Weekend Market Commentary 12/18/15 – $RUT, $RVX, $SPX

Big Picture:

Who’s ready to build a case for a bullish move next week?!

Who’s ready to build a case for a bullish move next week?!

I’m sure that when you came over to read the weekend commentary you were expecting some sort of downer, the world is going to end, and RUT is heading to zero sort of pitch. Even though I’d love to build that case and I always think it’s possible, this week I’m not so sure.

Here’s the deal. The market was off this past week just a little bit while implied volatility came in. The lesson there is that the market was probably nervous going into the Fed announcement and premium was a little rich. Obviously that’s not extremely surprising, but it happened. Note – It’s troubling that a Quasi-Governmental agency has as much control over the markets as it does, but that’s not the point today.

After the announcement was released, the market sold off for a couple of days, but the moves seemed somewhat controlled and the market didn’t violate any major technical levels on the daily or weekly timeframes. On Friday, I half expect the market to reverse and head higher, but it never happened. Since the next two weeks are holidays, the volume will be low and the potential for exaggerated moves increases.

My conspiracy theory is that the Plunge Protection Team steps in this week and next to push the S&P to flat or green on the year. Will it happen? Who knows, but it’s certainly possible with the S&P less than 3% percent below zero for the year. The Russell has a little further to travel to get back to flat and I think we’ll see RUT end the year with a negative return.

Moving beyond my two week prediction, the markets look unhealthy with the RUT showing a significant amount of weakness. If you looked at an inverted chart of the RUT, it might look like a buying opportunity. As the chart sits, it looks more like an opportunity to be flat or short. My outlook for 2016 hasn’t changed and the only reason I’m worried about that opinion is that others have it as well.

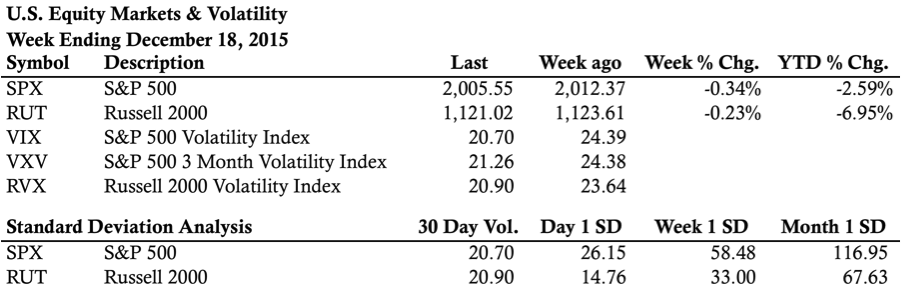

Market Stats:

Levels of Interest:

In the levels of interest section, we’re drilling down through some timeframes to see what’s happening in the markets. The analysis begins on a weekly chart, moves to a daily chart, and finishes with the intraday, 65 minute chart of the Russell 2000 ($RUT). Multiple timeframes from a high level create context for what’s happening in the market.

Live Trades . . .

The “Live Trades” section of the commentary focuses on actual trades that are in the Theta Trend account. The positions are provided for educational purposes only.

—————————–

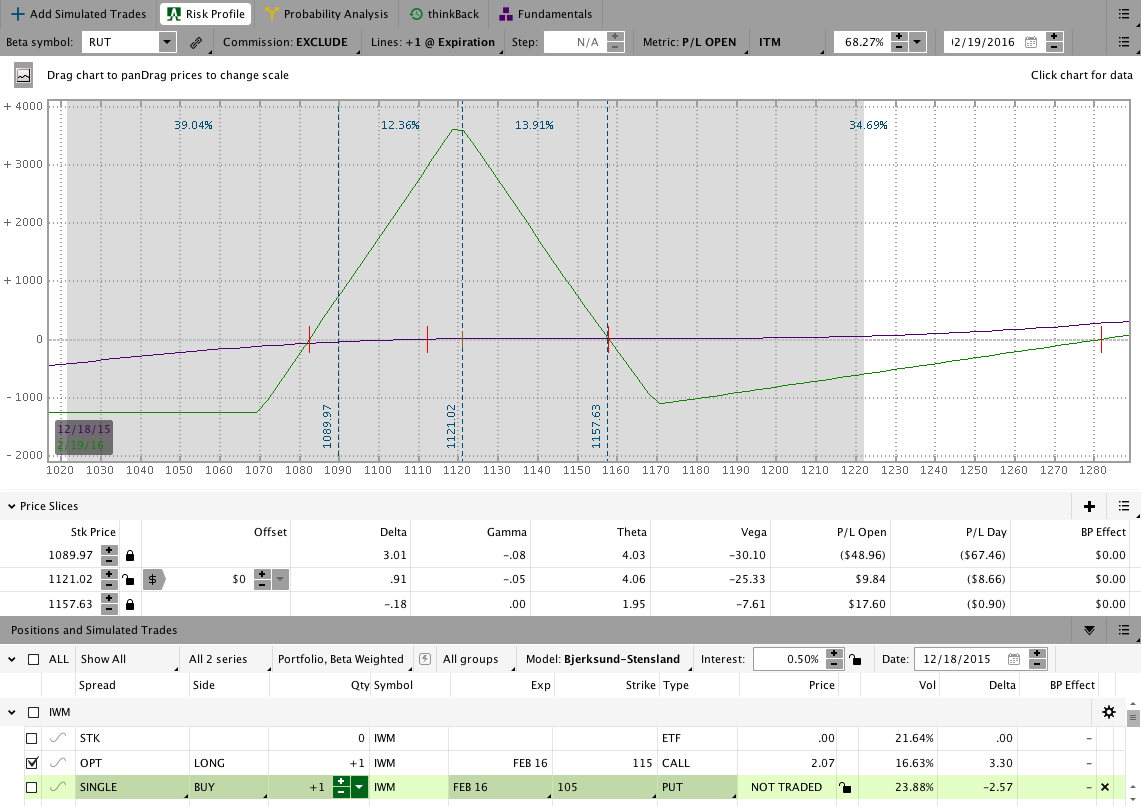

This week I opened the February CIB, which means the trade was started a little earlier than usual. For now there isn’t anything to say about the position other than it’s open and an image of the risk graph is shown below.

I also sold a short RUT put spread using March 2016 options and I’ll be monitoring that based on Parabolic SAR on the weekly chart (see the charts above).

I’ll update the results sheet sometime in the next couple of days. Here’s a picture of the position in the meantime.

Click here to learn about the Premium Course that covers the CIB Trade in Detail

Looking ahead, etc.:

I’m in the February trade now, which should be my first closed trade in 2016. The capital I have at work is small and that’s okay with me. 2015 has been a good trading year for me and I’ve been able to push through a lot of fears. I suspect we’ll talk about touchy feely stuff like emotions next week. Until then . . . enjoy the rest of the weekend!

Please share this post if you enjoyed it.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.