Weekend Market Commentary 1/24/14 – Stocks, Bonds, Gold ($SPY, $IWM, $QQQ, $TLT, $GLD)

Big Picture:

Before we get into the market commentary, let me just say that I love McDonald’s. Not the stock, the institution. I’m away from home this weekend and have been struggling all morning to find reliable internet. The search for reliable internet at 5:30 am on a Saturday led me to McDonalds. Now I realize the food is a little off the healthy path, etc, etc, but this isn’t the first time I’ve been able to rely on McDonalds for internet. Over Thanksgiving I found myself in a similar predicament, spent about 30 minutes driving around Moab, UT in the dark, and, ultimately, landed at McDonalds. One of the great things about franchises is consistency in the food, but I’d venture to say there’s a lot to be said for consistency in the experience as well. Thanks $MCD.

Before we get into the market commentary, let me just say that I love McDonald’s. Not the stock, the institution. I’m away from home this weekend and have been struggling all morning to find reliable internet. The search for reliable internet at 5:30 am on a Saturday led me to McDonalds. Now I realize the food is a little off the healthy path, etc, etc, but this isn’t the first time I’ve been able to rely on McDonalds for internet. Over Thanksgiving I found myself in a similar predicament, spent about 30 minutes driving around Moab, UT in the dark, and, ultimately, landed at McDonalds. One of the great things about franchises is consistency in the food, but I’d venture to say there’s a lot to be said for consistency in the experience as well. Thanks $MCD.

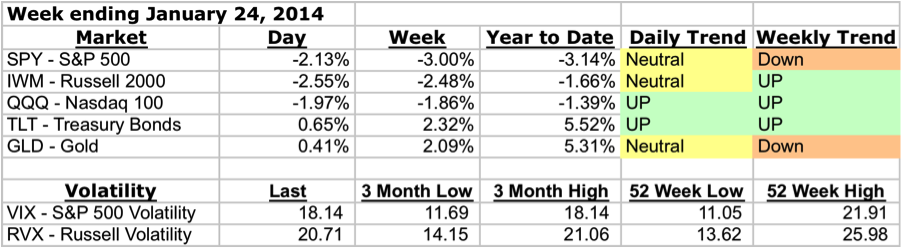

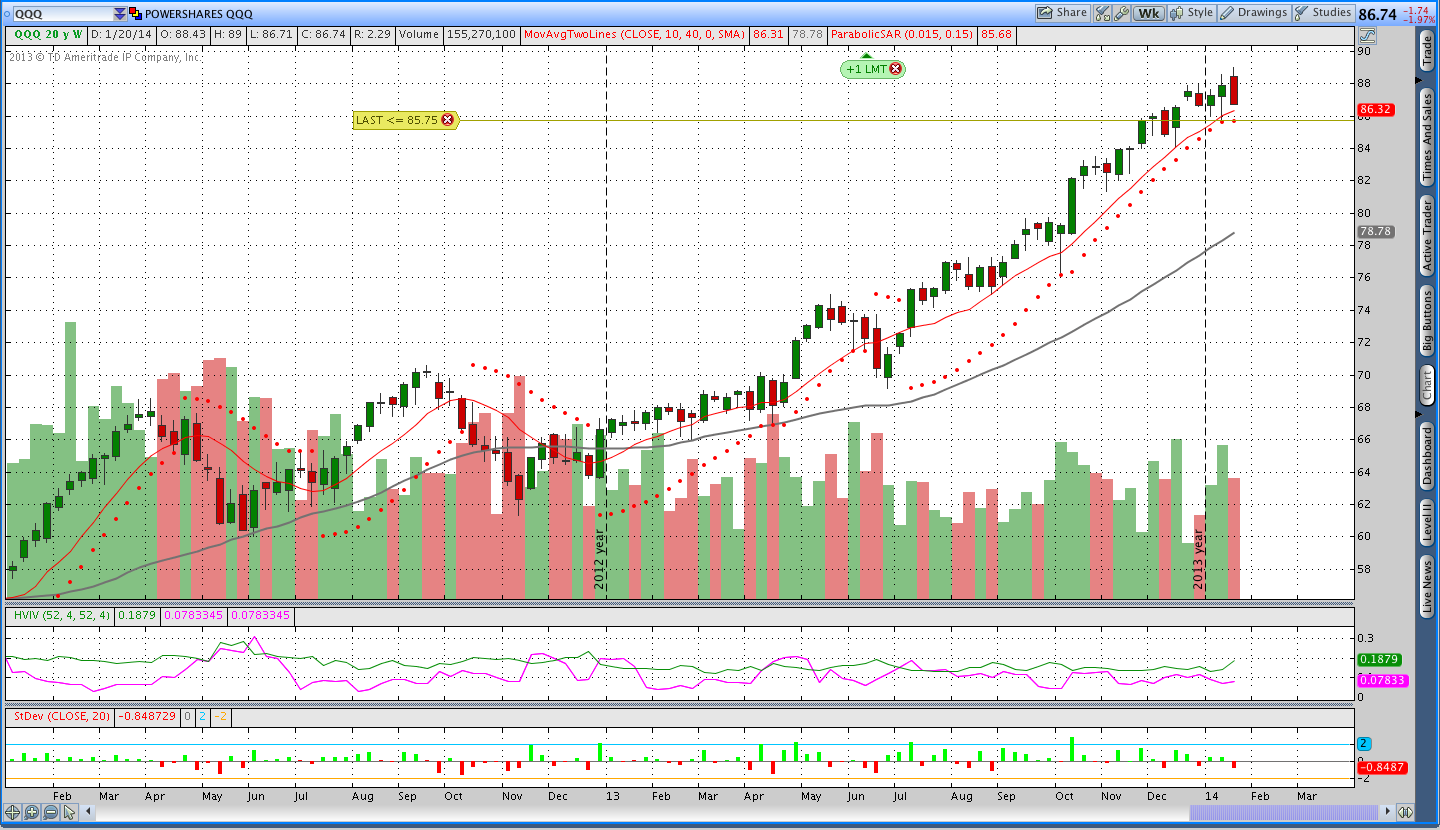

Todays commentary will be a little brief because of the whole quest for internet while away from home situation. For a couple of weeks I’ve been talking about a shift in trend that might be taking place. Right now I think we’re seeing a correction in several markets and a slowing in trend. I woke up Friday morning to orders saying my Yen trades were closed and also noticed equity futures were down. Friday was the first “real” down day we’ve had in stocks in a while and they were broadly weaker all day. Treasury Bonds rallied and Gold was strong as well. Overall, markets look correlated and the trends are taking a breather. Check out the year to date stats for $TLT and $GLD below, very impressive.

The Weekly Stats:

A note about trend . . . Trend on the daily timeframe is defined using Donchian channels and an Average True Range Trailing Stop. There are three trend states on the Daily timeframe: up, neutral, and down. On the weekly timeframe, I’m looking at Parabolic SAR to define trend and there are two trend states, up and down. In reality, there are always periods of chop and I’m using the indicator to capture the general bias of both the trend and those periods of chop.

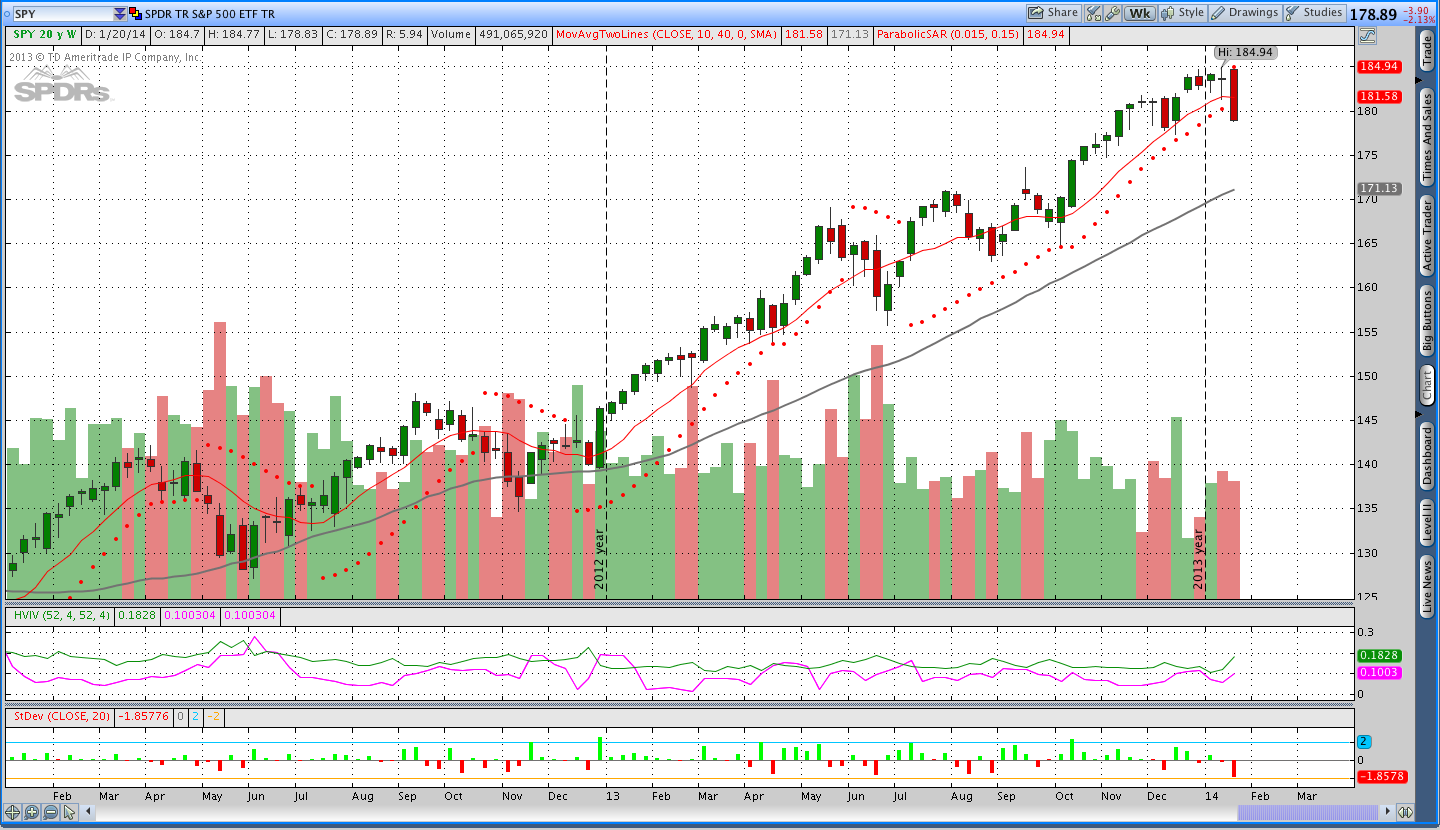

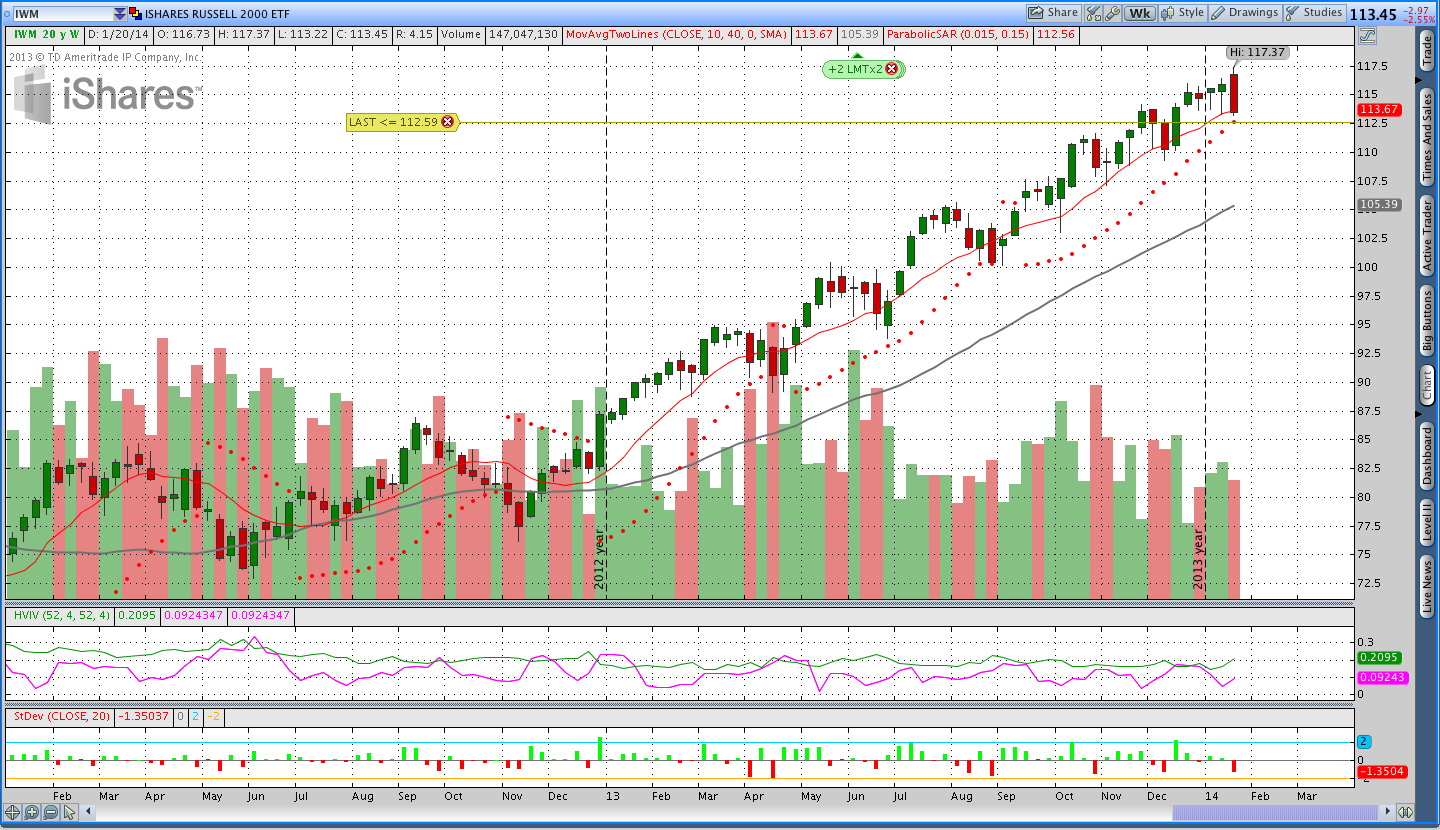

Stocks ($SPY – SPDR S&P 500 ETF and $IWM – iShares Russell 2000 Index ETF):

Stocks ended the week on a down note. The shakeout hit the pTheta trailing stop in the S&P and I closed the naked put on Friday. The Russell 2000 and Nasdaq are both stronger than the S&P, but that doesn’t mean their stop levels can’t be hit next week. ATM implied volatility exploded higher on Friday. I guess people get spooked when stocks go down and there was a run on long premium.

Gold ($GLD – SPDR Gold Shares ETF):

Gold continued the march higher this week. The longer term trend is still down, but we did see strength. The weekly volume has been declining as Gold has rallied, but price this week suggested more strength than weakness. Ultimately, price is all that matters.

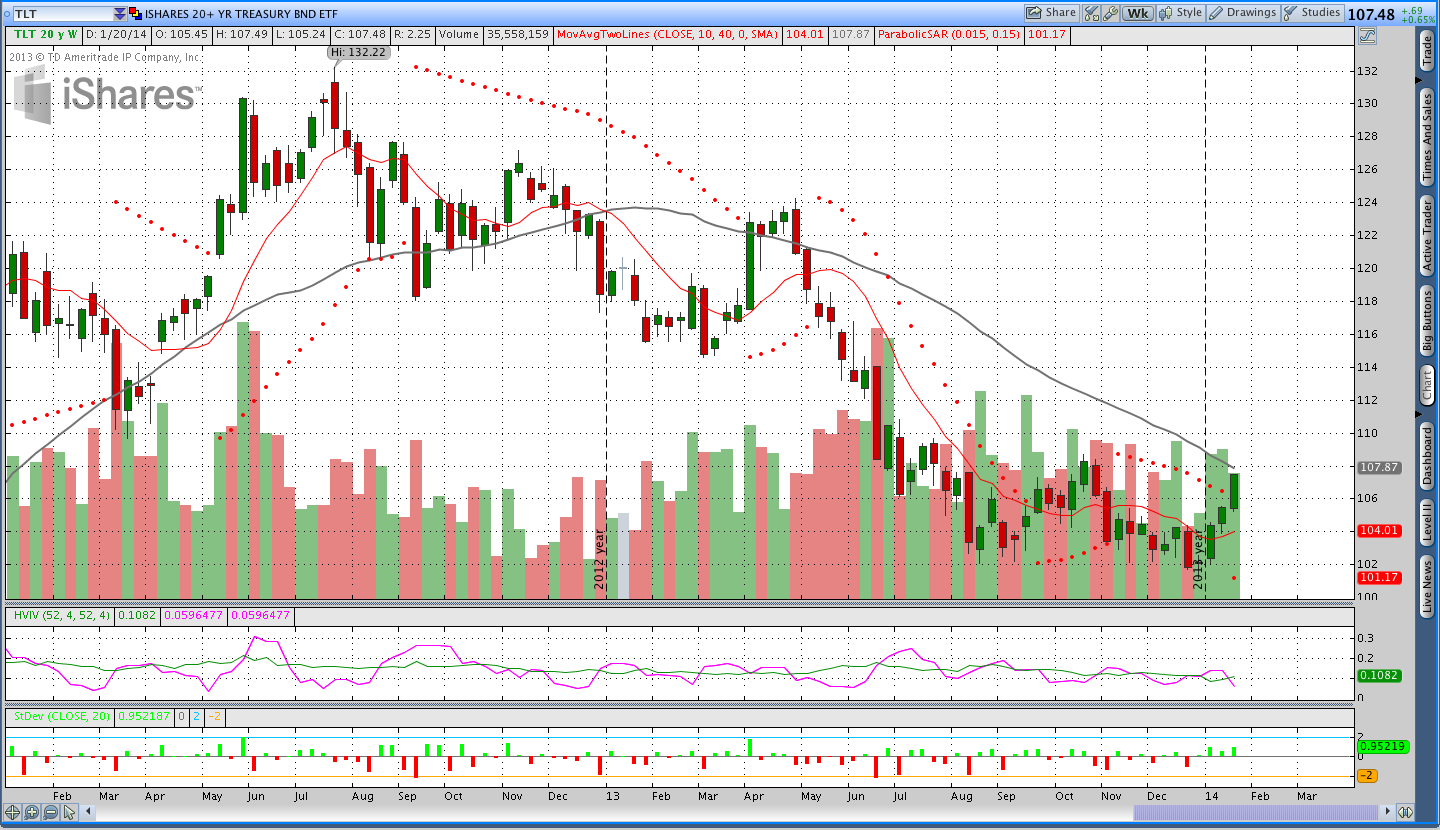

Bonds ($TLT – iShares Barclays 20+ Year Treasury Bond ETF):

My short Bond trades are now closed. A rally has seemed possible for a couple of weeks now and this week we saw some good follow through.

Trades This Week:

GDXJ – Sold a naked March 31 Put for .50

SPY – Closed the April 162 Put for 1.12

TLT – Closed the naked April 109 Call for .66

GLD – Sold a naked April 133 Call for .50

USD/JPY – Sold to close

NZD/JPY – Sold to close

Option Inventory:

IWM – Short March 2014 94 Put (sold for .70)

GLD – Short March 2014 139 Call (sold for .53)

GLD – Short April 2014 133 Call (sold for .50)

GDXJ – Short March 2014 31 Put (sold for .50)

QQQ – Short April 2014 79 Put (sold for .53)

IWM – Short April 2014 101/126 Strangle (sold for 1.07)

ETF & Forex Inventory:

BAL (Cotton) – Long 50 shares from 53.19

JO (Coffee) – Long 58 shares from 23.38

Looking ahead:

Next week stocks have the potential for more downside, but the Nasdaq and Russell 2000 are stronger than the S&P. The S&P has broken some short term support on the daily timeframe, and a rally back into that level wouldn’t surprise me. I’m specifically talking about the 182ish level in $SPY. Bonds and Gold look short term overextended and will need to constructively deal with their gains if they’re going to continue moving up.

I may take a new trade in $TLT if I can find a put that I want to sell. The challenge with selling puts in $TLT right now is that implied volatility is low and price is extended. As a result, short puts have the potential to come under pressure quickly if there is a short term reversal and nobody likes heat. Have a great weekend.