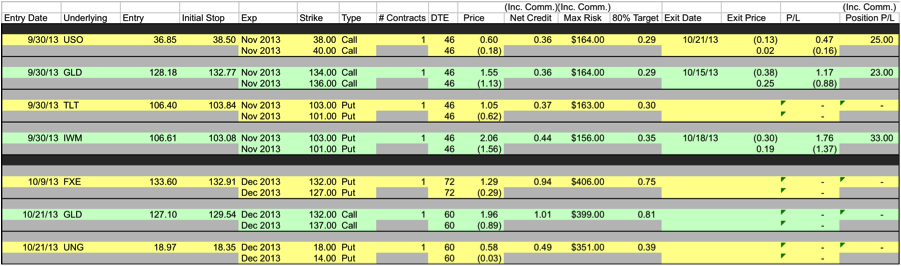

Options trend following credit spreads position update and musings

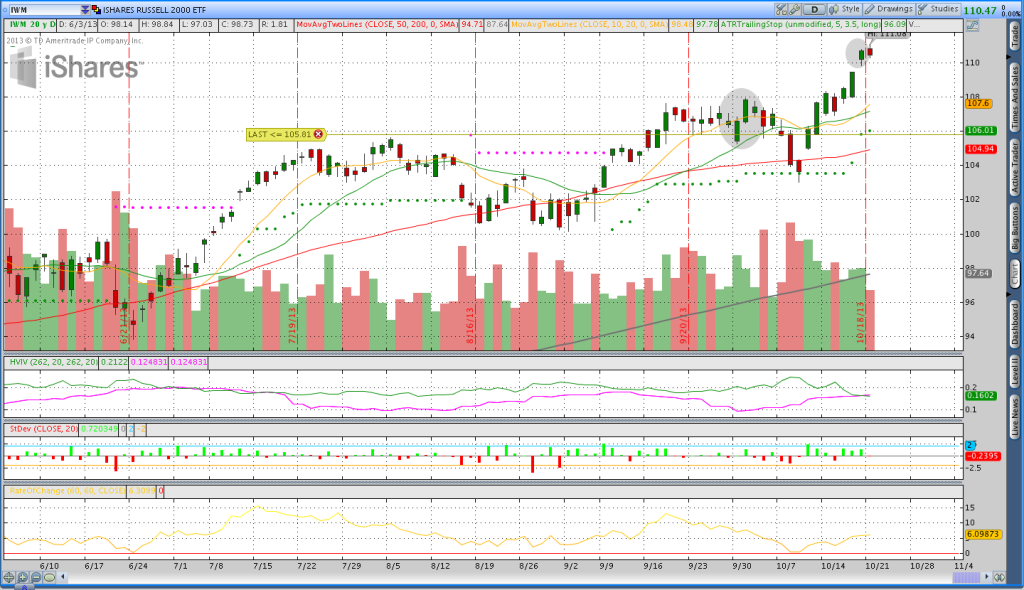

In the past few days there have been a few updates to my credit spread positions. As of now, the only position I still have open in the Nov 2013 expiration is the trade in TLT. As I briefly mentioned in this video, last Friday I was able to close the IWM spread for a profit. The IWM position was an interesting trade and I came very close to being stopped out of it. In the image you can see my primary indicator of trend, the Average True Range trailing stop, came very close to being violated.

My stop rule is that I do not close positions unless there is a close above or below the trailing stop and October 9th is a good example of why it’s very important to trade with a plan. On October 9th, the financial news was grim (not that it matters) and price traded through the trailing stop and I received an email alert while I was at work. After the close I checked Thinkorswim and to my surprise price closed above the trailing stop and I did not need to exit the next morning.

In the IWM image there are two shaded ovals. The first oval indicates the day the credit spread was initiated and the second oval indicates the day the spread was closed. The day after entering the spread, price popped higher and the trade was immediately profitable, but that profit disappeared over the next week or so during the shakeout down to the average true range trailing stop. After running to that level, price rallied higher and the trade was closed.

Yesterday, October 21st, I entered some new trades for the December expiration. Specifically, I got short gold (GLD) with a 132/137 call spread that I sold for a 1.07 credit and I took a long position in natural gas (UNG) by selling the 18/14 put spread for a .55 credit. I was also able to close my November expiration short oil (USO) position for a .11 debit.

The video below walks through the positions and the full position tracker is at the bottom of the page.