Reverse Harvey Adjustment For A Longer Term Broken Wing Butterfly – (Video)

Overview:

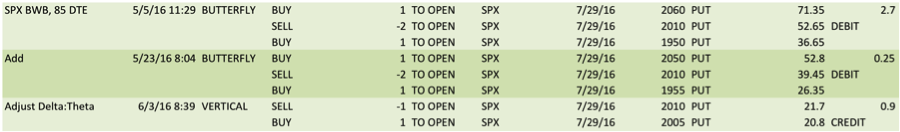

The video below makes reference to the July 29, 2016 expiration $SPX Broken Wing Butterfly. The trade was started with 85 DTE, scaled into, and then adjusted due to an open profit. The video below talks about a potential Reverse Harvey adjustment for the trade. Ultimately, I opted for a less aggressive adjustment and sold a vertical spread within the body of the fly.

Order History:

The orders for this position have been made available as the trade progressed (since 5/5/2016) on the Results Page. They’re duplicated below for easier viewing.

Video:

If you like what you see and want to learn more, check out Theta Trend Daily. In Theta Trend Daily, we evaluate the market from the perspective of a non-directional options trader. That discussion is framed within the context of our live trades. Click here to learn more.