Dropping a RUT Iron Condor for a SPY Short Strangle – Video Post

Overview:

I guess sometimes we can’t get the trades we want and in those cases it’s usually better to wait another day or go play another game. I decided to go play another game . . . of sorts. A while back I mentioned that I would trade a RUT Iron Condor as part of the diversified trend following portfolio. While I had really good intentions of doing that, selling a naked SPY strangle was a better option.

Last week I tried to get filled on a roughly 15 delta RUT Iron Condor and could not get a decent price. One of the great things about the RUT is that the large size makes it easy to save on commissions, but sometimes the fills seem poor. I personally find it painful to start RUT Iron Condors down $20 so I try to place an order that will get filled if the market moves against the trade or a bad order comes through the market. Last week I had orders in to sell an iron condor for a few days and just couldn’t get filled. I finally decided to look at a short strangle in the SPY instead.

The trade:

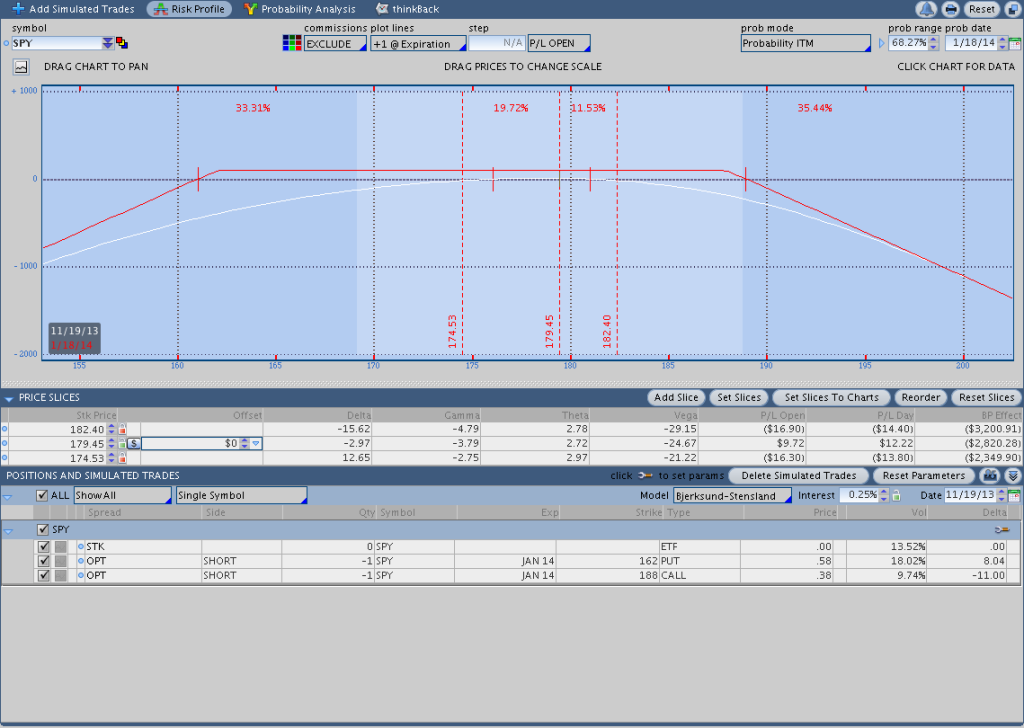

11/14/13 Sold the January 2014 188 Call/162 Put SPY Short Strangle for .96 with 64 days to the January expiration. I was looking for options with a short delta of around 10, but the call side didn’t have very much premium because implied volatility is so depressed. As a result, I moved up to an 11ish delta on the call. I’m aiming to collect roughly 60% of the premium ($56) and willing to risk the same amount (my max loss). My initial adjustment points will be triggered if the spread is down $20, which is about 1/3 of the way to my max loss.

The video:

the video below goes through adjustment points, the adjustment strategy, and the target. Enjoy.

Trade risk graph: