Options Trend Following Portfolio Update With a New Theta Breakout Trade

Overview:

Today I’m doing a video recap of the open Theta Trend options positions and the monthly rotation system position. Equity markets have been moving slowly and seem to be consolidating around all time highs. Fortunately, we’re short options on both sides of the market and the decay is coming into the positions . . . always a good thing. You can read through discussions on the individual positions below or jump to the bottom for the video. Enjoy.

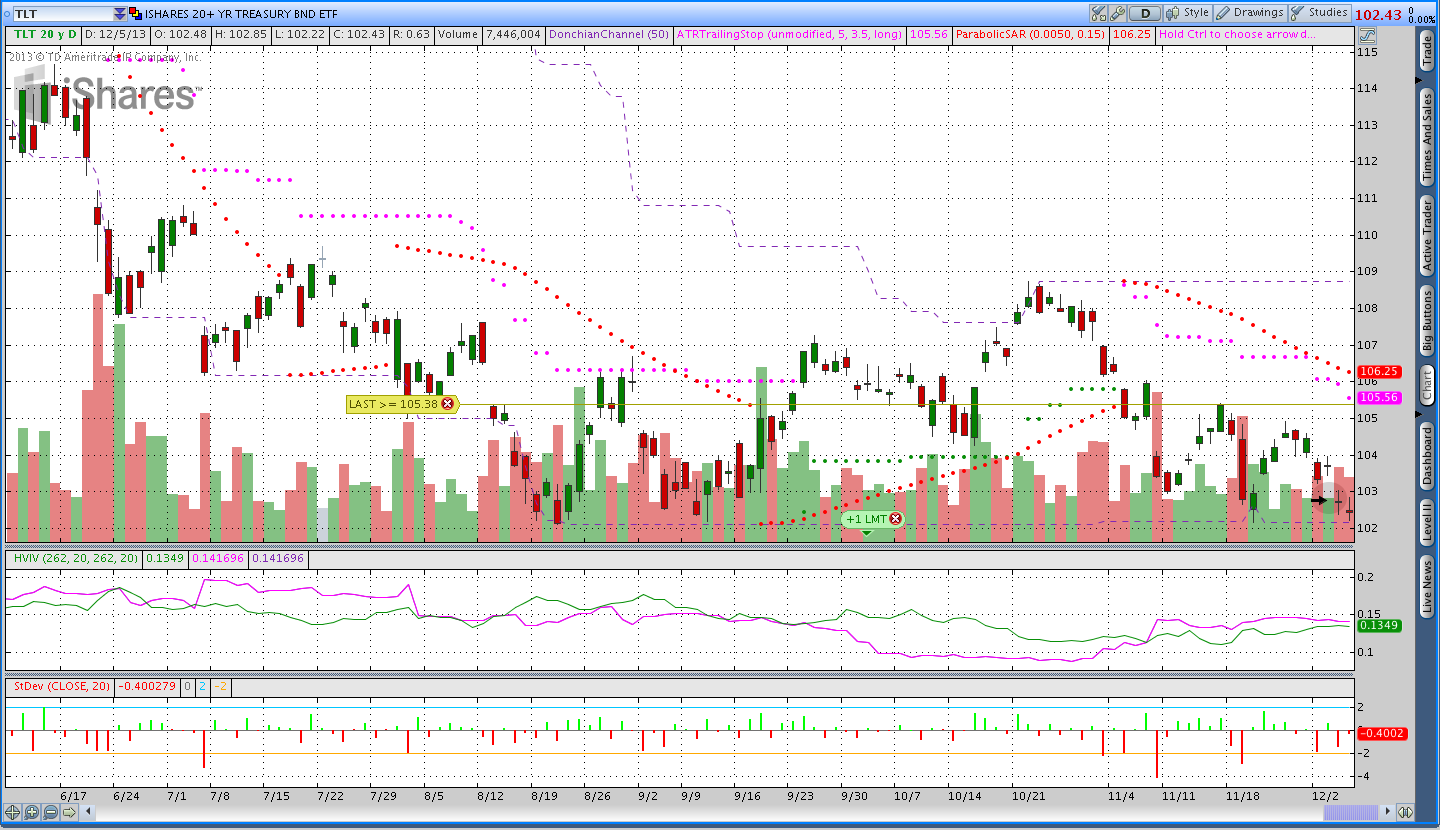

Theta Breakout Trade in TLT – iShares 20+ Year Treasury Bond ETF:

On December 5th I opened a new trade in TLT using the rules outlined in the Theta Breakout system. I sold the 106/110 Feb 2014 Call spread for a .70 credit and Tweeted the trade shortly after entry. If you want to know when I enter trades, please check me out on Twitter. I do my best to Tweet when an order is filled. As I’m writing this, I see that Bond futures are up a little bit before the open and the position might take a some heat. Guess we’ll see.

IWM – iShares Russell 2000 ETF:

The IWM naked short put at 96 is doing well. Price moved in our favor shortly after entering the trade and while it has come off those levels a little bit, everything is still going smoothly. Even if price closes below the stop level, some profit should be preserved.

SPY – SPDR S&P 500 ETF:

The SPY naked strangle is also doing well and price is sitting right in the middle of the “sweet spot.” The SPY strangle was sold for the non-directional part of the trend following portfolio and I’m currently looking at RUT Iron Condors for next month.

PGJ – Powershares Golden Dragon China Portfolio:

PGJ is the new Top Performing ETF’s Monthly Rotation System position. Not much has happened with the position since the trade was entered on December 2nd. My opinion, which never matters to the market, is that price appears to be in a low volume consolidation. Obviously I want the consolidation to be resolved to the upside with a push higher.

Check Out the Video for More Details:

Dan, I have a question….I thought your trigger is a 50day high being broken…? are you using a different rule? im sure Im missing something

Never mind….i got it. You put on a bear call spread. By the way, the videos are helpful. Thats how i realized my mistake