Weekend Market Commentary 12/31/2015 – $RUT, $RVX

Big Picture:

Surely the markets are happy to be done with 2015.

Surely the markets are happy to be done with 2015.

On Thursday we wrapped up the last minutes of trading for the year with a little sell-off. What a gift, Santa remembered the bears! 2015 was very unkind to quite a few Hedge Funds and investors who chose to seek yield in risky asset classes. At the same time, turning the page on the calendar does not change the general environment we’re in.

Right now there are two major themes of commentary about the US economy and the markets. The first camp says that unemployment is low, things are going okay, and it’s time to raise rates because the markets can take it. Note that the Fed sitting around thinking about the markets at all should evoke a sense of horror in you, but that’s a conversation for another time. The second camp effectively says the first camp is lying and everything is awful. Who’s right? Time will tell.

Despite being relatively bearish by nature, I try to find reasons for optimism. The US is a great country and it’s full of creative, resourceful people. Those who are able to recognize shifts in themes and trends should be just fine. Those who don’t are going to have a rougher path. I spend a lot of time thinking about the labor market as it relates to people I know. The period where people could go to school for a degree and then get a nice middle class job are over. I very reluctantly work as a Tax CPA and I can assure you that the clients with money are not punching the clock at a cozy, middle class “nine to five.”

A couple of interesting labor market themes are playing out. In the late 90’s and early 2000’s we began to see this trend of outsourcing. That trend continues today where simple work is being moved offshore. From an Economics standpoint, outsourcing is rational and makes sense. Those who can produce an identical good or service more cheaply have a competitive advantage and should produce it. What we’re seeing now is a continuation and acceleration of outsourcing and people are responding in one of three ways:

- Some choose to pursue the “proven” path and hope their college degree will translate into a middle class job. These people are doomed to failure. The middle class is disappearing rapidly and many college degrees are no longer good investments. Private schools with astronomical tuition are even worse.

- Another group is realizing the shift and pursuing skill based trades and professional work. This includes everything from Plumbers to Engineers and Accountants. My belief is that over time the people choosing the proven path will shift their energy to the skill based trades resulting in reduced wages and a surplus of labor. While skill based trades still have value, knowing a trade is really just the illusion of security. Most products and services are commodities masquerading as unique offerings. As more people offer commodities and the supply increases, the value will decrease. Don’t believe me? Look at what’s happening with online bookkeeping companies.

- The third group of people recognizes that the system has changed. It’s not broken, it has simply changed. Nobody owes anyone a middle class job for taking on a bunch of college debt and the promises told to the younger generations are becoming lies pretty quickly. The only way to truly create security is to acquire income producing assets. For people born without assets this usually translates into entrepreneurial endeavors. This group of people has the potential to become the new middle class.

The reason we care about the labor market is that it’s deeply related to consumption and consumption keeps the country afloat. We’re addicted to debt in the US and that debt has been artificially inflating our consumption for quite some time. As a result, we don’t even know what we’re really capable of consuming. We just borrow, borrow more, and defer payment as long as possible. The problem is that debt needs to be repaid at some point and that requires income. If the labor market participants struggle to create income, the potential for major problems exists. The alternative to repayment is default.

Debt is the quiet (maybe even silent) bubble right now for both the US and individuals. When you’re in a bubble market nobody likes to believe there’s a bubble. The participants want to believe the music will go on and on, but eventually the music stops. When the music stops, there are usually fewer chairs than anyone ever expected. For the time being, the market has shrugged off a lot of the structural problems that exist. Easy money has allowed the market to move higher for several years and the real question is what happens now.

As we move into 2016, it’s important to keep in mind that the market doesn’t have a clearly defined direction at the moment. The market is trapped in an area of balance and that means price is moving around about a mean. Price tends to revert to the mean over time and, at the same time, the mean changes. Right now we see a sideways market trapped below recent high levels. Sure, sitting below recent highs is a little Bearish, but the market really has not shown us where it wants to go yet.

While I’m always tooting the bear horn, it’s good to recognize the possibility that price does have the potential to move higher. As I’ve indicated in the charts below, RUT is trapped between 1100 and 1200. If the market attempts to break through the lower level and fails, a move to the other end of the range is possible and even likely.

The last couple weeks of every year are fairly quiet and this year was no exception. As we move into the new year we need to be ready for volume to pick back up and for backed up orders to flow in and move the market. We don’t know where the market will go. We just need to be aware that it has the potential to move.

Remember all that fundamental stuff above? Understand it and then promptly forget it. Be agnostic about market direction and focus on reacting to changes in price and volatility. What happens next is anyone’s guess.

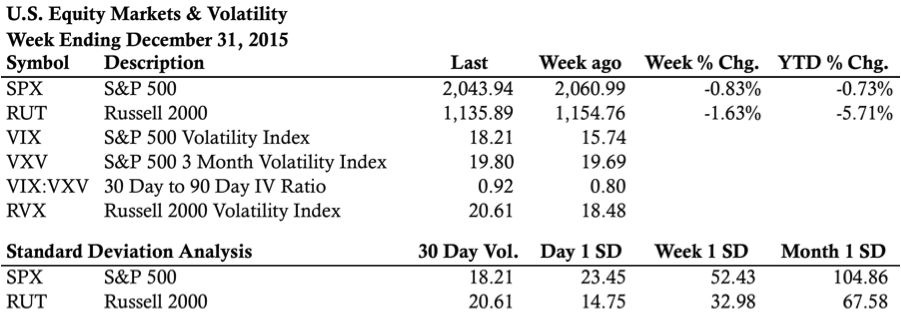

Market Stats:

Levels of Interest:

In the levels of interest section, we’re drilling down through some timeframes to see what’s happening in the markets. The analysis begins on a weekly chart, moves to a daily chart, and finishes with the intraday, 65 minute chart of the Russell 2000 ($RUT). Multiple timeframes from a high level create context for what’s happening in the market.

Live Trades . . .

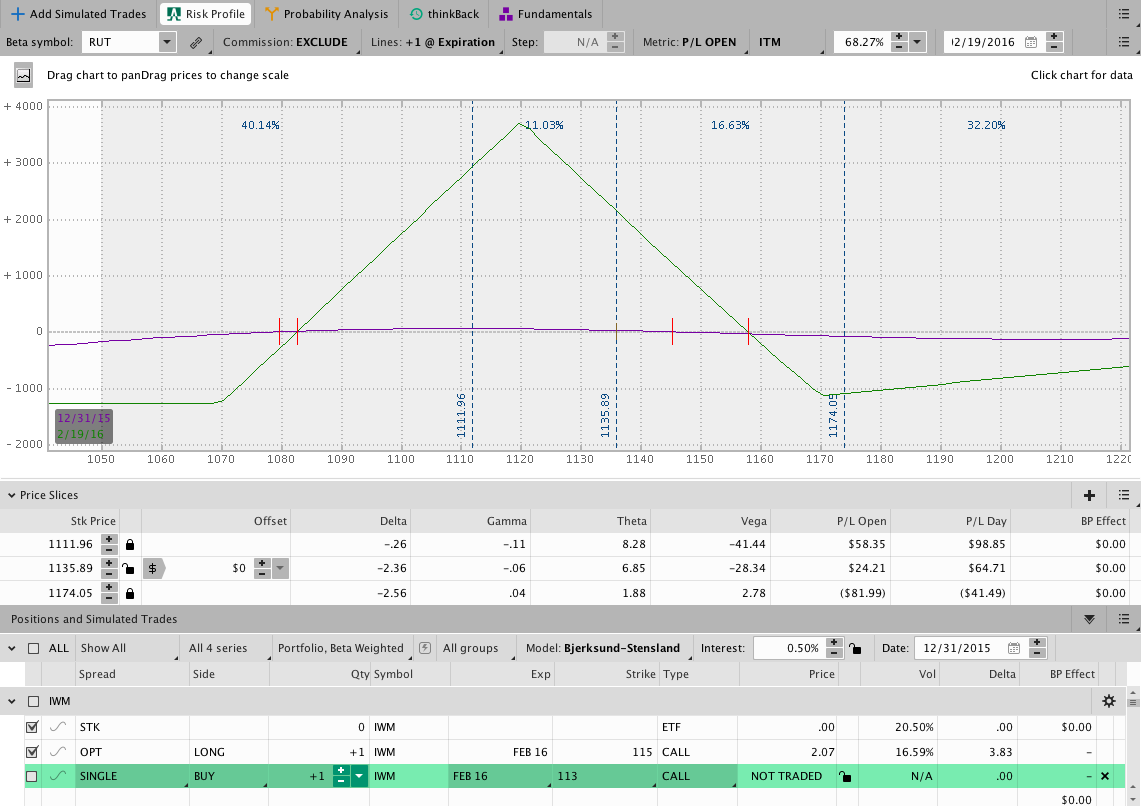

The “Live Trades” section of the commentary focuses on actual trades that are in the Theta Trend account. The positions are provided for educational purposes only.

——————————

There’s not much to say about my open trades at the moment. Earlier this week it looked like the CIB might need an upside adjustment (as discussed here), but we never hit the level and price sold off. The T+Zero line is starting to rise, which is always a good thing. If we head higher, I’ll adjust. If we don’t, I won’t. Simple. Done.

The Results Spreadsheet is updated and shows the open positions. Note that there are two tabs in that spreadsheet now showing both 2015 and 2016 results and trades. All of the trades mentioned are actual trades that I’ve taken. There are no paper trades or fuzzy fills, they’re all real.

Click here to learn about the Premium Course that covers the CIB Trade in Detail

Looking ahead, etc.:

Happy New Year and thanks for following ThetaTrend in 2015. As we move into 2016 I’m going to focus on keeping on keeping on. The markets are a big riddle and I’ll just be reacting. This week should be a little more exciting as people return from the holidays and I’ll focus on keeping an open mind to whatever plays out. See you next weekend and thanks for reading.

Let me know if you have an interest in Coaching or more personalized help with your income trading. I have a few ideas in mind, but it’s always better to hear what you’re thinking. Send an email to info[at]thetatrend.com if you’re interested.

Thanks for a great year and for following ThetaTrend!

Please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.