Top Performing ETF’s Monthly Rotation System Ranking Update

Ranking Recap:

We’re about 2/3 of the way through November and it seems like a good time to check in on the rankings for the Top Performing ETF’s Monthly Rotation System. On November 1st I initiated a position in FAN (First Trust Global Wind Energy ETF), the then #2 ranking ETF and the only ETF in the top three to show positive momentum in October. You can read about the full reasoning behind the position here. So far the position hasn’t done much for me as the chart below shows, but sometimes that’s just the way things go. Fortunately, and more importantly, the position hasn’t done much to hurt me either.

As you can see in the image below, the FAN trade was entered on November 1st as indicated in the shaded rectangle. The horizontal line at roughly 11.20 is our cost basis in the position. Right now FAN just looks like it’s consolidating more than anything after making some pretty impressive gains (the chart below is May 1st to November 19th). My hope (not that it matters) is that if FAN pulls back to the red 50 day moving average, it will attract buyers and we’ll get something of a pop. Last week we had a shakeout in the direction of the 50 day moving average and buyers stepped in before it could make it all the way to the 50 day moving average. I consider last weeks low to be a significant level in the short term. FAN now has a lower high on the daily chart, but it’s still in a longer term primary uptrend so we’ll see what happens in the next 10 days.

An Open Position in #2:

At the beginning of November FAN was our #2 ranking ETF, but this month it’s falling in the rankings. Unless something changes by the end of the month, we’ll probably be switching up positions. In an interesting market coincidence, the #2 spot in the 5 month ranking is currently GREK or Greek Stocks. However, I currently have an open position in GREK based on the Donchian Channel breakout system.

In the chart below, a 50 day Donchian Channel breakout long entry was triggered back in early September. The area in the shaded oval. At that time, I took a 1% volatility adjusted position in GREK and have been hanging on ever since. In the past week Greek stocks have softened a little bit and price has been hovering around my stop level at 21 even. The green line below is the 25 day low and my current stop level in the position. It will be interesting to see if the two positions overlap at the end of November. Specifically, will the Donchian Channel System and the Monthly Rotation System both recommend positions in GREK? Guess I’ll tell you in about 10 days. For now, I’m hoping GREK gets up and moves higher.

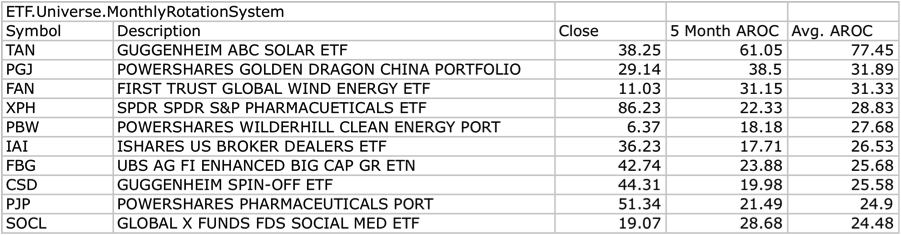

The Current 5 Month Ranking (Top 10 ETF’s):

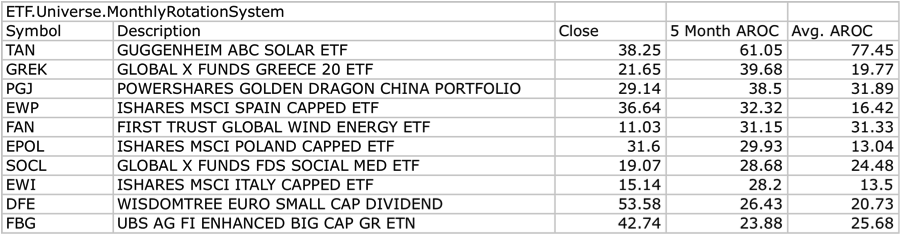

The Current 1 Year Average Ranking (Top 10 ETF’s):