Should We Have Options Trading Goals or a Quest?

When I first started trading back in the late 1990’s, I thought trading would be an awesome way to make money. After a failed attempt at day-trading (using a dial up modem baby!), I thought I would become a overnight options superstar. I must have thought I was going to swing around my big stick and knock hundred dollar bills out of the air. Funny . . . it didn’t quite work out that way.

I’ve been watching markets and trading on and off since that time, but it’s largely through writing this blog and connecting with other traders that I’ve been able to find a style of trading that I believe fits with my personality and is sustainable. Hey, it only took a touch over a decade!

Over the years, I have experimented with a wide range of trading styles and strategies including everything from scalping Futures and Forex to Trend Following to Momentum Trading with countless diversions into Options Trading. In the past year or so, as evidenced by the conversation on the blog, I’ve become heavily focused on a relatively non-directional Butterfly Options Strategy (the CIB).

Now, I don’t want to give you the impression that I think I’ve found the holy grail or developed some supernatural power to stop the rotation of the earth, but finding a trade or set of trades is essential for long term success. At some point you need to decide what is or is not working for you in trading and then focus the majority of your energy on what works. Yes, I am advocating specialization rather than diversification and my reason for that is based on my objective.

My biggest challenge in trading has been adhering to a set of rules over a long enough period of time for them to work. I don’t have a problem keeping my risk down (if anything it’s too low) or taking big losses. My biggest challenge is that I love studying the market and finding news ways of trading. At some point, I realized what I was doing and decided I needed to stop that and focus if my goal is to trade for a living.

I spend a good amount of time in my head and lately I’ve been thinking about a quest. My quest has always been something about wanting trade for a living. The obvious question is why. Reaching that level suggests I’ve been able to elevate my trading to a very high level that few people reach. That level necessarily requires an effective emotional framework and commitment to operating at a high level while always pushing for improvement.

Trading is one of the most emotionally challenging activities that you can engage in and, consequently, one of the most OR least rewarding. Trading for a living symbolizes security, freedom, and self-efficacy.

Great, so how do you get there?

With an objective in mind, we can do some math that gives us an idea of how we get there. A reasonably consistent options trading system and trader might aim to make 20-30% a year. That figure is based on a monthly return of 2-4% on capital with around 10 winning months a year. The one or two losing months must also be around 2-4% for the math to work. Suppose we have the ability to earn around 20% a year trading options. It won’t be easy, but it is possible and possible without taking excessive risk.

Based on a 20% return, we’d need $200,000 to earn around $40k per year or $300,000 to earn $60k. For now we’re ignoring taxes as well. If we could earn 30% per year, trading a $200k-$300k account becomes a little more reasonable. Regardless of the exact number, let’s say $200k is the capital number we need to be around. If nothing else, 20% return on $200k is $40k and would be a good supplemental income.

The next problem is getting to the capital number. I personally don’t have $200k-$300k sitting around in a taxable account and my guess is that many aspiring traders don’t either. Bummer, that means I’m going to need to figure out how to earn it by compounding, saving, or some combination of the two.

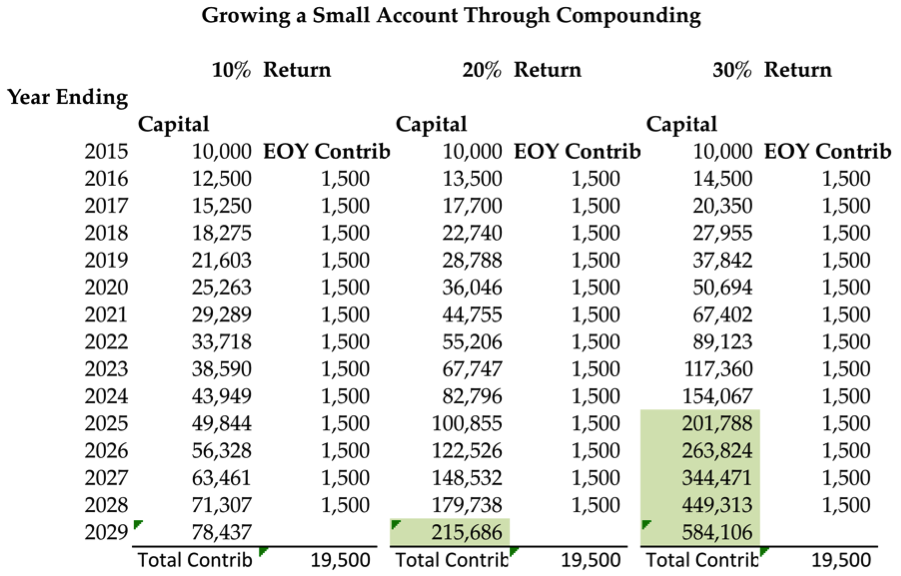

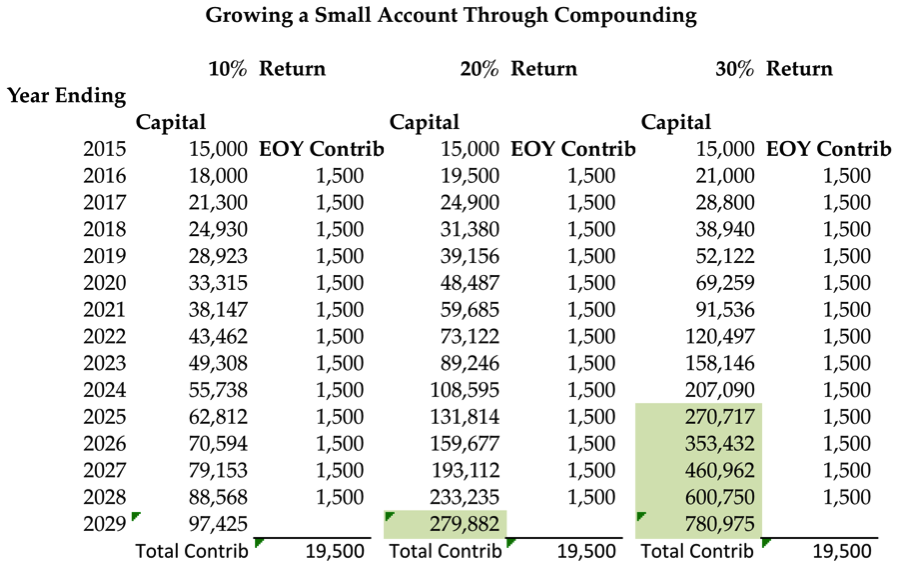

The tables below present a few scenarios for compounding and saving to grow a small, $10,000 or $15,000 account through options trading. Both images also include a small, $1,500 contribution at the end of every year.

Compounding scenarios beginning with $10,000:

Compounding scenarios beginning with $15,000:

What it means:

After looking through the tables above, it might be easy to get discouraged. We’re talking about taking a relatively small sum of money and attempting to make it big enough to matter. The reality is that there is no easy, overnight way to do that without taking excessive risk.

In other words, we can certainly take a small account and grow it through options trading into a large enough sum that it could be used to trade for a living, BUT it won’t happen tomorrow. Okay, now I know. I intuitively knew that was probably true before running the numbers, but it was good to do some math around it.

What the math really means is that if I start now, with a relatively small account, compound regularly, and contribute what I can along the way, I have the potential to earn a full time living from trading at some point in the future (10-15 years from now). If I contribute or earn more, it will happen sooner.

Assumptions:

While talking about compounding, math, and hypothetical returns is great, there are some major assumptions behind those numbers. The reality is that without a deliberate plan and trading system, I (and you) will never reach that level. The numbers we’re looking at above are the long game. There is no short game in options income trading with overnight riches unless there is also excessive risk and that’s not my style.

My goal in trading has always been to develop a style of trading that is scalable and consistent. I’m not a fan of huge equity swings, which is why options income trading is very appealing to me.

Fear of failure and why goals are bullshit:

One of the first things I asked myself after running the numbers is what happens if I don’t make it. Yeah, I have a little fear at times. Rather than think about “not making it,” I’m going to think about the more cheery question of what is the absolute worst possible outcome. In my mind, the worst possible outcome is that I don’t achieve my goal of trading for a living. Fortunately, not reaching my goal is something I can’t control so it’s not worth worrying about.

Worrying about not reaching goals is a way of letting fear creep in and focusing on an end that can’t be controlled. Sitting around focusing on the goal will not bring it about; developing, following, and improving a good process will. Goals are achieved by developing good processes that are sustainable and consistently followed.

In trading, good processes have positive expectancy and fit with your personality. Goals are reached as a side effect of a good process, but we’re often told that we need to focus on goals. That’s bullshit. Developing a good process might lead to the goal we want and, if it doesn’t, the result is likely to be another positive outcome we didn’t expect.

——————————————

Final Note: Over the years, writing this blog has been immensely helpful and improved my trading. However, I’ve also learned a lot about trading from some good friends that I’ve made online (mainly The Lazy Trader, Jonathan Lien of Create Monthly Income Fund, and Aram of Trade With Aram). All of us have very different ways of trading and approaches to the markets, but we all strive to be very transparent and help newer traders succeed.

If you can relate to the ideas in this post, you’re likely to enjoy their ideas as well.

Want to receive an alert when new content is posted?

Join the Theta Trend email list and stay up to date with the latest information on options trading.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.