4 Low Risk Butterfly Trades For Any Market Environment

Note: The following is an excerpt from a guest post that appeared at Steady Options. Steady Options offers a subscription service for traders with an impressive track record and their blog is filled with high quality information. Make sure to check them out if you haven’t already.

—————-

The other day I was having a conversation with an options blogger and he asked me how I traded. When I told him that my primary trade is the Butterfly, he was surprised and said I was one of the first people he met who regularly traded Butterflies. In a world where Iron Condors get all the love, it wasn’t the first time I had that conversation. I’ve traded a wide range of options strategies, but, for a number of reasons, the Butterfly is my preferred trade.

The other day I was having a conversation with an options blogger and he asked me how I traded. When I told him that my primary trade is the Butterfly, he was surprised and said I was one of the first people he met who regularly traded Butterflies. In a world where Iron Condors get all the love, it wasn’t the first time I had that conversation. I’ve traded a wide range of options strategies, but, for a number of reasons, the Butterfly is my preferred trade.

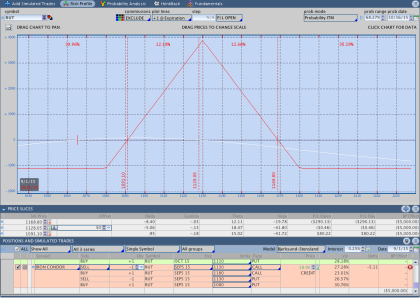

The Butterfly is possibly one of the least understood and least utilized options income strategies. Butterflies can be used to construct high probability positions with a profit range similar to and potentially larger than an Iron Condor with less risk. Alternatively, a short dated Butterfly can provide a great risk/reward ratio when traded slightly out of the money. Perhaps my favorite characteristic of the Butterfly is that the position can make money prior to expiration even if price trades outside of the expiration break even points.

In this post we’ll take a look at four different Butterflies with very different trading characteristics.

Specifically, we’ll take a look at the following Butterfly Positions:

- At The Money Butterfly

- Directional Butterfly

- Broken Wing Butterfly

- Consistent Income Butterfly