Weekend Trend Following Market Commentary 7/25/2014

Big Picture:

For those of you who are used to seeing the Market Commentary show up on Saturday mornings, I had to switch it to Sunday this week. Yesterday I was on a really great mountain bike ride close to where I live and that took up the entire day (the ride itself took a bit over 8 hours). The picture here is a view from the ride. Because I’m a little technologically impaired when it comes to cameras, the picture is a little blurry but you get the idea.

For those of you who are used to seeing the Market Commentary show up on Saturday mornings, I had to switch it to Sunday this week. Yesterday I was on a really great mountain bike ride close to where I live and that took up the entire day (the ride itself took a bit over 8 hours). The picture here is a view from the ride. Because I’m a little technologically impaired when it comes to cameras, the picture is a little blurry but you get the idea.

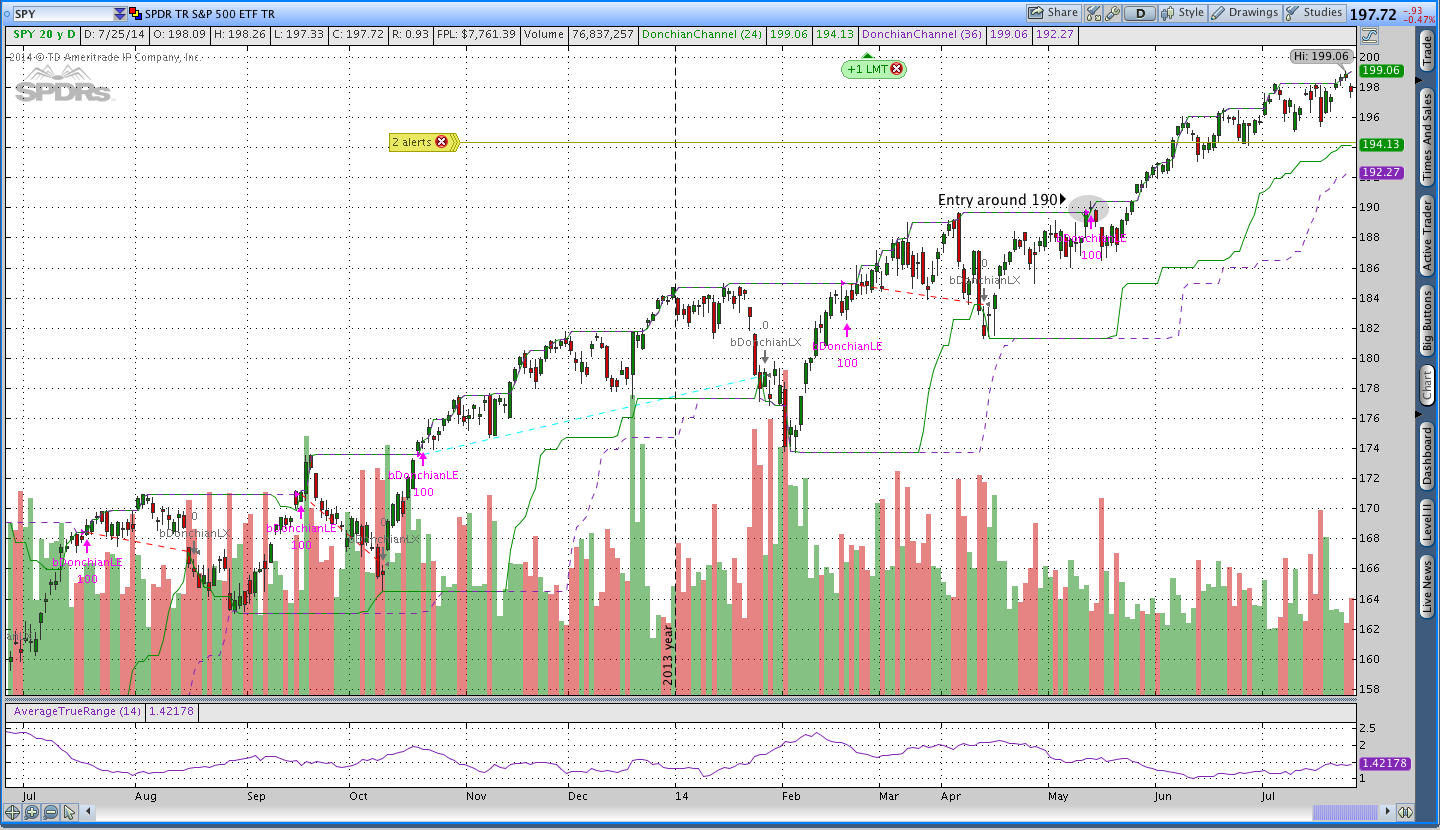

Back to the markets . . . This was a fairly uneventful week for the S&P 500. The market pushed to new highs only to get sold off and end the week unchanged. It seems like the willingness to buy is decreasing, but price looks more neutral than bearish to me. Bonds had a strong week and moved up to new highs for the year. Note that TLT is now up over 15% year to date and that’s price only (not including dividends).

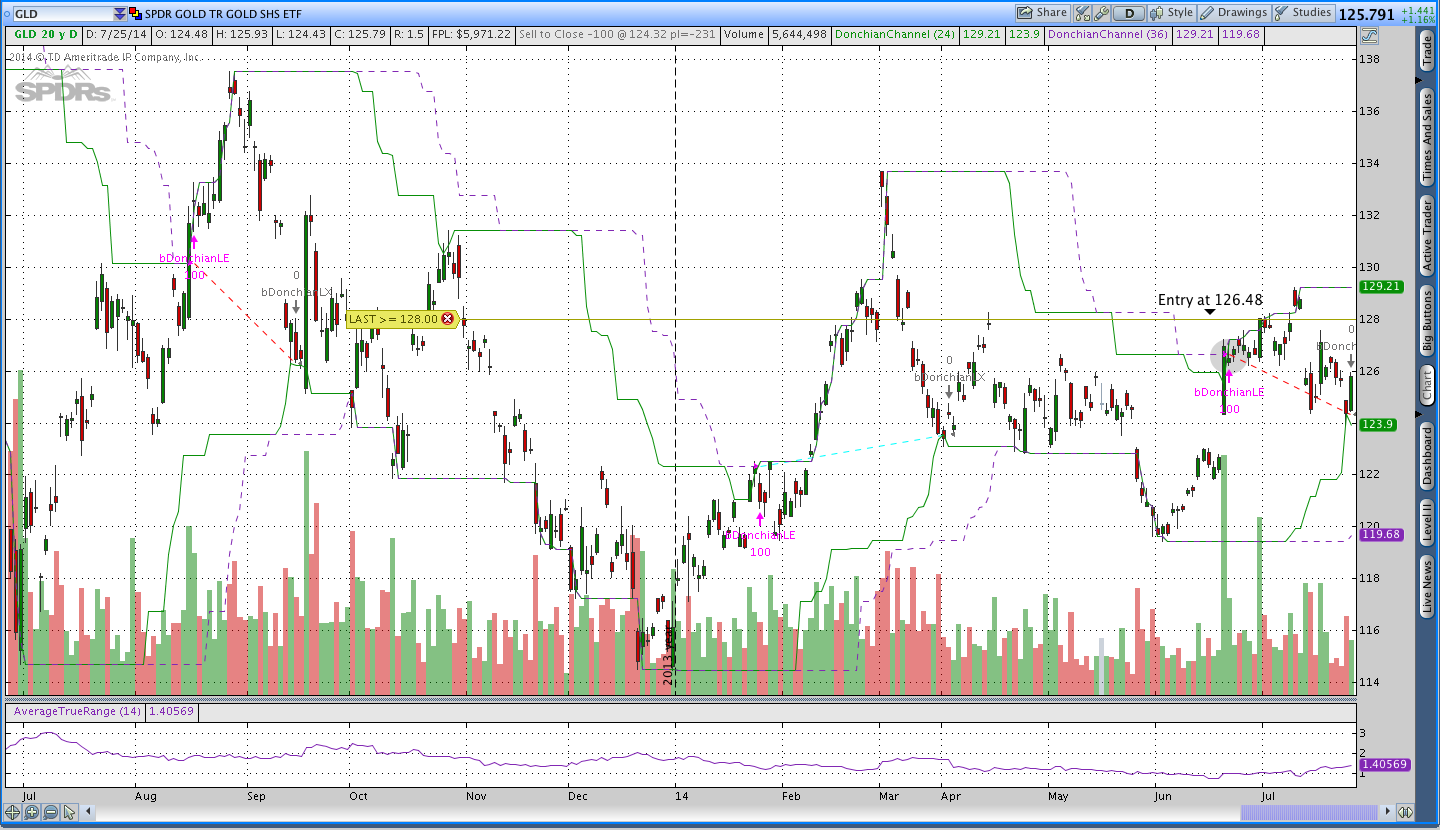

Gold sold off earlier in the week and took out the long breakout trade only to reverse on Friday. While that’s always a little frustrating, it’s just the way it works sometimes. There are quite a few situations where price doesn’t reverse and continues lower, but trying to predict what will/should happen is not how I trade.

Implied Volatility:

The VIX ticked up a little bit this week despite the unchanged market. Interestingly, the RVX was down a bit with the RUT. We didn’t really see a significant move in IV this week, but the increase in the VIX without a significant change in price is worth keeping in mind.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

Stocks ($SPY and $SPX – S&P 500):

The S&P 500 made a move higher early in the week and found sellers at the new highs. What we saw this week is a slowing in the rate of advance rather than a reason to get bearish. The market did violate a previous intraday higher low around 1981 and that’s a reason for a little bit of caution this week. If SPX gets back above the 1981 level, we could potentially see new highs.

There was not a valid signal for the Weekly Theta system this week because price was extended beyond the standard deviation offset, meaning the market was a little too extended to take a trade. If I had sold a vertical spread on Thursday morning, it would have been either stopped out or taking heat on Friday when the market moved from the high 1980’s to 1975. Moves against weekly vertical spreads shortly after opening the positions can create problems quickly.

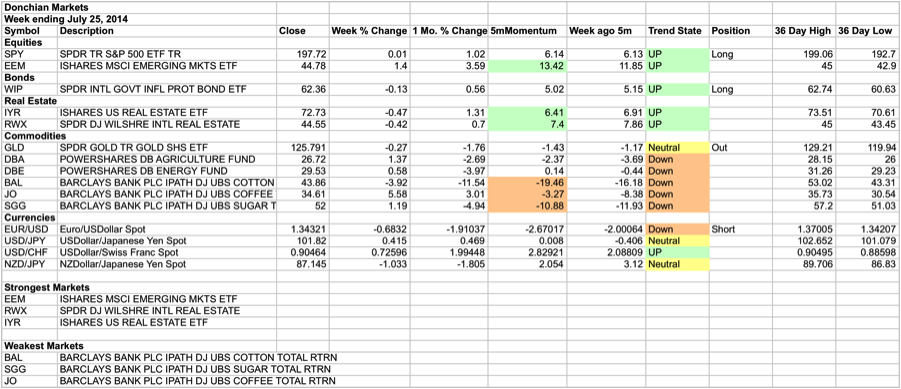

Breakout System Market Stats:

The three strongest and weakest markets remained the same this week with Emerging Markets (EEM) becoming stronger than last week. Despite being in the bottom 3, Coffee is now nearing the 36 day channel high and a new long trade might be triggered sometime soon. The general theme right now is that Real Estate and Equities are strong while Commodities are weak and the Dollar is fairly neutral.

The three strongest and weakest markets remained the same this week with Emerging Markets (EEM) becoming stronger than last week. Despite being in the bottom 3, Coffee is now nearing the 36 day channel high and a new long trade might be triggered sometime soon. The general theme right now is that Real Estate and Equities are strong while Commodities are weak and the Dollar is fairly neutral.

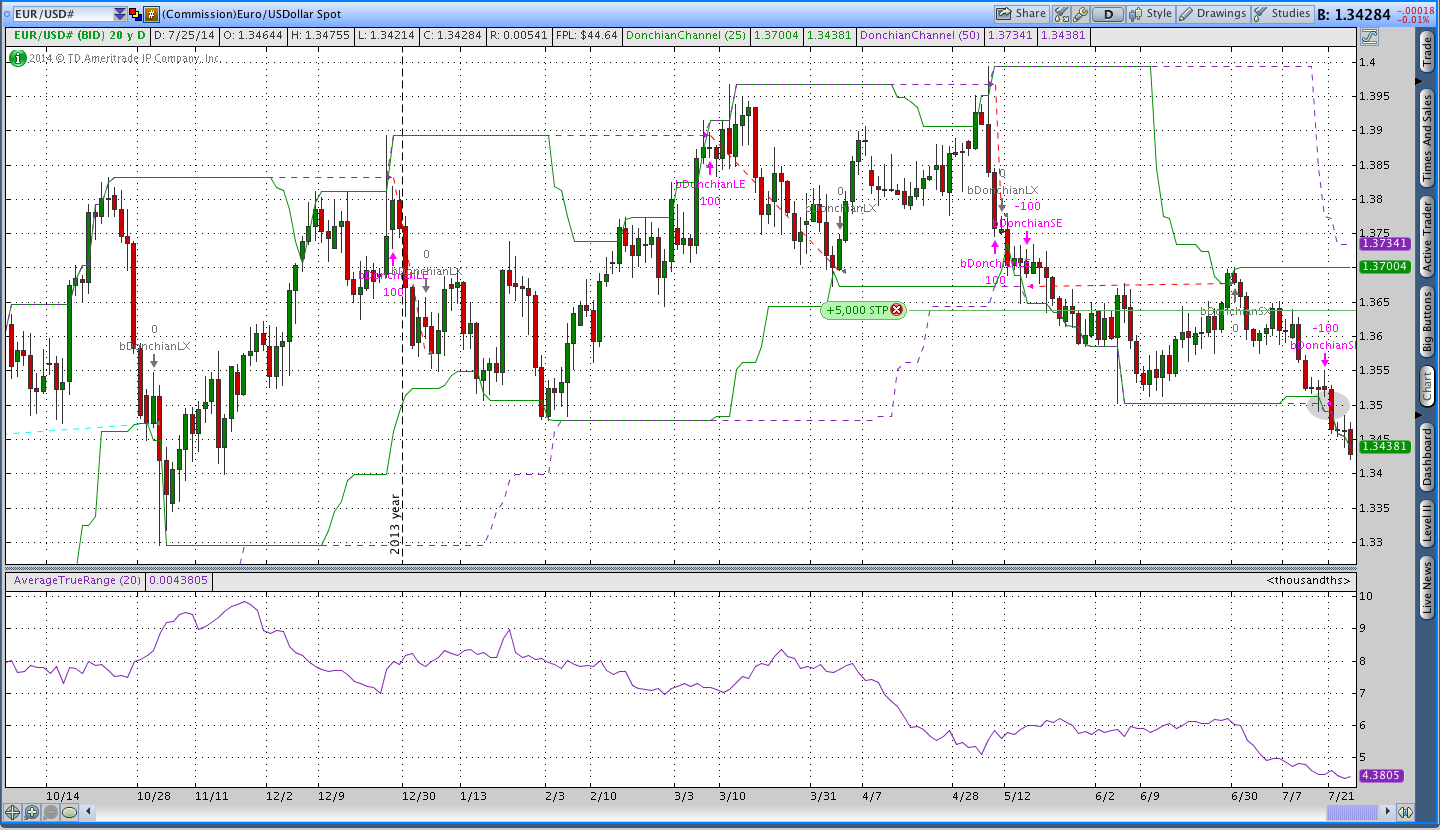

On Friday there was a new long breakout in USD/CHF and I’ll be taking a long trade sometime soon. Currencies have been horrible for the breakout system this year and it has been a while since there has been a good trend so I’m hoping something develops soon. I have a short position in EUR/USD that has been moving in my favor and that’s good. USD/CHF and EUR/USD seem to be fairly correlated and it’s not uncommon to have a short EUR trade at the same time as a short Swiss Franc trade. Note that being long USD/CHF is the same thing as being short the Swiss Franc.

Trades This Week:

GLD – Sold to close 33 shares at 124.19

SPX – Sold to open a Sep 2014 1795/1805/2055/2065 Iron Condor for 1.50

SPY – Bought to close Aug 2014 173 Put at .10

Option Inventory:

SPY – Short Sep 2014 178 Put (sold for .65)

SPX – Short Sep 2014 1795/1805/2055/2065 Iron Condor (sold for 1.50)

ETF & Forex Inventory:

SPY – Long 12 shares from 188.58

WIP – Long 100 shares from 61.66

EUR/USD – Short 5,000 notional units from 1.35028

Looking ahead:

Coffee is getting close to making a new 36 day high and that would signal a new long trade. The Swiss Franc broke out on Friday and I’m going to be taking a long position. I’ll be taking a look at the Weekly Theta system again this week to see if there is a valid trade. This week was a good reminder of why the SD offset was incorporated because the selling on Friday would have put a weekly trade under pressure.

If you enjoyed this post, please click above to like it on Facebook or Tweet it out. As always, thanks for reading and enjoy the rest of your weekend.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading and trend following.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.