3 Steps For Timing Your Butterfly Trade Entry – $RUT $RVX

Timing markets is hard, really hard. Part of why I like trading non-directional option strategies is that they reduce my need to time the market well. I’m not horrible at market timing, but I’m definitely not gifted either and, for options trading, that’s good enough.

The steps below outline how I assess the market when I’m getting ready to enter a Butterfly trade. Note that I only trade this style of Butterfly in the Russell 2000 ($RUT), but some traders like to use other cash settled indexes.

In this example, we’re looking at an income Butterfly positioned 10-20 points below the money giving it a slight bearish bias (short delta). The Butterfly uses long wings placed 50 points on either side of the short strike and I also pick up an $IWM call to hedge the upside. My preferred entry window is 50-55 DTE and I’m willing to enter as early as 60 DTE or as little as 45 DTE.

1. Define your window of opportunity

When you’re new to options income trading, it’s acceptable to put on trades with an exact number of days to expiration. However, as you become more familiar with options trading, you start to realize that your initial greeks can give you either an immediate small profit or immediate small loss. In other words, when you open the trade it has a slight directional bias.

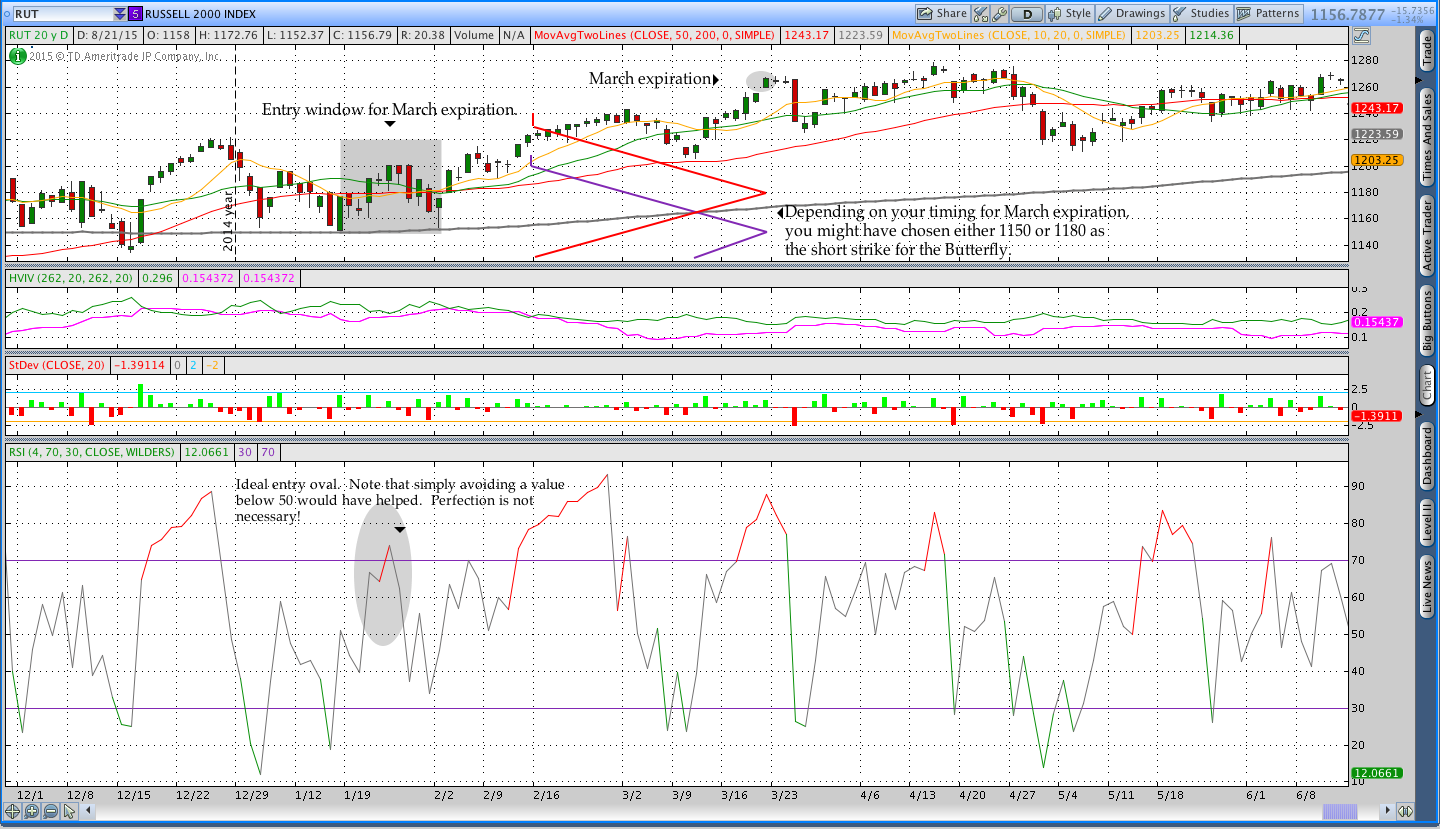

The chart below shows the 45-60 day window of time for trading the March 2015 expiration cycle. In the entry window below, you could have chosen an initial short strike anywhere from 1190 to 1150. For March expiration, a higher short strike would have been easier to adjust on the upside than a lower strike. Trust me, I started March with a short strike at 1160!

2. Assess the market

Once you’ve determined a window of time for placing the trade, you need to look for your preferred conditions. Since this Butterfly has a slight bearish bias, we want to enter the trade when the market is likely to decline slightly after entry. While it’s difficult to know for sure when the market will decline, using a short term overbought/oversold indicator can help.

One of my preferred overbought/oversold indicators is the Relative Strength Index (RSI) with a value of 4 days rather than the standard 14 days. We’re not trying to get in at the exact top, but we don’t want to jump into a slightly bearish trade right before the market bounces. In the image below, you can see the more overbought days in the entry window when RSI(4) came up to around 70. Simply avoiding trade entry on a day when RSI(4) was under 50 would have helped with timing.

3. Cast your line and get some protection

Once you’ve decided that the market is short-term overbought, it’s time to place the trade. I like to position my short strikes 10-20 points below the money. My general market opinion influences how close to the money I place the short. If I’m more bullish, I’ll keep the short closer to the money. If I’m more bearish, I position the Butterfly further away. That being said, a slight difference in the initial short strike won’t make or break the trade . . . your adjustments will.

After the Butterfly is purchased, I buy a long $IWM call to hedge the upside delta. The ratio I use is 1 $IWM call to 1 $RUT Butterfly. I’m comfortable leaning a little short delta when the trade begins, but I don’t like being heavily short delta.

Beware!

While the steps above will certainly get you into a trade, they will not guarantee a successful trade. Butterflies usually have a narrower probability window than Iron Condors and, consequently, require more trade management.

In other words, you need to have a plan for managing your Butterfly after the trade is placed. If you don’t have a plan for managing the trade prior to entry, you’re asking for trouble.

Let me know in the comments below if you want to hear more about managing an income Butterfly once the trade is open.

One last thing: The rules above are great in theory, but the real challenge is trading the position. I traded the March expiration with a starting strike of 1160 (very poor initial positioning).

This article talks about my March 2015 expiration trade and the adjustments I made.