$RUT April Options Butterfly Recap and Analysis

Overview:

Last Thursday I closed the April 2015 $RUT Butterfly. Thursday was an up day for the Russell and price was moving outside of the expiration break-even with under 20 days to expiration. In hindsight, I should have adjusted the trade and sat in it a little longer. However, I was in the process of driving from Arizona to Texas with limited internet access and decided it was best to close the position.

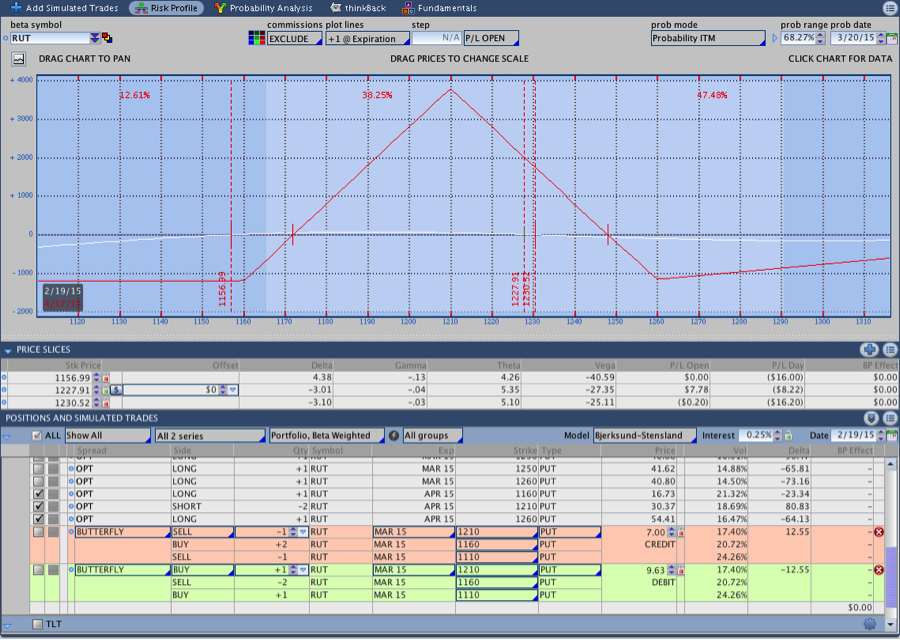

Day 1 – February 17, 2015:

I entered the trade shortly after the Russell 2000 broke out to a new all time high. Even though my entry was a little premature, the Russell didn’t move significantly higher after making the new high. I had the order to buy the Butterfly sitting in the market and it filled near the end of the day. I added a long $IWM call the next morning and the picture below shows the position after adding the long call.

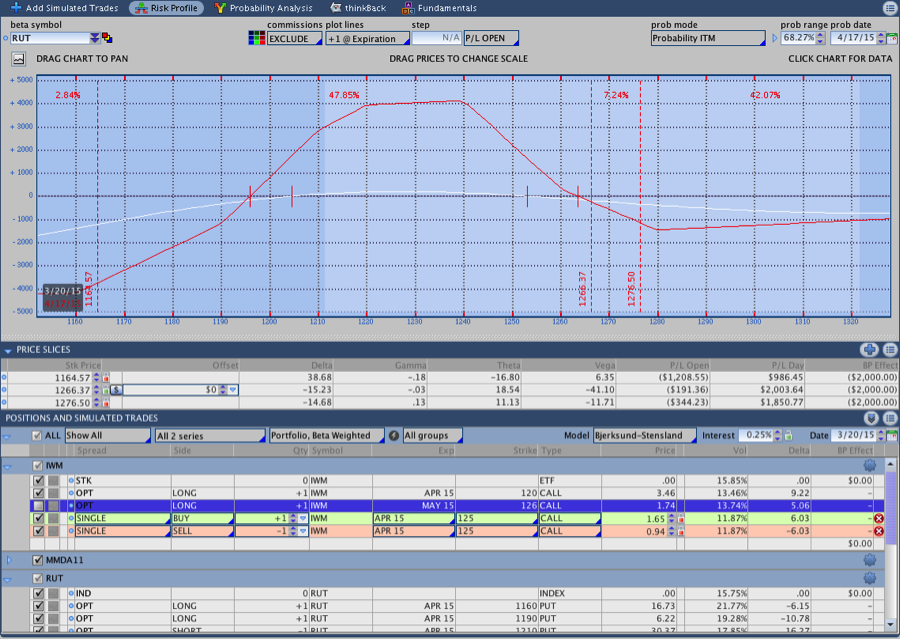

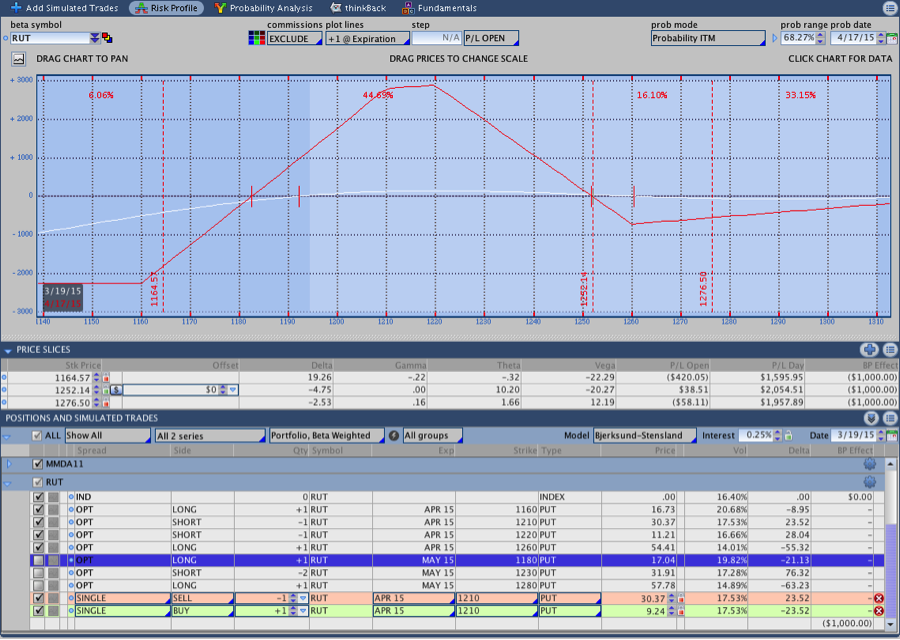

Adjustment #1:

The first adjustment I made didn’t take place until March 9th when I rolled down my long $IWM call. After rolling down the call, I rolled up one of the short puts on March 18th and that resulted in the image below.

The biggest mistake I made during the period leading up to the March 18th adjustment was not closing the position. The Russell 2000 traded higher immediately after entering the trade and then sold off. After selling off, the position was up around $200-$250 for a few days, which is an acceptable profit target for the trade. Instead of getting out, I stayed in the position and was forced to made additional adjustments that didn’t add a significant amount of profit to the trade.

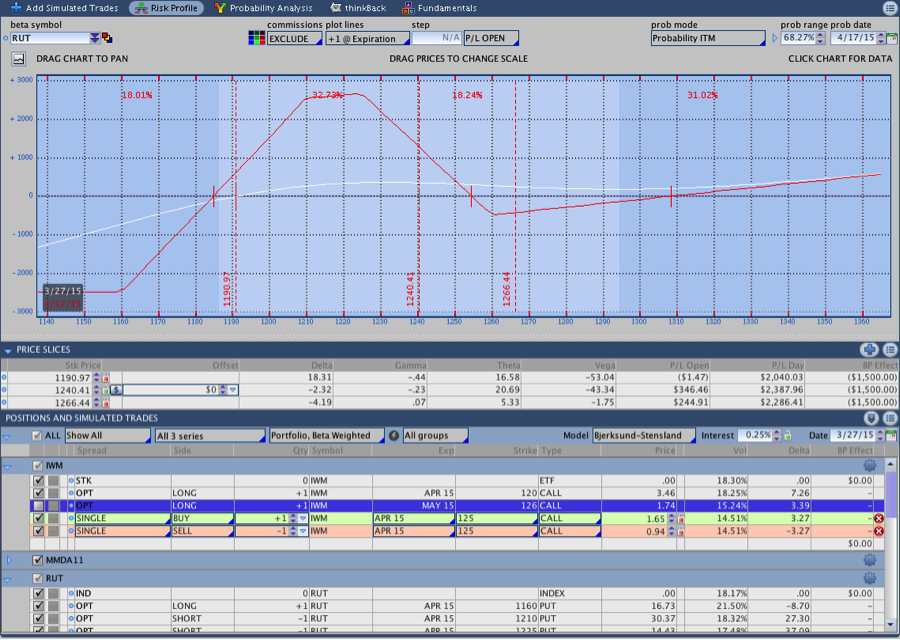

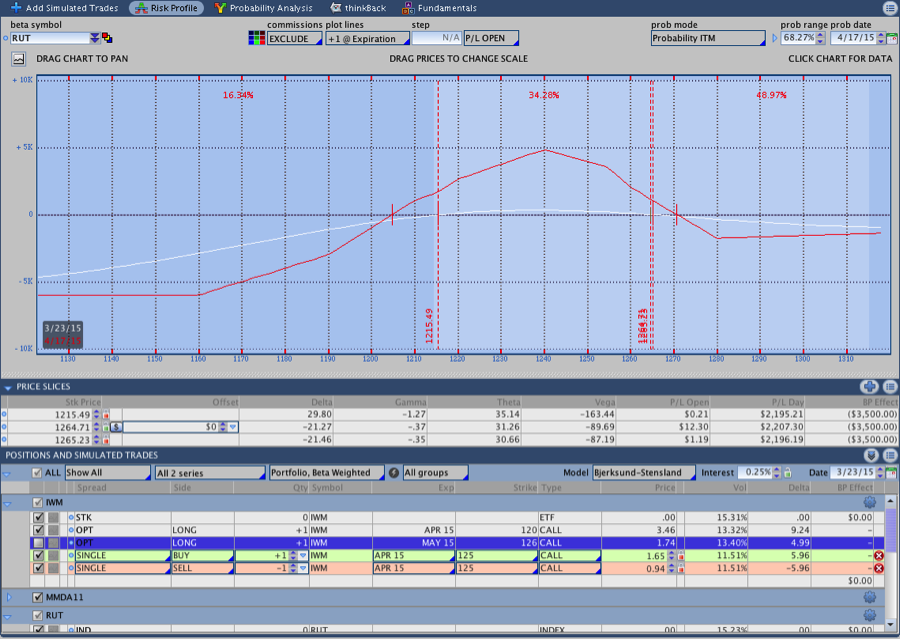

Adjustment #2:

A few days passed after rolling up the short put and the Russell made some new highs. Around the time $RUT was making new highs, the S&P 500 ($SPX) seemed weak and I didn’t really believe the move higher. Nevertheless, I adjusted the position to the upside again by adding an unbalanced Butterfly. That adjustment stretched out the expiration break even and added size to the position. As you can see in the image below, $RUT continued up and was beyond the expiration break even and the position needed another adjustment.

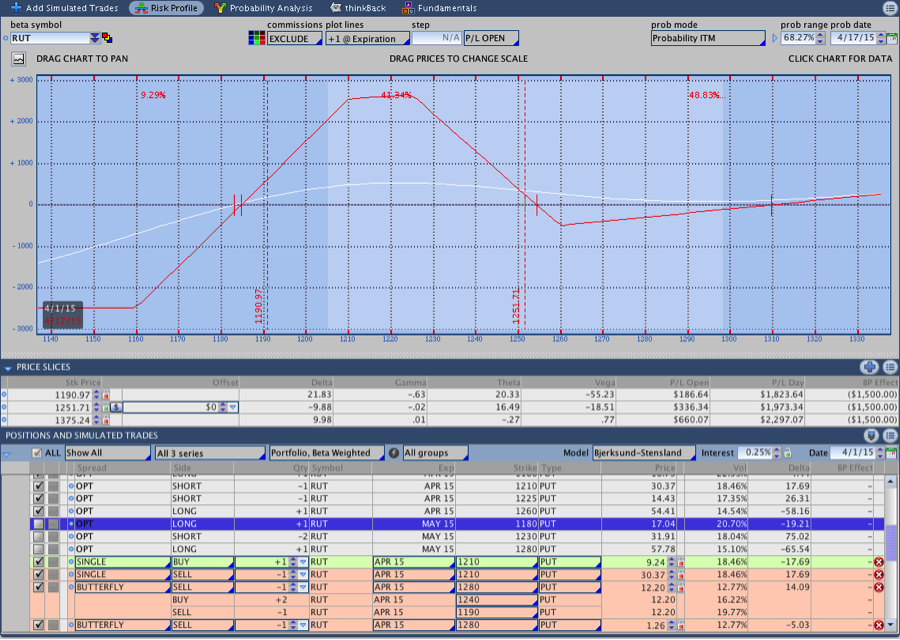

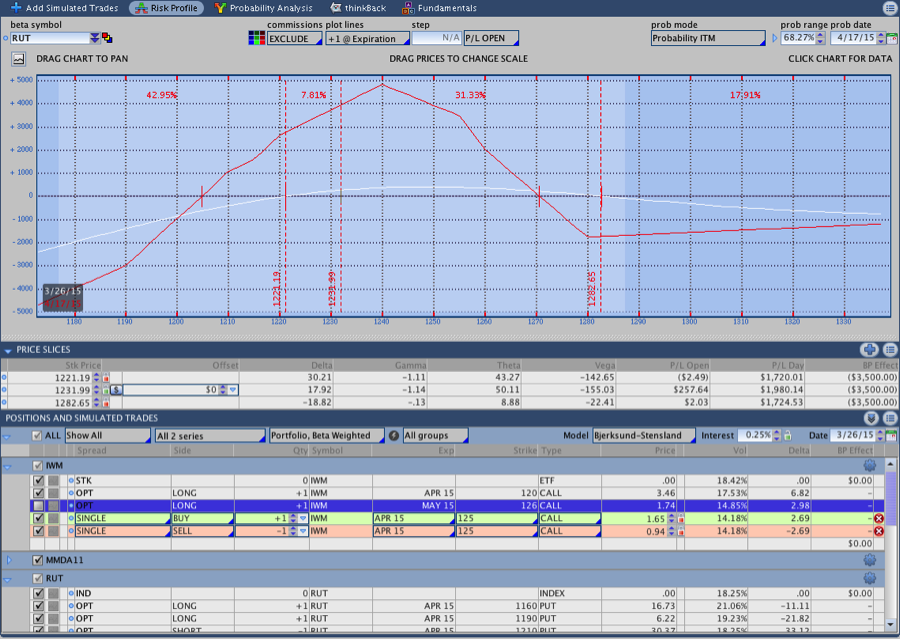

Adjustment #3:

After making the adjustment above, $RUT didn’t back off and that made it necessary to adjust the upside again. On March 23rd, the position was adjusted again by buying another unbalanced Butterfly. That Butterfly increased size and stretched out the expiration break even lines. At this point in the trade, I was feeling short term bearish on the market and didn’t want to get too aggressive on the upside. In the image below, you can see that the downside begins to become a little uncomfortable when $RUT gets to 1230 or so.

Shortly after making the adjustment above, the Russell 2000 finally gave up on the upside and pulled back. That pullback helped the position in a big way, but it created an uncomfortable situation with the Greeks. The image below shows the position after $RUT sold off right into the 1230 level. With $RUT at 1230 I was concerned about further selling that would take the position into the red and I did not want to stay long Delta.

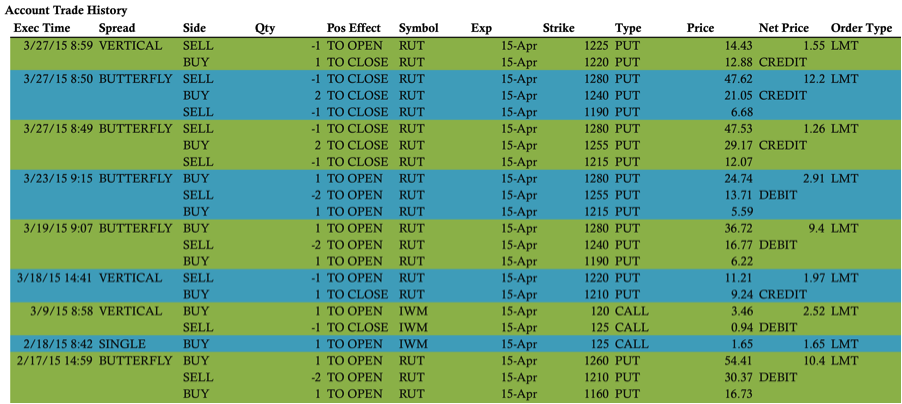

Adjustment #4 (Partial Close):

Due to the quick sell-off shown above, I needed to adjust the position again. My hope at this point was that the Russell would stabilize and trade sideways for a while. The adjustment I made closed a couple of the Butterflies, which left me with one Butterfly and two long $IWM calls. The image below shows what the position looked like after the adjustment. I stretched out the downside in case of a move lower and reduced my upside risk. I set up the position to avoid pain in case $RUT decided to swing back higher. Guess what? That’s exactly what happened.

Adjustment #5 Before the Close:

Adjustment #4 above was good from a risk management standpoint, but wasn’t exceptionally helpful when $RUT swung higher a couple of days later. As a result, I rolled one of the short puts up again, but $RUT was strong and I decided to simply close the trade rather than continue the chase higher. The image below shows the final position the day before the close.

The Full Close:

I closed the position last week before the long weekend with $RUT pushing higher. The position could have been adjusted to the upside again, but I was driving across the southern part of the country and felt more comfortable getting out. I definitely didn’t trade the position perfectly or do everything right, but it was still another profitable month. The trade was closed for a pre-commission profit of around $278 ($237 net). That represents around a 2% gain on a $10,000 account and is slightly better than the gain on the March Options $RUT Butterfly.

The two big lessons for me are that the position should have been closed early when it showed a profit of around $250 and it could easily have been adjusted on more time on the upside. I don’t feel bad about not making a last adjustment to stay in the position longer, but not taking a quick profit on the position wasn’t a great move. Lesson learned.