$RUT December 2015 Butterfly (CIB) Trade Review

Overview:

Normally on the weekend, I’d write a market commentary, but the December CIB was closed on Friday and I went into the weekend flat.

The December expiration was a slightly less than ideal environment for the CIB, but it wasn’t too bad overall. The trade was initiated when RUT was chopping around and not really going anywhere. After sitting for a while, the market pushed higher and the trade was adjusted on the upside.

Since the market sat around prior to the move higher, the long call decayed somewhat. That scenario made the upside more painful than usual and the trade was down almost $250 at one point. That open loss was close to the $300 max loss per position. Fortunately, the market reversed from that point and the trade quickly went up money. Overall, the December trade was relatively easy to manage and didn’t require a large number of adjustments (unlike the November trade).

Even though I chose to exit the trade on Friday, the position probably could have been left running a while longer. However, the trade was above the target profit and exiting was just following the rules. Sometimes exiting at a target can be hard because you feel like you’re giving up potential profit, but it’s important to remember that systems are designed with long term results in mind. In this case, the trade grossed around $385 and netted around $330, which represents a little over a 3% return on a $10k account. If those returns can be achieved most months of the year, the results can be very impressive.

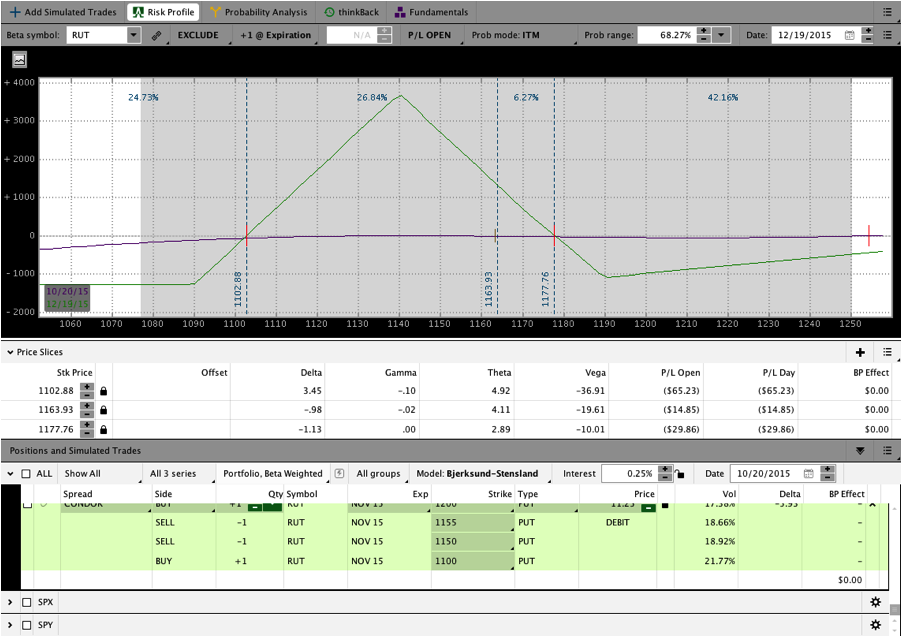

Initiation:

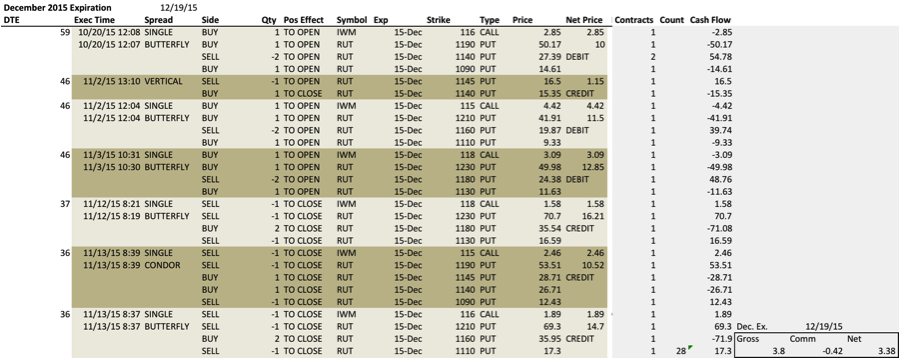

The image below shows the trade on the day of initiation, October 20th with 59 DTE. I bought the 1090/1140/1190 December RUT Put Butterfly for 10.00 and the 116 IWM Call for 2.85. Originally I was hoping to buy the 1150 Butterfly, but I couldn’t get a price I liked so I went with the 1140 instead. I was able to sit in the position below for a while before doing anything.

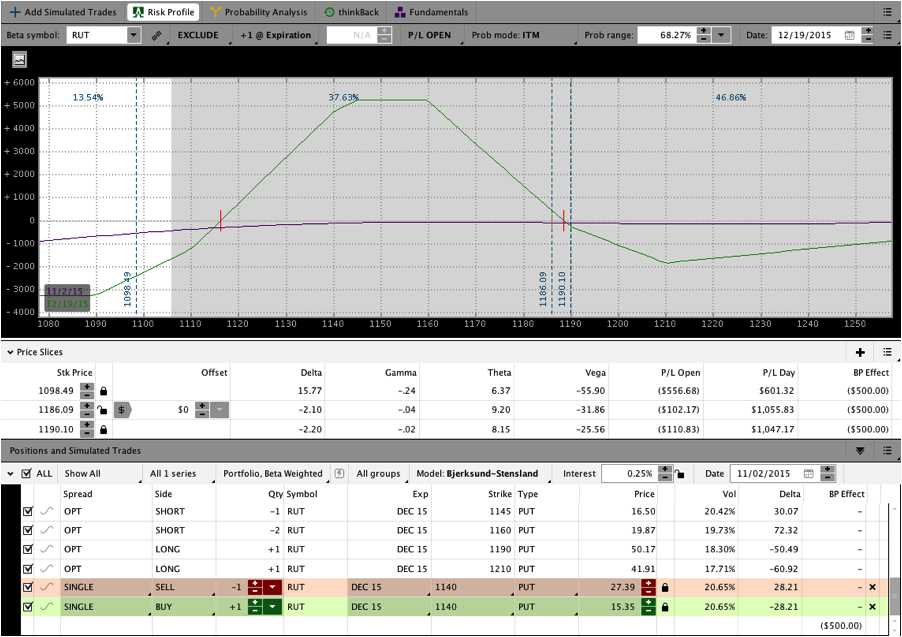

Adjustment #1 – Add and Roll Up A Short Put:

After almost two weeks without an adjustment, the RUT broke out and started to move higher. The late move higher put the trade under pressure. As a result, I added the second Butterfly at 1160 and rolled up one of the short puts to keep Delta under control. At the time, I was concerned that the RUT could move sharply higher because it had broken out of a consolidation and the SPX was already very strong. The image below shows the position after the adjustments.

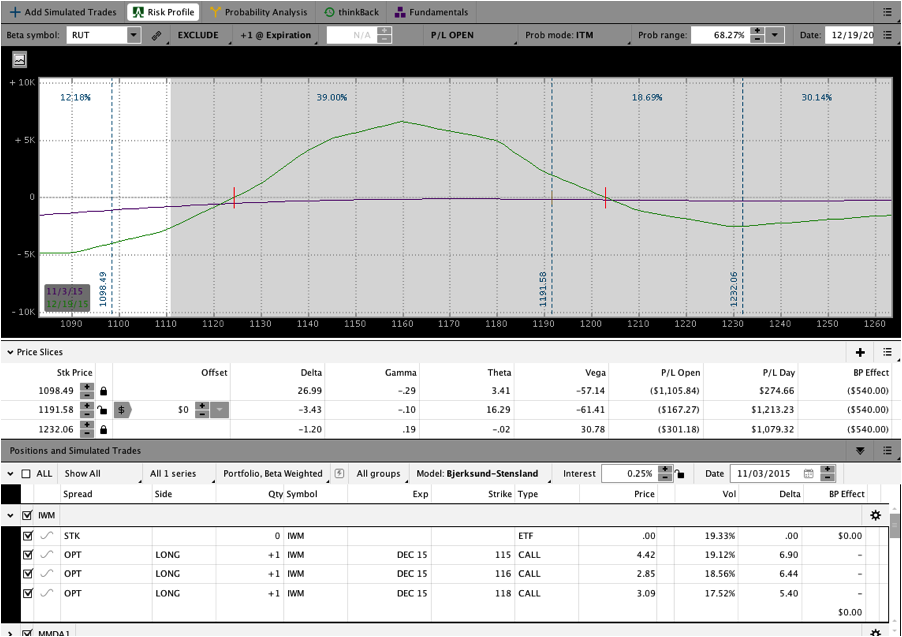

Adjustment #2 – Add Again:

Shortly after adding to the position, it became necessary to add again when the market continued higher. The image below shows the trade shortly before RUT reached the 1200 area. As you can see, the T+Zero line is sunken. The reason for the sunken line is that the initial position had a long call that decayed before the move higher. That scenario made the upside more painful than if the market had quickly moved higher after entry. Rolling up the short put in my first adjustment helped somewhat, but there was still a little pain.

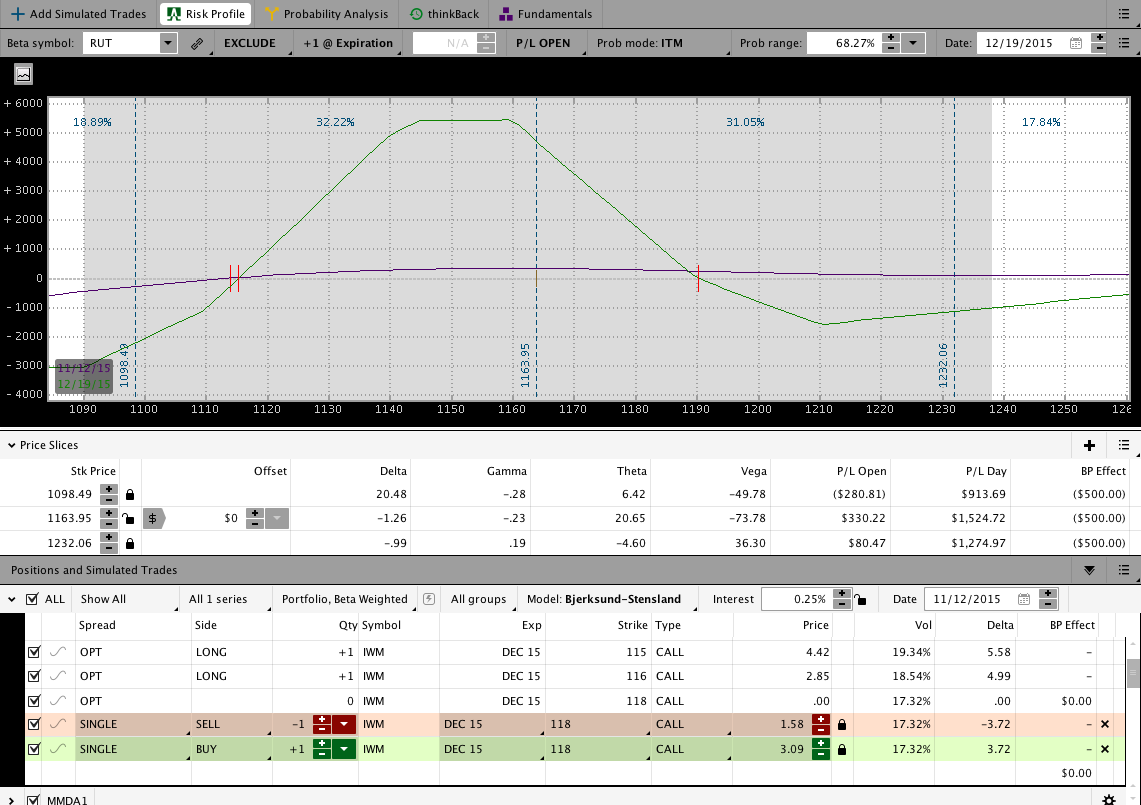

Peeling Exit #1:

Around a week before the peeling exit took place, RUT was up closer to the 1190-1200 area. From there, the market traded down nicely. With the move lower, I was able to close the highest Butterfly and long call to lock in a profit. After peeling off the top part of the position, the trade was relatively safe as shown in the image below. I only sat in this position one day and closed the position in full the next day (Friday, November 13th).

Full Close:

The image above is the last picture I have of the trade before the full close. I peeled off part of the position on Thursday and then took the full exit on Friday. The trade exceeded the profit target and rather than carry risk into the weekend, I decided to close the position.

The December Butterfly grossed 3.80 and net 3.38 in around 3 weeks. That return represents around 3.3% on intended capital and the 2015 Results spreadsheet is updated.

Click here to learn about the Premium Course that covers the CIB Trade in Detail

Order History: