases, yield increases. For example, if a stock pays a dividend of $1 per year and the price declines from $50 to $25 the yield goes from 2% to 4% and suddenly that stock becomes more attractive from a yield standpoint.

Safety and Income

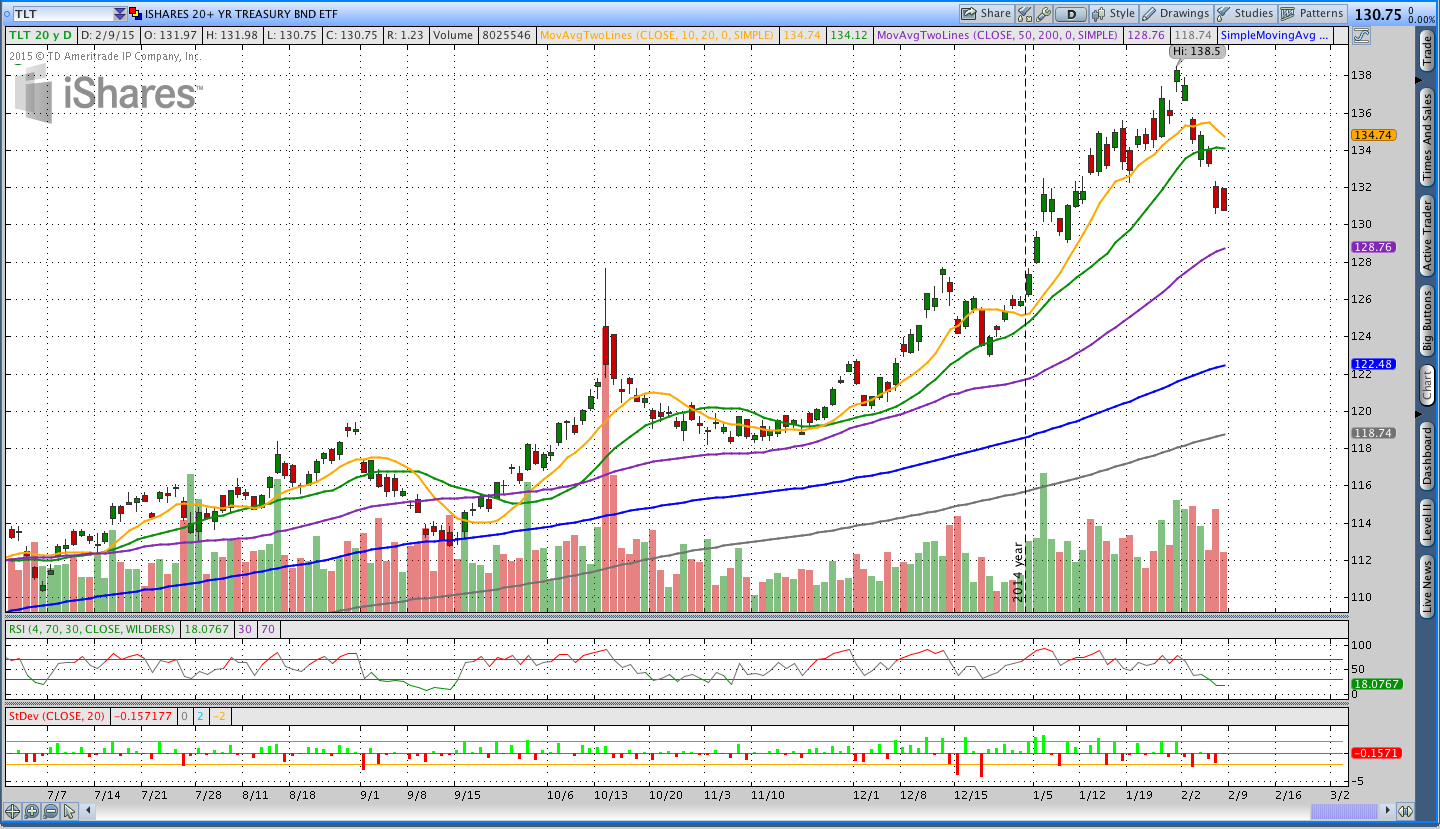

The Long Term Treasury Bond ($TLT) is the benchmark for safe yield, but the market has taken a big hit over the past week and still looks somewhat extended. Additionally, the yield on $TLT has been beaten down to a measly 2.56% meaning the income is doing less to justify the price risk.

Where’s the yield?

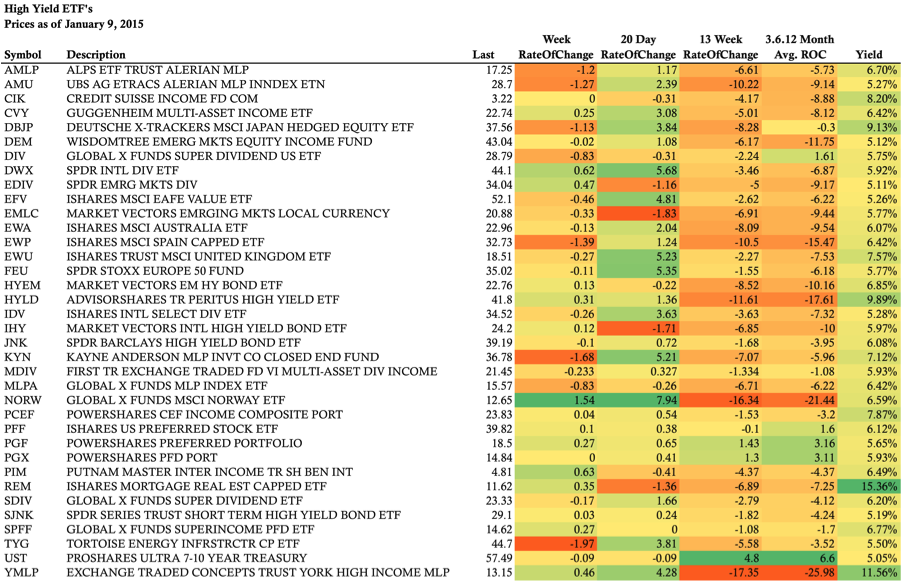

The only thing for an income investor to do in a low interest rate environment is to look around and find other markets with a higher yield. In the image below, we’re taking a look at unleveraged ETF’s with a yield over 5% and an average daily volume of at least 100,000 shares.

When we look at the ETF performance above, there are some definite patterns. In the past month (20 day Rate of Change), we’ve seen positive price performance in International Dividend ETF’s and Foreign Stocks. The top price performers over the past month are the SPDR International Dividend ETF ($DWX +5.68%, Yield = 5.92%), Global X Funds MSCI Norway ($NORW +7.94, Yield = 6.59%), and SPDR Stoxx Europe 50 Fund ($FEU + 5.35%, Yield = 5.77%). Interestingly, when we look out to the Average Rate of Change column that averages the 3, 6, and 12 month returns, those markets have all performed very poorly. The recent short term strength might be suggesting a shift into riskier assets with a higher yield.

If we want to rank the ETF’s purely on yield, the highest yielding ETF’s are the iShares Mortgage Real Estate Capped ETF ($REM 15.36%), the York High Income MLP ($YMLP 11.56%), and the Advisorshares High Yield ETF ($HYLD 9.89%). In other words, the highest yield is being found in Mortgages, MLP’s, and High Yield Corporate Bonds.

Part of the reason for the high yield in Mortgages, MLP’s, and High Yield Corporate Bonds is that the markets have declined significantly in price over the past year. The image below of the High Yield Corporate Bond market tells the story well.

Everything is a tradeoff:

The challenge with pursuing an investment purely based on yield is that the higher yield is frequently accompanied by greater price risk. In the examples above, the highest yielding markets have all experienced significant declines in the past year. However, those declines may open the door for both bargain hunters and income seeking investors to enter.

It’s important to understand that the return on your investments is made up of two components: price appreciation and yield. When an investment has significant price appreciation, yield becomes less important. However, yield is extremely important if price appreciation is mediocre.

Income in and of itself is great, but the real power of income comes through compounding. As discussed in, The Most Powerful Force In Investing, compounding the income on an investment can make the value of the investment grow far beyond the value an investor would ever expect.

This post originally appeared on See It Market.

Join my email list to find out when new posts on investing and income are published.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.