Reverse Harvey Options Income Butterfly Adjustment (Video)

Overview:

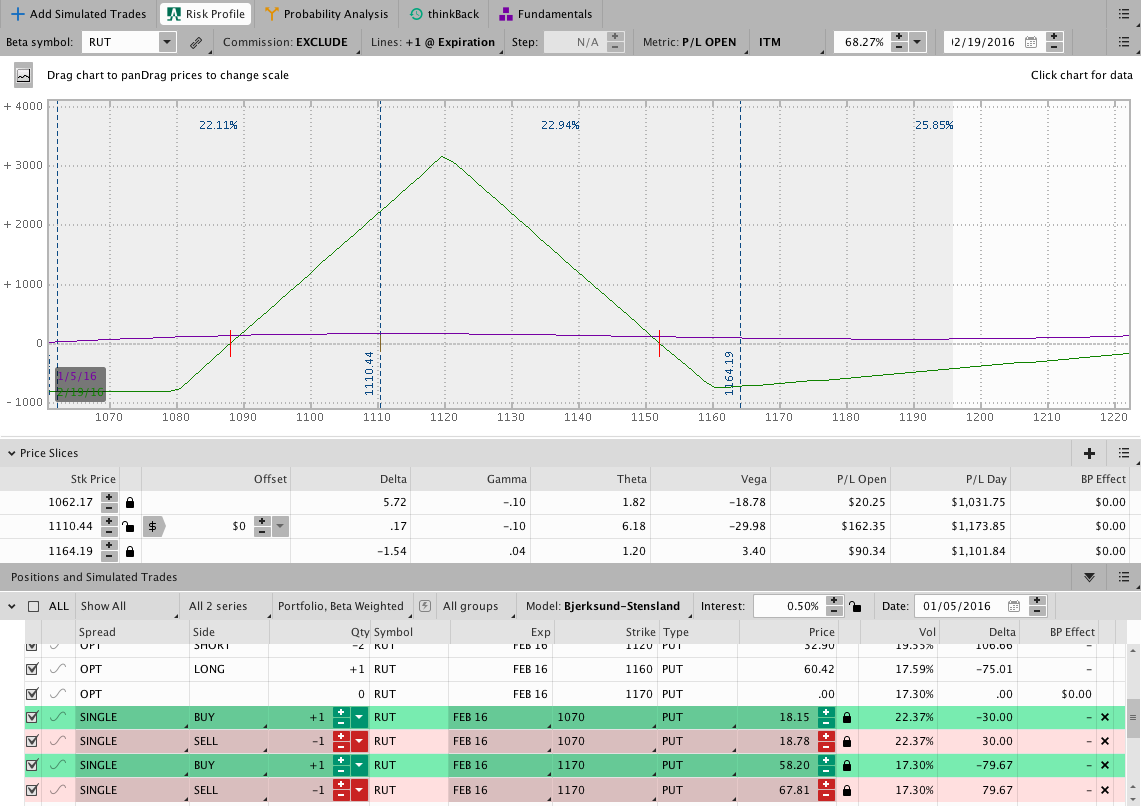

The video below walks through a Reverse Harvey adjustment that was made to the February CIB. With the move lower in RUT, we had an open profit and it made sense to protect the position in case of a fast move higher. The Reverse Harvey knocks in the wings of the Butterfly and reduces risk. The downside is that we experience a loss of Theta, but the position is directionally “safer.” The Results Spreadsheet has been updated.

I do my best to Tweet these adjustments when they happen so click here to follow me on Twitter.

If you want to receive video updates, click here to Subscribe on YouTube.

Enjoy:

The image below shows the risk graph following the adjustment:

Don’t miss out!

Click here to follow me on Twitter

Click here to Subscribe on YouTube