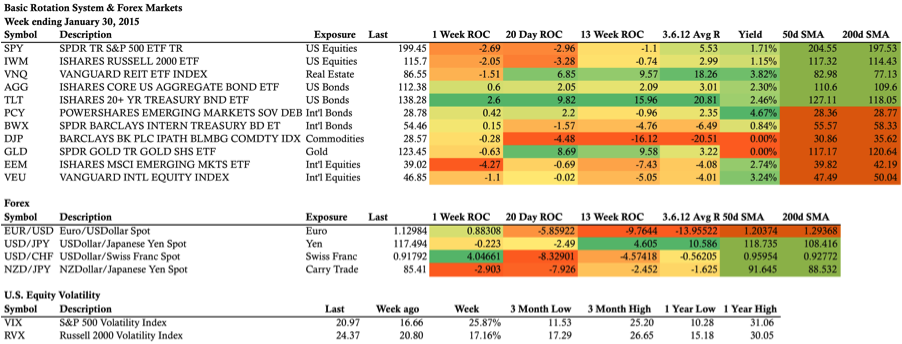

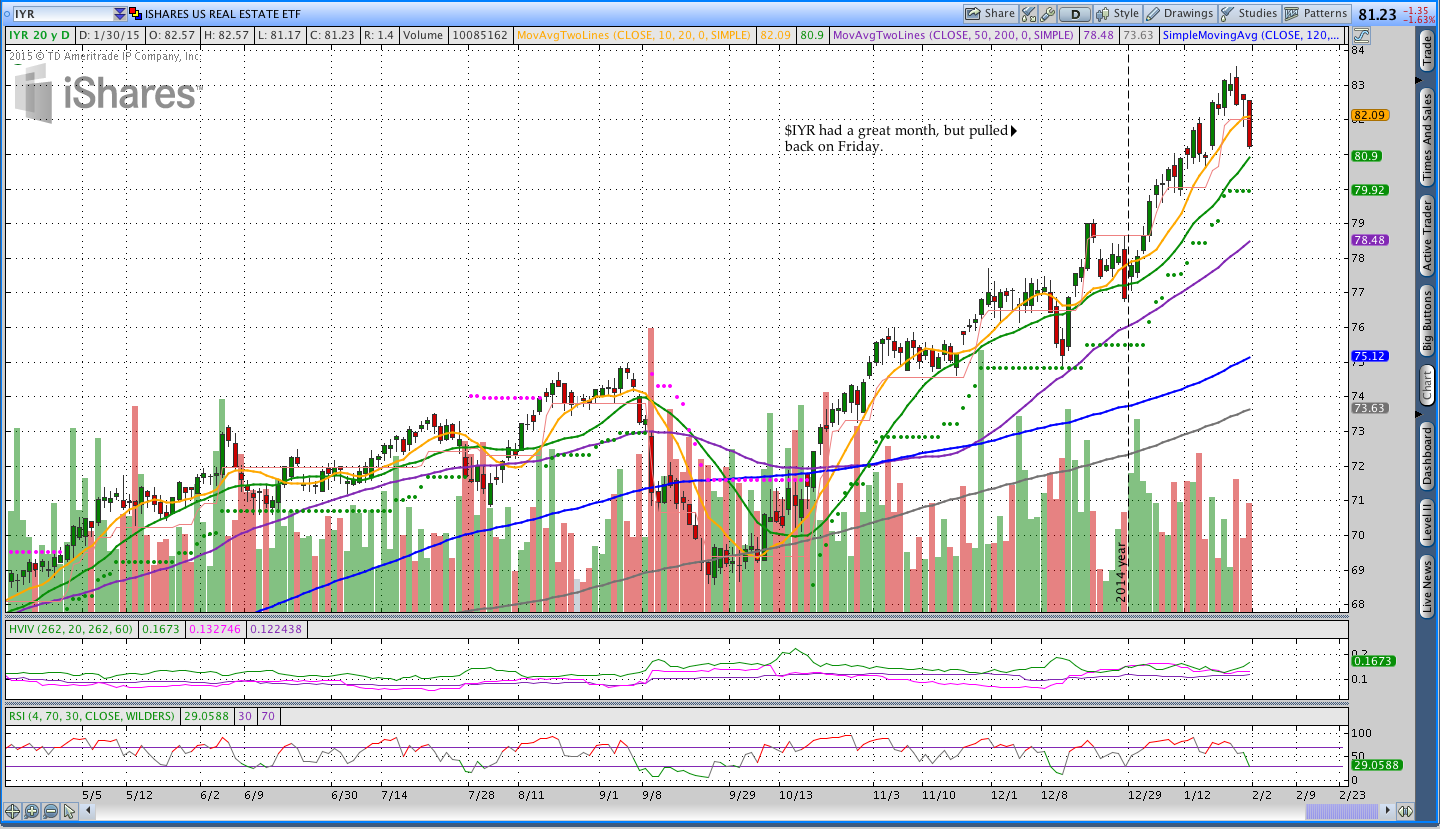

Negative Interest Rates & The Weekend Market Commentary 1/30/15 – $SPY $IYR $TLT $VNQ $RUT

Big Picture:

I’ve been thinking about Real Estate quite a bit lately. As I mentioned a couple of weeks ago, I need to make a change to a warmer climate and, as a result, I listed my house. Within a couple of days the house was under contract, which is really great. For those of you who are wondering, Austin, TX is at the top of my list right now. Putting moving aside, I’ve also been thinking about Real Estate in terms of what’s going on in the markets.

Over the past year, we’ve seen some strong trends emerge in Real Estate and Interest Rates. Real Estate and long dated U.S. Treasury Bonds have been extremely strong. At the same time, lower grade Corporate or Junk Bonds have taken a beating and stocks are beginning to churn around their all time highs. Around the world, we’re starting to see examples of interest rates going negative. In a negative interest rate environment, you pay to hold money at an institution. How long do you want to do that? Personally, I never want to do that. In that type of an environment, an asset (cash) has effectively been converted to debt.

Over the past year, we’ve seen some strong trends emerge in Real Estate and Interest Rates. Real Estate and long dated U.S. Treasury Bonds have been extremely strong. At the same time, lower grade Corporate or Junk Bonds have taken a beating and stocks are beginning to churn around their all time highs. Around the world, we’re starting to see examples of interest rates going negative. In a negative interest rate environment, you pay to hold money at an institution. How long do you want to do that? Personally, I never want to do that. In that type of an environment, an asset (cash) has effectively been converted to debt.

The moment it begins to cost money to hold cash, you have an incentive to convert that cash into something else. If you’re converting your previous money (now debt) to another type of asset, you probably want to hold something that generates yield and/or appreciates in price. I think the trends in interest rates and real estate are related to investors trying to find assets with either intrinsic value or yield.

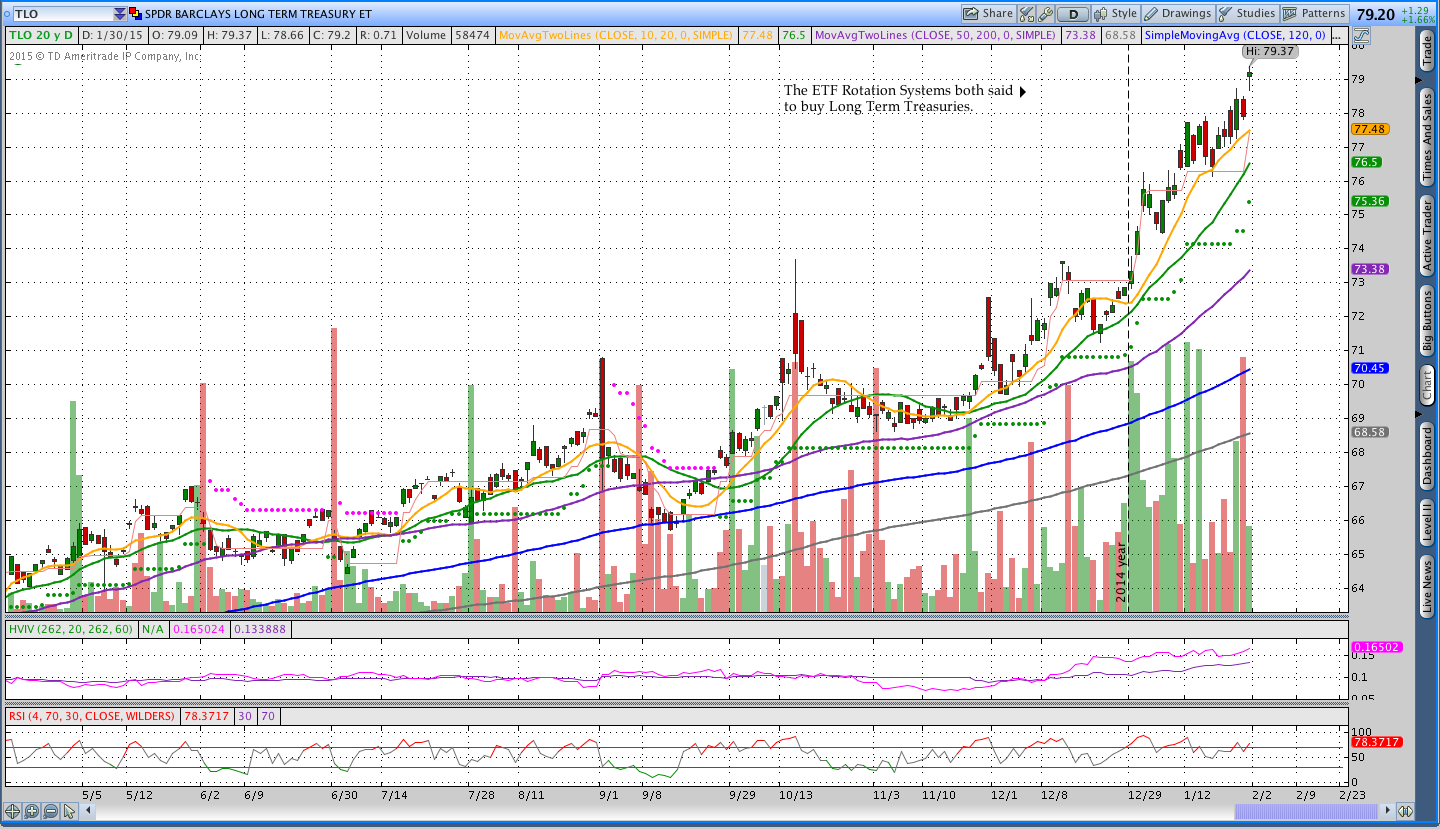

The move higher in the U.S. Treasury Bond continues to surprise many people and it’s worth noting that the yield the Long Term Treasury ETF ($TLT) is around 2.46%. At the same time, the yield on the S&P 500 ETF ($SPY) is sitting at 1.71% and Real Estate ($VNQ) is generating 3.82%. Investors are always willing to hold assets with a lower yield IF those investments have the potential to appreciate in price. When you consider the lower yield on stocks relative to bonds and real estate, it’s not surprising to see money flowing into those markets.

Last week I mentioned that stocks might have a little bit of upside this week. Early in the week it looked like I was going to be proven right, but equities headed lower as the week went on. The S&P 500 was weaker than the Russell 2000 this week and $SPX is testing an area of support that’s just slightly above the 200 day moving average. Right now the market appears to be trading in a range, but it looks like the market is getting ready to test the lower end of that range.

The Weekly Stats:

ETF Rotation System Positions:

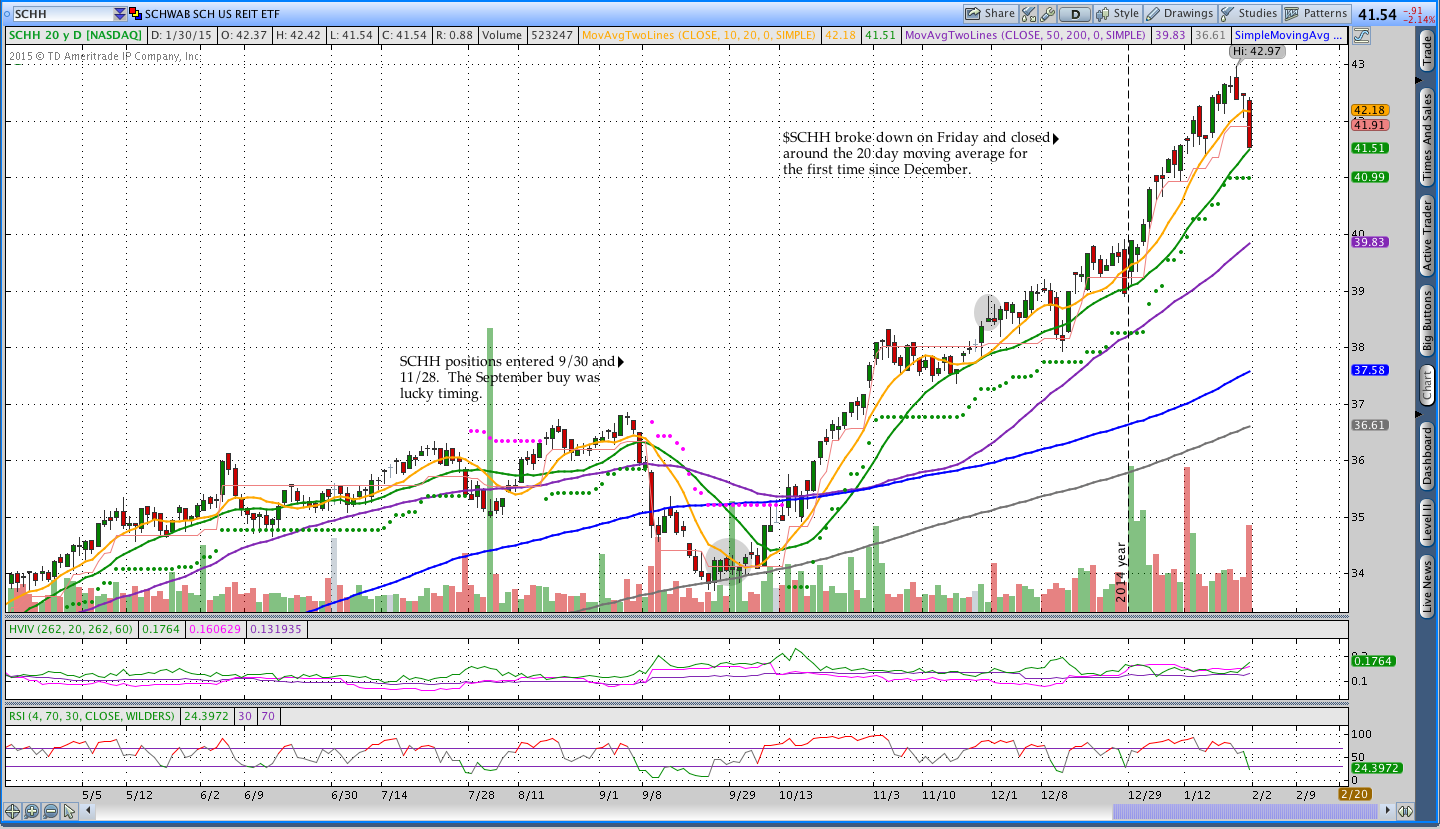

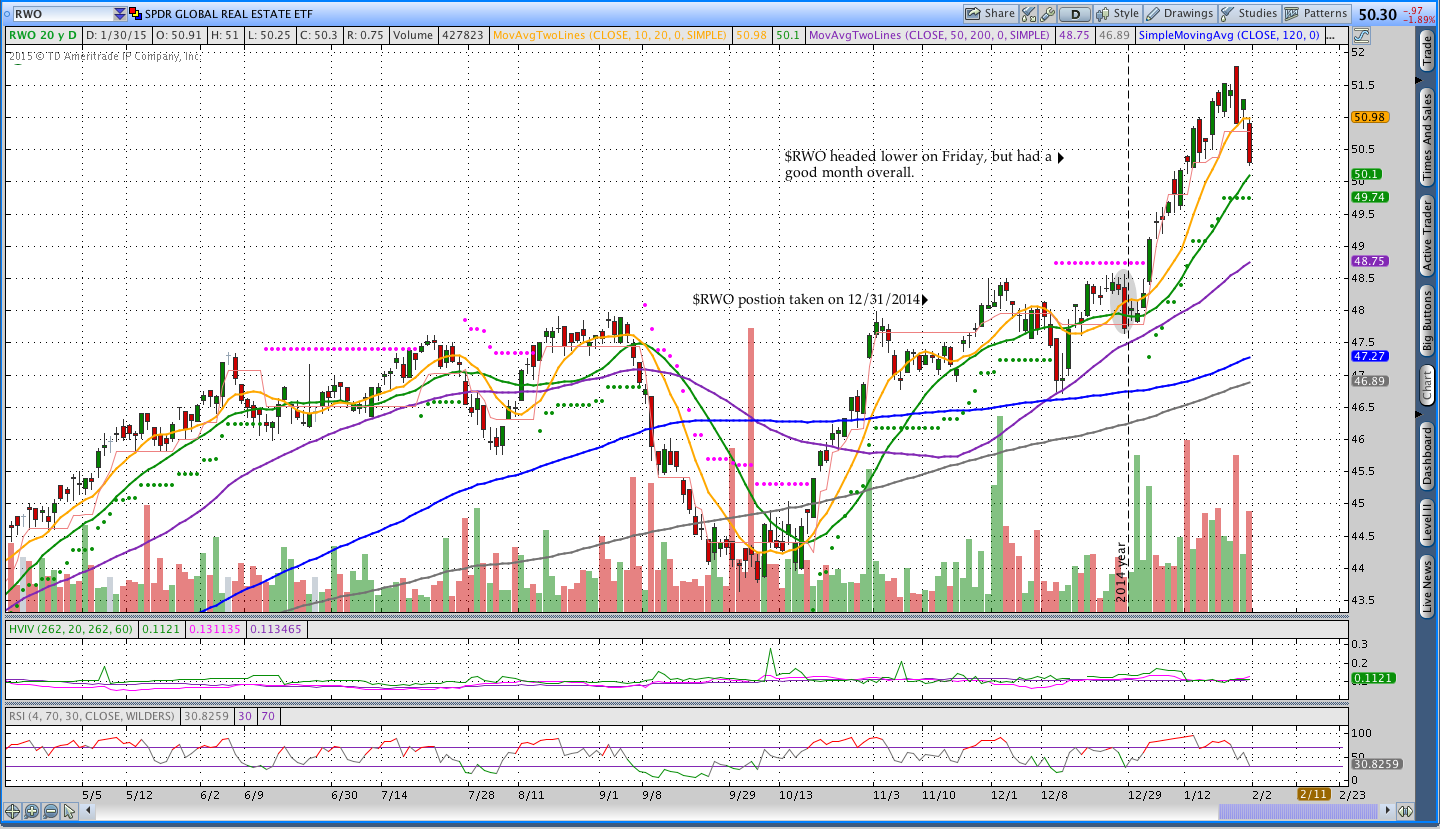

Yesterday was the last trading day of the month and, as a result, I moved around the ETF Rotation System positions. Based on some feedback from readers, I’m going to begin tracking the Schwab System using the Top 3 markets rather than just the Top 2. The Basic ETF Rotation System will continue to take positions in the Top 2. In rebalancing the Schwab system, I added a position in Long Term Treasuries ($TLO) and bought a few additional shares of Real Estate ($SCHH) and International Real Estate ($RWO) to bring the exposure up to $5,000 per position.

The Basic ETF Rotation System sold out the Russell 2000 ($IWM) position and is holding Real Estate ($IYR) and Long Term Treasury Bonds ($TLT). I will note that it was psychologically difficult to buy bonds at this level, but I know that over time the system will work everything out.

The January 2015 Market Momentum Newsletter was posted this week and I’ve gotten a lot of really great feedback on the newsletter. Next month I think we’re going to begin using a slightly different format. On the last trading day of the month (or the night before), I’ll issue more of a trade alert that will give position rankings and the positions for the next day. A few days later, I’ll follow up with a more comprehensive newsletter to review the system performance for the prior month.

Click here to see a copy of the January 2015 Market Momentum Newsletter that covers the systems in more detail.

Schwab Commission Free ETF Rotation System Positions:

Basic ETF Rotation System Positions:

Donchian Breakout Trades:

The Gold and Silver ($GLD and $SLV) Donchian Channel breakout trades are still open and running. Precious metals took a bit hit on Thursday, but the positions are still positive. Hopefully precious metals will lift next week.

Options Trading:

On Thursday I sold to open a $SPX Weekly call spread for a .45 credit. I was fishing for a good price all day on Thursday, but the markets were really low in the morning and I don’t like to get short with options when I feel like price has already moved. As a result, I put in an order well above the market that sat all day and I thought would probably expire worthless. However, price raced higher late in the day and I was filled on the 2080/2085 Feb1 Call spread right around the close. On Friday I had another sitting order to close the position for a .10 debit and that was hit at the end of the day. It was a nice, quick weekly trade without any heat and it doesn’t get much better than that.

Note that I do my best to Tweet out options trades when they take place so you should probably follow me on Twitter.

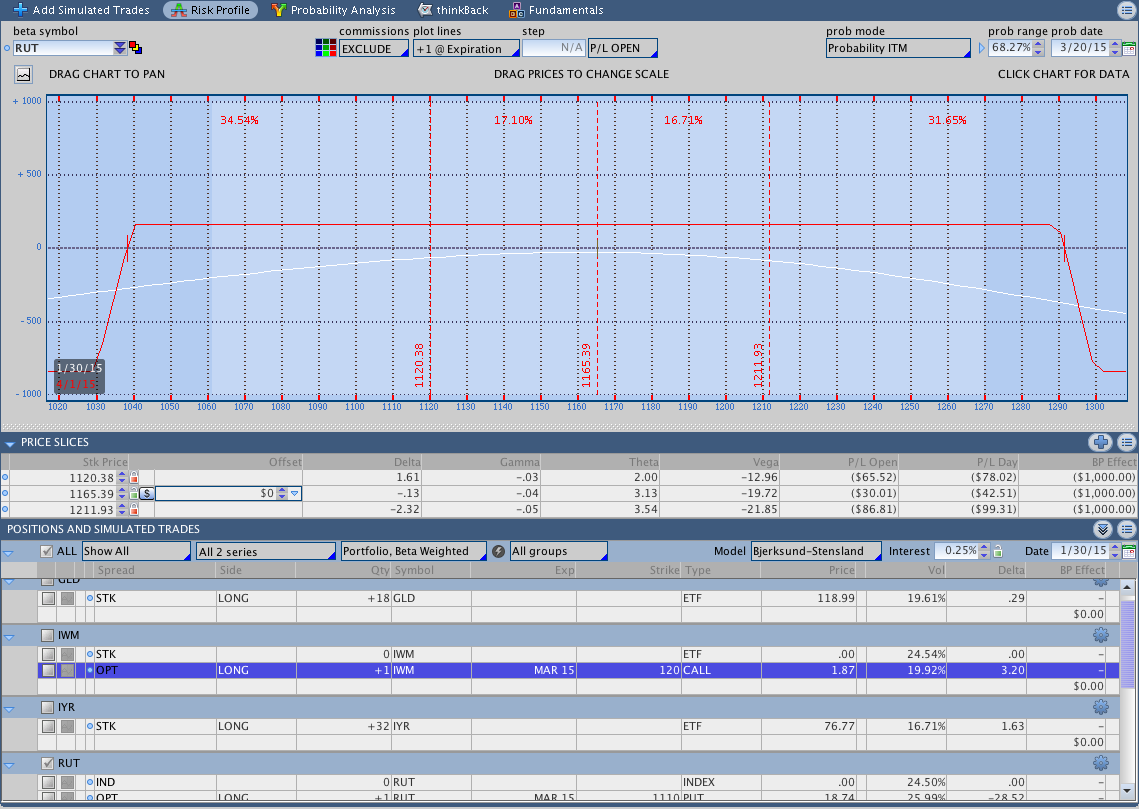

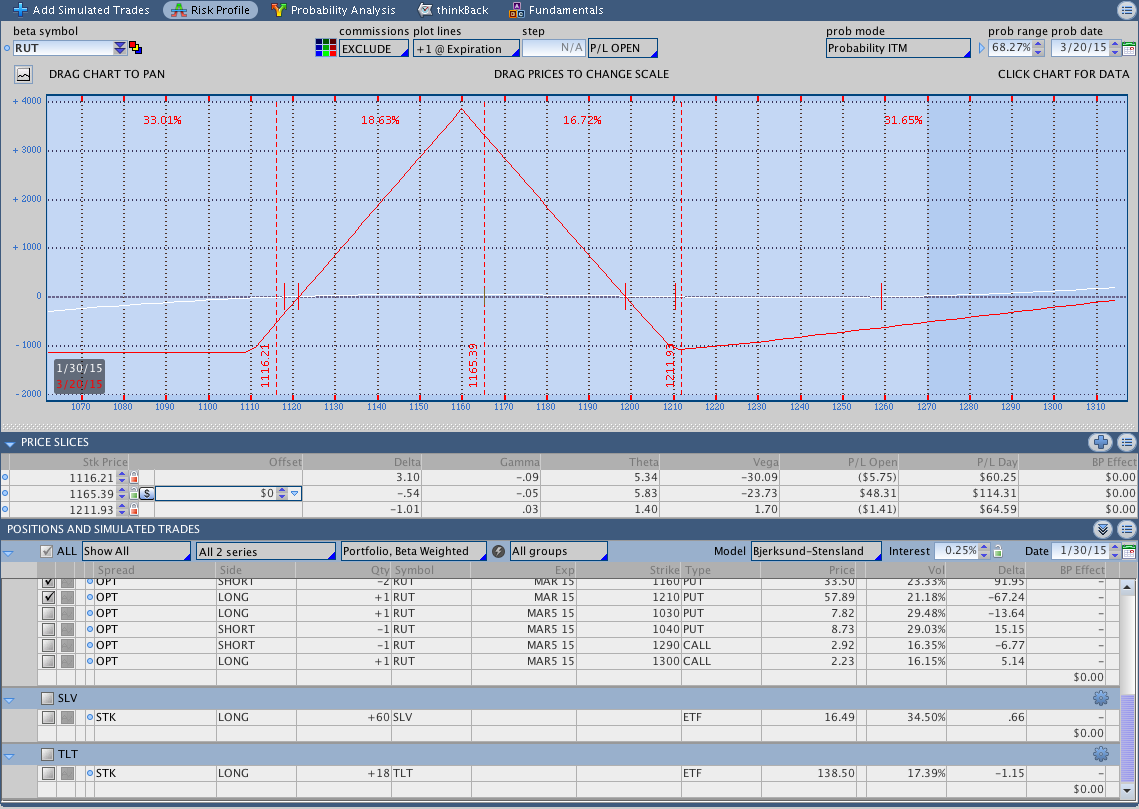

I also opened up a couple of longer term options trades this week and I’m including screen shots of the positions below. The first position is a $RUT Iron Condor that was opened with 64 days to expiration and the other is a 50 day $RUT Butterfly with a long $IWM call to hedge the upside.

A couple of months ago I was trading $IWM Butterflies through the crash higher in the Russell 2000 and found the trades to be much easier to manage than Iron Condors. As a result, I’m trading an Iron Condor and a Butterfly simultaneously this month to sort out some of my personal psychology related to the trades. Historically, I have found it much easier to manage the risk in Butterfly positions and generally prefer them over Iron Condors. A brief look at the T+zero line on the two risk graphs below should more than explain “why.”

The Iron Condor position is down money and underwater after the pop in Implied Volatility and the Butterfly is doing well with the pop in IV. Both trades are short vega trades and should theoretically benefit from a decrease in IV, but, as I mentioned in this post, the implied volatility of the individual options and the skew is what really matters.

Trades This Week:

IWM – Sold to Close 20 Shares at 117.73

TLT – Bought to open 18 Shares at 138.50 (using a MOC order)

SCHH – Bought to open 4 Shares at 42.28 (To rebalance)

RWO – Bought to open 5 Shares at 50.92 (To rebalance)

TLO – Bought to open 63 Shares at 78.94

RUT – Bought to open 1110/1160/1210 March 2015 Put Butterfly for 9.63 (50 DTE)

IWM – Bought to open March 2015 120 Call at 1.87 (Butterfly Hedge – 50 DTE)

RUT – Sold to open 1030/1040/1290/1300 Mar5 2015 Iron Condor for a 1.60 credit (64 DTE, 10 delta)

SPX – Sold to open (.45 credit) and bought to close (.10 debit) 2080/2085 Call vertical

ETF, Options, & Forex Inventory:

IYR – Long 32 Shares from 76.7699

TLT – Long 18 Shares from 138.50

SCHH – Long 41 Shares from 34.009

SCHH – Long 72 Shares from 38.73

SCHH – Long 4 Shares from 42.28

RWO – Long 92 Shares from 48.49

RWO – Long 5 Shares from 50.92

TLO – Long 63 Shares from 78.94

GLD – Long 18 Shares from 118.99

SLV – Long 60 Shares from 16.49

RUT – 1110/1160/1210 March 2015 Put Butterfly bought for a 9.63 debit

IWM – March 2015 120 Call bought for a 1.87 debit (Butterfly Hedge)

RUT – 1030/1040/1290/1300 Mar5 2015 Iron Condor sold for 1.60 credit

Looking ahead:

This was a really busy trading week for me with a lot of new positions. I’m hoping next week is quieter. Yesterday I also opened up new positions in the Interactive Brokers account for the Covestor portfolio. That portfolio won’t be visible to the public for a while, but at least it’s moving forward.

I’m not sure what to think of the moves in the equity markets right now, but the markets don’t look happy. I should have the January performance numbers for the ETF Rotation Systems posted sometime this week so keep an eye on the blog.

Thanks again for all of the great feedback on the Market Momentum Newsletter and feel free to get in touch any time. Ultimately, this blog is being written for everyone who’s reading it and it’s great to connect with all of you.

Thanks for reading and have a good weekend.

Click here to follow me on Twitter.

Want to receive an alert as soon as the next market commentary is posted?

Sign up for my email list and I’ll keep you in the loop.

Click here to sign up for the list, get a copy of the Theta Trend Options Trading System, the Trade Tacker I use, and information about new systems.

Even better . . . it’s all totally free.